A high quality growth company with massive tailwinds, going the SPAC route to accelerate its vision. Lets go!

Sema4 has a genomics testing solution for patients, which it leverages to build a repository of real world patient data

They then monetise this database to Pharma & healthcare systems

Would Pharma & healthcare pay for this service

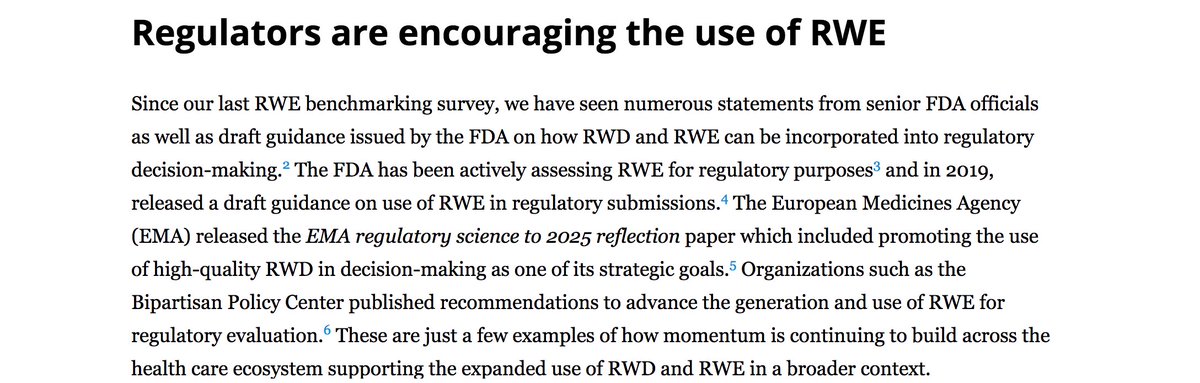

In 2016, the Congress passed the Cures Act to accelerate medical product development

The Act included a provision for the FDA to create a Real World Evidence (RWE) framework to guide developers in using Real World Data (RWD) for regulatory approval

RWD  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏩" title="Nach rechts zeigendes doppeltes Dreieck" aria-label="Emoji: Nach rechts zeigendes doppeltes Dreieck"> RWE

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏩" title="Nach rechts zeigendes doppeltes Dreieck" aria-label="Emoji: Nach rechts zeigendes doppeltes Dreieck"> RWE

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔈" title="Lautsprecher" aria-label="Emoji: Lautsprecher">Real World Data (RWD) are the data relating to patient health status or the delivery of health care routinely collected from a variety of sources

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔈" title="Lautsprecher" aria-label="Emoji: Lautsprecher">Real World Data (RWD) are the data relating to patient health status or the delivery of health care routinely collected from a variety of sources

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔈" title="Lautsprecher" aria-label="Emoji: Lautsprecher">Real World Evidence (RWE) is clinical evidence regarding the usage of medical product derived from analysis of RWD

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔈" title="Lautsprecher" aria-label="Emoji: Lautsprecher">Real World Evidence (RWE) is clinical evidence regarding the usage of medical product derived from analysis of RWD

