CPI Breakdown

The base effect is starting to impact the year over year numbers so we& #39;ll take a look at other measures for a less skewed idea of the recent inflation numbers.

1/

The base effect is starting to impact the year over year numbers so we& #39;ll take a look at other measures for a less skewed idea of the recent inflation numbers.

1/

Over the last few months, we& #39;ve seen a sharp rise in commodity inflation, producer inflation, and import inflation.

The price power hadn& #39;t been passed on to consumers

(See below tweet)

https://twitter.com/EPBResearch/status/1379084257641951234?s=20

2/">https://twitter.com/EPBResear...

The price power hadn& #39;t been passed on to consumers

(See below tweet)

https://twitter.com/EPBResearch/status/1379084257641951234?s=20

2/">https://twitter.com/EPBResear...

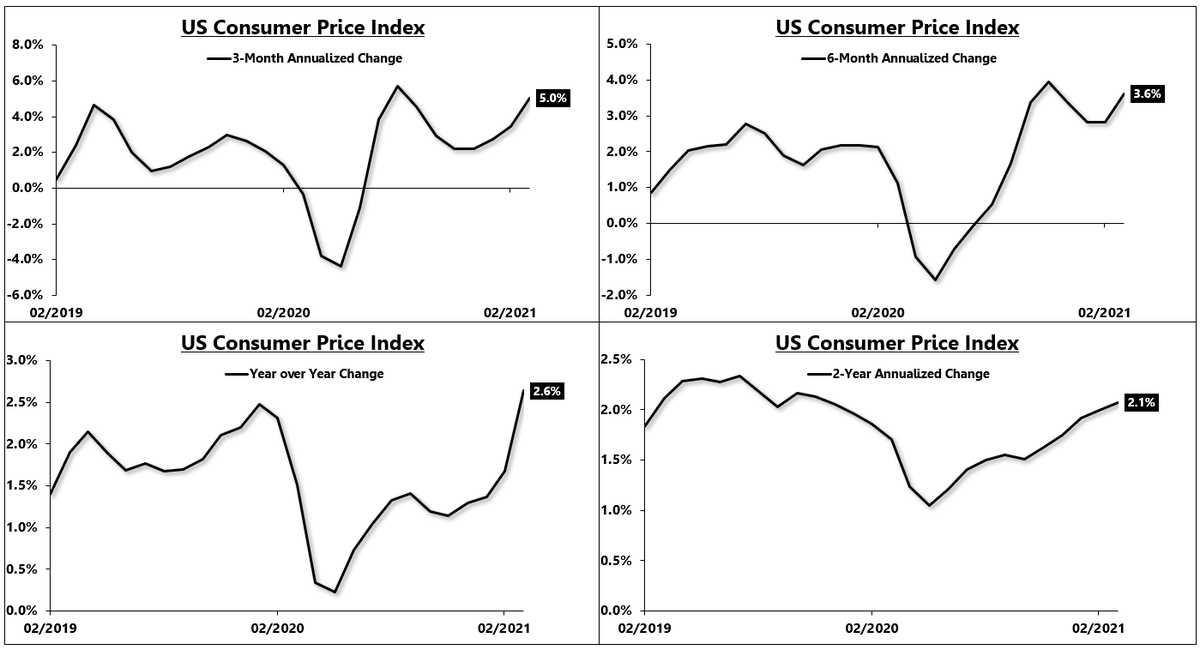

Today& #39;s CPI report showed headline inflation at 2.6% on a year over year basis.

On a 3-month and 6-month annualized basis, the CPI figures have come in "hot" with readings at 5.0% and 3.6% respectively.

3/

On a 3-month and 6-month annualized basis, the CPI figures have come in "hot" with readings at 5.0% and 3.6% respectively.

