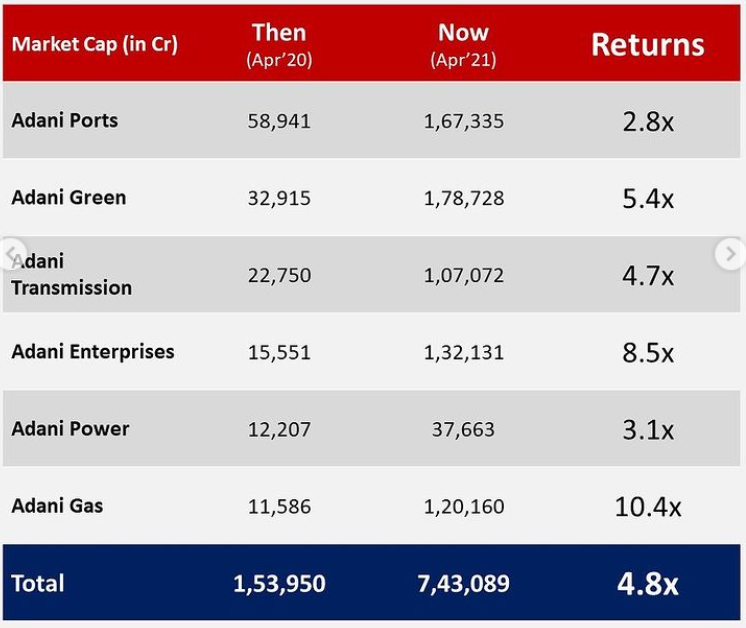

Group put together made ~3,800 Cr of profits in FY20, however the trailing twelve months profits has been 6459 Cr. A rise of 70%.

The business has improved from what it was a year ago. But this doesn’t explain the 480% rise.

The business has improved from what it was a year ago. But this doesn’t explain the 480% rise.

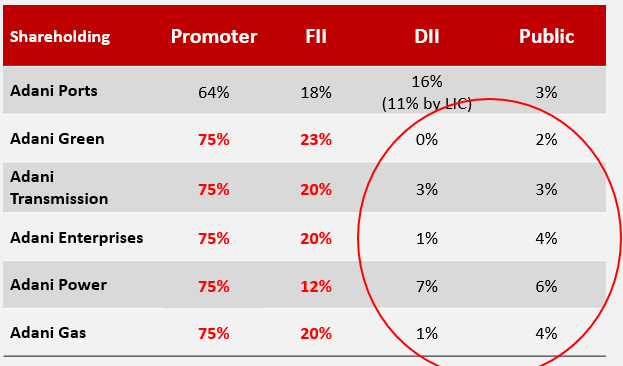

Let& #39;s check the shareholding.

- 5 out of 6 companies have 75% #promoter holding

- #FIIs seem to love the company

- #Domestic & #retail investors are minority

- It seems there aren’t enough stocks to trade freely

- 5 out of 6 companies have 75% #promoter holding

- #FIIs seem to love the company

- #Domestic & #retail investors are minority

- It seems there aren’t enough stocks to trade freely

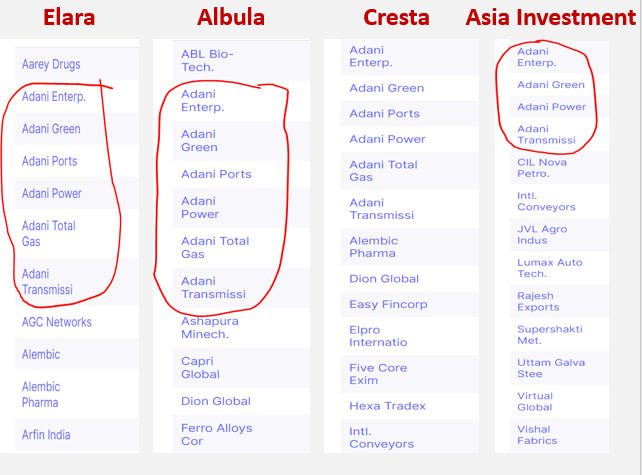

Let& #39;s see who these FIIs are:

- Elara, Cresta, Albura, APMS, Vespera and Asia Investment Corp love Adani Group

- Basically majority of FIIs (>1% holding) are same in all Adani Groups

- Are these firms related to Adani? Can’t say

- Elara, Cresta, Albura, APMS, Vespera and Asia Investment Corp love Adani Group

- Basically majority of FIIs (>1% holding) are same in all Adani Groups

- Are these firms related to Adani? Can’t say

Ok, what are the other holdings of these FIIs?

A large part of their investment in India are in Adani Group. Interesting!

A large part of their investment in India are in Adani Group. Interesting!

Key takeaways:

1. Adani Group seems to be doing better than before on the business front

2. However, the aggressive bidding for projects to jack up its value is happening and might put it at risk. This is partially evident from the airport bids that Adani won at a huge premium

1. Adani Group seems to be doing better than before on the business front

2. However, the aggressive bidding for projects to jack up its value is happening and might put it at risk. This is partially evident from the airport bids that Adani won at a huge premium

But in last 1 year major reason for rise in price can be attributed to:

a) Lower stocks available for retail investors to buy and sell (~90%+ held by promoter & FIIs)

b) Concentrated holdings

c) Same FIIs investing in Adani!

End of Thread

#investing #nse #bse #nifty #sensex

a) Lower stocks available for retail investors to buy and sell (~90%+ held by promoter & FIIs)

b) Concentrated holdings

c) Same FIIs investing in Adani!

End of Thread

#investing #nse #bse #nifty #sensex

Read on Twitter

Read on Twitter