How does this relate to Sema4? Hang in there, it will make sense

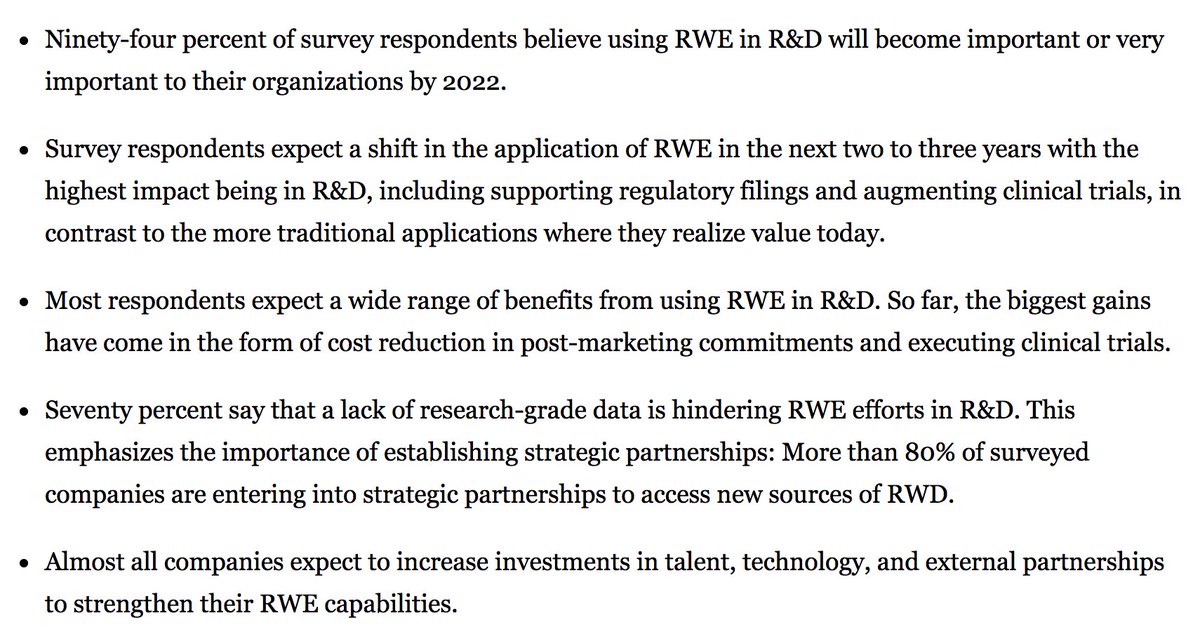

Pharma companies see massive value in RWE/RWD

Study by Deloitte surveying pharma reveals:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> 94% believe RWE will be very important by 2022

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> 94% believe RWE will be very important by 2022

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Almost all companies expect to increase external partnerships for RWD

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Almost all companies expect to increase external partnerships for RWD

Pharma companies see massive value in RWE/RWD

Study by Deloitte surveying pharma reveals:

Who has the best clinical data?

