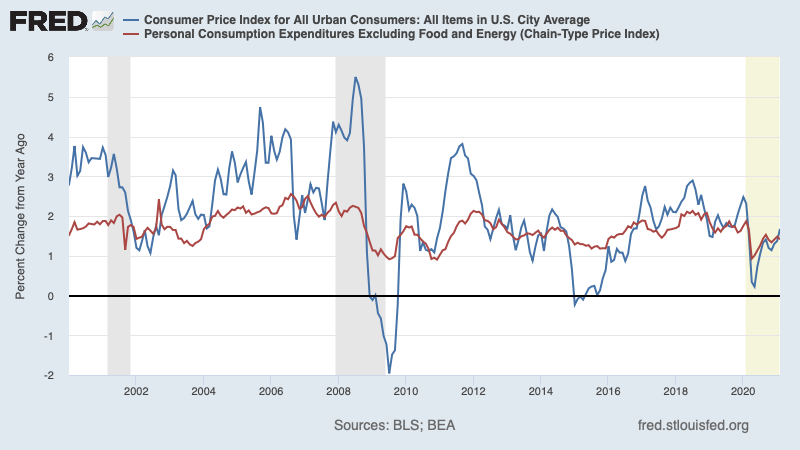

So, will this be Inflation Freakout Week? Maybe, or maybe it will wait a month or two. But soon we& #39;ll be seeing some big headline price rises — and it will be important to put them in context. Even if you& #39;re worried about a long hot Summers of overheating, this won& #39;t be it 1/

Where we are now is that what looks like rapid economic recovery will run into bottlenecks that cause some prices to rise quickly — and temporarily. That is, it won& #39;t represent a rise in underlying inflation, it will just be a blip 2/

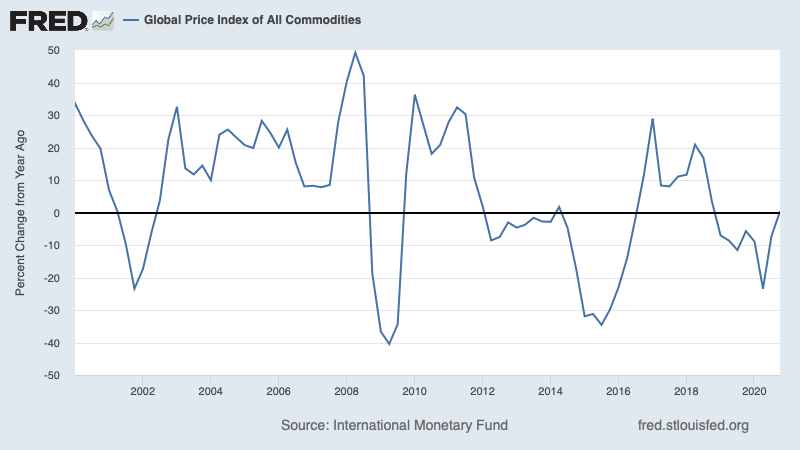

A fairly recent historical precedent: early 2008, when rising global demand hit bottlenecks in commodity production. Commodity prices really surged 3/

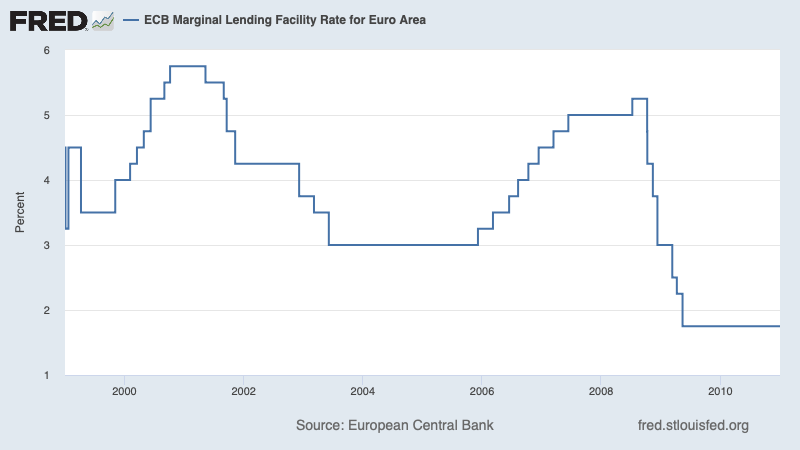

There were a lot of people calling on the Fed to slam the brakes, even though as we now know we were already in recession. The Fed stayed calm; the ECB didn& #39;t 5/

Read on Twitter

Read on Twitter