I& #39;m beginning to see charts & other signals pointing to slowly dwindling market liquidity. I haven& #39;t fully made sense of it yet, but the trend is worth watching closely.

Posting the charts/signals I find on a rolling basis below:

Posting the charts/signals I find on a rolling basis below:

CME& #39;s e-mini S&P 500 futures saw abnormally low top-of-book depth during March 2021, even after adjusting for volatility. Order book depth as a standalone metric has been low since March 2020.

March& #39;s quarterly SPX expiry had is lowest OI print in "at least a decade" as short interest sinks to new lows.

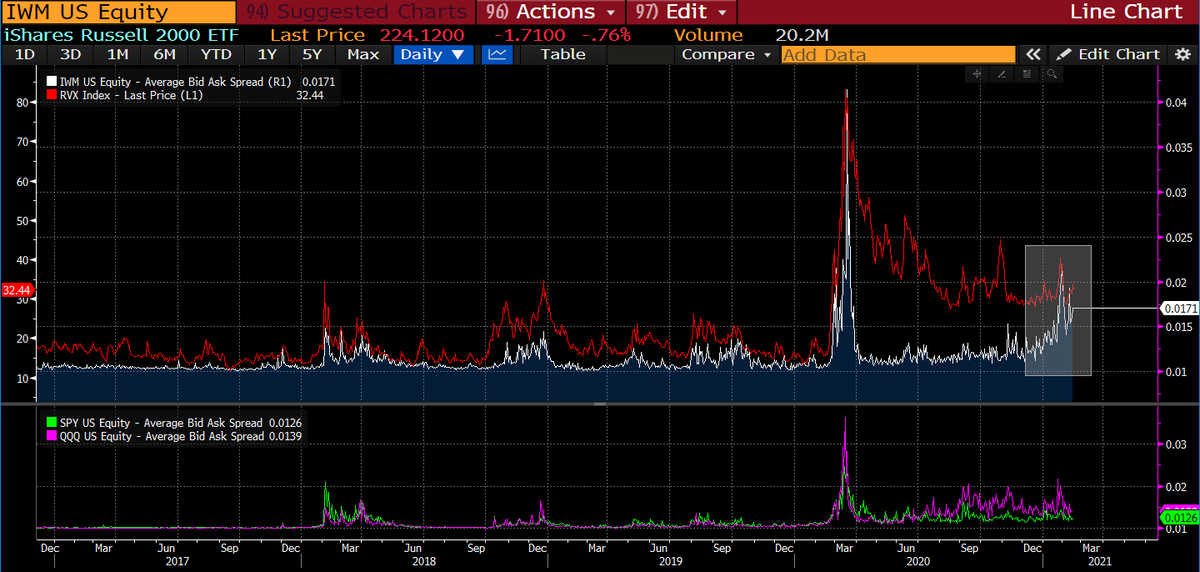

$IWM spreads have been widening throughout 2021 even as the VIX drops below 20 - could be impact of passive focusing on large cap names over small cap?

The number of 5-sigma moves in S&P 500 daily returns vs. their trailing 30 day avg has been rising even since 2019. I& #39;m sure this chart looks even crazier updated through 2021:

Spreads of even the top 5 largest, most liquid names have seen spreads trend upward since March 2020, with material spikes during selloffs:

Read on Twitter

Read on Twitter