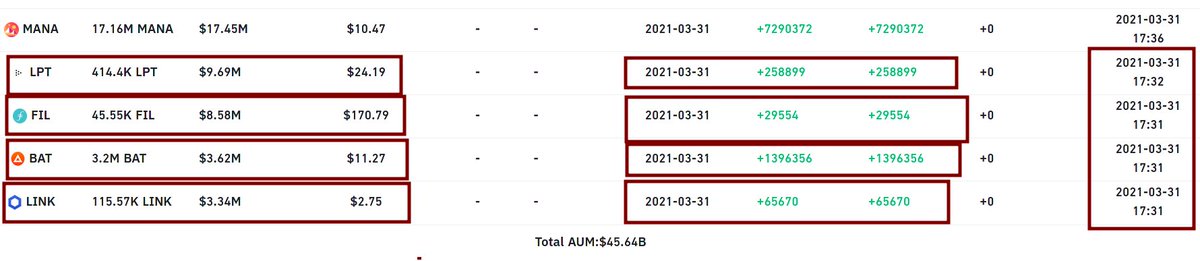

1/ Recently, Grayscale made some serious efforts to diversify their portfolio following the massive discount that emerged on Bitcoin and Ethereum a couple of weeks ago.

We& #39;re going to speak on why the premiums are important.

We& #39;re going to speak on why the premiums are important.

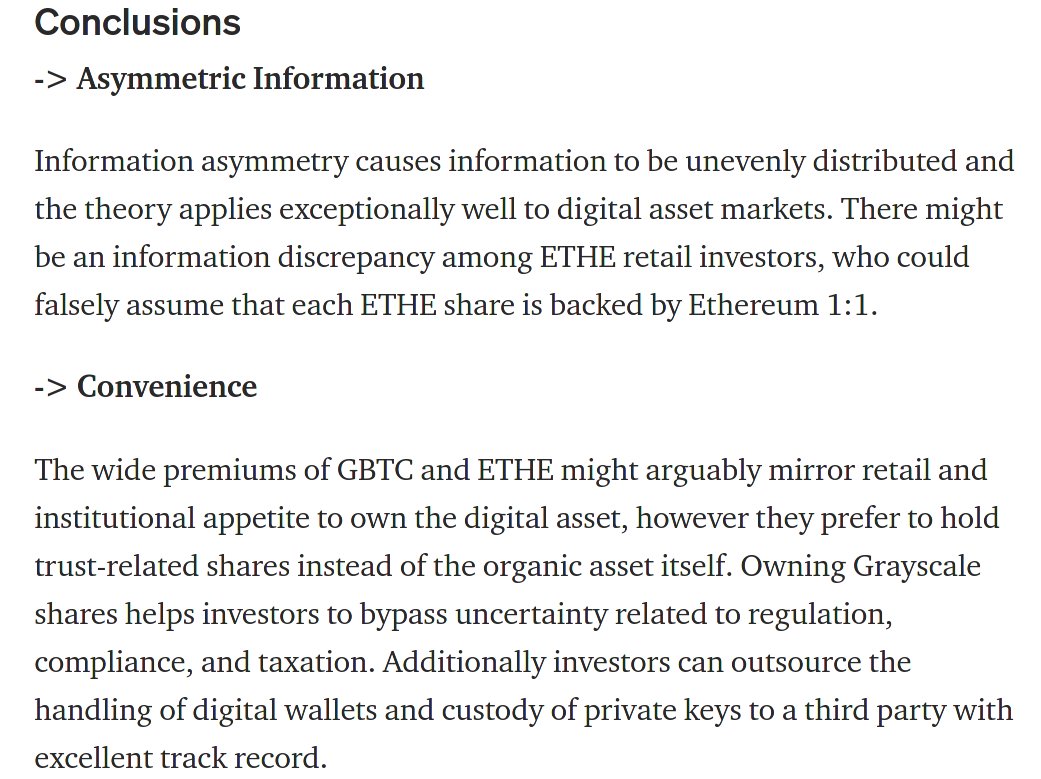

2/ Many people have been baffled about why GBTC and other Trusts by @Grayscale have traded with a premium.

After all, if you could buy Bitcoin for $15,000 on the markets, why would you pay $30k/share? Furthermore, why would you buy shares you can& #39;t even redeem for that asset?

