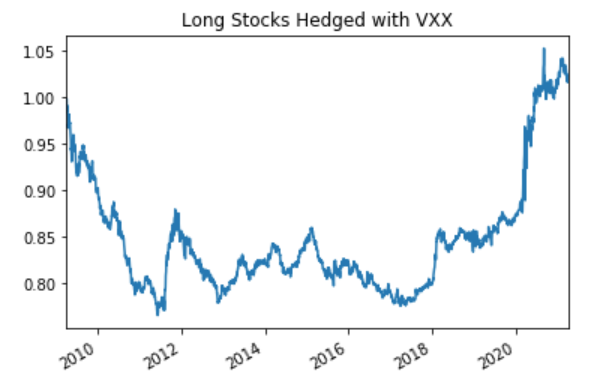

Owning volatility is expensive - about 11%/ yr to hedge a stock portfolio. Since $VXX came out, this would have eaten your whole return. Meh.

In this thread I& #39;ll explore what I think are better, more delightful "negative risk premia" https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

1/ A visual of stocks hedged with $VXX

In this thread I& #39;ll explore what I think are better, more delightful "negative risk premia"

1/ A visual of stocks hedged with $VXX

2/ Stats - Gearing - $.25 of $VXX to hedge your whole stock portfolio.

Hedge Cost: 11% per year

% Loss Hedged During 1%+ Down weeks / " Loss Coverage": 94%

Sharpe Ratio of Stocks Hedged with VXX (aka "Neutral Stock Sharpe"): .06

Outside of not using up much capital, VXX is weak.

Hedge Cost: 11% per year

% Loss Hedged During 1%+ Down weeks / " Loss Coverage": 94%

Sharpe Ratio of Stocks Hedged with VXX (aka "Neutral Stock Sharpe"): .06

Outside of not using up much capital, VXX is weak.

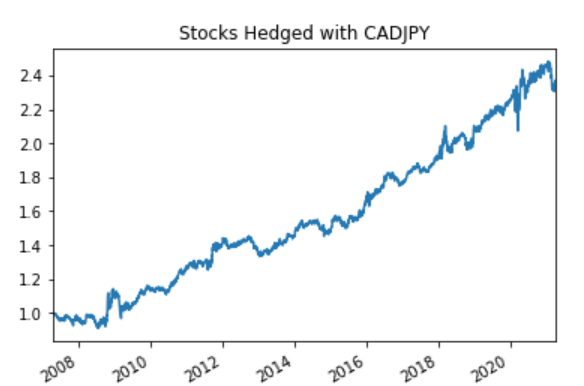

3/ CADJPY, the FX pair trades with the S&P because Canada is a riskier /higher beta country than Japan. But unlike owning VIX, shorting CADJPY hasn& #39;t lost you money historically, partly bc when both Central banks are racing to print money. Stocks hedged with CADJPY have worked

4/ CADJPY Stats:

Gearing: 2.7x Leverage

Hedge Cost: +1% Per Year

Loss Coverage: 74%

Hedged Stock Sharpe: .74

So shorting $2.7 of CADJPY for $1 of S&P exposure has covered 74% of your losses while not really costing you anything (vs 11% a year for the 96% VXX coverage).

Gearing: 2.7x Leverage

Hedge Cost: +1% Per Year

Loss Coverage: 74%

Hedged Stock Sharpe: .74

So shorting $2.7 of CADJPY for $1 of S&P exposure has covered 74% of your losses while not really costing you anything (vs 11% a year for the 96% VXX coverage).

