It was four months ago that I first wrote about bitcoin, and a lot has happened (and a lot has been learned) since then. So here is a refresh of my take on the topic. (THREAD)

In my view, there are at least two dimensions to what makes bitcoin unique: an asymptotic supply curve and an exponential demand curve. At the intersection of the two lies a parabolic price discovery curve for this unique asset class. /2

The supply curve is best described by the stock-to-flow (S2F) model, originated by @100trillionUSD. The higher the S2F, the higher the valuation. From what I understand, the S2F model is basically a power regression between bitcoin’s price and it’s inflation rate. /3

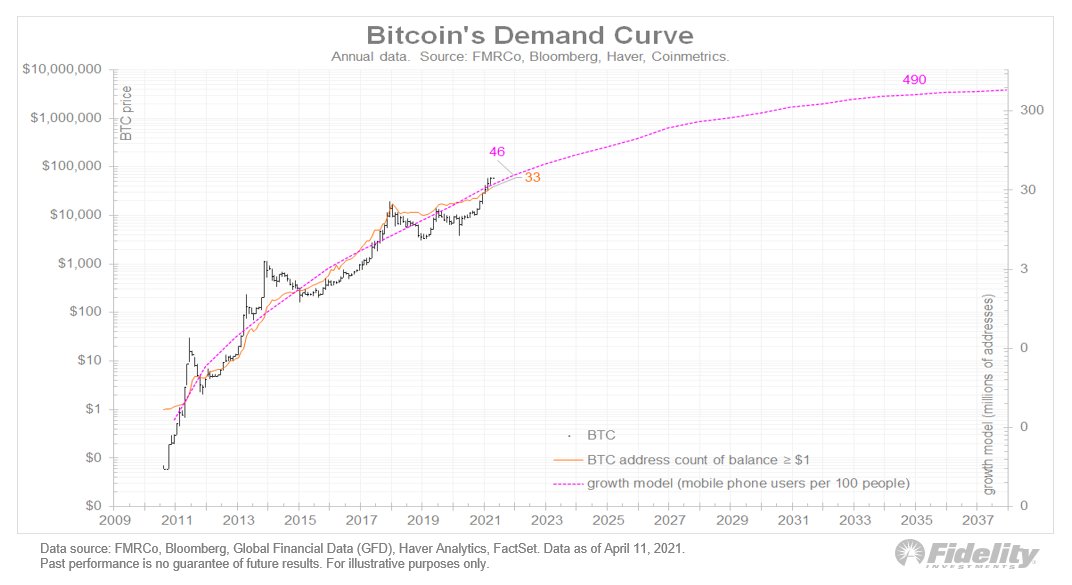

Supply scarcity is not enough though. Fortunately, the demand curve is equally compelling—and equally exponential. The chart below shows the price of bitcoin against the number of bitcoin addresses with a balance of at least $1. /4

Both scales are logarithmic, which shows that both price & demand have been growing exponentially. While we know the supply curve in advance (based on the pre-determined halvings), we don’t know what the demand curve will look like going forward. /5

Fortunately, we have many examples of historical S-curves to guide us. We can use these analogs to help give us a possible clue to how bitcoin’s demand curve might evolve in the years to come. /6