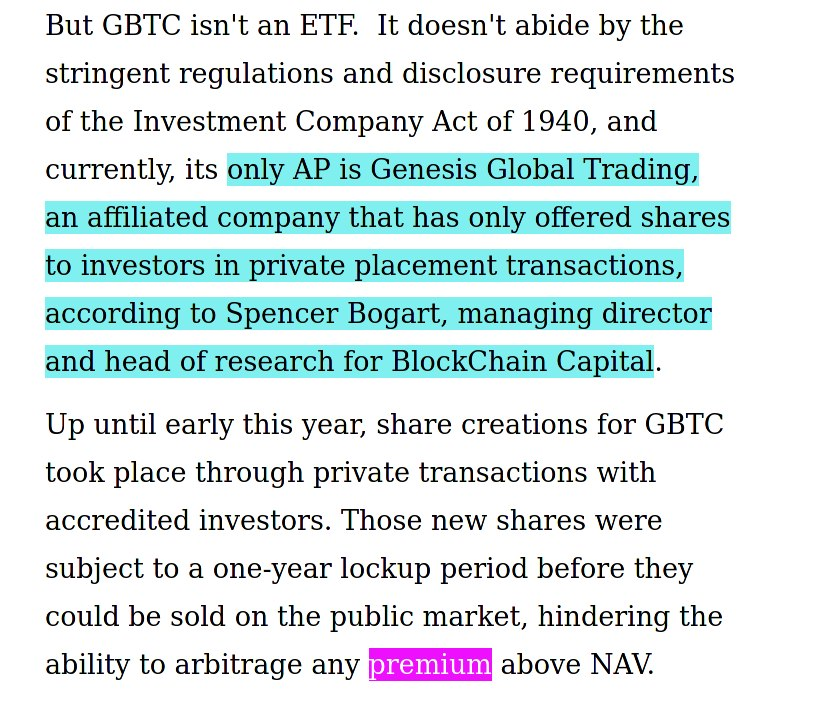

After all, if you could buy Bitcoin for $15,000 on the markets, why would you pay $30k/share? Furthermore, why would you buy shares you can& #39;t even redeem for that asset?

3/ Every screenshot attached to this tweet is an example of false information that has been shared with the general public as an excuse for why the GBTC premium has been as high as it has been.

Even @skewdotcom refused to tell you all the truth about the premium

Even @skewdotcom refused to tell you all the truth about the premium

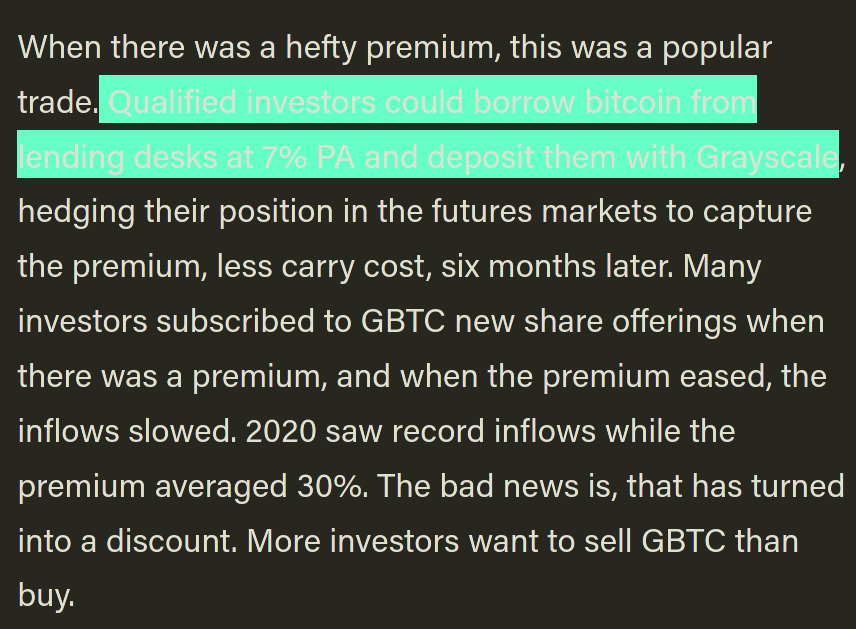

3a/ Since @ByteTree was the only entity that told the truth about what& #39;s going on with @Grayscale.

Investors were *borrowing* Bitcoin, and depositing those bitcoins w Grayscale in exchange for shares

A) https://bytetree.com/insights/2021/03/implications-of-the-grayscale-discount/">https://bytetree.com/insights/...

B) https://bytetree.com/insights/2021/03/investors-turn-to-fundamentals-as-gbtc-plunges-to-a-discount/">https://bytetree.com/insights/...

Investors were *borrowing* Bitcoin, and depositing those bitcoins w Grayscale in exchange for shares

A) https://bytetree.com/insights/2021/03/implications-of-the-grayscale-discount/">https://bytetree.com/insights/...