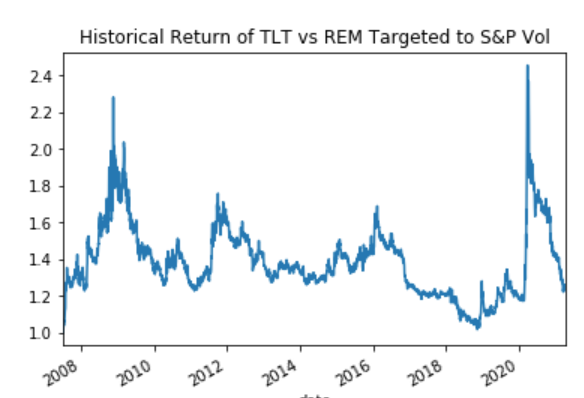

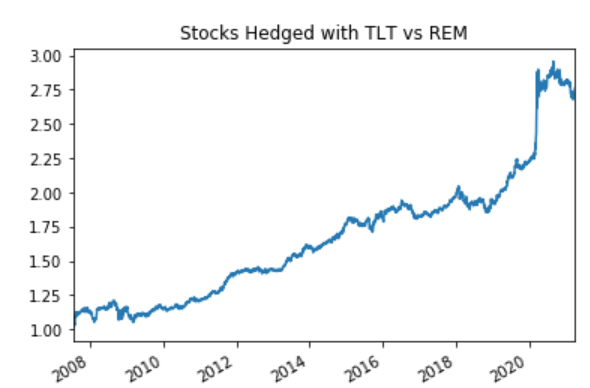

5/ Owning 20+ year Treasuries $TLT (or futures) while shorting Mortgage REITs (REM) intuitively is a great hedge for stocks bc when mortgage delinquencies kick in you get paid big time. Also the mREITs tend to be run with 9-12x+ leverage and periodically blow up.

6/ Long TLT short REM stats:

Average Leverage: 1.32x

Hedge Cost: +2.9% per year

Loss Coverage: 74%

Hedged Stocks Sharpe: .56

This hedge is great because it doesn& #39;t use much balance sheet if you use futures, as you& #39;re basically shorting someone else& #39;s over-leveraged portfolio

Average Leverage: 1.32x

Hedge Cost: +2.9% per year

Loss Coverage: 74%

Hedged Stocks Sharpe: .56

This hedge is great because it doesn& #39;t use much balance sheet if you use futures, as you& #39;re basically shorting someone else& #39;s over-leveraged portfolio

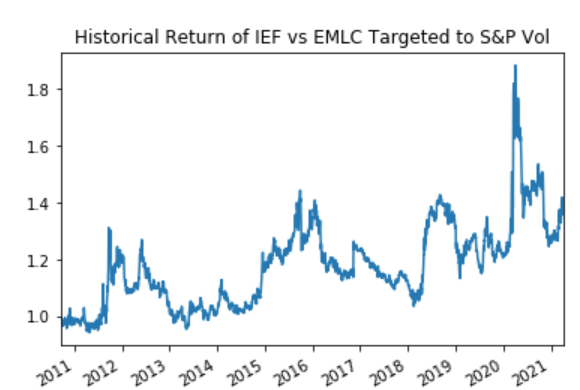

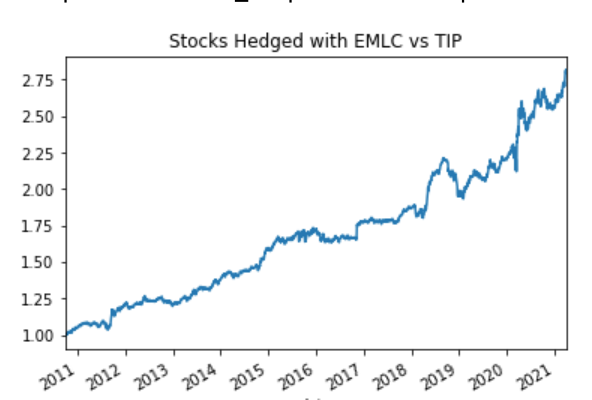

7/ Another favorite of mine is owning Treasury Inflation Protected Securities $TIP vs EM Local Currency Debt $EMLC. You get the negative beta of the EM currency plus the default risk and hedge your inflation risk. This worked well in both 08 (not shown) and Covid.

