One of more interesting sleepy IPOs of 2021 is Olo

Olo is sort of an enterprise Toast. SaaS for restaurant chains etc

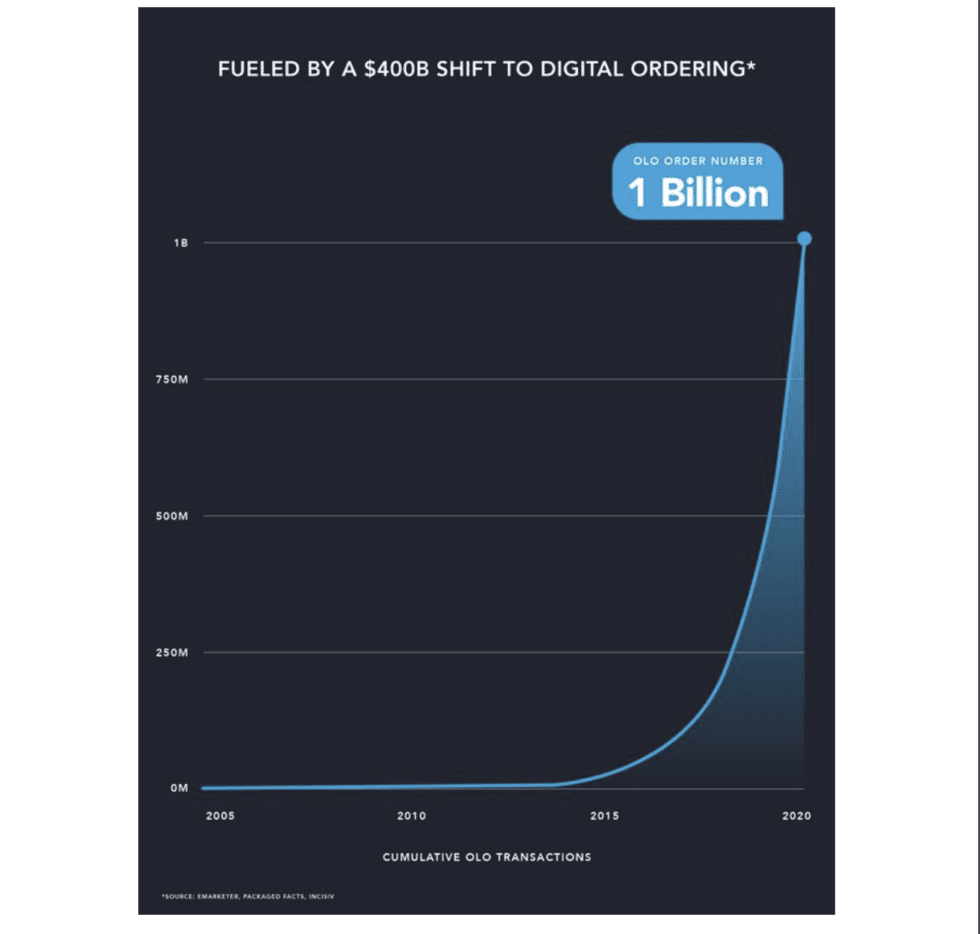

It started waay too early in 2005. And only burned $24m to get to $100m ARR

Then Covid came. And the world change

5 Interesting Learnings: https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

Olo is sort of an enterprise Toast. SaaS for restaurant chains etc

It started waay too early in 2005. And only burned $24m to get to $100m ARR

Then Covid came. And the world change

5 Interesting Learnings:

Note that Olo was relatively a small company to IPO — only $130m ARR.

But its explosive 94% growth after Covid let it IPO on its way to a $3.5 Billion valuation today.

A breathtaking 30x+ its ARR

But its explosive 94% growth after Covid let it IPO on its way to a $3.5 Billion valuation today.

A breathtaking 30x+ its ARR

#1. Growth fueled by the addition of transactional revenue, not SaaS revenues

Olo’s explosive growth in the past 24 months wasn’t fueled so much by its SaaS revenue, but by transaction revenue as part of orders. SaaS itself didn& #39;t grow that fast.

