1/x Interested in learning how volatility forecasting models work? Time for a thread.

Consider a time series of stock returns (model input). At time t-1, we make the prediction of the future return R(t) using the information available at time t-1.

R(t) = [P(t) - P(t-1)]/P(t-1)

Consider a time series of stock returns (model input). At time t-1, we make the prediction of the future return R(t) using the information available at time t-1.

R(t) = [P(t) - P(t-1)]/P(t-1)

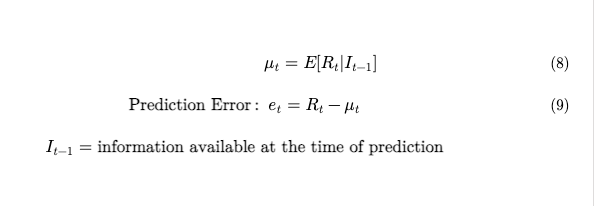

2/x The first step of our prediction exercise is to predict the mean return. Put simply, what& #39;s the best possible prediction of actual return? It& #39;s the expectation of the future return given I(t-1).

Remember, I(t-1) is the information available at the time of prediction (t-1).

Remember, I(t-1) is the information available at the time of prediction (t-1).

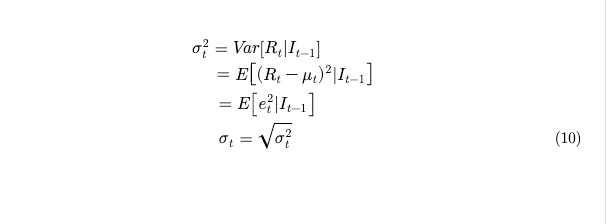

3/x Now that we& #39;ve predicted the mean return, we proceed to predict the variance. Put simply, how far off the return can be from its mean, given the information available at the time of prediction t-1? $VXX $VIX

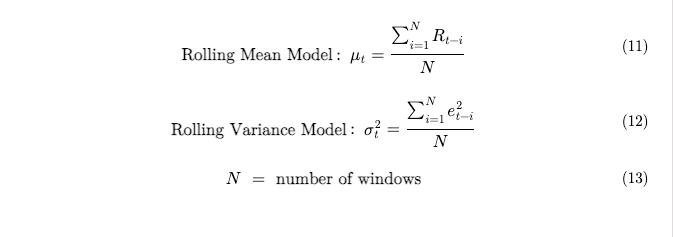

4/x We need to formulate an equation that maps the past returns into a prediction of the mean and another equation that maps the past returns to predict the variance. This is accomplished by using "rolling" models (rolling mean model & rolling variance model).

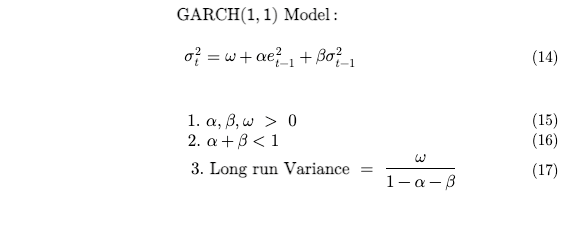

5/x GARCH(1,1), one of the most popular volatility forecasting models, simply maps the past returns into predictions of the variance. Parameter restriction #2 (see below) ensures that the predicted variance always returns to the long-run variance hence, variance is mean-reverting.

Read on Twitter

Read on Twitter![1/x Interested in learning how volatility forecasting models work? Time for a thread.Consider a time series of stock returns (model input). At time t-1, we make the prediction of the future return R(t) using the information available at time t-1.R(t) = [P(t) - P(t-1)]/P(t-1) 1/x Interested in learning how volatility forecasting models work? Time for a thread.Consider a time series of stock returns (model input). At time t-1, we make the prediction of the future return R(t) using the information available at time t-1.R(t) = [P(t) - P(t-1)]/P(t-1)](https://pbs.twimg.com/media/EyzkHP1XEAkuT88.png)