The Barbell Strategy

@nntaleb pioneered and popularized this approach to investing. Let& #39;s break it down!

In a nutshell:

1. put 90% of your money in risk-free assets, protecting your downside.

2. bet 10% on super-risky opportunities, giving you the chance for a big windfall.

@nntaleb pioneered and popularized this approach to investing. Let& #39;s break it down!

In a nutshell:

1. put 90% of your money in risk-free assets, protecting your downside.

2. bet 10% on super-risky opportunities, giving you the chance for a big windfall.

In the end, your portfolio looks like an unbalanced barbell  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆🏼" title="Rückhand Zeigefinger nach oben (mittelheller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach oben (mittelheller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆🏼" title="Rückhand Zeigefinger nach oben (mittelheller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach oben (mittelheller Hautton)">

This strategy breaks with the traditional method, which says:

• diversify your investments across industries and pick options that are neither super risky nor super safe.

It looks smart and measured...but...

This strategy breaks with the traditional method, which says:

• diversify your investments across industries and pick options that are neither super risky nor super safe.

It looks smart and measured...but...

the traditional method has two problems:

1. You& #39;re not actually diversified. One thing in one industry can impact all others (think 2008).

2. You& #39;re not exposed to big returns.

In essence: you& #39;re picking up nickels in front of a steamroller.

1. You& #39;re not actually diversified. One thing in one industry can impact all others (think 2008).

2. You& #39;re not exposed to big returns.

In essence: you& #39;re picking up nickels in front of a steamroller.

You might bristle at this idea if you& #39;ve studied statistics.

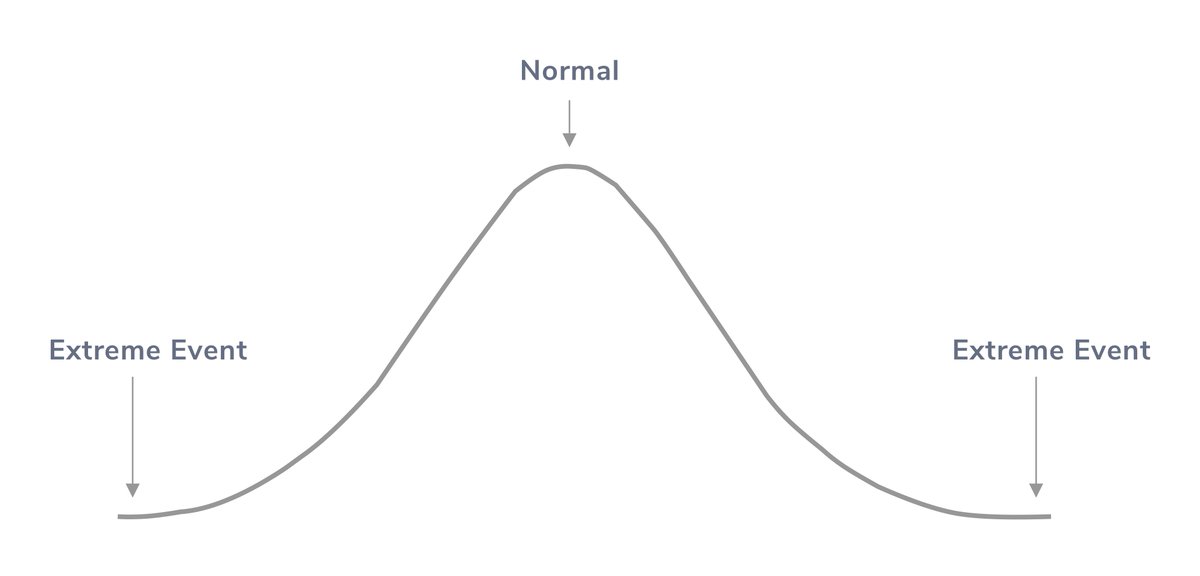

Statisticians teach that nearly everything is normally distributed. In other words, they follow a bell curve, which tend toward the average.

After extreme events, things regress toward the mean. They normalize.

Statisticians teach that nearly everything is normally distributed. In other words, they follow a bell curve, which tend toward the average.

After extreme events, things regress toward the mean. They normalize.