B) https://bytetree.com/insights/2021/03/investors-turn-to-fundamentals-as-gbtc-plunges-to-a-discount/">https://bytetree.com/insights/...

4/ We don& #39;t have to look any further than 2016 to see how @Grayscale got here. That year, the SEC imposed actions against @BarrySilbert and @DCGco that barred them from redeeming shares in "Bitcoin Investment Trust" now & #39;Grayscale& #39; for supposed violations of Reg M

5/ This is a big part of the reason for why there& #39;s been a premium on @Grayscale& #39;s Bitcoin Trust as there& #39;s no real arbitrage (i.e., redemption for Bitcoin to sell off). In laymen& #39;s terms, there was no other Bitcoin Trust one could trade those shares for / with / against)

6/ Let& #39;s go take a quick look at the Grayscale Bitcoin Trust at the time of writing.

Its currently trading at a -9.73% discount to the "NAV" (price of the holdings per BTC).

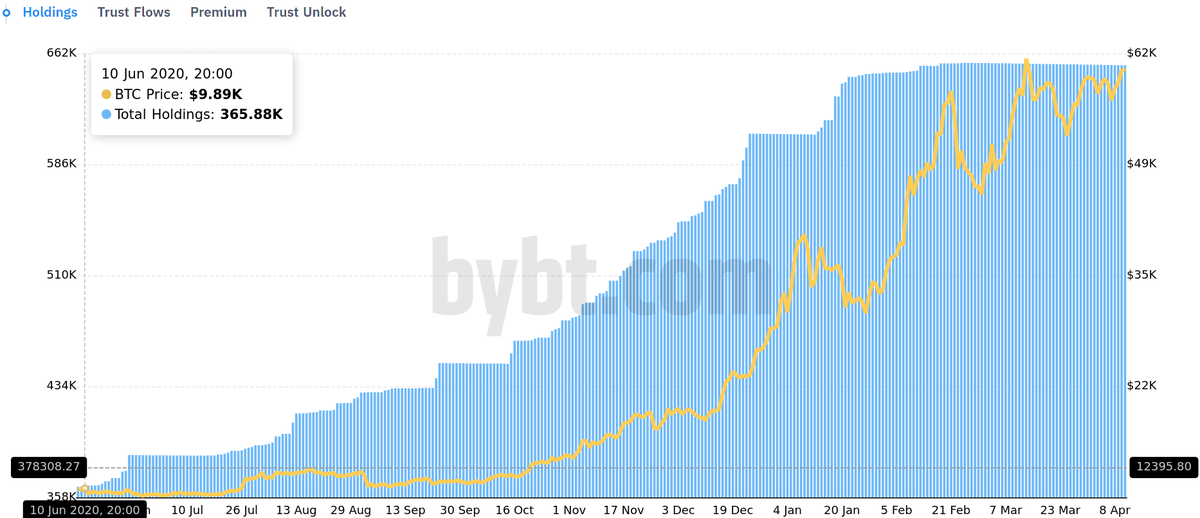

That aside, there are 655,000 bitcoins there. That& #39;s almost double the amt from last summer.

Its currently trading at a -9.73% discount to the "NAV" (price of the holdings per BTC).

That aside, there are 655,000 bitcoins there. That& #39;s almost double the amt from last summer.