Enter Sema4

.. and growing

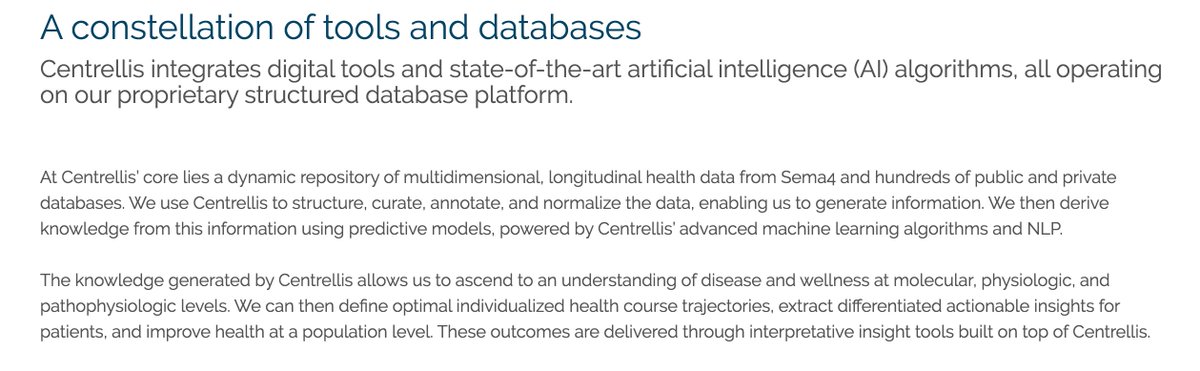

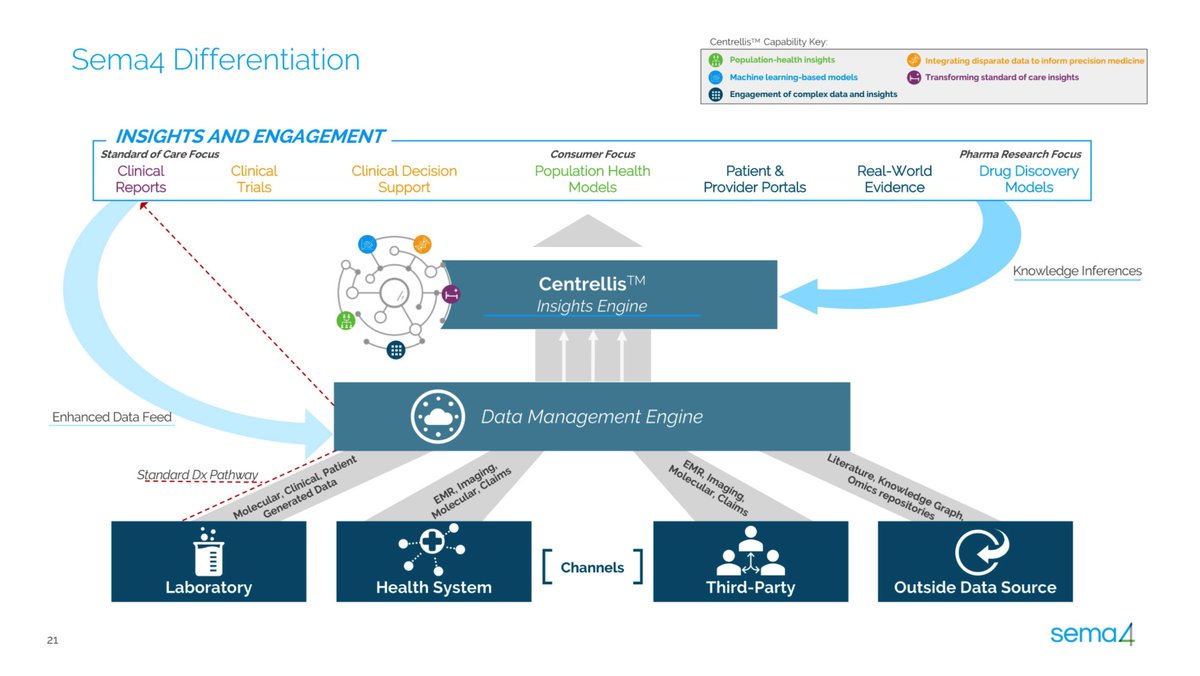

Sema4 collects clinical data from patients & other sources

..the data is fed into the Centrellis engine which generates insights for client use in trials, models

..which then creates enhanced data that is fed back into Centrellis

we like a good flywheel

This is where it gets fun..

Combine the demand for Real World Data with Centrellis and you get a business that compounds data like Buffet compounds his investments

The more customers use Sema4, the better the data will be for future customers and the wheel keeps spinning

Combine the demand for Real World Data with Centrellis and you get a business that compounds data like Buffet compounds his investments

The more customers use Sema4, the better the data will be for future customers and the wheel keeps spinning

