If Italians were forced to decide between #austerity and the #euro, what would they choose?

@luciobaccaro, @ErikNeimanns & I wanted to find out and wrote a paper, which is now out & #openaccess in @EUP_TheJournal.

A long-ish https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">on our findings

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">on our findings https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

[1/18] #bibr42-14651165211004772">https://journals.sagepub.com/doi/full/10.1177/14651165211004772 #bibr42-14651165211004772">https://journals.sagepub.com/doi/full/...

@luciobaccaro, @ErikNeimanns & I wanted to find out and wrote a paper, which is now out & #openaccess in @EUP_TheJournal.

A long-ish

[1/18] #bibr42-14651165211004772">https://journals.sagepub.com/doi/full/10.1177/14651165211004772 #bibr42-14651165211004772">https://journals.sagepub.com/doi/full/...

In fall 2019, there was a standoff between the Italian gov. and the European Commission about the country’s budget deficit.

This increased the risks of a new financial crisis in https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇪🇺" title="Flagge der Europäischen Union" aria-label="Emoji: Flagge der Europäischen Union">: it once again raised questions about the sustainability of Italy& #39;s public finances.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇪🇺" title="Flagge der Europäischen Union" aria-label="Emoji: Flagge der Europäischen Union">: it once again raised questions about the sustainability of Italy& #39;s public finances.

[2/18]

This increased the risks of a new financial crisis in

[2/18]

Such concerns about debt sustainability can easily turn into a self-fulfilling prophecy: higher interest rates make it difficult for the government to refinance itself, forcing it to ask for a bailout or exit from the common currency.

[3/18]

[3/18]

According to the rules introduced during the euro crisis, a European bailout is costly: countries applying for an ESM loan have to implement austerity and structural reforms. Unsurprisingly, these policies are unpopular.

[4/18]

[4/18]

On the unpopularity of austerity, see some of my work with colleagues from the @EUI_EU in the @BJPolS.

Other people with great work on this include @EveHubscher, @SattlersThomas, @MarkusWagnerAT, @alexgkuo, @LHaffert, @Olijacques89 & many others.

[5/18] https://www.cambridge.org/core/journals/british-journal-of-political-science/article/effect-of-austerity-packages-on-government-popularity-during-the-great-recession/AB8459689B9F126B11E50C488138CDEB">https://www.cambridge.org/core/jour...

Other people with great work on this include @EveHubscher, @SattlersThomas, @MarkusWagnerAT, @alexgkuo, @LHaffert, @Olijacques89 & many others.

[5/18] https://www.cambridge.org/core/journals/british-journal-of-political-science/article/effect-of-austerity-packages-on-government-popularity-during-the-great-recession/AB8459689B9F126B11E50C488138CDEB">https://www.cambridge.org/core/jour...

Still, voters in most crisis-ridden countries don& #39;t want to leave the € despite the costs of austerity. For example, @IgnacioJurado, @stefwalter__, @nikkon7 & @EliasDinas show that Greek voters wanted to remain despite rejecting the bailout.

[6/18] https://journals.sagepub.com/doi/abs/10.1177/1465116520928118">https://journals.sagepub.com/doi/abs/1...

[6/18] https://journals.sagepub.com/doi/abs/10.1177/1465116520928118">https://journals.sagepub.com/doi/abs/1...

How do Italians evaluate this trade-off?

The question is important because support for the € is lower in Italy than in most other countries.

Due to its size, a financial crisis in Italy and a potential #Italexit could also have dramatic consequences for the eurozone.

[7/18]

The question is important because support for the € is lower in Italy than in most other countries.

Due to its size, a financial crisis in Italy and a potential #Italexit could also have dramatic consequences for the eurozone.

[7/18]

We thus fielded an online survey in Italy in Oct. 2019. All respondents read a basic, hypothetical crisis scenario but we randomly exposed them to additional info about a) the costs of a bailout (austerity) and b) who was responsible for the crisis (the gov. vs. the EU)

[8/18]

[8/18]

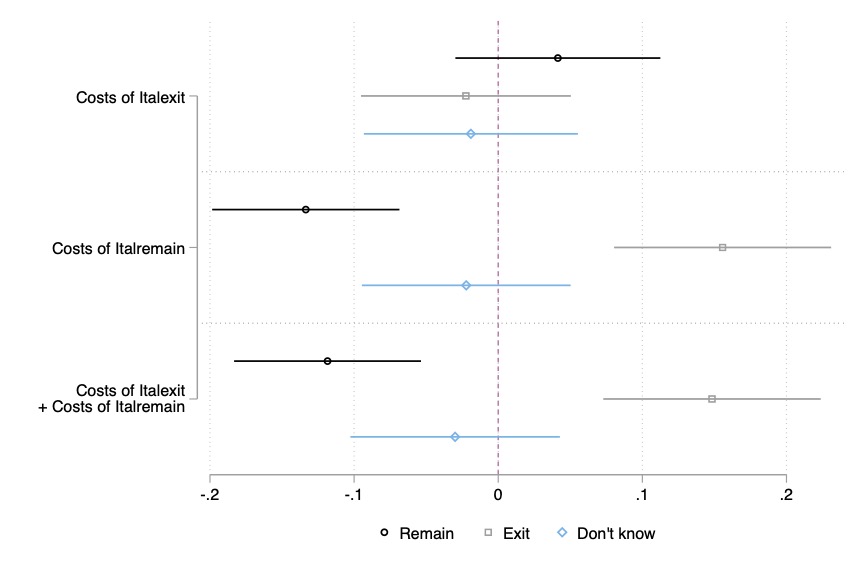

Our results suggest that public opinion is sensitive to the costs of remaining in the monetary union. If voters are informed that eurozone membership comes at the cost of austerity, support for exit increases by 15%, while support for remaining decreases by almost 20%.