3/

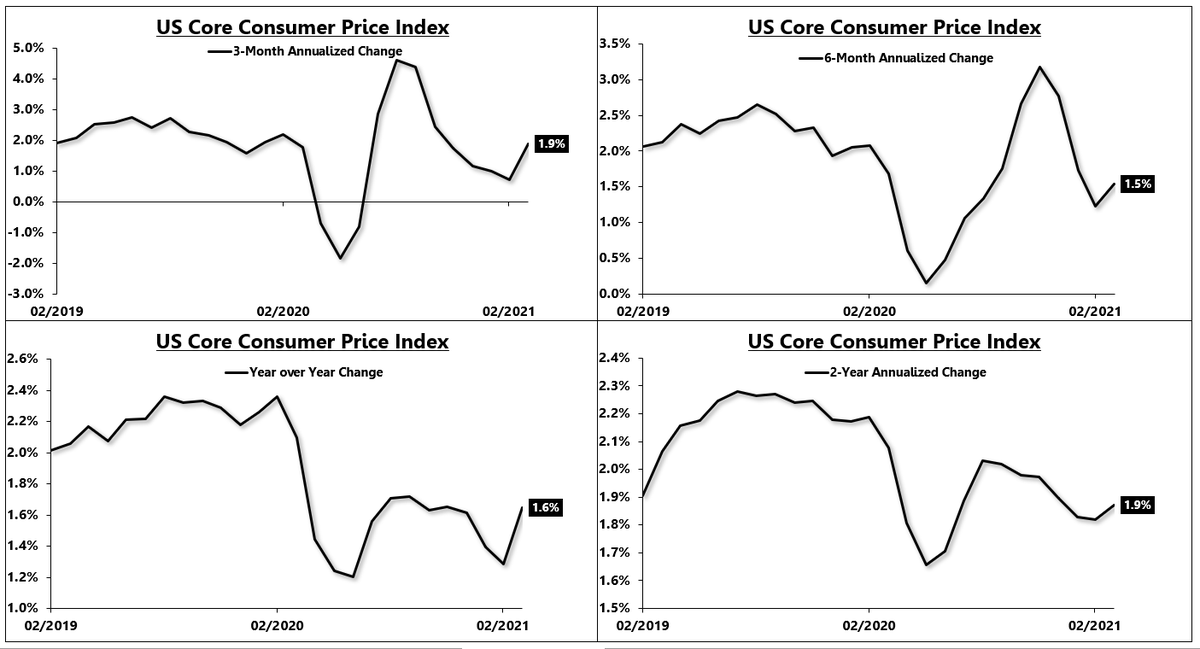

Core inflation also perked up. The year-over-year figure increased to 1.6% but core inflation also increased slightly on a 3-month and 6-month annualized basis.

From a high level, core inflation remains very subdued.

4/

From a high level, core inflation remains very subdued.

4/

Core inflation is being held down by rent inflation, which has declined to 1.8% on a year-over-year basis.

On a shorter 3-month and 6-month basis, there was a slight uptick in rent inflation.

5/

On a shorter 3-month and 6-month basis, there was a slight uptick in rent inflation.