I see two main customers: health systems & Pharma companies

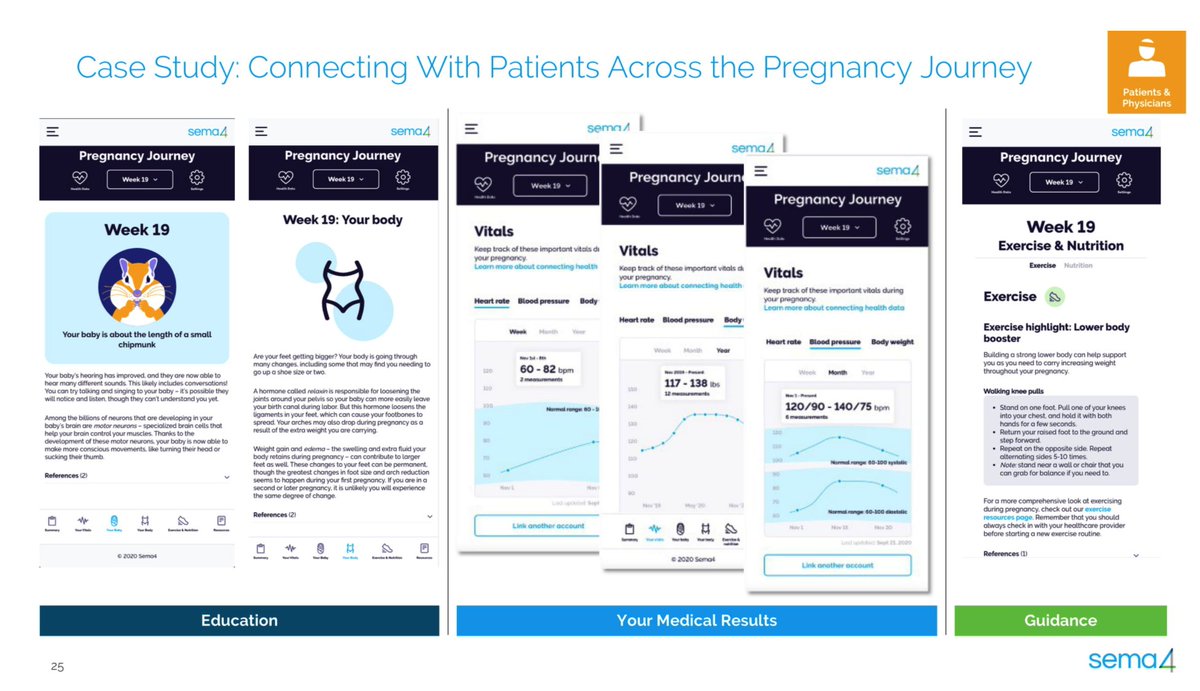

For health systems, the value proposition is simple: offer actionable insights at every stage of the patient journey

The value Sema4 provides is the ability to personalise insights which could help identify risks

For health systems, the value proposition is simple: offer actionable insights at every stage of the patient journey

The value Sema4 provides is the ability to personalise insights which could help identify risks

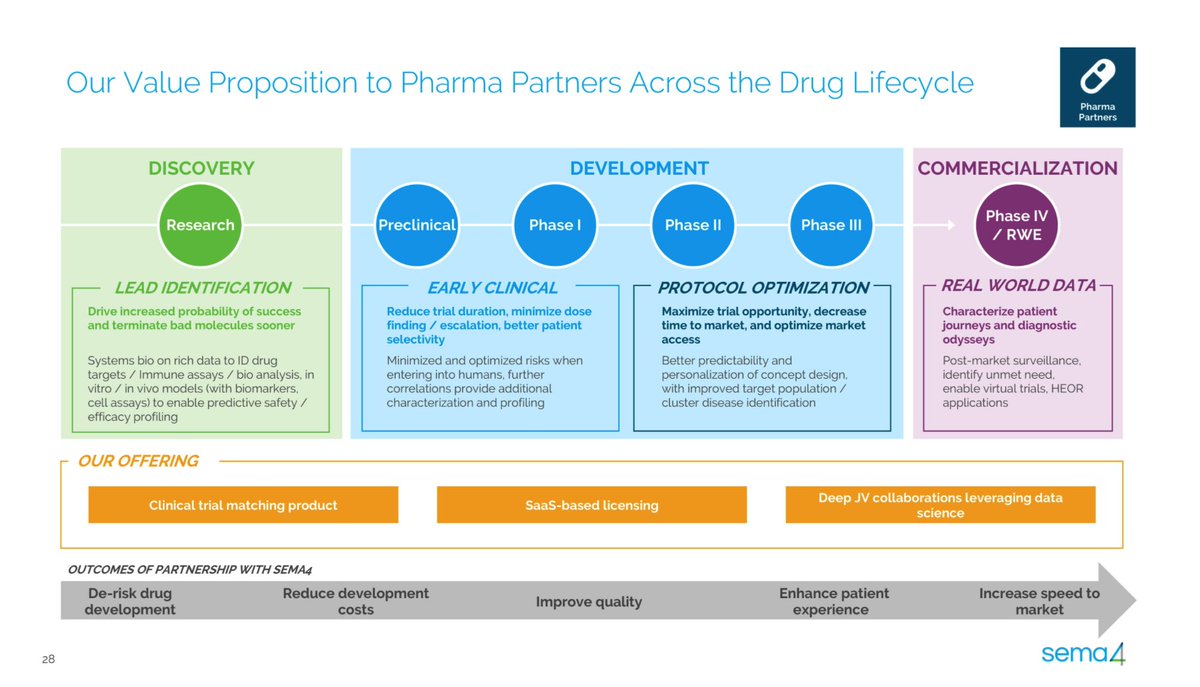

For Pharma companies, Sema4 has a smorgasbord of solutions.

In general, Sema4 adds value to Pharma& #39;s who need to use its intelligence to:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">De-risk drug development

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">De-risk drug development

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Reduce developmental costs

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Reduce developmental costs

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Improve patient selectivity

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Improve patient selectivity

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Increase speed to market

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Increase speed to market

and so on..

