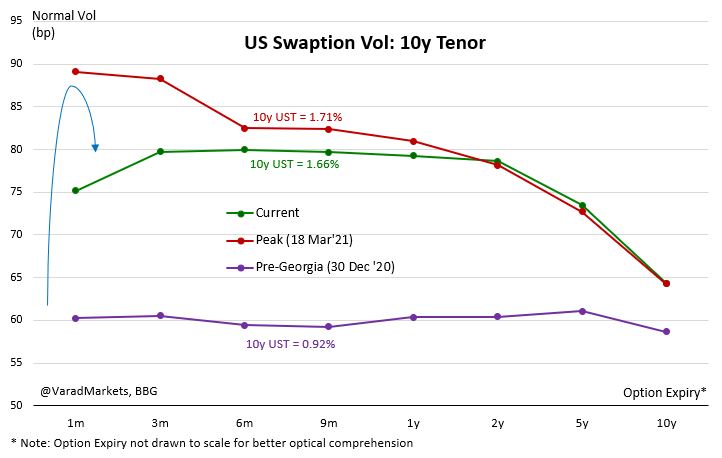

US Swaption/Rates Vol off highs but still elevated

Reasons:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Economic data ahead; CPI tom; Fed data dependent

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Economic data ahead; CPI tom; Fed data dependent

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> UST supply, 3y 10y 30y auctions this wk

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> UST supply, 3y 10y 30y auctions this wk

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> US ylds, off highs, still close to higher end => risk premium in vols

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> US ylds, off highs, still close to higher end => risk premium in vols

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Market v/s Fed disconnect on Rate Hike

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Market v/s Fed disconnect on Rate Hike

1/4

Reasons:

1/4

2/4

3/4

@bondstrategist

https://twitter.com/VaradMarkets/status/1371717468276727810?s=20">https://twitter.com/VaradMark...

Basic Swaption recap:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Option on USD Interest Rate Swap (IRS); Call (Payer); Put (Receiver)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Option on USD Interest Rate Swap (IRS); Call (Payer); Put (Receiver)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Two time horizons:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Two time horizons:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> Tenor of underlying swap

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> Tenor of underlying swap

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2"> Maturity/expiry of option

https://abs.twimg.com/emoji/v2/... draggable="false" alt="2⃣" title="Tastenkappe Ziffer 2" aria-label="Emoji: Tastenkappe Ziffer 2"> Maturity/expiry of option

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Vol Cube => Vol across Strike vs Tenor vs Maturity

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Vol Cube => Vol across Strike vs Tenor vs Maturity

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> 3m10y => 3m Expiry Option on 10yr USD IRS

https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> 3m10y => 3m Expiry Option on 10yr USD IRS

Read on Twitter

Read on Twitter Economic data ahead; CPI tom; Fed data dependenthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> UST supply, 3y 10y 30y auctions this wkhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> US ylds, off highs, still close to higher end => risk premium in volshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Market v/s Fed disconnect on Rate Hike1/4" title="US Swaption/Rates Vol off highs but still elevatedReasons:https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Economic data ahead; CPI tom; Fed data dependenthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> UST supply, 3y 10y 30y auctions this wkhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> US ylds, off highs, still close to higher end => risk premium in volshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Market v/s Fed disconnect on Rate Hike1/4" class="img-responsive" style="max-width:100%;"/>

Economic data ahead; CPI tom; Fed data dependenthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> UST supply, 3y 10y 30y auctions this wkhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> US ylds, off highs, still close to higher end => risk premium in volshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Market v/s Fed disconnect on Rate Hike1/4" title="US Swaption/Rates Vol off highs but still elevatedReasons:https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Economic data ahead; CPI tom; Fed data dependenthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> UST supply, 3y 10y 30y auctions this wkhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> US ylds, off highs, still close to higher end => risk premium in volshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Market v/s Fed disconnect on Rate Hike1/4" class="img-responsive" style="max-width:100%;"/>

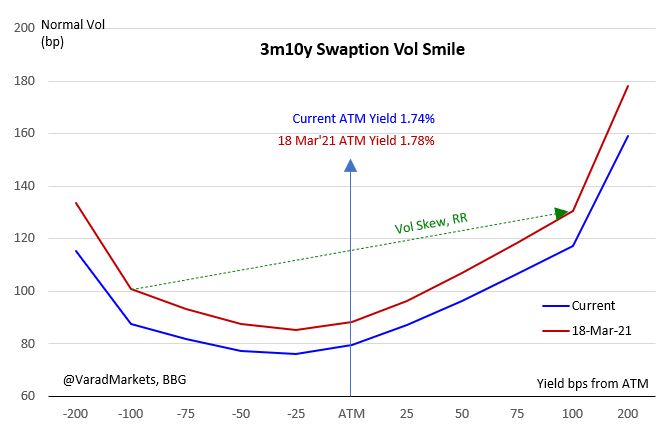

SEP-based June FOMC important => till then would have got two more NFPs & Inflation data till May incorporating Apr/May base effect + stimulus based spikes => little kink around 3m in vol curvehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Vol Skew mildly softer but still topside nervousness (convexity hedging)2/4" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> SEP-based June FOMC important => till then would have got two more NFPs & Inflation data till May incorporating Apr/May base effect + stimulus based spikes => little kink around 3m in vol curvehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Vol Skew mildly softer but still topside nervousness (convexity hedging)2/4" class="img-responsive" style="max-width:100%;"/>