5/

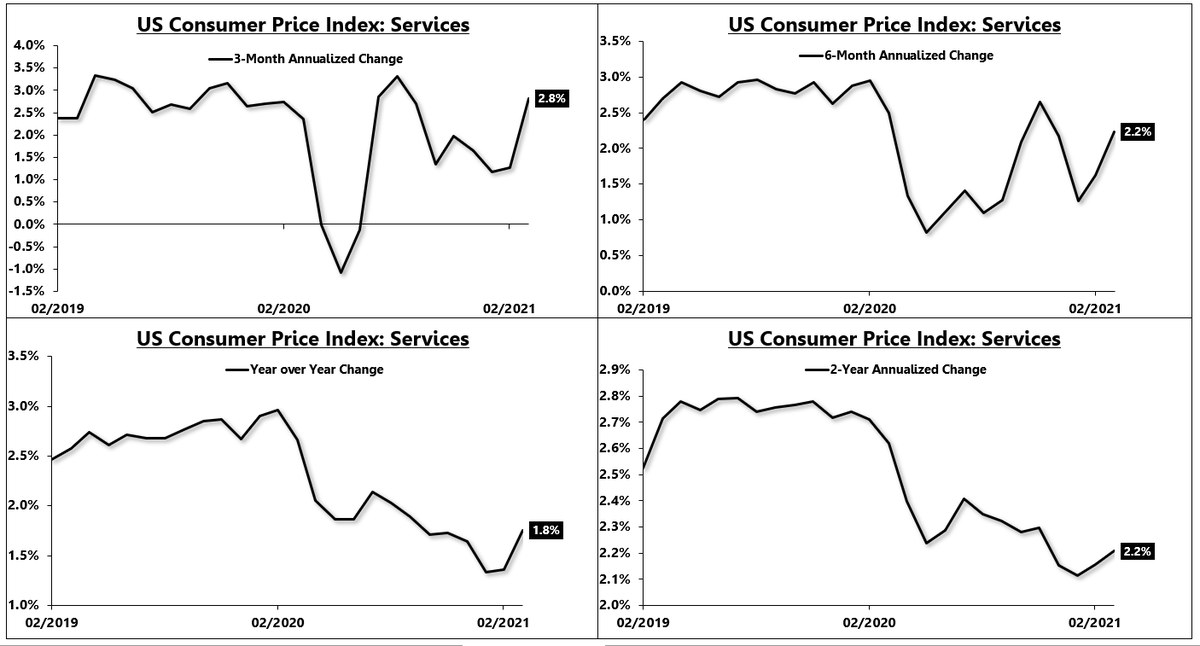

Services inflation has started to move higher as the economy reopens. Services CPI increased to 1.8% on a year over year basis but rose to 2.8% and 2.2% on a 3-month and 6-month annualized basis.

