Let’s say you’re a financially responsible person not wanting to eat $10k in depreciation as soon as you drive a new car of the lot.

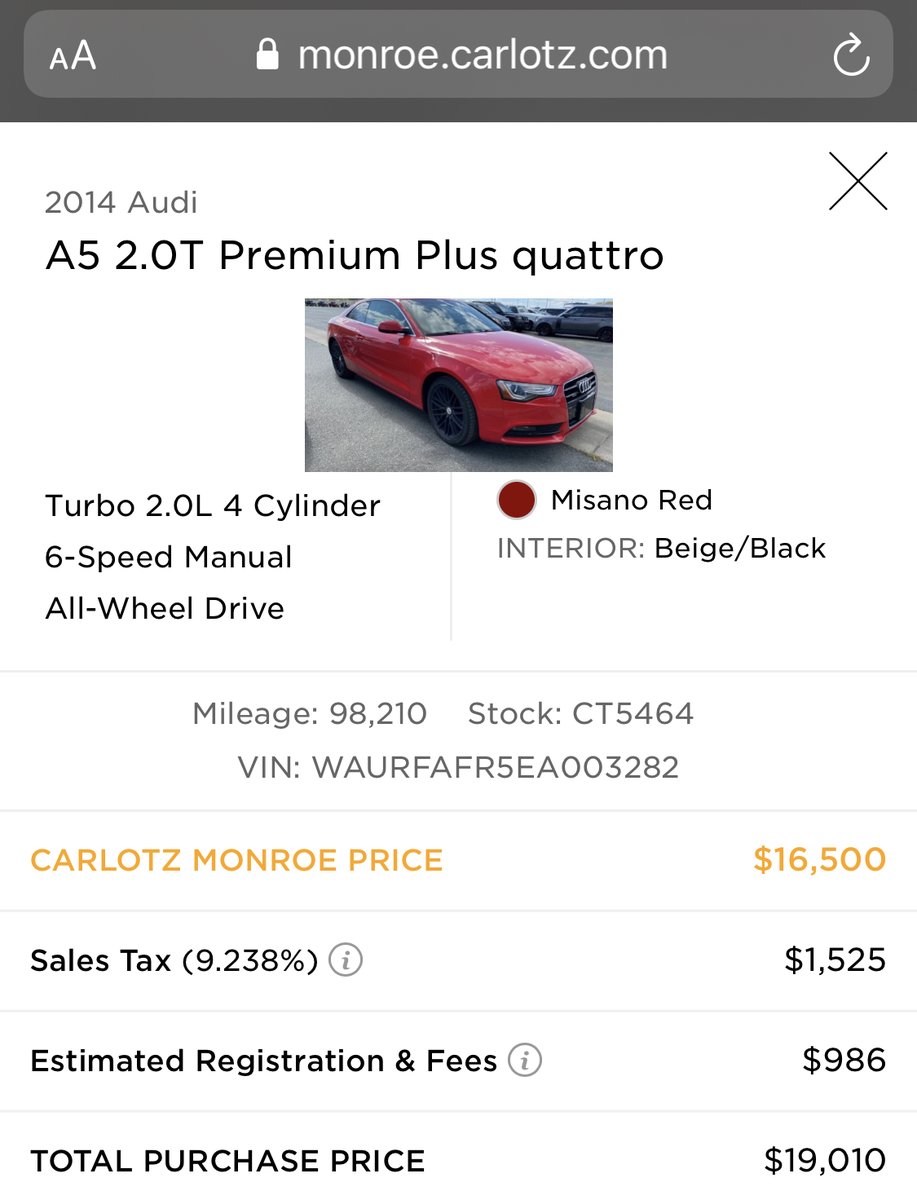

So you chose a used Audi for $20k

So you chose a used Audi for $20k

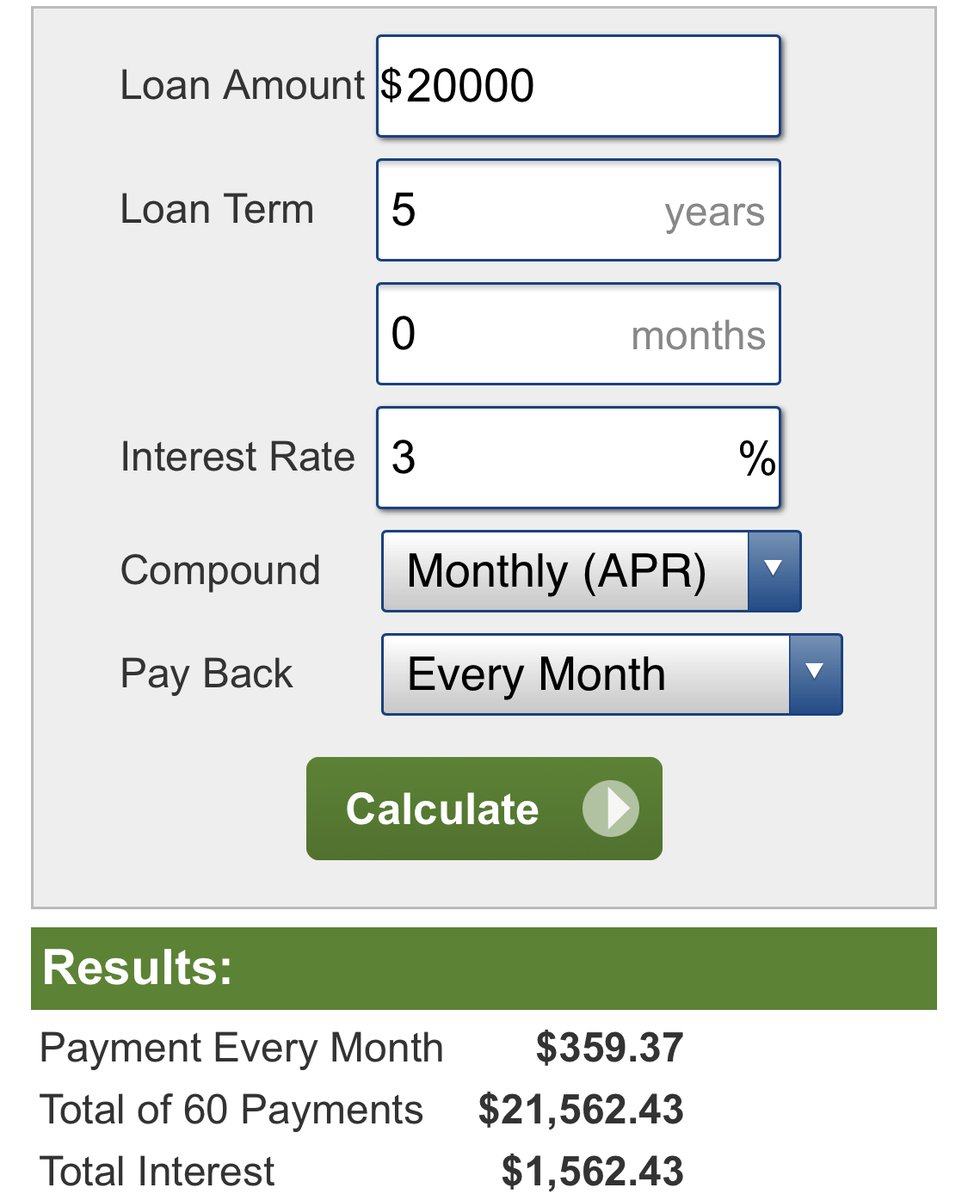

If you finance it the numbers come close to $400/mo

It’s a tidy sum but affordable within your salary.

It’s a tidy sum but affordable within your salary.

But as a financially woke person you want to finance your purchase with cash flow from assets.

How much would you need to invest to finance your gently used car?

How much would you need to invest to finance your gently used car?

If you were to go the traditional route of dividend growth stocks at a 2-3% yield you would need $160k to fund your car.

Ain’t gonna happen.

Ain’t gonna happen.

What if you found a safe way to boost your yield though?

That’s where something like $QYLD comes in.

It is a relatively a safe 11% net yielder that generates cash flow from covered call income.

That’s where something like $QYLD comes in.

It is a relatively a safe 11% net yielder that generates cash flow from covered call income.

How much $QYLD would you need to finance the Audi?

Only $40k or “buying it twice”

Much more achievable than the lower yield growth focused dividend stocks.

Only $40k or “buying it twice”

Much more achievable than the lower yield growth focused dividend stocks.

Another benefit of this approach is that when you pay off your loan you still get to keep the stocks and cash flow.

If you’re lucky they will have appreciated in value.

If you’re lucky they will have appreciated in value.

Of course there are other ways to buy cash flow like real estate, vending machines, websites and more.

What matters is that you try to find the highest safe yield available to you and fits your investing style.

What matters is that you try to find the highest safe yield available to you and fits your investing style.

Please give the top tweet a RT if you liked the thread!

If you’d like to learn more about higher yielding dividends check out my book.

Over 3,000 people have started their cash flow machine with it. http://gum.co/CSdwG ">https://gum.co/CSdwG&quo...

If you’d like to learn more about higher yielding dividends check out my book.

Over 3,000 people have started their cash flow machine with it. http://gum.co/CSdwG ">https://gum.co/CSdwG&quo...

Read on Twitter

Read on Twitter![An example of “you can’t afford it unless you can buy it twice.”[Thread] An example of “you can’t afford it unless you can buy it twice.”[Thread]](https://pbs.twimg.com/media/EysxbspXEAsv7H4.jpg)