[9/18]

[9/18]

In contrast, blame attribution does not have any effect. Apparently, Italian voters do not care much about whose fault the crisis is, but they strongly oppose further austerity.

[10/18]

[10/18]

Overall, our results show that in 2019, a majority would have preferred to stay in the euro if a bailout did not involve conditionality, but that a majority would have opted for #Italexit if a bailout was contingent on austerity policies.

[11/18]

[11/18]

There is an important caveat: in this paper, we did not present respondents with information highlighting the costs of #Italexit. In a follow-up study, however, we find that Italians discount these costs.

Read the full working paper here: https://osf.io/preprints/socarxiv/atg8p/

[12/18]">https://osf.io/preprints...

Read the full working paper here: https://osf.io/preprints/socarxiv/atg8p/

[12/18]">https://osf.io/preprints...

For this working paper, we actually conducted two new survey experiments and presented respondents in Germany with the same scenario: a financial crisis in Italy. In contrast to Italians, Germans strongly react to a frame highlighting the costs of Italexit for them.

[13/18]

[13/18]

This makes European debt mutualization possible if there is a credible threat of Italexit.

But back to the @EUP_TheJournal paper: our results here clearly show that conditionality may turn Italians against the €. This is independent of who is to blame for the crisis.

[14/18]

But back to the @EUP_TheJournal paper: our results here clearly show that conditionality may turn Italians against the €. This is independent of who is to blame for the crisis.

[14/18]

Now, you may ask: did the pandemic recovery fund, if passed soon, not fundamentally the situation?

In my view, not really.

[15/18]

In my view, not really.

[15/18]

#NextGenEU undermined the arguments of Eurosceptics, even within Lega. It also changed the dynamics of Italian politics, as conflicts about how to spend emerged.

Read the @monkeycageblog article by @Ari_Tassinari and @FabioBulfone on this.

[16/18] https://www.washingtonpost.com/politics/2021/02/23/italys-last-prime-minister-fell-thanks-fights-over-eu-money-new-one-now-has-chance-spend-it/?utm_campaign=wp_monkeycage&utm_source=twitter&utm_me">https://www.washingtonpost.com/politics/...

Read the @monkeycageblog article by @Ari_Tassinari and @FabioBulfone on this.

[16/18] https://www.washingtonpost.com/politics/2021/02/23/italys-last-prime-minister-fell-thanks-fights-over-eu-money-new-one-now-has-chance-spend-it/?utm_campaign=wp_monkeycage&utm_source=twitter&utm_me">https://www.washingtonpost.com/politics/...

However, the money earmarked for Italy will likely be too small compared to Italy& #39;s debt and the additional (fiscal) burden caused by the pandemic. Moreover, conditionality is not dead: rather, the money from the fund will apparently also come with some strings attached.

[17/18]

[17/18]

Our paper shows that this is approach is dangerous. European policymakers could hit the limit of their preferred crisis resolution strategy if there was a fiscal crisis in Italy, as voters are unwilling to accept austerity in exchange for (limited) financial support.

[18/18]

[18/18]

Read on Twitter

Read on Twitter![How do Italians evaluate this trade-off?The question is important because support for the € is lower in Italy than in most other countries.Due to its size, a financial crisis in Italy and a potential #Italexit could also have dramatic consequences for the eurozone.[7/18] How do Italians evaluate this trade-off?The question is important because support for the € is lower in Italy than in most other countries.Due to its size, a financial crisis in Italy and a potential #Italexit could also have dramatic consequences for the eurozone.[7/18]](https://pbs.twimg.com/media/Ey2Z07eXIAYfM6q.jpg)

![Our results suggest that public opinion is sensitive to the costs of remaining in the monetary union. If voters are informed that eurozone membership comes at the cost of austerity, support for exit increases by 15%, while support for remaining decreases by almost 20%.[9/18] Our results suggest that public opinion is sensitive to the costs of remaining in the monetary union. If voters are informed that eurozone membership comes at the cost of austerity, support for exit increases by 15%, while support for remaining decreases by almost 20%.[9/18]](https://pbs.twimg.com/media/Ey2aUqGWEAAxa2k.jpg)

![Overall, our results show that in 2019, a majority would have preferred to stay in the euro if a bailout did not involve conditionality, but that a majority would have opted for #Italexit if a bailout was contingent on austerity policies.[11/18] Overall, our results show that in 2019, a majority would have preferred to stay in the euro if a bailout did not involve conditionality, but that a majority would have opted for #Italexit if a bailout was contingent on austerity policies.[11/18]](https://pbs.twimg.com/media/Ey2ahnBXMAApGRK.jpg)