1/ Nick Huber ( @sweatystartup) is a real estate investor.

With a series of smart business decisions, he went from bootstrapping a business in college to managing 16 properties in his early 30s.

Here& #39;s how he did it... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

With a series of smart business decisions, he went from bootstrapping a business in college to managing 16 properties in his early 30s.

Here& #39;s how he did it...

2/ Nick has a longtime friend as a business partner.

He and @dan_hagberg were co-captains of the Cornell track team. In 2011, they founded a company called Storage Squad which picked up, stored, and re-delivered students& #39; items when they went home for the summer.

He and @dan_hagberg were co-captains of the Cornell track team. In 2011, they founded a company called Storage Squad which picked up, stored, and re-delivered students& #39; items when they went home for the summer.

3/ They grew Storage Squad to service over 7,000 students per year at 25 major colleges at 12 states, $2.5M per year in revenue and $500k per year in profit.

They also learned that a stressful services business wasn& #39;t how they wanted to spend the rest of their lives.

They also learned that a stressful services business wasn& #39;t how they wanted to spend the rest of their lives.

4/ By 2015, they saved up $500k. They got interested in self-storage real estate because:

- They had the money to get started in real estate

- They had deep self-storage expertise

- Nick& #39;s dad is a construction manager who could advise on building a self-storage facility

- They had the money to get started in real estate

- They had deep self-storage expertise

- Nick& #39;s dad is a construction manager who could advise on building a self-storage facility

5/ So they started raising money from anyone who had money to invest in real estate.

They pitched 100+ people before rounding out their investment team:

- 5 LPs

- 2 sponsors: Nick and Dan

They built a $2.4M facility with 39k rentable SF, and the facility was making money.

They pitched 100+ people before rounding out their investment team:

- 5 LPs

- 2 sponsors: Nick and Dan

They built a $2.4M facility with 39k rentable SF, and the facility was making money.

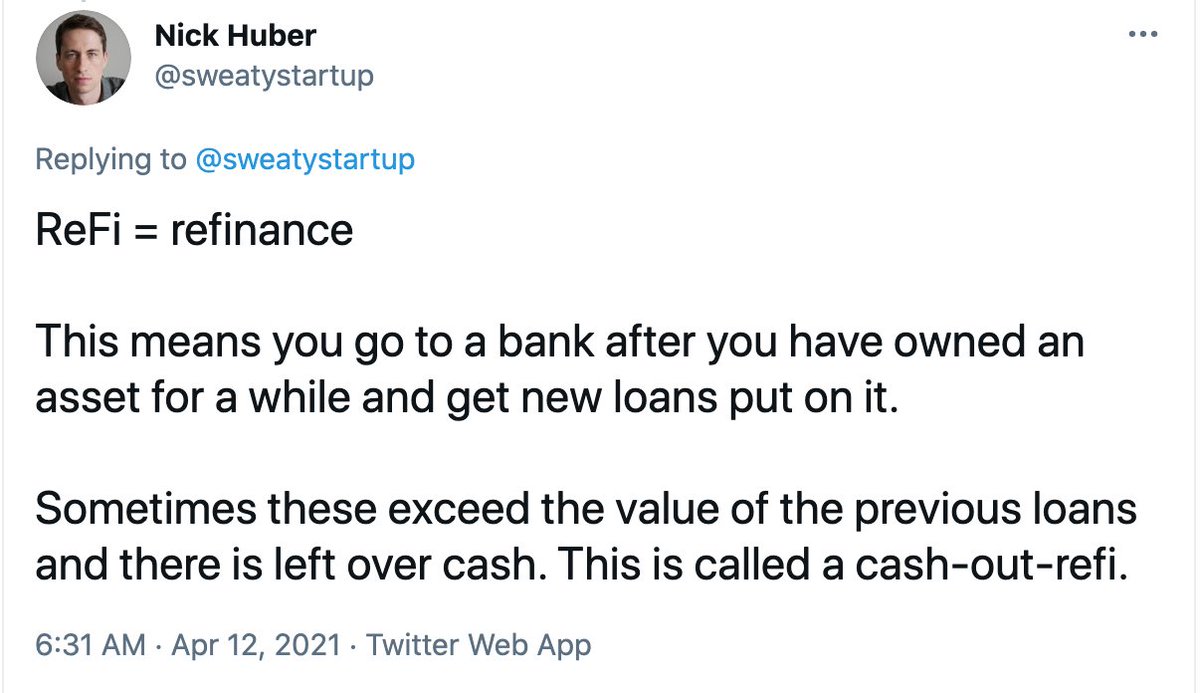

6/ Nick & Dan soon learned about the magical cash-out refinance. Check out Nick& #39;s tweet here for a brief explanation.

They refinanced to get a tax-free $2M deposited into their bank accounts.

Nick & Dan became millionaires at 29.

Real estate investors do this all the time.

They refinanced to get a tax-free $2M deposited into their bank accounts.

Nick & Dan became millionaires at 29.

Real estate investors do this all the time.

7/ With initial success under their belt, they sought to expand.

In my view, their successful expansion is due to at least 3 things:

- Competitive advantage

- Dealflow

- Fundraising

In my view, their successful expansion is due to at least 3 things:

- Competitive advantage

- Dealflow

- Fundraising

8/ Their competitive advantage comes from being young operators of Storage Squad. They are good at online-first customer experiences, digital marketing, and remote-first logistics.

They can achieve healthy returns on small rural properties while large REITs can& #39;t.

They can achieve healthy returns on small rural properties while large REITs can& #39;t.

9/ In my assessment, they have great dealflow because they are more experienced buyers.

Real estate in tertiary markets is weird because most sellers have never sold before.

Nick & Dan had a lot to gain by creating their own scalable buying process.

Real estate in tertiary markets is weird because most sellers have never sold before.

Nick & Dan had a lot to gain by creating their own scalable buying process.

10/ Fundraising is important because you can do larger deals and grow faster.

Inspired by @moseskagan, Nick started tweeting intentionally to build an audience. He built enough organic relationships to fundraise and reach the next level of scale for his business.

Inspired by @moseskagan, Nick started tweeting intentionally to build an audience. He built enough organic relationships to fundraise and reach the next level of scale for his business.

11/ Today, Nick and Dan are operating as Bolt Storage and they& #39;re growing quickly.

Nick had $500k in his pocket at 24, had a $5M net worth at 29, and is on track to being worth $50M by 40.

Nick had $500k in his pocket at 24, had a $5M net worth at 29, and is on track to being worth $50M by 40.

12/ If you want to learn more about real estate, follow Nick @sweatystartup.

If you like these stories about smart moves to make money, follow @dillonzfo.

If you want to invest in real estate, I& #39;m building Steady Capital so you can invest for $100: https://www.steady.capital/ ">https://www.steady.capital/">...

If you like these stories about smart moves to make money, follow @dillonzfo.

If you want to invest in real estate, I& #39;m building Steady Capital so you can invest for $100: https://www.steady.capital/ ">https://www.steady.capital/">...

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="1/ Nick Huber ( @sweatystartup) is a real estate investor.With a series of smart business decisions, he went from bootstrapping a business in college to managing 16 properties in his early 30s.Here& #39;s how he did it... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" title="1/ Nick Huber ( @sweatystartup) is a real estate investor.With a series of smart business decisions, he went from bootstrapping a business in college to managing 16 properties in his early 30s.Here& #39;s how he did it... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>