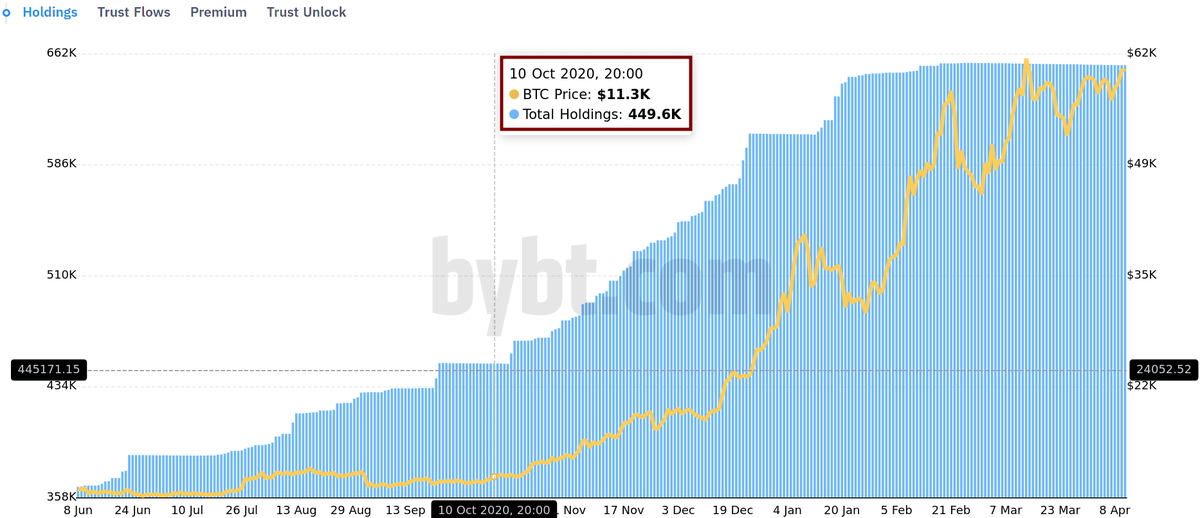

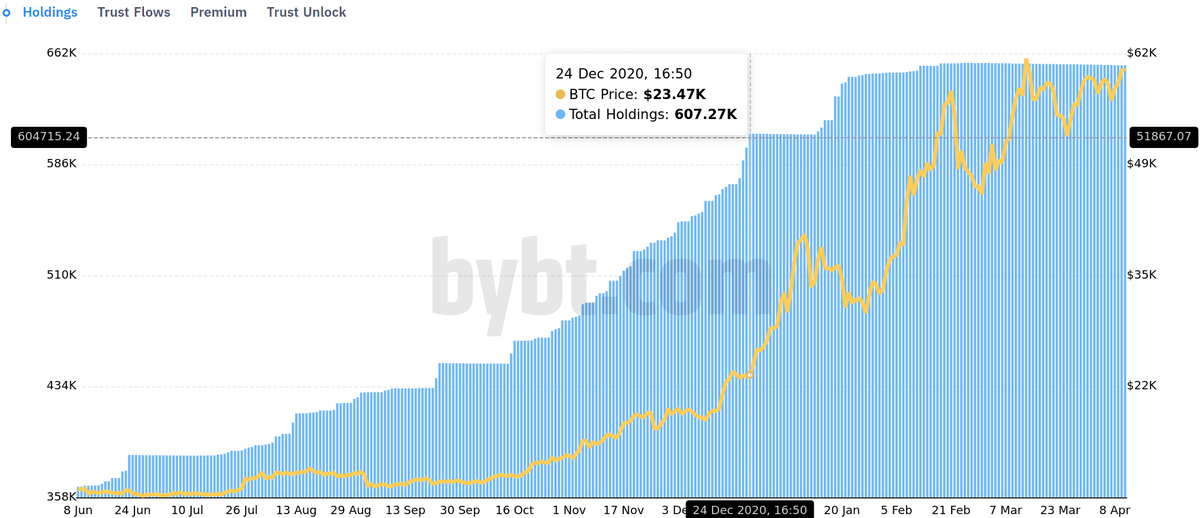

7/ Specifically, look at the trust on October 10th, 2020 (start of the bull market); there were 449.6k bitcoins.

By Dec 24th, 2020 (2 months + 2 weeks), there were 607k bitcoins.

Price went from $11k to $23k (+118%)

By Dec 24th, 2020 (2 months + 2 weeks), there were 607k bitcoins.

Price went from $11k to $23k (+118%)

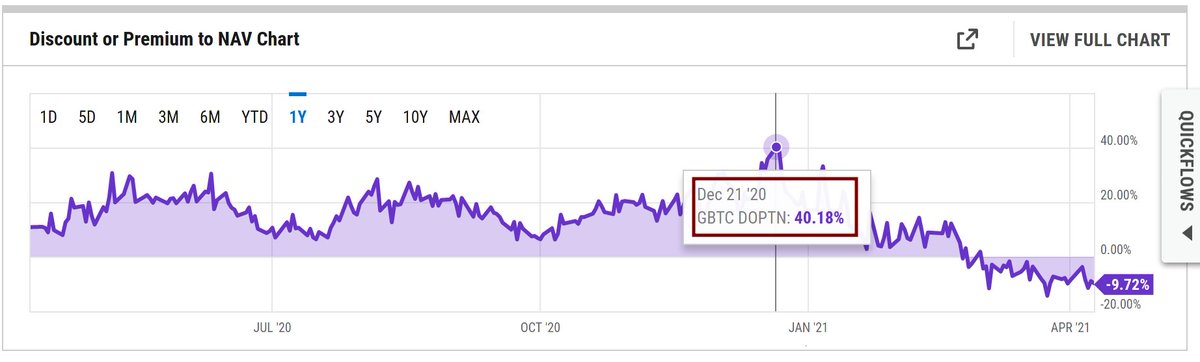

8/ The premium / discount to NAV for GBTC was hovering at +12.13% on October 9th, 2020.