In general, Sema4 adds value to Pharma& #39;s who need to use its intelligence to:

and so on..

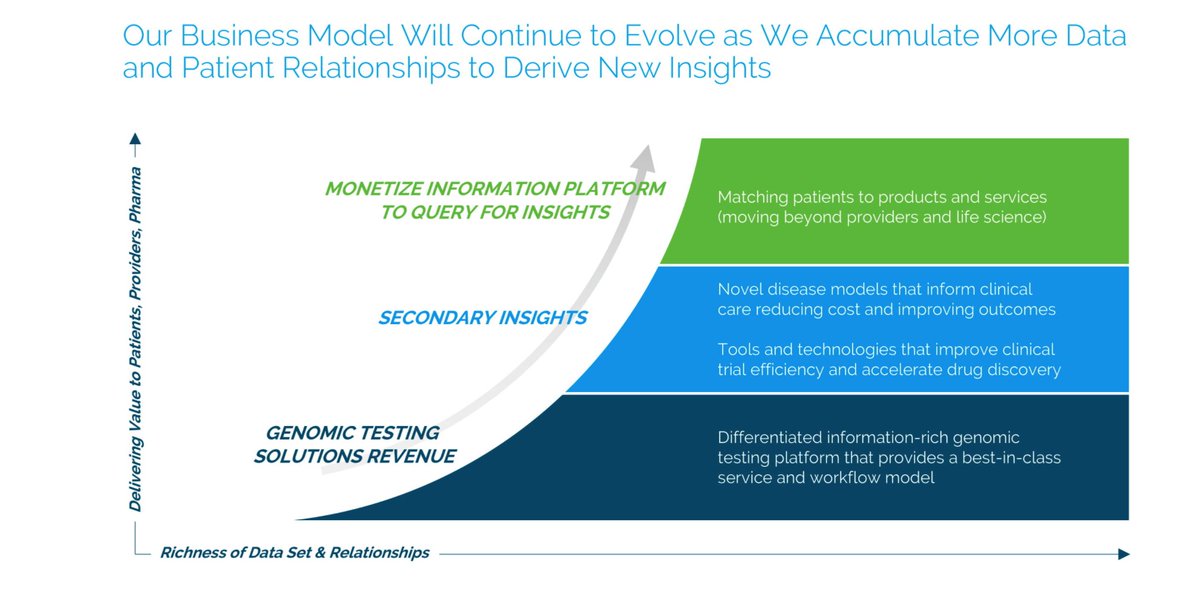

The base: revenue from genomics testing

The core: providing data-driven insights to improve the outcomes for Pharma & health systems

The aspiration: potentially a consumer play that matches patients to healthcare solutions and services (fascinating)

To achieve this, $CMLF needs to expand into other markets outside of women& #39;s health and increase the number/size of partnerships. Watch closely

