JPMorgan is finally awakened to the #BTC  https://abs.twimg.com/hashflags... draggable="false" alt=""> contango trade & issued a report on it!

https://abs.twimg.com/hashflags... draggable="false" alt=""> contango trade & issued a report on it!

TLDR: #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s contango will drive institutions to buy BTC, reducing its supply and creating a virtuous cycle that drives BTC& #39;s price higher.

https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s contango will drive institutions to buy BTC, reducing its supply and creating a virtuous cycle that drives BTC& #39;s price higher.

The trade is another reason $GBTC& #39;s premium stays -ve. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

TLDR: #BTC

The trade is another reason $GBTC& #39;s premium stays -ve.

1/ What& #39;s the #BTC  https://abs.twimg.com/hashflags... draggable="false" alt=""> contango trade?

https://abs.twimg.com/hashflags... draggable="false" alt=""> contango trade?

The trade exists because BTC futures (not perpetual swaps) price is higher than its spot price. The current annualized premium for the 6/21 contract is from 15.1%-49.4%!

The trade is to buy spot BTC and short BTC futures to pocket the premium.

The trade exists because BTC futures (not perpetual swaps) price is higher than its spot price. The current annualized premium for the 6/21 contract is from 15.1%-49.4%!

The trade is to buy spot BTC and short BTC futures to pocket the premium.

2/ The #BTC  https://abs.twimg.com/hashflags... draggable="false" alt=""> contango exists because of:

https://abs.twimg.com/hashflags... draggable="false" alt=""> contango exists because of:

1. Difficulty in obtaining #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> exposure

https://abs.twimg.com/hashflags... draggable="false" alt=""> exposure

2. Long time to unwind futures position to free up capital (quarterly duration)

3. Counterparty risk if trade is done between different exchanges

1. Difficulty in obtaining #BTC

2. Long time to unwind futures position to free up capital (quarterly duration)

3. Counterparty risk if trade is done between different exchanges

3a/ When $GBTC& #39;s premium is in double digits, the arbitrage trade is to borrow #BTC  https://abs.twimg.com/hashflags... draggable="false" alt=""> to subscribe to GBTC shares. These shares have a 6 mo. lock-up. When the lock-up expires, sell the shares on the OTC market usually for a premium and pay back the lender of #BTC

https://abs.twimg.com/hashflags... draggable="false" alt=""> to subscribe to GBTC shares. These shares have a 6 mo. lock-up. When the lock-up expires, sell the shares on the OTC market usually for a premium and pay back the lender of #BTC  https://abs.twimg.com/hashflags... draggable="false" alt=""> + interest.

https://abs.twimg.com/hashflags... draggable="false" alt=""> + interest.

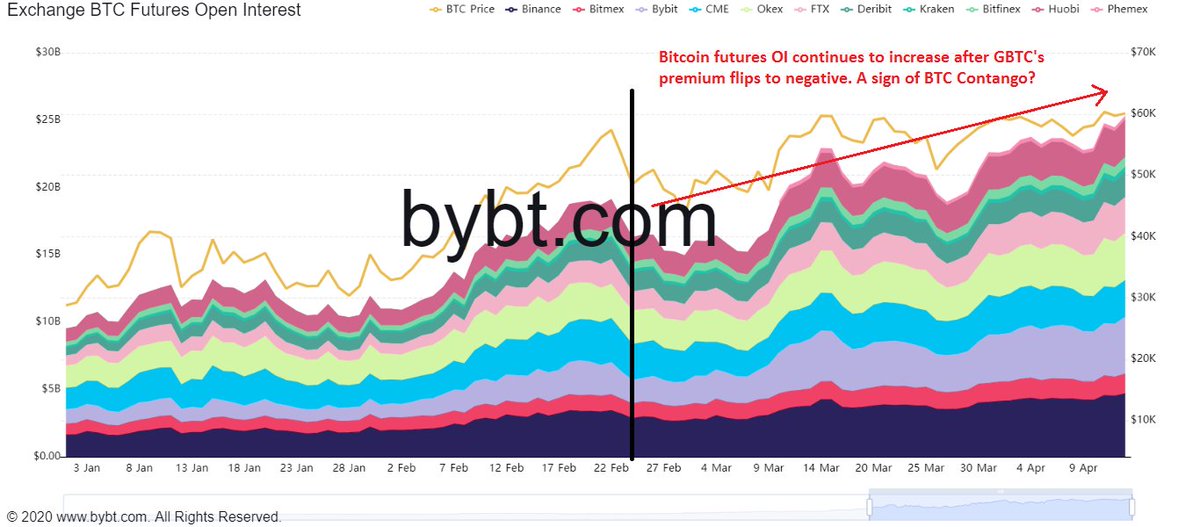

3b/ Once $GBTC& #39;s premium flips to -ve, institutions switch over from the GBTC arb trade to #BTC  https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s contango. The big jump in BTC futures OI is a sign of this institution switch over.

https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s contango. The big jump in BTC futures OI is a sign of this institution switch over.