On December 21st, 2020 it hit +40% (and has been in a backslide ever since).

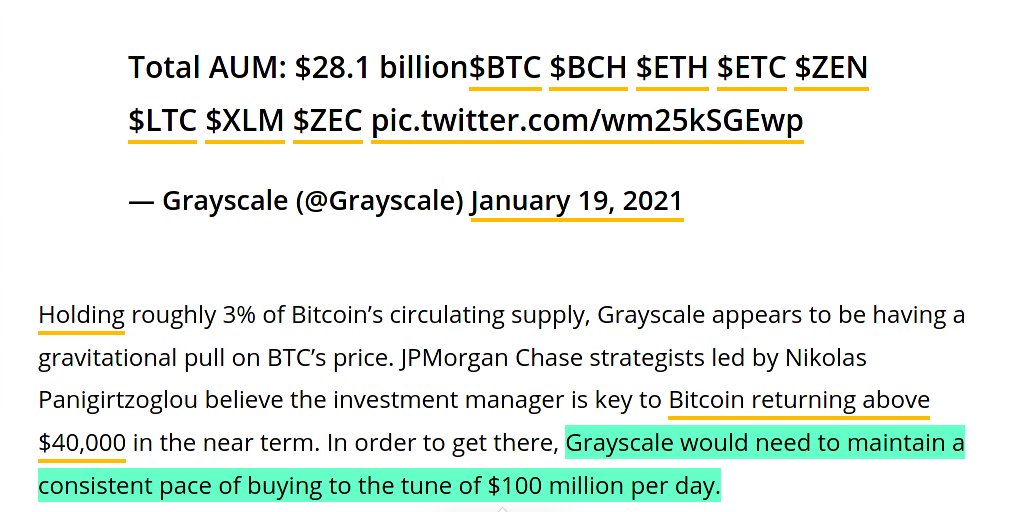

@CoinDesk was accurate in asserting JP Morgan& #39;s opinions on this + noting @Grayscale represented majority buys

On December 21st, 2020 it hit +40% (and has been in a backslide ever since).

@CoinDesk was accurate in asserting JP Morgan& #39;s opinions on this + noting @Grayscale represented majority buys

8a/ Attached to this tweet are some screenshots from the investor reports that JP Morgan has been publishing reflecting the impact of Grayscale on the markets.

9/ While premiums have been advertised as a drawback to GBTC, they& #39;re actually a hidden feature of GBTC.

Many people look at the premiums and think, "Oh you have to pay bitcoin& #39;s price +40%"; that& #39;s only if you pay in CASH. If you trade in bitcoins you get the equivalent shares

Many people look at the premiums and think, "Oh you have to pay bitcoin& #39;s price +40%"; that& #39;s only if you pay in CASH. If you trade in bitcoins you get the equivalent shares

9a/ Imagine I have a trust. Each share = 1 bitcoin. We& #39;re trading at a 20% premium. Rather than buy that share for $72k (+20%) in cash, you& #39;ll give me 1 bitcoin ($60k right now), and wait 6 months (Rule144A) and then sell that share for $72k cash.

9b/ These premiums are *always* relative to the price of Bitcoin. So let& #39;s say Bitcoin goes up to $100k in that 6 month period in which my shares are locked.

If the premium is still 20%, then my share is worth $120k. So I get the 67%+ appreciation in bitcoin + another 20%+.

If the premium is still 20%, then my share is worth $120k. So I get the 67%+ appreciation in bitcoin + another 20%+.

10/ Can you imagine how tempting it would be to plop all of my Bitcoin in a product like that? Especially if say...some related entity like... @GenesisTrading was allowing me to borrow bitcoins directly.

11/ Genesis broke down in their quarterly report where they got all of this money to loan out Bitcoin.

It was from the Fed making it rain on prime brokerages (i.e., Goldman / JP Morgan) post-March 2020

source: https://genesistrading.com/wp-content/uploads/2020/11/GenesisQ3QuarterlyReport-3.pdf">https://genesistrading.com/wp-conten...

It was from the Fed making it rain on prime brokerages (i.e., Goldman / JP Morgan) post-March 2020

source: https://genesistrading.com/wp-content/uploads/2020/11/GenesisQ3QuarterlyReport-3.pdf">https://genesistrading.com/wp-conten...

12/ You might think the level of criminality by Bitfinex, DCG et. al., makes them stupid ; they& #39;re not. At least @Grayscale isn& #39;t. These people created DeFi and the plays they& #39;re making on these markets aren& #39;t as elementary as "print USDT, buy Bitcoin".

Read on Twitter

Read on Twitter