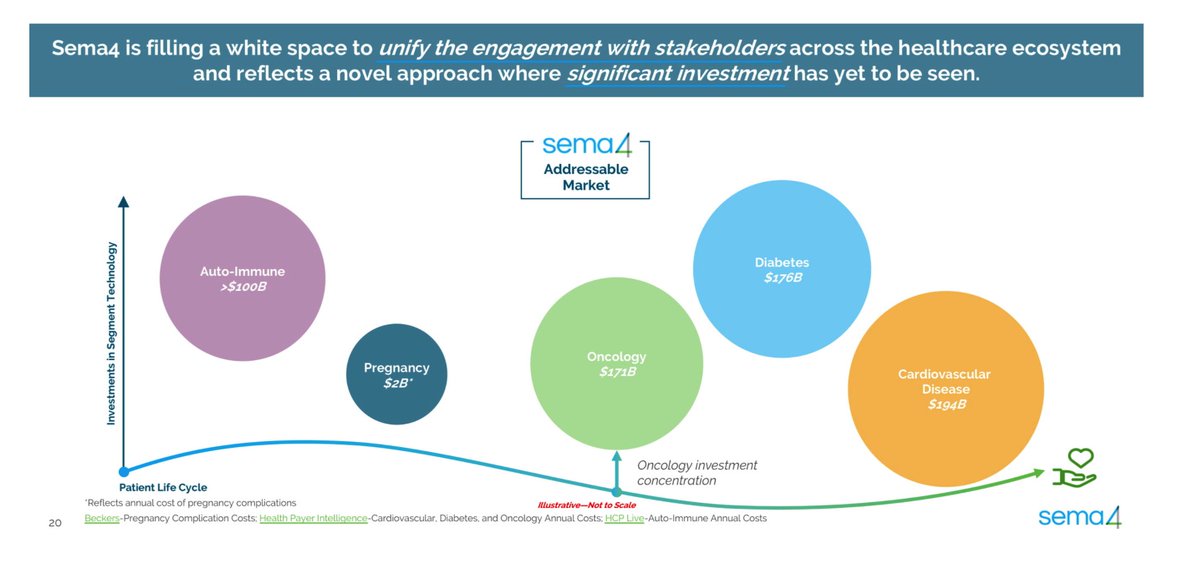

This is a tricky one to size (in a good way), Sema4 is pulling so many things together in an unprecedented way that it is difficult to see their ceiling

To use their own sizing: they estimate a $643B total addressable market

Their valuation is ~$3B

Where does their valuation stand amongst competitors?

$NVTA:$7.3B

$NTRA: $8.9B

$GH: $15.5B

$EXAS: $21B

$ADPT: $5.5B

$CMLF: $3B

I think its only crime is that it is underreported and it just missed the post Covid-19 Genomics mini bull run. There is a fair deal to be had here

$NVTA:$7.3B

$NTRA: $8.9B

$GH: $15.5B

$EXAS: $21B

$ADPT: $5.5B

$CMLF: $3B

I think its only crime is that it is underreported and it just missed the post Covid-19 Genomics mini bull run. There is a fair deal to be had here

It would be remiss of me not to mention the world class CEO: Eric Schadt Ph.D.

Dean for Precision Medicine at Mount Sinai

Fr Head of Genomics, Merck

Fr CSO $PACB

Founder at Sage Bionetworks

Chief Scientist at Rosetta Inpharmatics

You want him on your team

$CMLF is an attractive, longer term play built on:

If you enjoyed this $CMLF DD, follow along:

@RiskRewardCap https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille">

I also think you& #39;d like this DD:

@AnthonyOhayon

@NatHarooni

@LuoshengPeng

@SatoshiAlien

@BackpackerFI

@cperruna

@plantmath1

@RiskRewardCap

I also think you& #39;d like this DD:

@AnthonyOhayon

@NatHarooni

@LuoshengPeng

@SatoshiAlien

@BackpackerFI

@cperruna

@plantmath1

Use this to retweet the whole DD chain or simply to get back to the start! https://twitter.com/RiskRewardCap/status/1381674355587915777">https://twitter.com/RiskRewar...

Read on Twitter

Read on Twitter 94% believe RWE will be very important by 2022https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Almost all companies expect to increase external partnerships for RWD" title="How does this relate to Sema4? Hang in there, it will make sensePharma companies see massive value in RWE/RWDStudy by Deloitte surveying pharma reveals:https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> 94% believe RWE will be very important by 2022https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Almost all companies expect to increase external partnerships for RWD" class="img-responsive" style="max-width:100%;"/>

94% believe RWE will be very important by 2022https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Almost all companies expect to increase external partnerships for RWD" title="How does this relate to Sema4? Hang in there, it will make sensePharma companies see massive value in RWE/RWDStudy by Deloitte surveying pharma reveals:https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> 94% believe RWE will be very important by 2022https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">Almost all companies expect to increase external partnerships for RWD" class="img-responsive" style="max-width:100%;"/>