8/ Long TIP short EMLC stats:

Avg Leverage: 2.8

Cost of Hedge: +3.7%

% Loss Coverage: 76%

Sharpe Ratio of Hedged Stocks: 1+

This trade is less liquid and scalable, and EMLC can be hard to borrow- likely accounting for its superior tastiness. Still a favorite.

Avg Leverage: 2.8

Cost of Hedge: +3.7%

% Loss Coverage: 76%

Sharpe Ratio of Hedged Stocks: 1+

This trade is less liquid and scalable, and EMLC can be hard to borrow- likely accounting for its superior tastiness. Still a favorite.

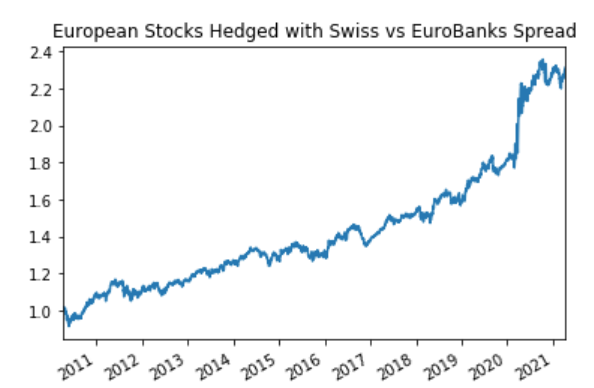

9/ Now let& #39;s talk about European equities. European banks are always blowing up while Switzerland is a safe haven. This allows you to hedge European stocks $VGK with a spread of Swiss Equities $EWL and European Banks $EUFN. Bill Hwang hates this one weird trick

10/ $EWL vs $EUFN stats

Avg Leverage: 2.3x

Cost of Hedging: +5.3%

% Loss Coverage: 63%

Sharpe Ratio of Hedged Stocks: . 8

Like the mReits this trade benefits when over leveraged participants do stupid things and then people pile into the safe haven. This is a general theme.

Avg Leverage: 2.3x

Cost of Hedging: +5.3%

% Loss Coverage: 63%

Sharpe Ratio of Hedged Stocks: . 8

Like the mReits this trade benefits when over leveraged participants do stupid things and then people pile into the safe haven. This is a general theme.

11/ A number of reasons I like trades like this:

1] Rates are low so leverage is cheap, making them easier to carry

2] People on annual pay cycles have been selling vol in stupid ways since time immemorial

3] They aren& #39;t negative drift and largely benefit from QE

1] Rates are low so leverage is cheap, making them easier to carry

2] People on annual pay cycles have been selling vol in stupid ways since time immemorial

3] They aren& #39;t negative drift and largely benefit from QE

12/ More on the last point. 2 causal reasons. A] if all Central Banks print at the same rate the forex pairs might move with stocks but go nowhere in aggregate. B] Central banks have a tendency to buy higher quality assets leveraged players are actually short, adding asymmetry

13/ There are countless negative risk premia - or asset spreads which tend to move with stocks but have negative expected value due to moral hazard or structural asymmetries. These are just a few. In an era of money printing and moral hazard, I think it& #39;s a great thing to explore

Read on Twitter

Read on Twitter 1/ A visual of stocks hedged with $VXX" title="Owning volatility is expensive - about 11%/ yr to hedge a stock portfolio. Since $VXX came out, this would have eaten your whole return. Meh.In this thread I& #39;ll explore what I think are better, more delightful "negative risk premia"https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">1/ A visual of stocks hedged with $VXX" class="img-responsive" style="max-width:100%;"/>

1/ A visual of stocks hedged with $VXX" title="Owning volatility is expensive - about 11%/ yr to hedge a stock portfolio. Since $VXX came out, this would have eaten your whole return. Meh.In this thread I& #39;ll explore what I think are better, more delightful "negative risk premia"https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">1/ A visual of stocks hedged with $VXX" class="img-responsive" style="max-width:100%;"/>