6/

6/

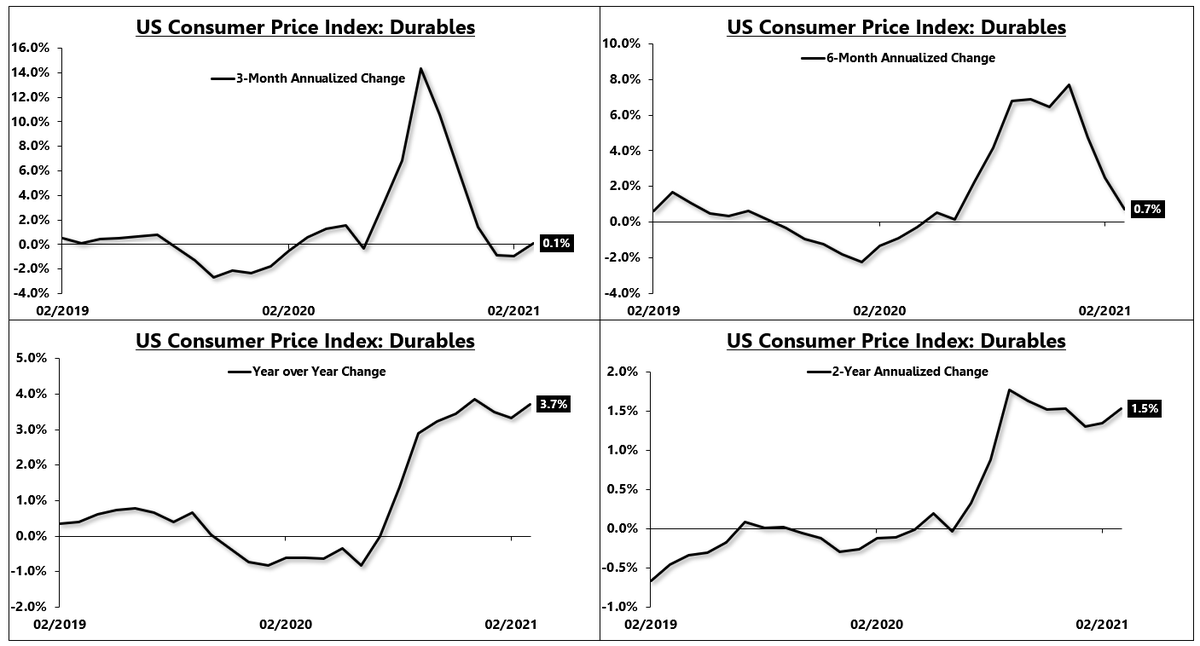

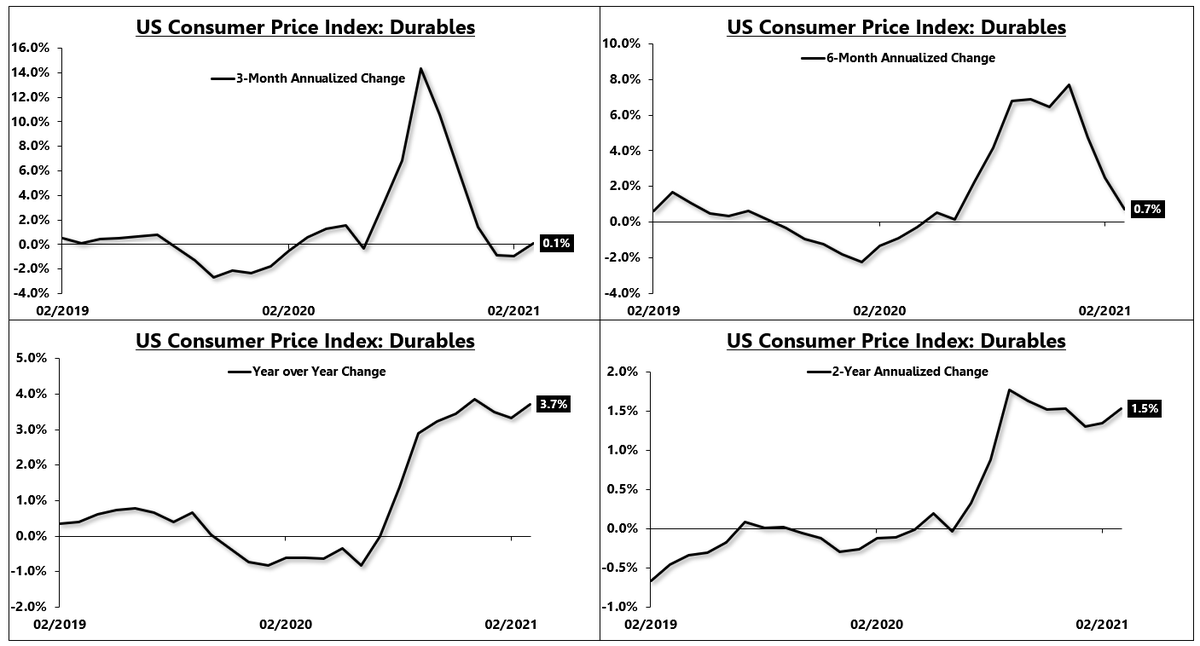

The key driver of inflation over the last several months has been durable goods due to backlogs and supply chain disruptions.

At one point, durable goods inflation rose 14% on a 3-month basis. Over the last 3-months, durable goods inflation has cooled to 0%.

7/

At one point, durable goods inflation rose 14% on a 3-month basis. Over the last 3-months, durable goods inflation has cooled to 0%.

7/

As the economy reopens & supply chains normalize, we& #39;ll see the price pressure on durables continue to come down as the inflation in the service sector edges up

On balance, we& #39;ve likely seen peak supply chain disruptions & peak short-term inflation with items like durables

9/

On balance, we& #39;ve likely seen peak supply chain disruptions & peak short-term inflation with items like durables

9/

With commodity price pressure still rising, it is premature to suggest that inflation will start to cool now, but some of the key drivers like durables have likely seen their peak. Once commodity price pressure cools, broader CPI will likely make its peak.

10/10

10/10

Read on Twitter

Read on Twitter