1/ In the last 2 weeks the Kimchi premium returned with a vengeance reaching over 20% the highest level we’ve seen since 2017-18. While restricted travel is a major contributing factor to the arb, one cannot ignore the buying frenzy in the Korean retail market especially in Alts

2/ On some days crypto volumes on the largest Korean exchange have been larger than on the Korean equity exchanges! The frenzy has consumed all age groups - including the older 40-50s segment, something that could possibly draw increased regulatory intervention

3/ While the Korean market only accounts for roughly 2% of global crypto trading volumes today (compared to 7-8% in 2018) such retail fever in general tends to put a damper on topside price breakouts for the largest market cap coins especially BTC

4/ This pattern is typical during Alt-season as the small market cap tokens see gains in multiples day to day. Another key topic of interest is profit opportunities in crypto derivatives. A highlight in the last two weeks has been the futures/perpetual swap basis

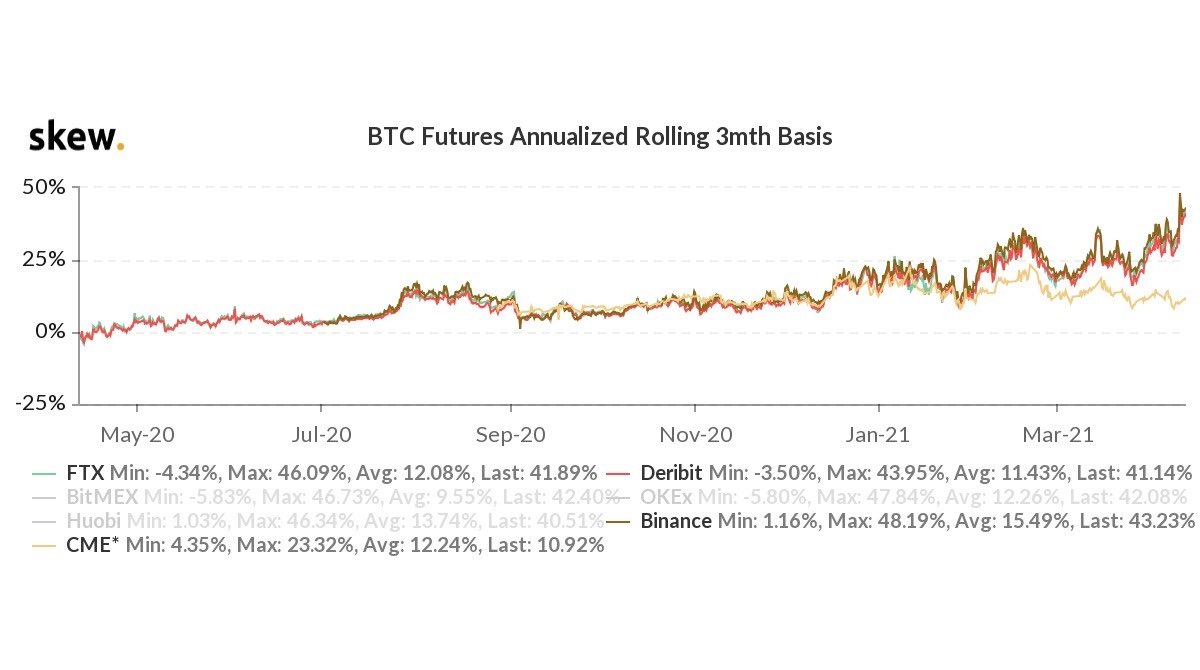

5/ Clear evidence of outsized buying interest can be seen in the BTC futures curve - with fresh all-time highs in the 3m basis at well over 40% annualized. This massive contango is the steepest of any financial asset class out there by far..

6/ ..and has been attracting a lot of attention in the mainstream media with institutions especially keen to get in on the risk-free futures rolldown yield. This has caused further divergence between CME and native derivative exchanges

7/ CME being the largest regulated/traditional venue trades at a 10% annualized contango now compared to 43% on Binance for example. That leaves an incredible 30% annualized inter-exchange arb on an equivalent futures contract!

8/During 2020s Sep-Dec during the exponential bull run CME was consistently higher than other exchanges as institutional demand dominated flows. Leveraged buying on non-regulated exchanges now lead the market. On the CME front-month itself the parabolic support level has broken..

9/ This divergence is partly caused by the retail mania overshadowing the institutional side right now, but also because of institutional interest in the rolldown yield, aka cash & carry. As institutions deploy more to this trade on CME, retail players..