GBTC& #39;s premium won& #39;t flip to +ve unless Grayscale https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">its fees/its parent buys back GBTC shares.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">its fees/its parent buys back GBTC shares.

GBTC& #39;s premium won& #39;t flip to +ve unless Grayscale

4a/ What are the implications as more institutions enter the #BTC  https://abs.twimg.com/hashflags... draggable="false" alt=""> contango trade?

https://abs.twimg.com/hashflags... draggable="false" alt=""> contango trade?

The size of the global fixed income market is >$120T. Most bonds are yielding single digit or negative returns. If only a fraction of that pursue the contango trade, #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s price could skyrocket.

https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s price could skyrocket.

The size of the global fixed income market is >$120T. Most bonds are yielding single digit or negative returns. If only a fraction of that pursue the contango trade, #BTC

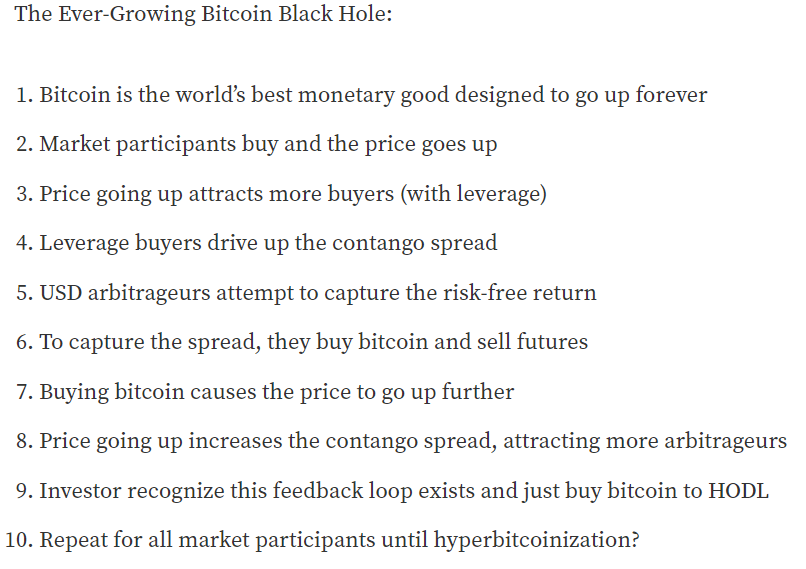

4b/ Supply of #BTC  https://abs.twimg.com/hashflags... draggable="false" alt=""> is reduced as they& #39;re locked up in the trade. The price of #BTC

https://abs.twimg.com/hashflags... draggable="false" alt=""> is reduced as they& #39;re locked up in the trade. The price of #BTC  https://abs.twimg.com/hashflags... draggable="false" alt=""> will be bid up as more institutions enter the trade.

https://abs.twimg.com/hashflags... draggable="false" alt=""> will be bid up as more institutions enter the trade.

Mimesis Capital has a piece that the #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> contango could create a massive black hole to suck up capital and drive #BTC

https://abs.twimg.com/hashflags... draggable="false" alt=""> contango could create a massive black hole to suck up capital and drive #BTC  https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s price to the moon.

https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s price to the moon.

Mimesis Capital has a piece that the #BTC

5/ What& #39;d break #BTC  https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s contango?

https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s contango?

Both JPMorgan & Mimesis Capital have good points on this:

a. Emergence of #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> ETFs that allow for an efficient arb trade to normalize returns

https://abs.twimg.com/hashflags... draggable="false" alt=""> ETFs that allow for an efficient arb trade to normalize returns

b. Old whales sell #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> in volume

https://abs.twimg.com/hashflags... draggable="false" alt=""> in volume

c. Institutions take profit

d. Central banks cut back money printing

Both JPMorgan & Mimesis Capital have good points on this:

a. Emergence of #BTC

b. Old whales sell #BTC

c. Institutions take profit

d. Central banks cut back money printing

Conclusion: The #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> contango trade is definitely a fuel to propel #BTC

https://abs.twimg.com/hashflags... draggable="false" alt=""> contango trade is definitely a fuel to propel #BTC  https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s price higher in its current bull phase.

https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s price higher in its current bull phase.

More institutions will wake up to this trade and participate in it to drive #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s price to 6-digits.

https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s price to 6-digits.

Ref: https://bitcoinmagazine.com/markets/jpmorgan-eyeing-bitcoins-contango-releases-bullish-report">https://bitcoinmagazine.com/markets/j... https://twitter.com/IIICapital/status/1378335129827860480">https://twitter.com/IIICapita...

