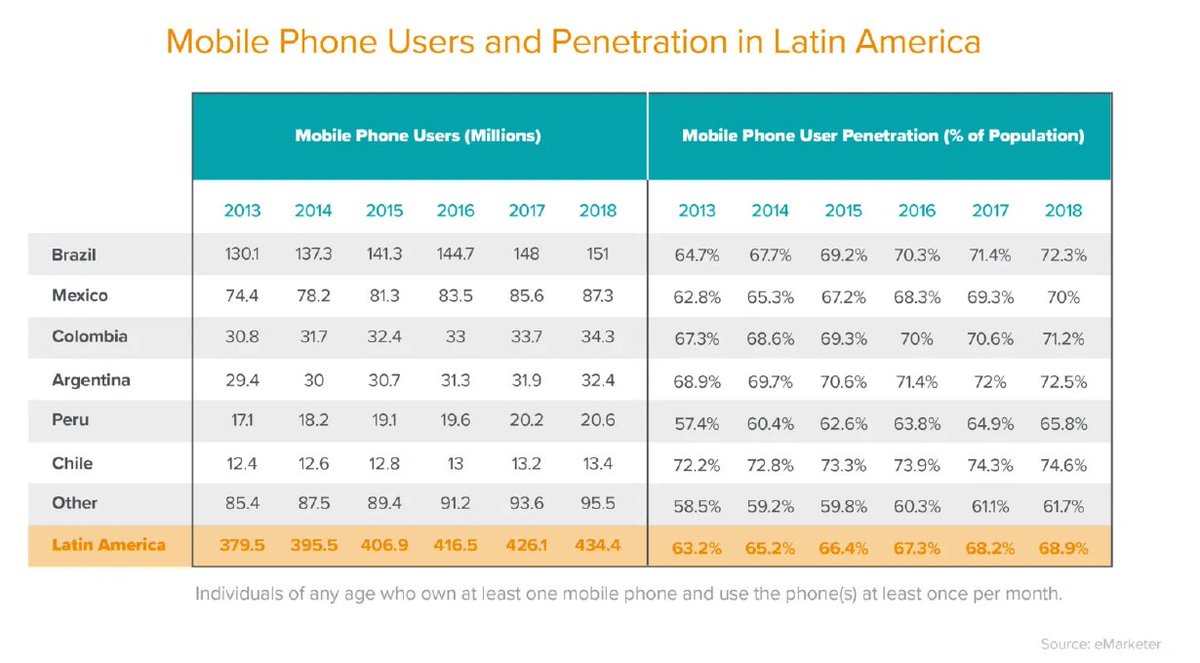

1/ Fintech in Latin America is growing explosively. Why? New post by @matt_haf & me on the large, latent demand of >600m people and why the opportunity for startups has never been bigger  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://a16z.com/2021/04/13/latin-america-fintech/">https://a16z.com/2021/04/1...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://a16z.com/2021/04/13/latin-america-fintech/">https://a16z.com/2021/04/1...

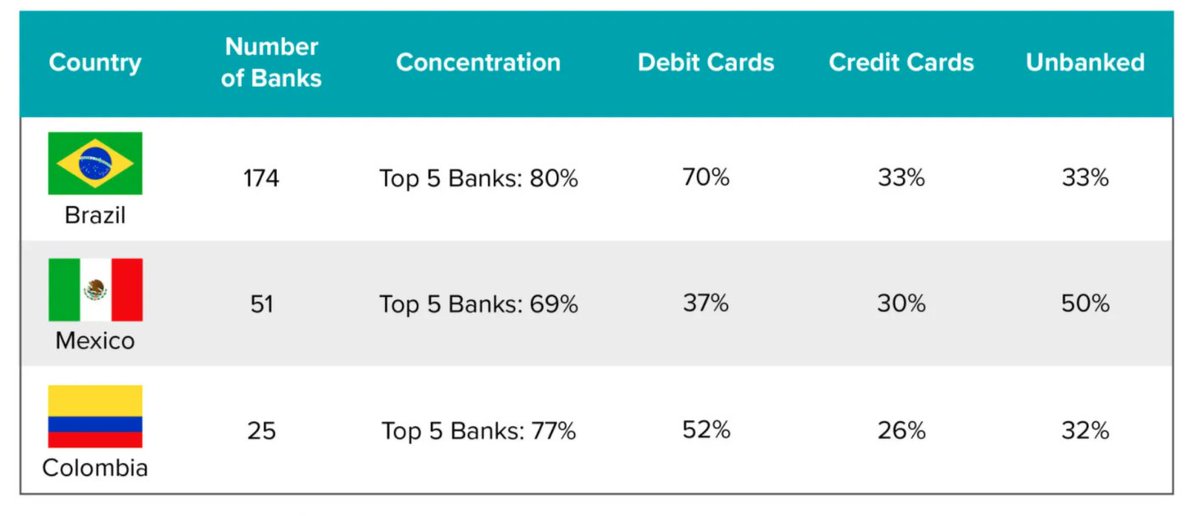

2/ Much of the population is underserved: credit card penetration< 1/3 in most countries, often >1/3 unbanked. For those that are served, the experience is still far from optimized (~25+ fields in an online app and day(s) to wait to be approved for a bank account)

