What do the latest #IMF World Economic Outlook projections tell us about the #Cypriot  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇨🇾" title="Flagge von Zypern" aria-label="Emoji: Flagge von Zypern">economy. A thread.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇨🇾" title="Flagge von Zypern" aria-label="Emoji: Flagge von Zypern">economy. A thread.

There’s a few stories appearing in the IMF’s latest set of projections. Let’s unpick some of them....

There’s a few stories appearing in the IMF’s latest set of projections. Let’s unpick some of them....

According to the IMF, the pandemic will cost the Cyprus economy almost 6% by 2024 or around 1.3 billion euro of foregone output in 2019 price levels

When converted to per person costs, this comes down to around 1,500 euro per person compared to the counterfactual of no pandemic happening

What does the future hold? Let’s focus on GDP per capita—here, the IMF reckons pc output is projected to grow by an average of around *1.8% per annum* in the 2021-26 period. On the face of it, this seems OK. Let’s dig a bit more….

Economic theory states that st specific conditions there should be convergence of incomes.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> the line of best fit shows that this relationship broadly holds in the Eurozone (using some proxies of the former)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> the line of best fit shows that this relationship broadly holds in the Eurozone (using some proxies of the former)

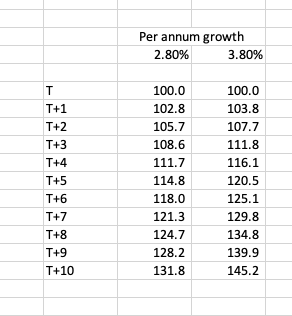

Look at Cyprus though—its projected GDP pc growth underperforms relative to the expected relationship. The IMF reckons Cypriot per capita output is expected to grow by….

…an average of *around 1.8% per annum* compared to an *expected 2.7%-2.8% per annum* based on the Eurozone-wide relationship that holds between GDP pc levels and projected growth rates. This is a one percentage gap of forgone income per year – this is MASSIVE

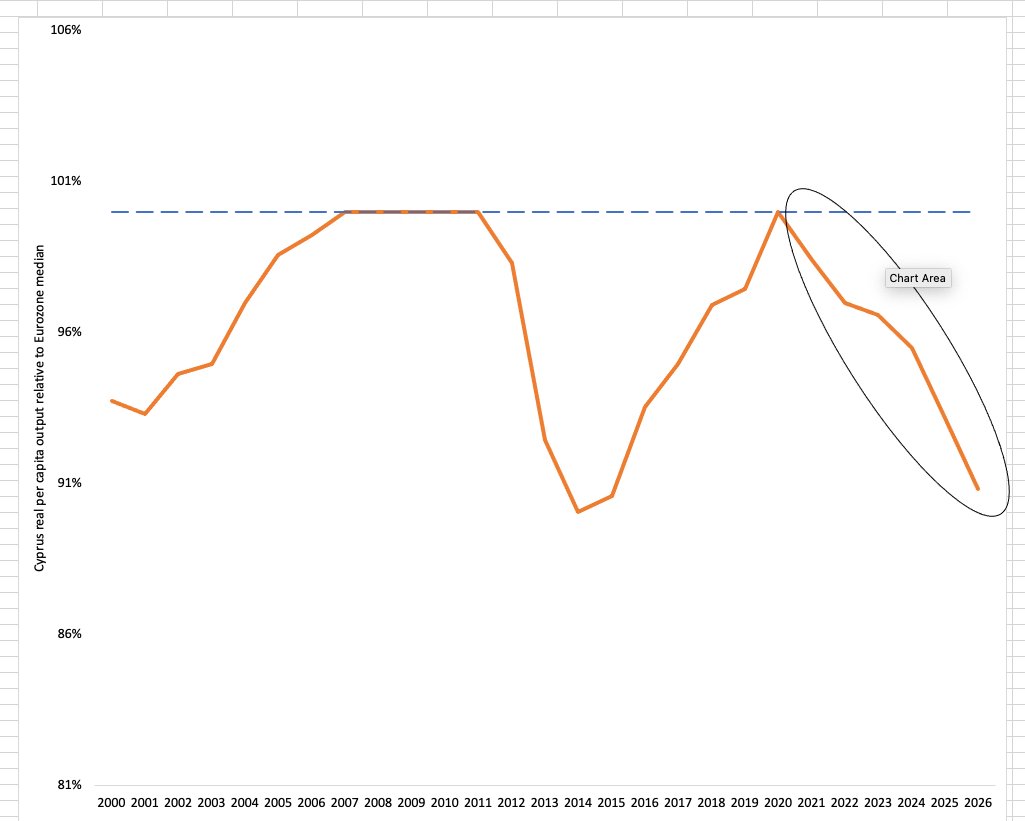

What about Cyprus’s relative performance? After all, it is this which matters more relative to our peers in the bloc. The story here is not positive—the IMF expect Cypriots GDP pc to decline relative to the median in the Eurozone

Why is Cyprus underperforming? There’s lots of reasons. First, Cyprus’s economic model is not fit for the future. The old, out-dated model of “easy” growth, based on low-skilled immigration, maximising volume of tourists and building empty skyscrapers is simply...

...not sustainable economically and environmentally (see chart) There are other factors as well. Given the investment-savings imbalance, Cyprus is reliant on FDI (or sales of assets) to plug the gap.

What sophisticated investor will come to Cyprus to buy a piece of land and build a factory if: a) s/he will get the title deed in 10 years b) might have to provide kick-backs to someone to get the job done?

If Cyprus doesn’t manage to deal with some of these issues decisively then it will pay the price with lower standards of living, stuck in a mediocre slump, whilst our cousins in Europe forge ahead. More threads to come in the future.

Read on Twitter

Read on Twitter

the line of best fit shows that this relationship broadly holds in the Eurozone (using some proxies of the former)" title="Economic theory states that st specific conditions there should be convergence of incomes. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> the line of best fit shows that this relationship broadly holds in the Eurozone (using some proxies of the former)" class="img-responsive" style="max-width:100%;"/>

the line of best fit shows that this relationship broadly holds in the Eurozone (using some proxies of the former)" title="Economic theory states that st specific conditions there should be convergence of incomes. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> the line of best fit shows that this relationship broadly holds in the Eurozone (using some proxies of the former)" class="img-responsive" style="max-width:100%;"/>