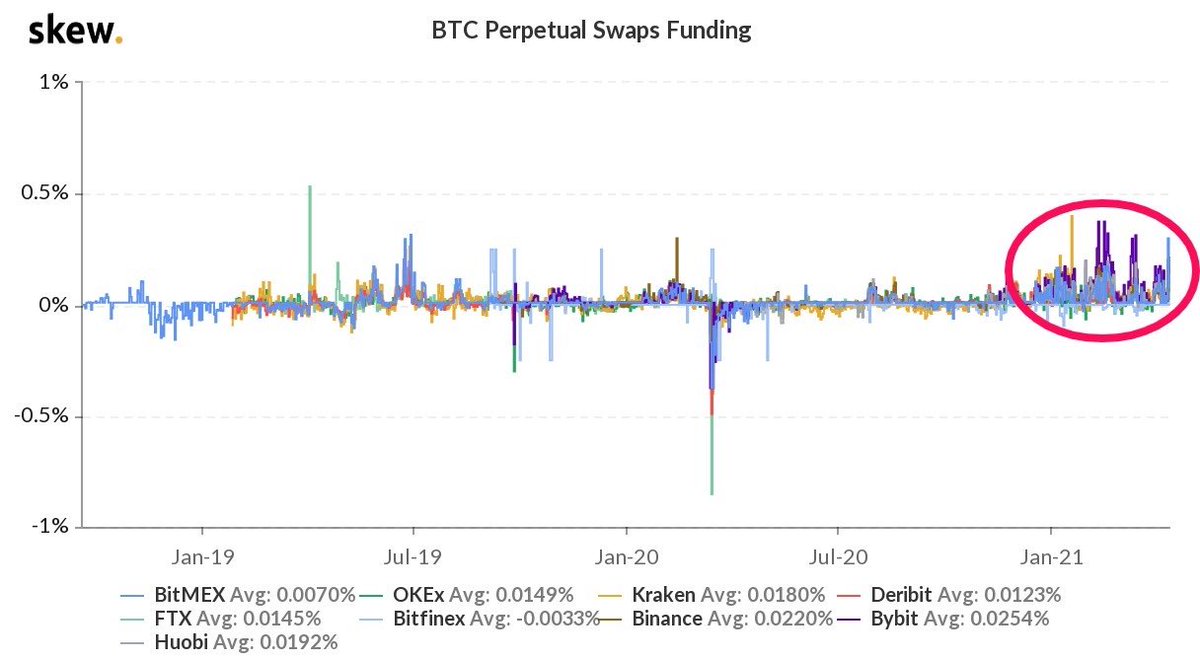

10/ ..find it hard to put this structure on in size due to the unlevered spot leg. Retail players are more inclined to lever up through the perpetual swap futures - where we are seeing the most sustained positive funding in history . This means that retail leverage typically a..

11/ ..leading indicator of market exhaustion is at highest levels since prior to the exponential move. In contrast spot volumes have continued to decline especially on institutional platforms like Coinbase. We& #39;re now watching the spot 55k level closely as our next bull/bear line

12/ This month& #39;s big crypto event is the Coinbase (CBSE) listing on Wednesday. Spillover from the hype over this listing can be seen from the huge moves higher in BNB and FTT in the past month. BNB is up more than 1500% since the start of the year!

13/ This is largely tracking the market cap of Coinbase - with BNB& #39;s fully diluted market cap topping $100bn today, trading very much in sync with CBSE. CBSE in pre-listing trading is up to a whopping $147bn valuation (based on CBSE/USD on FTX)

14/ The Coinbase hype within crypto, in terms of valuation & its domino effect on other markets, now sets Coinbase’s IPO up to be a key catalyst event. BTC has drastically underperformed the S&P 500 in the last month, and a successful Coinbase IPO is needed to bridge this gap

15/ However we& #39;re extremely wary that the IPO on Wednesday could ultimately reveal too much short-term froth in the system and begin the seasonal mid-month decline. This seasonal intra-month pattern we highlighted previously has been performing like clockwork this year

16/ A month-end bottom leading into a mid-month top followed by a correction, rinse and repeat. This intra-month top has now occurred on the 14th of the month twice in three months now, and we think Wed& #39;s IPO is setting up for that again

17/ More worrying this time is how Miners have been unusually HODLing their coin to the largest extent since the bull run began, not selling since before the March dip. While we& #39;ve been building BTC & ETH longs since the Mar-end expiry anticipating the $60k BTC & $2k ETH break..

18/ ..the above reasons have made us turn again into trading mode, selling out our long calls and covering BTC spot long by selling the June & Sep 68k strikes. On ETH, we turn our long calls into spreads by selling the Jun $2800 strike

19/ While the lower implied vol made going long calls attractive, the steepness of the forward curve makes it expensive now especially on the longer tenors. However this doesn& #39;t mean we have turned bearish but rather believe the froth & current market dynamics do not favour..

20/ ..a further exponential move like the ones we& #39;ve seen in Q1, and is currently being priced into the futures contango and call skew. Our favourite trade right now is locking in the Jun futures basis here at 44% annualized.

Read on Twitter

Read on Twitter