See, also, Shopify (in part)

Olo’s explosive growth in the past 24 months wasn’t fueled so much by its SaaS revenue, but by transaction revenue as part of orders. SaaS itself didn& #39;t grow that fast.

See, also, Shopify (in part)

This switch to transactional revenue is breathtaking:

In 2018, 93% of Olo’s revenue was pure SaaS

In 2020, transactional revenue had grown to 43%

If Olo had stayed “just SaaS”, the success story would have been much, much more modest.

Olo calls this “transactional SaaS”

In 2018, 93% of Olo’s revenue was pure SaaS

In 2020, transactional revenue had grown to 43%

If Olo had stayed “just SaaS”, the success story would have been much, much more modest.

Olo calls this “transactional SaaS”

#2. Only burned $24m to get to $100m+ in revenues — but it took a long time as a result

Prior to IPO, Olo had raised $100m, but it still had $76m of cash on hand — so net of revenue, it only burned $24m to get to $100m+ in ARR. It got started in 2005 with a $500k seed round

Prior to IPO, Olo had raised $100m, but it still had $76m of cash on hand — so net of revenue, it only burned $24m to get to $100m+ in ARR. It got started in 2005 with a $500k seed round

Raising very little money wasn& #39;t a net benefit per se

Growth was very modest in the early years.

And dilution wasn& #39;t avoided. Founder Noah Glass owned 10% at IPO.

A lot, but also, plenty of dilution even with a modest raise

Growth was very modest in the early years.

And dilution wasn& #39;t avoided. Founder Noah Glass owned 10% at IPO.

A lot, but also, plenty of dilution even with a modest raise

#3. Growth remains strong, but not as crazy strong post-Covid.

Just as Zoom projected 40%+ growth post-Covid, Olo also is still experiencing strong growth, but not close to the 100%+ YoY it had during peak Covid quarters

But it is projecting growth of half that going forward

Just as Zoom projected 40%+ growth post-Covid, Olo also is still experiencing strong growth, but not close to the 100%+ YoY it had during peak Covid quarters

But it is projecting growth of half that going forward

#4. More valuable products and modules = more revenue. We’ve seen this with Box & others.

71% of Olo’s customers now use all 3 of its modules, up from 44% in 2019.

This has been key to the accelerated growth and 120% NRR

71% of Olo’s customers now use all 3 of its modules, up from 44% in 2019.

This has been key to the accelerated growth and 120% NRR

#5. DoorDash is 19% of its revenue — up from 2.6% in 2018.

A bona fide risk, especially since DoorDash now also >competes<. But apparently, public market investors are OK with it.

A bona fide risk, especially since DoorDash now also >competes<. But apparently, public market investors are OK with it.

And a few bonus notes:

#6. Customers sign 3 year contracts, with 99% enterprise customer retention. 3 year contracts do help retain them! But still, 99% customer retention is impressive.

#6. Customers sign 3 year contracts, with 99% enterprise customer retention. 3 year contracts do help retain them! But still, 99% customer retention is impressive.

#7. Modest sales & marketing expense of just 9%, and just 134 employees in sales, mktg, & success at $130m ARR

This is low, in part is because of somewhat organic expansion of selling to chains & franchisees

Olo thus has substantial free cash flow (20%!) even at just $130m ARR

This is low, in part is because of somewhat organic expansion of selling to chains & franchisees

Olo thus has substantial free cash flow (20%!) even at just $130m ARR

#8. Requires customers to be exclusive on their direct digital ordering services.

This blocks out the competition, at least a segment of it.

We& #39;ll see if it pays off in the long-run

This blocks out the competition, at least a segment of it.

We& #39;ll see if it pays off in the long-run

More here: https://www.saastr.com/5-interesting-learnings-from-olo-at-130000000-in-arr/">https://www.saastr.com/5-interes...

Read on Twitter

Read on Twitter