Unprecedented tailwindshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌬️" title="Wind blasendes Gesicht" aria-label="Emoji: Wind blasendes Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">All Pharma companies now believe RWD is important https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">The FDA is now pushing for the use of RWDhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">RWE is derived from analysing RWDhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="4⃣" title="Tastenkappe Ziffer 4" aria-label="Emoji: Tastenkappe Ziffer 4">Pharmas are constantly searching for high quality data sourcesWho has the best clinical data? Enter Sema4" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌬️" title="Wind blasendes Gesicht" aria-label="Emoji: Wind blasendes Gesicht">Unprecedented tailwindshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌬️" title="Wind blasendes Gesicht" aria-label="Emoji: Wind blasendes Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">All Pharma companies now believe RWD is important https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">The FDA is now pushing for the use of RWDhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">RWE is derived from analysing RWDhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="4⃣" title="Tastenkappe Ziffer 4" aria-label="Emoji: Tastenkappe Ziffer 4">Pharmas are constantly searching for high quality data sourcesWho has the best clinical data? Enter Sema4" class="img-responsive" style="max-width:100%;"/>

Unprecedented tailwindshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌬️" title="Wind blasendes Gesicht" aria-label="Emoji: Wind blasendes Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">All Pharma companies now believe RWD is important https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">The FDA is now pushing for the use of RWDhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">RWE is derived from analysing RWDhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="4⃣" title="Tastenkappe Ziffer 4" aria-label="Emoji: Tastenkappe Ziffer 4">Pharmas are constantly searching for high quality data sourcesWho has the best clinical data? Enter Sema4" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌬️" title="Wind blasendes Gesicht" aria-label="Emoji: Wind blasendes Gesicht">Unprecedented tailwindshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🌬️" title="Wind blasendes Gesicht" aria-label="Emoji: Wind blasendes Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1">All Pharma companies now believe RWD is important https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2">The FDA is now pushing for the use of RWDhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="3⃣" title="Tastenkappe Ziffer 3" aria-label="Emoji: Tastenkappe Ziffer 3">RWE is derived from analysing RWDhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="4⃣" title="Tastenkappe Ziffer 4" aria-label="Emoji: Tastenkappe Ziffer 4">Pharmas are constantly searching for high quality data sourcesWho has the best clinical data? Enter Sema4" class="img-responsive" style="max-width:100%;"/>

How much Real World Data does Sema4 have?https://abs.twimg.com/emoji/v2/... draggable="false" alt="📊" title="Balkendiagramm" aria-label="Emoji: Balkendiagramm">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">10+ million patient recordshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">5 million records w/ longitudinal clinical data https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">300K patient genomic data.. and growinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤖" title="Robotergesicht" aria-label="Emoji: Robotergesicht">Information stored & processed inside its Centrellis engine which uses machine learning to derive insights" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📊" title="Balkendiagramm" aria-label="Emoji: Balkendiagramm">How much Real World Data does Sema4 have?https://abs.twimg.com/emoji/v2/... draggable="false" alt="📊" title="Balkendiagramm" aria-label="Emoji: Balkendiagramm">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">10+ million patient recordshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">5 million records w/ longitudinal clinical data https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">300K patient genomic data.. and growinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤖" title="Robotergesicht" aria-label="Emoji: Robotergesicht">Information stored & processed inside its Centrellis engine which uses machine learning to derive insights" class="img-responsive" style="max-width:100%;"/>

How much Real World Data does Sema4 have?https://abs.twimg.com/emoji/v2/... draggable="false" alt="📊" title="Balkendiagramm" aria-label="Emoji: Balkendiagramm">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">10+ million patient recordshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">5 million records w/ longitudinal clinical data https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">300K patient genomic data.. and growinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤖" title="Robotergesicht" aria-label="Emoji: Robotergesicht">Information stored & processed inside its Centrellis engine which uses machine learning to derive insights" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📊" title="Balkendiagramm" aria-label="Emoji: Balkendiagramm">How much Real World Data does Sema4 have?https://abs.twimg.com/emoji/v2/... draggable="false" alt="📊" title="Balkendiagramm" aria-label="Emoji: Balkendiagramm">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">10+ million patient recordshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">5 million records w/ longitudinal clinical data https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">300K patient genomic data.. and growinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤖" title="Robotergesicht" aria-label="Emoji: Robotergesicht">Information stored & processed inside its Centrellis engine which uses machine learning to derive insights" class="img-responsive" style="max-width:100%;"/>

