So I was talking about 1958 recently and @Fullcarry didn& #39;t know the link so I thought, if he doesn& #39;t know then maybe it& #39;s time to re-up as we say (because he& #39;s clever and knowledgeable but there are so many hours in the day you can use to play with your dogs).

1/x

1/x

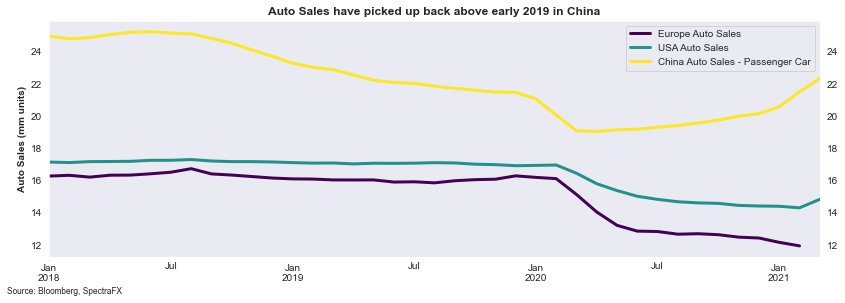

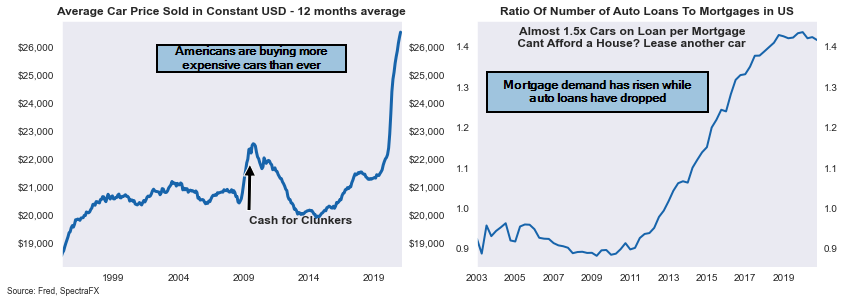

So the thing is as everyone is posting (cc @pearkes), housing and car sales are on fuego in the US (and looking at prices in my London hood this morning, it& #39;s the same here).

Auto loans were crashing last year but we can expect a resurgence, and looking at sales in China...

2/x

Auto loans were crashing last year but we can expect a resurgence, and looking at sales in China...

2/x

And when I look at the JOLTs data (not that i like it but it& #39;s what we have to use to construct Beveridge curves a la @TimDuy , despite the fact that it& #39;s a bit weird for the average monthly job opening to be 0 per cohort).

Waiters and Nurses are needed. In the South. FAST!.

3/x

Waiters and Nurses are needed. In the South. FAST!.

3/x

And we have a strong infra plan that will push everything higher still.

Now I need Marty McFly to take me back to the 1950s.

4/x

Now I need Marty McFly to take me back to the 1950s.

4/x

In 1957 the world was struck with a flu pandemic which killed around 1 million people worldwide, including circa 100k in the US alone.

The US came into the pandemic with a general reduction in activity, from capex to housing.

Sounds familiar?

5/x

The US came into the pandemic with a general reduction in activity, from capex to housing.

Sounds familiar?

5/x

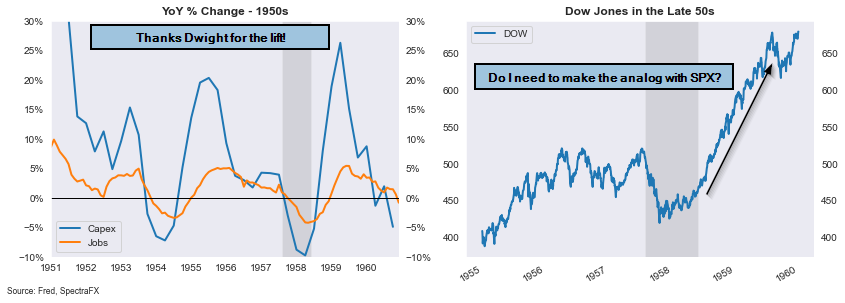

So what did Eisenhower do? Yeah...

• A push to infrastructure projects, with rural electrification.

• Making it easier to purchase a home

• Unemployment benefits

This lead to a boom in Capex, a lift in jobs, and a boom in equities.

6/x

• A push to infrastructure projects, with rural electrification.

• Making it easier to purchase a home

• Unemployment benefits

This lead to a boom in Capex, a lift in jobs, and a boom in equities.

6/x

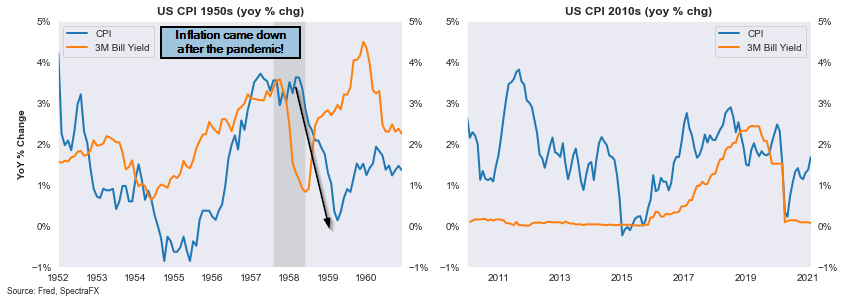

But what’s even more interesting is that it didn’t lead to a push in inflation in the aftermath of the pandemic and the govt push!

