So @SEBI_India says that Yes Bank AT1 Bonds were mis-sold to retail investors (see order: https://www.sebi.gov.in/enforcement/orders/apr-2021/adjudication-order-in-the-matter-of-at1-bonds-of-yes-bank-limited_49822.html)

But">https://www.sebi.gov.in/enforceme... RBI& #39;s position has been that they have not been mis-sold.

Looks like a redo of the Sebi-Irda-Ulip-2009 story.

But">https://www.sebi.gov.in/enforceme... RBI& #39;s position has been that they have not been mis-sold.

Looks like a redo of the Sebi-Irda-Ulip-2009 story.

& #39;Yes Bank: ‘Noticee 1’

Mr. Vivek Kanwar: ‘Noticee 2’

Mr. Ashish Nasa: ‘Noticee 3’

Mr. Jasjit Singh Banga: ‘Noticee 4’.

(Noticees 1 to 4 are hereinafter being collectively referred to as ‘Noticees’)& #39;

Rana Kapoor is in jail, therefore he is getting more time, says the Sebi order.

Mr. Vivek Kanwar: ‘Noticee 2’

Mr. Ashish Nasa: ‘Noticee 3’

Mr. Jasjit Singh Banga: ‘Noticee 4’.

(Noticees 1 to 4 are hereinafter being collectively referred to as ‘Noticees’)& #39;

Rana Kapoor is in jail, therefore he is getting more time, says the Sebi order.

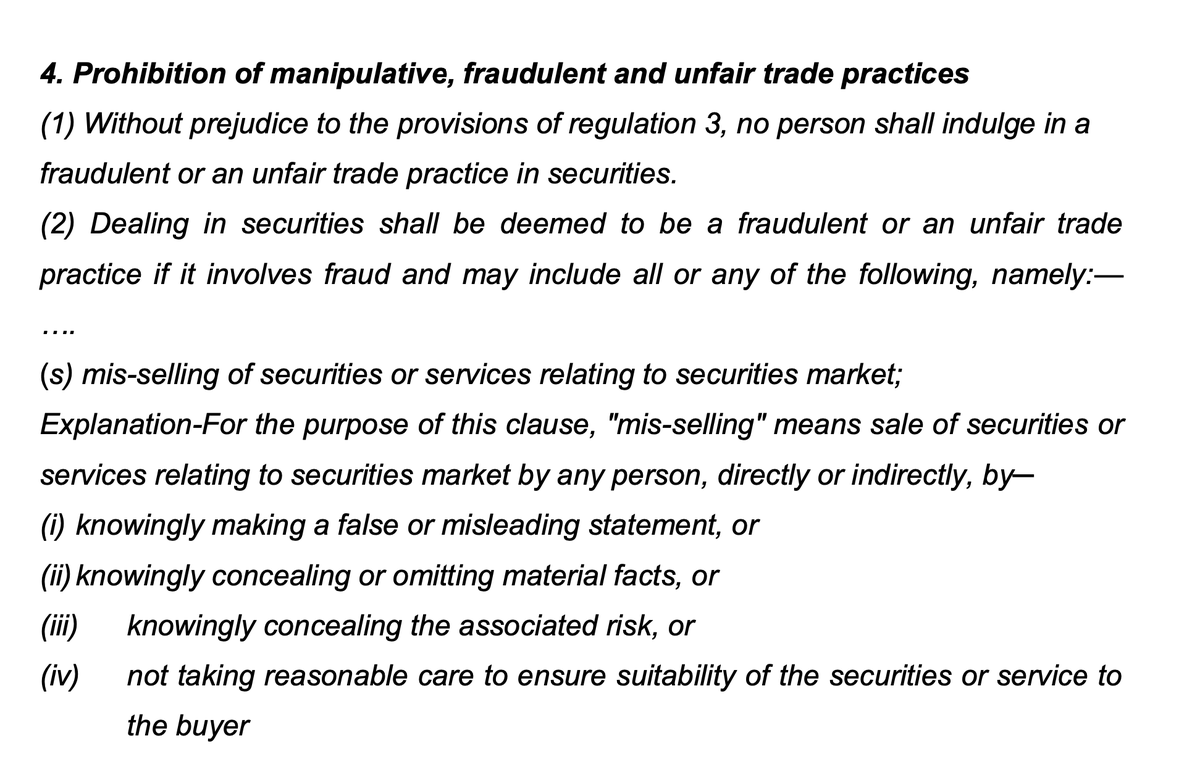

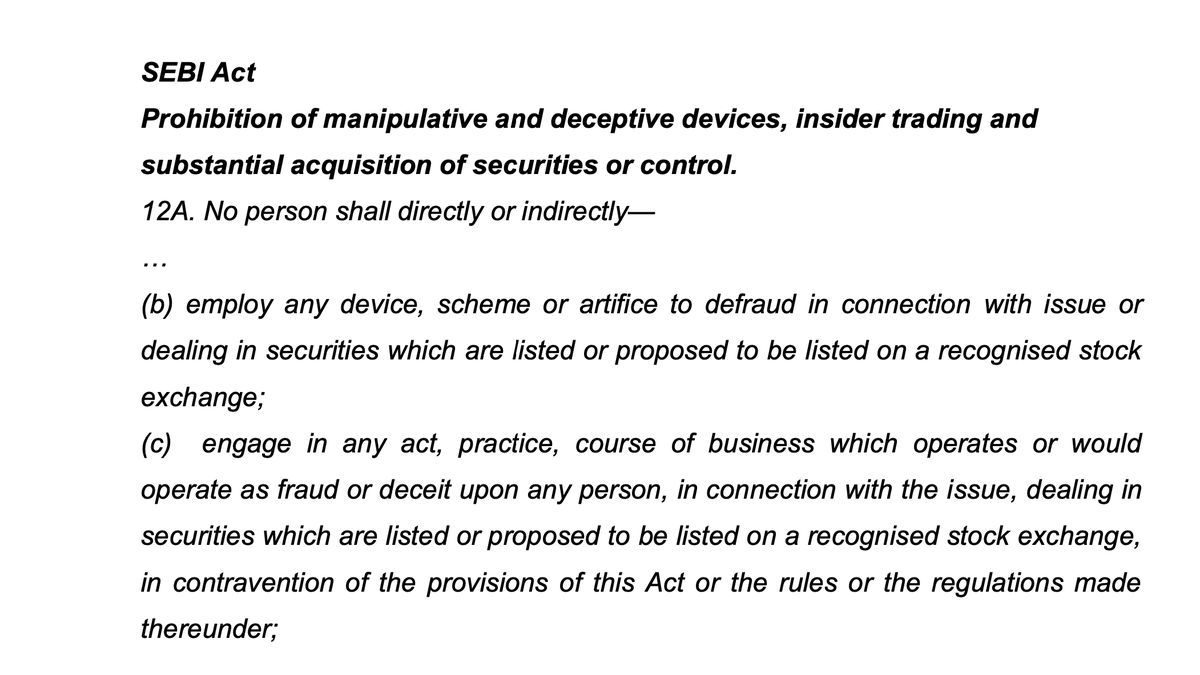

Sebi is doing this under the Prevention of Fraudulent and Unfair Trade Practices that deals with mis-selling.

And mis-selling is defined as:

And mis-selling is defined as:

Read on Twitter

Read on Twitter