SEP-based June FOMC important => till then would have got two more NFPs & Inflation data till May incorporating Apr/May base effect + stimulus based spikes => little kink around 3m in vol curvehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Vol Skew mildly softer but still topside nervousness (convexity hedging)2/4" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> SEP-based June FOMC important => till then would have got two more NFPs & Inflation data till May incorporating Apr/May base effect + stimulus based spikes => little kink around 3m in vol curvehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Vol Skew mildly softer but still topside nervousness (convexity hedging)2/4" class="img-responsive" style="max-width:100%;"/>

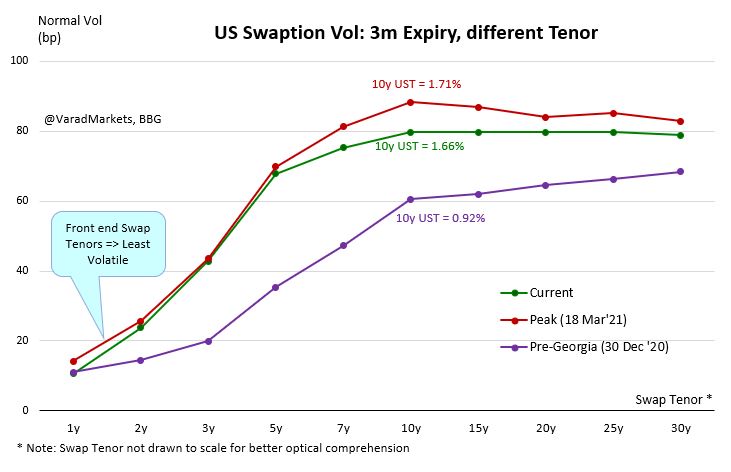

Chart: 3m Expiry Vol across Swap Tenors => Front end swap tenors least volatile as anchored by Fed Fund/OIS/T-Bill yieldshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Chart: 3m10y Swaption Vol v/s 10yr US Yield: higher yield => higher vol as reflected in Vol Skew3/4 @bondstrategist https://twitter.com/VaradMark..." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Chart: 3m Expiry Vol across Swap Tenors => Front end swap tenors least volatile as anchored by Fed Fund/OIS/T-Bill yieldshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Chart: 3m10y Swaption Vol v/s 10yr US Yield: higher yield => higher vol as reflected in Vol Skew3/4 @bondstrategist https://twitter.com/VaradMark...">

Chart: 3m Expiry Vol across Swap Tenors => Front end swap tenors least volatile as anchored by Fed Fund/OIS/T-Bill yieldshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Chart: 3m10y Swaption Vol v/s 10yr US Yield: higher yield => higher vol as reflected in Vol Skew3/4 @bondstrategist https://twitter.com/VaradMark..." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Chart: 3m Expiry Vol across Swap Tenors => Front end swap tenors least volatile as anchored by Fed Fund/OIS/T-Bill yieldshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Chart: 3m10y Swaption Vol v/s 10yr US Yield: higher yield => higher vol as reflected in Vol Skew3/4 @bondstrategist https://twitter.com/VaradMark...">

Chart: 3m Expiry Vol across Swap Tenors => Front end swap tenors least volatile as anchored by Fed Fund/OIS/T-Bill yieldshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Chart: 3m10y Swaption Vol v/s 10yr US Yield: higher yield => higher vol as reflected in Vol Skew3/4 @bondstrategist https://twitter.com/VaradMark..." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Chart: 3m Expiry Vol across Swap Tenors => Front end swap tenors least volatile as anchored by Fed Fund/OIS/T-Bill yieldshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Chart: 3m10y Swaption Vol v/s 10yr US Yield: higher yield => higher vol as reflected in Vol Skew3/4 @bondstrategist https://twitter.com/VaradMark...">

Chart: 3m Expiry Vol across Swap Tenors => Front end swap tenors least volatile as anchored by Fed Fund/OIS/T-Bill yieldshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Chart: 3m10y Swaption Vol v/s 10yr US Yield: higher yield => higher vol as reflected in Vol Skew3/4 @bondstrategist https://twitter.com/VaradMark..." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Chart: 3m Expiry Vol across Swap Tenors => Front end swap tenors least volatile as anchored by Fed Fund/OIS/T-Bill yieldshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="▪️" title="Schwarzes kleines Quadrat" aria-label="Emoji: Schwarzes kleines Quadrat"> Chart: 3m10y Swaption Vol v/s 10yr US Yield: higher yield => higher vol as reflected in Vol Skew3/4 @bondstrategist https://twitter.com/VaradMark...">