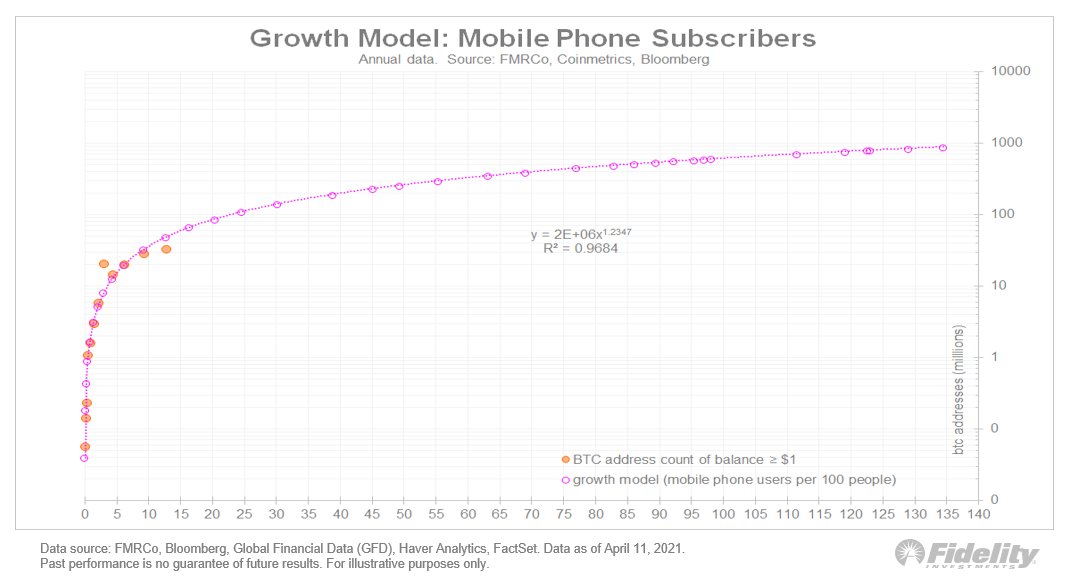

Below is one example, using mobile phone subscriptions per 100 people in the US. The scatter plot regresses mobile phone subscriptions vs bitcoin addresses. I then added a power regression trendline to project potential future values for bitcoin demand. /7

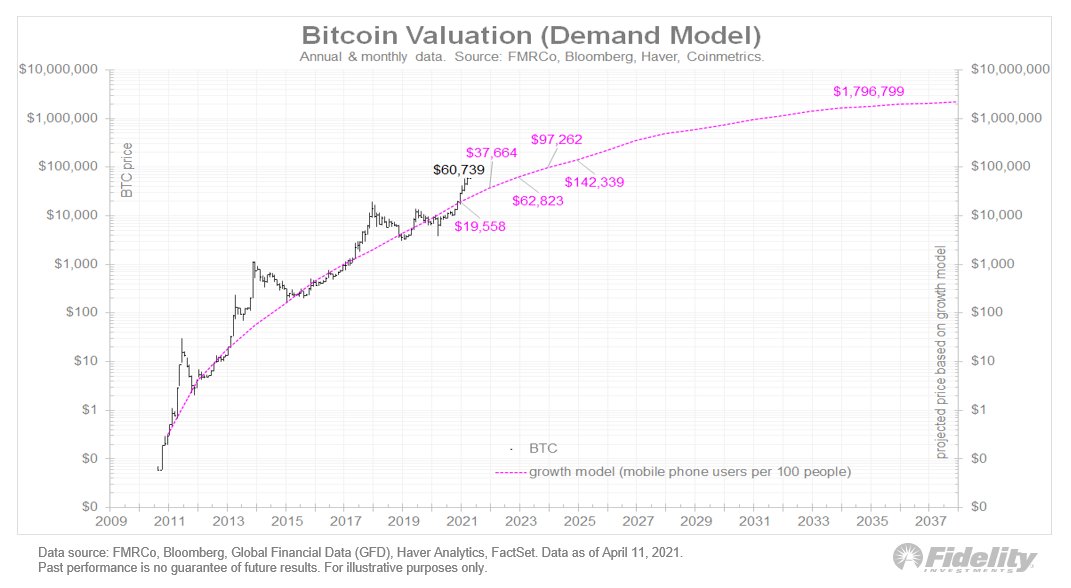

From there we can convert this demand curve into a price projection, by applying a power regression to the series. /9

Now let’s compare this to the stock-to-flow model. Below I added in the S2F model, which is the aforementioned inflation rate regressed against price. /10

I find it interesting that both the demand and supply models line up as well as they do, each appearing to predict ongoing impressive price gains. But the demand model turns more conservative than the S2F the further out we go. /11

Such is the nature of S-curves, as demand growth turns increasingly asymptotic while the supply curve continues on its pre-existing exponential trend. /12

I don’t know which model (if any) will do the best job in suggesting bitcoin’s historic journey, but for me the main takeaway is that it is helpful to look at both supply and demand curves. /13

While the S2F model seems too optimistic in the out years given its persistent exponential slope, the demand curve seems more plausible to me. (END/14)

Read on Twitter

Read on Twitter