More institutions will wake up to this trade and participate in it to drive #BTC

Ref: https://bitcoinmagazine.com/markets/jpmorgan-eyeing-bitcoins-contango-releases-bullish-report">https://bitcoinmagazine.com/markets/j... https://twitter.com/IIICapital/status/1378335129827860480">https://twitter.com/IIICapita...

Read on Twitter

Read on Twitter contango trade?The trade exists because BTC futures (not perpetual swaps) price is higher than its spot price. The current annualized premium for the 6/21 contract is from 15.1%-49.4%!The trade is to buy spot BTC and short BTC futures to pocket the premium." title="1/ What& #39;s the #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> contango trade?The trade exists because BTC futures (not perpetual swaps) price is higher than its spot price. The current annualized premium for the 6/21 contract is from 15.1%-49.4%!The trade is to buy spot BTC and short BTC futures to pocket the premium." class="img-responsive" style="max-width:100%;"/>

contango trade?The trade exists because BTC futures (not perpetual swaps) price is higher than its spot price. The current annualized premium for the 6/21 contract is from 15.1%-49.4%!The trade is to buy spot BTC and short BTC futures to pocket the premium." title="1/ What& #39;s the #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> contango trade?The trade exists because BTC futures (not perpetual swaps) price is higher than its spot price. The current annualized premium for the 6/21 contract is from 15.1%-49.4%!The trade is to buy spot BTC and short BTC futures to pocket the premium." class="img-responsive" style="max-width:100%;"/>

& #39;s contango. The big jump in BTC futures OI is a sign of this institution switch over.GBTC& #39;s premium won& #39;t flip to +ve unless Grayscale https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">its fees/its parent buys back GBTC shares." title="3b/ Once $GBTC& #39;s premium flips to -ve, institutions switch over from the GBTC arb trade to #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s contango. The big jump in BTC futures OI is a sign of this institution switch over.GBTC& #39;s premium won& #39;t flip to +ve unless Grayscale https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">its fees/its parent buys back GBTC shares." class="img-responsive" style="max-width:100%;"/>

& #39;s contango. The big jump in BTC futures OI is a sign of this institution switch over.GBTC& #39;s premium won& #39;t flip to +ve unless Grayscale https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">its fees/its parent buys back GBTC shares." title="3b/ Once $GBTC& #39;s premium flips to -ve, institutions switch over from the GBTC arb trade to #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s contango. The big jump in BTC futures OI is a sign of this institution switch over.GBTC& #39;s premium won& #39;t flip to +ve unless Grayscale https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">its fees/its parent buys back GBTC shares." class="img-responsive" style="max-width:100%;"/>

contango trade?The size of the global fixed income market is >$120T. Most bonds are yielding single digit or negative returns. If only a fraction of that pursue the contango trade, #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s price could skyrocket." title="4a/ What are the implications as more institutions enter the #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> contango trade?The size of the global fixed income market is >$120T. Most bonds are yielding single digit or negative returns. If only a fraction of that pursue the contango trade, #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s price could skyrocket." class="img-responsive" style="max-width:100%;"/>

contango trade?The size of the global fixed income market is >$120T. Most bonds are yielding single digit or negative returns. If only a fraction of that pursue the contango trade, #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s price could skyrocket." title="4a/ What are the implications as more institutions enter the #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> contango trade?The size of the global fixed income market is >$120T. Most bonds are yielding single digit or negative returns. If only a fraction of that pursue the contango trade, #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s price could skyrocket." class="img-responsive" style="max-width:100%;"/>

is reduced as they& #39;re locked up in the trade. The price of #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> will be bid up as more institutions enter the trade.Mimesis Capital has a piece that the #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> contango could create a massive black hole to suck up capital and drive #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s price to the moon." title="4b/ Supply of #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> is reduced as they& #39;re locked up in the trade. The price of #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> will be bid up as more institutions enter the trade.Mimesis Capital has a piece that the #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> contango could create a massive black hole to suck up capital and drive #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s price to the moon." class="img-responsive" style="max-width:100%;"/>

is reduced as they& #39;re locked up in the trade. The price of #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> will be bid up as more institutions enter the trade.Mimesis Capital has a piece that the #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> contango could create a massive black hole to suck up capital and drive #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s price to the moon." title="4b/ Supply of #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> is reduced as they& #39;re locked up in the trade. The price of #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> will be bid up as more institutions enter the trade.Mimesis Capital has a piece that the #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> contango could create a massive black hole to suck up capital and drive #BTC https://abs.twimg.com/hashflags... draggable="false" alt="">& #39;s price to the moon." class="img-responsive" style="max-width:100%;"/>