1. Utilize Compound Interest

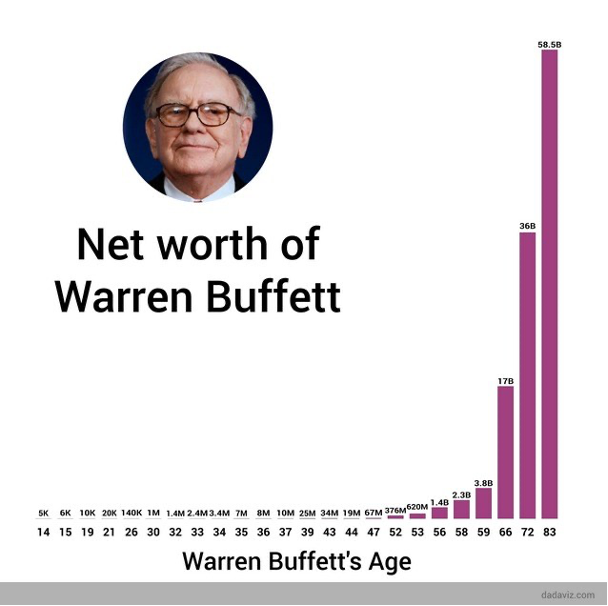

Buffett first started learning about investing at age 7 and bought his first stock at age 11.

The earlier you start investing, the better. This allows compounding to have more time to do the heavy lifting.

Get compound interest on your side ASAP.

Buffett first started learning about investing at age 7 and bought his first stock at age 11.

The earlier you start investing, the better. This allows compounding to have more time to do the heavy lifting.

Get compound interest on your side ASAP.

2. Ignore Other’s Opinions

Don’t listen to your friends buying GME and Dogecoin (obviously).

Look at the facts, learn to control your emotions, and stick with what you know and understand best.

Learn to think for yourself.

Don’t listen to your friends buying GME and Dogecoin (obviously).

Look at the facts, learn to control your emotions, and stick with what you know and understand best.

Learn to think for yourself.

3. Read Every Day

Buffett reads for 5-6 hours a day. As a kid he read every book in the Omaha Public Library.

While this would be a bit much for most, get in the habit of reading books or daily newsletters.

The best investment you will ever make is in yourself.

Buffett reads for 5-6 hours a day. As a kid he read every book in the Omaha Public Library.

While this would be a bit much for most, get in the habit of reading books or daily newsletters.

The best investment you will ever make is in yourself.

4. Have a Margin of Safety

Invest in businesses with a wide moat that offer you a margin of safety in any market environment.

Don’t be too greedy. Use leverage with caution.

“Rule number one: Never lose money. Rule number two: Never forget rule number one."

Invest in businesses with a wide moat that offer you a margin of safety in any market environment.

Don’t be too greedy. Use leverage with caution.

“Rule number one: Never lose money. Rule number two: Never forget rule number one."

5. Find a Good Mentor

Buffett’s best mentor for investing was Benjamin Graham.

Buffett was a student for Graham and eventually worked for him. He learned how investment firms are run from Graham.

Learn everything you can from those who are doing what you want to do.

Buffett’s best mentor for investing was Benjamin Graham.

Buffett was a student for Graham and eventually worked for him. He learned how investment firms are run from Graham.

Learn everything you can from those who are doing what you want to do.

6. Always be Competing

Act as if your competitors are chasing you 24/7 (because they are).

Never become complacent. This is how great companies slowly die off.

Always be on the move and one step ahead of the competition.

Act as if your competitors are chasing you 24/7 (because they are).

Never become complacent. This is how great companies slowly die off.

Always be on the move and one step ahead of the competition.

7. Enjoy What You Do

Life is too short to spend your whole life working a job you dislike.

Find the right balance between what you enjoy and what actually PAYS.

One of the best ways to capitalize on your interests is to start an online business.

Life is too short to spend your whole life working a job you dislike.

Find the right balance between what you enjoy and what actually PAYS.

One of the best ways to capitalize on your interests is to start an online business.

8. Stay within your Circle of Competence

You don’t have to be right about thousands of investments, you only have to be right about a few.

There are opportunities everywhere. Be patient.

Remember, you don’t have to have an opinion on everything.

You don’t have to be right about thousands of investments, you only have to be right about a few.

There are opportunities everywhere. Be patient.

Remember, you don’t have to have an opinion on everything.

9. Think Long-Term

Buffett ALWAYS thought long-term. He rarely sells his investments.

Berkshire has never issued a dividend to keep the compounding churning along.

“Our favorite holding period is forever.”

Buffett ALWAYS thought long-term. He rarely sells his investments.

Berkshire has never issued a dividend to keep the compounding churning along.

“Our favorite holding period is forever.”

10. Learn how to Communicate

When Buffett was 22, Buffett took the Dale Carnegie course which taught him public speaking.

The Dale Carnegie certificate still hangs in his office today.

Great information means nothing if it can& #39;t be communicated effectively.

When Buffett was 22, Buffett took the Dale Carnegie course which taught him public speaking.

The Dale Carnegie certificate still hangs in his office today.

Great information means nothing if it can& #39;t be communicated effectively.

Thank you for reading. If you loved this thread, please give it a retweet.

Then check out my book, the Quest for Financial Independence.

Learn how to put your money to work for you.

28 Perfect Five https://abs.twimg.com/emoji/v2/... draggable="false" alt="⭐" title="Mittelgroßer Stern" aria-label="Emoji: Mittelgroßer Stern"> Reviews https://gum.co/uYAev ">https://gum.co/uYAev&quo...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⭐" title="Mittelgroßer Stern" aria-label="Emoji: Mittelgroßer Stern"> Reviews https://gum.co/uYAev ">https://gum.co/uYAev&quo...

Then check out my book, the Quest for Financial Independence.

Learn how to put your money to work for you.

28 Perfect Five

Read on Twitter

Read on Twitter![Warren Buffett’s 10 Secrets to Success[THREAD] Warren Buffett’s 10 Secrets to Success[THREAD]](https://pbs.twimg.com/media/Eyx7-wnXIAAu7FN.jpg)