And at the time we had a similar pick up in retail sales (proxied here by the dept store sales for good measure).

But it came back quickly.

7/x

And at the time we had a similar pick up in retail sales (proxied here by the dept store sales for good measure).

But it came back quickly.

7/x

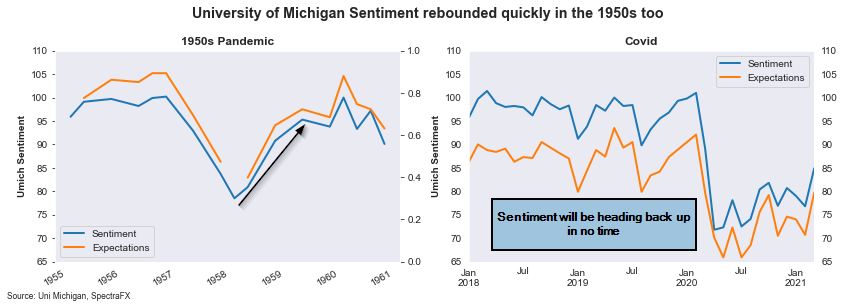

Looking at the University of Michigan (which is one of the oldest surveys available) the sentiment and expectations are bound to improve quickly.

8/x

8/x

One thing to note though is that the Fed was quick to cut rate in 1957 with 3M yields from 3.5% to circa 1%. And it was as quick in 1958 to raise them back quickly to 2.5%.

Lingering on the dovish side could force the market to actually price a more acute change in dynamic.

9/x

Lingering on the dovish side could force the market to actually price a more acute change in dynamic.

9/x

We are still pricing a decent amount of tightening once the Fed is lifting off, with 2.2 hikes priced for the 12 months after we lift off.

But that lift-off is still in 2023 for now.

A few months ago we were pricing that lift-off in 2024.

Pricing hikes sooner soon?

10/x

But that lift-off is still in 2023 for now.

A few months ago we were pricing that lift-off in 2024.

Pricing hikes sooner soon?

10/x

So overall I think we& #39;ve seen it before, and that we are bound for maybe quicker hikes than expected as growth comes back but if the Fed is not too stubborn we shouldn& #39;t see inflation explode.

11/x

11/x

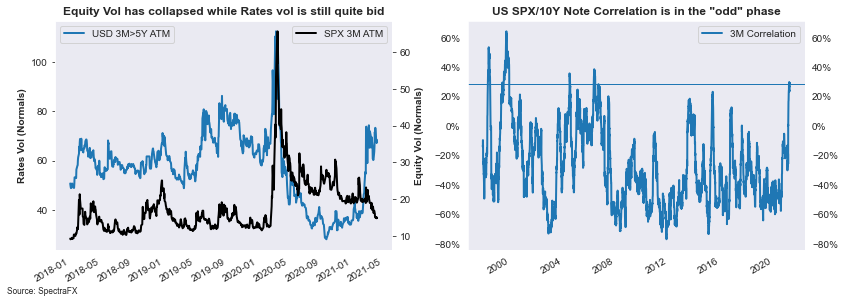

To finish I just want to make sure to point out that we all know we& #39;re in a bubble but now is the time we are getting really complacent.

We are starting to see rates vol bid, equity vol down, skew down.

Correlation between US equities and US bonds is at the highest.

12/x

We are starting to see rates vol bid, equity vol down, skew down.

Correlation between US equities and US bonds is at the highest.

12/x

In the post Archegos world of Prime Brokers deleveraging, we already have Credit Suisse moving to dynamic margining.

This means it should force funds into less leverage, and increase vols (because that measure accentuates episodes of short gamma).

13/x

This means it should force funds into less leverage, and increase vols (because that measure accentuates episodes of short gamma).

13/x

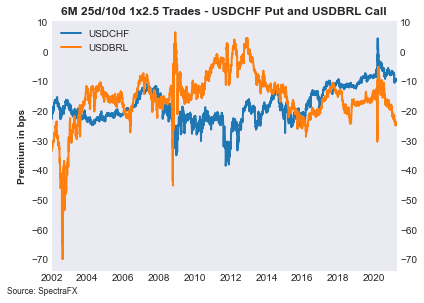

FX convexity is low as well. Looking at a simple measure of 25d/10d risk-off (ie you buy the 10d in delta neutral fashion) you can see the CHF Calls and BRL Puts are at the lows.

It& #39;s fun to clip coupons, but those short tails will be expensive in VaR terms.

14/x

It& #39;s fun to clip coupons, but those short tails will be expensive in VaR terms.

14/x

And now because this is a thread and @MagnusMacro started it, a snoot picture. Because boop. Vino time.

15/15

15/15

Read on Twitter

Read on Twitter