Flywheel alerthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Sema4 collects clinical data from patients & other sources..the data is fed into the Centrellis engine which generates insights for client use in trials, models..which then creates enhanced data that is fed back into Centrelliswe like a good flywheel https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎡" title="Riesenrad" aria-label="Emoji: Riesenrad">" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Flywheel alerthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Sema4 collects clinical data from patients & other sources..the data is fed into the Centrellis engine which generates insights for client use in trials, models..which then creates enhanced data that is fed back into Centrelliswe like a good flywheel https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎡" title="Riesenrad" aria-label="Emoji: Riesenrad">" class="img-responsive" style="max-width:100%;"/>

Flywheel alerthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Sema4 collects clinical data from patients & other sources..the data is fed into the Centrellis engine which generates insights for client use in trials, models..which then creates enhanced data that is fed back into Centrelliswe like a good flywheel https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎡" title="Riesenrad" aria-label="Emoji: Riesenrad">" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Flywheel alerthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">Sema4 collects clinical data from patients & other sources..the data is fed into the Centrellis engine which generates insights for client use in trials, models..which then creates enhanced data that is fed back into Centrelliswe like a good flywheel https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎡" title="Riesenrad" aria-label="Emoji: Riesenrad">" class="img-responsive" style="max-width:100%;"/>

De-risk drug developmenthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Reduce developmental costshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Improve patient selectivityhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Increase speed to marketand so on.." title="For Pharma companies, Sema4 has a smorgasbord of solutions. In general, Sema4 adds value to Pharma& #39;s who need to use its intelligence to:https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">De-risk drug developmenthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Reduce developmental costshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Improve patient selectivityhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Increase speed to marketand so on.." class="img-responsive" style="max-width:100%;"/>

De-risk drug developmenthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Reduce developmental costshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Improve patient selectivityhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Increase speed to marketand so on.." title="For Pharma companies, Sema4 has a smorgasbord of solutions. In general, Sema4 adds value to Pharma& #39;s who need to use its intelligence to:https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">De-risk drug developmenthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Reduce developmental costshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Improve patient selectivityhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧬" title="DNA" aria-label="Emoji: DNA">Increase speed to marketand so on.." class="img-responsive" style="max-width:100%;"/>

Sema4& #39;s growth strategyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">The base: revenue from genomics testingThe core: providing data-driven insights to improve the outcomes for Pharma & health systemsThe aspiration: potentially a consumer play that matches patients to healthcare solutions and services (fascinating)" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">Sema4& #39;s growth strategyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">The base: revenue from genomics testingThe core: providing data-driven insights to improve the outcomes for Pharma & health systemsThe aspiration: potentially a consumer play that matches patients to healthcare solutions and services (fascinating)" class="img-responsive" style="max-width:100%;"/>

Sema4& #39;s growth strategyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">The base: revenue from genomics testingThe core: providing data-driven insights to improve the outcomes for Pharma & health systemsThe aspiration: potentially a consumer play that matches patients to healthcare solutions and services (fascinating)" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">Sema4& #39;s growth strategyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">The base: revenue from genomics testingThe core: providing data-driven insights to improve the outcomes for Pharma & health systemsThe aspiration: potentially a consumer play that matches patients to healthcare solutions and services (fascinating)" class="img-responsive" style="max-width:100%;"/>

What is Sema4& #39;s TAMhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">This is a tricky one to size (in a good way), Sema4 is pulling so many things together in an unprecedented way that it is difficult to see their ceilingTo use their own sizing: they estimate a $643B total addressable marketTheir valuation is ~$3B" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">What is Sema4& #39;s TAMhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">This is a tricky one to size (in a good way), Sema4 is pulling so many things together in an unprecedented way that it is difficult to see their ceilingTo use their own sizing: they estimate a $643B total addressable marketTheir valuation is ~$3B" class="img-responsive" style="max-width:100%;"/>

What is Sema4& #39;s TAMhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">This is a tricky one to size (in a good way), Sema4 is pulling so many things together in an unprecedented way that it is difficult to see their ceilingTo use their own sizing: they estimate a $643B total addressable marketTheir valuation is ~$3B" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">What is Sema4& #39;s TAMhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🗺️" title="Weltkarte" aria-label="Emoji: Weltkarte">This is a tricky one to size (in a good way), Sema4 is pulling so many things together in an unprecedented way that it is difficult to see their ceilingTo use their own sizing: they estimate a $643B total addressable marketTheir valuation is ~$3B" class="img-responsive" style="max-width:100%;"/>