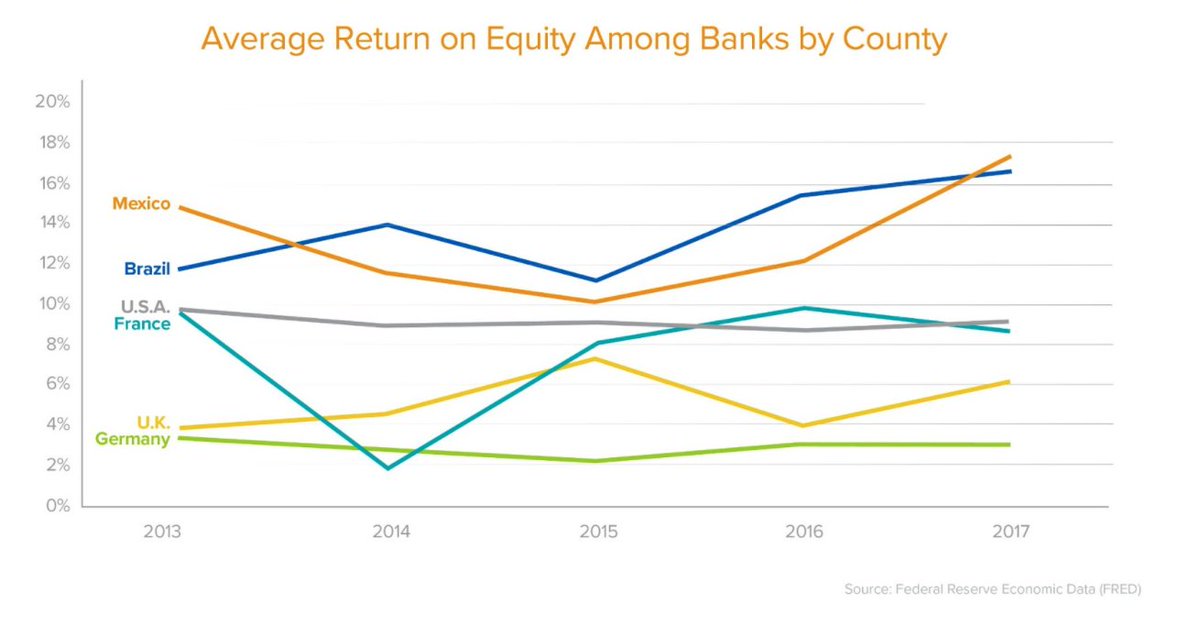

3/ Brazilian and Mexican banks have some of the highest ROEs in the world. In the words of Bezos - "Your margin is my opportunity" - the tipping point for fintech is now:

5/ Governments, especially those in MX and Brazil are driving legislation to create competition & to improve access (top 5 banks in both countries have 75%+ market share!). MX "ley fintech" creates path for fintechs to get banking licenses. Brazil& #39;s open banking is taking effect.

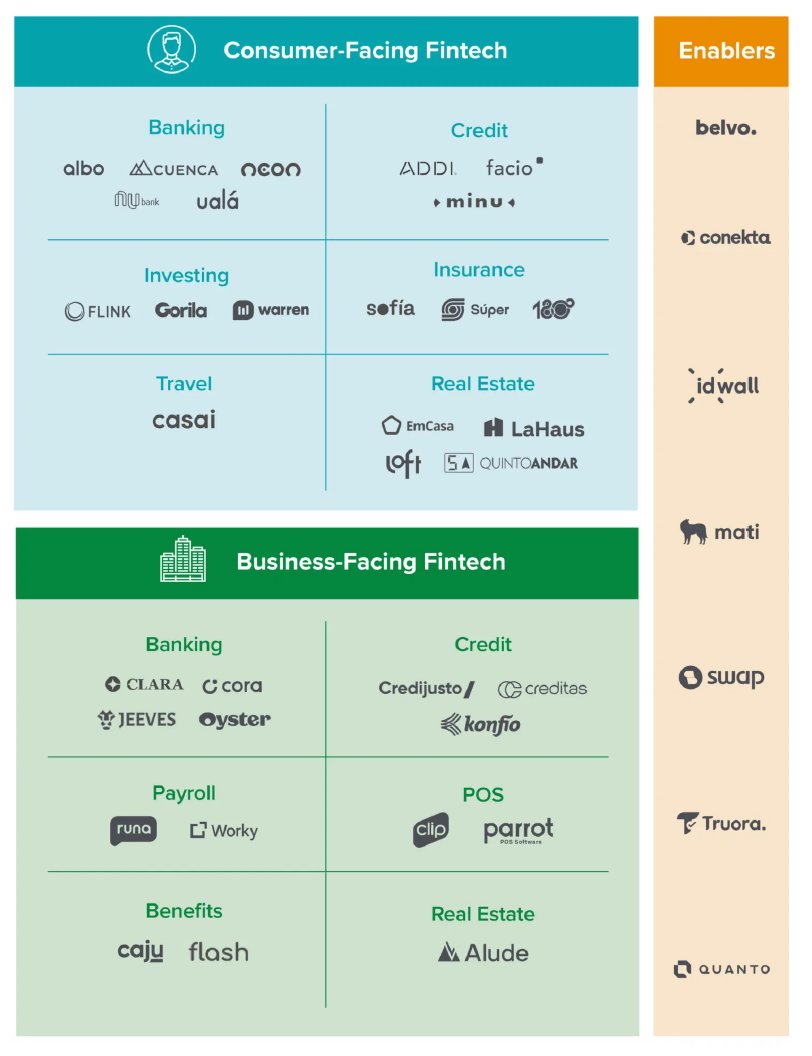

6/ The ecosystem is just getting started - Latam fintech covers most categories, and is growing quickly. Consumers & businesses in the near future may get their financial services entirely from companies built in the past 5 years...or those not yet in existence

7/ We are excited to partner with teams building the nextgen full stack players (banking per customer segment, investment platforms etc.), Infrastructure (new fintech customers wanting modern KYC, AML, aggregation), Business Services (modern payroll, b2b payments), Real Estate.

8/ Thank you to all our friends in the region (entrepreneurs, angels, local VCs) who have helped us so far! Look forward to partnering with you closely in the future

Read on Twitter

Read on Twitter