Let& #39;s use an example.

Imagine Steph Currie misses ten three-point shots in the first half of a basketball game.

Should you take him out?

No! His shooting is normally distributed. If you keep him in, he& #39;s likely to get hot hands and start knocking & #39;em down.

Imagine Steph Currie misses ten three-point shots in the first half of a basketball game.

Should you take him out?

No! His shooting is normally distributed. If you keep him in, he& #39;s likely to get hot hands and start knocking & #39;em down.

If global markets are normally distributed, then the next 20 year should be smooth sailing. They should normalize and regress toward the mean.

After all, we& #39;ve had three crashes since the turn of the century (2000, 2008, 2020)!

What an outlier!

After all, we& #39;ve had three crashes since the turn of the century (2000, 2008, 2020)!

What an outlier!

For many things, the bell curve is incredibly useful, but if you& #39;re not careful, it can infect your mind like a sickness.

Why?

1. Global markets are not normally distributed.

2. Impact matters more than probability in investing.

Why?

1. Global markets are not normally distributed.

2. Impact matters more than probability in investing.

First, global markets are not normally distributed.

In other words, they have "fat tails." Extreme events are unusually likely.

Technology & globalization turned our economy into a dynamic, complex system.

Small things ripple through the whole with outsized effects.

In other words, they have "fat tails." Extreme events are unusually likely.

Technology & globalization turned our economy into a dynamic, complex system.

Small things ripple through the whole with outsized effects.

Second, impact > probability.

Example. Say you invest everything in Apple. It& #39;s probably the best company to ever exist.

Relative to other stocks, you& #39;re unlikely to lose.

But *if* it goes belly up, you& #39;re broke.

It& #39;s over. You lost.

Don& #39;t pass go.

Don& #39;t collect $200.

Example. Say you invest everything in Apple. It& #39;s probably the best company to ever exist.

Relative to other stocks, you& #39;re unlikely to lose.

But *if* it goes belly up, you& #39;re broke.

It& #39;s over. You lost.

Don& #39;t pass go.

Don& #39;t collect $200.

Alright, so the traditional method has major problems, which Taleb designed the barbell strategy to overcome.

Now, what& #39;s next?

First, decide on the most risk-free investments possible.

Now, what& #39;s next?

First, decide on the most risk-free investments possible.

Cash is not an option because of inflation. Over time, the purchasing power of your money will melt like ice.

Taleb likes treasury bonds.

IMHO, the US will print so much money over the next 4-8 years that the returns from bonds won& #39;t be high enough to keep up with inflation.

Taleb likes treasury bonds.

IMHO, the US will print so much money over the next 4-8 years that the returns from bonds won& #39;t be high enough to keep up with inflation.

Probably, the safest bet is a 50/50 split between bonds and Bitcoin, which will increase in value with inflation.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷🏻♂️" title="Achselzuckender Mann (heller Hautton)" aria-label="Emoji: Achselzuckender Mann (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷🏻♂️" title="Achselzuckender Mann (heller Hautton)" aria-label="Emoji: Achselzuckender Mann (heller Hautton)">

So think about bonds. Think about Bitcoin.

Even better, think about both. Maybe throw in some land.

Get 90% of your portfolio into a safe haven.

So think about bonds. Think about Bitcoin.

Even better, think about both. Maybe throw in some land.

Get 90% of your portfolio into a safe haven.

Now comes the fun part.

Take 10% and get crazy. Find where you can 10x or 100x your money.

You can:

• angel invest

• day trade

• buy Tesla

• get some Dogecoin

• jump on Bitclout

• pump GME

Better yet, do it all! Do whatever you believe has a chance of going to the moon.

Take 10% and get crazy. Find where you can 10x or 100x your money.

You can:

• angel invest

• day trade

• buy Tesla

• get some Dogecoin

• jump on Bitclout

• pump GME

Better yet, do it all! Do whatever you believe has a chance of going to the moon.

You should design the safe 90% of your portfolio to *protect* you from the craziness of modern markets,

but the other 10% should be designed to *benefit* you from the craziness.

Remember, there& #39;s a winner and a loser on every trade.

Taleb wants you to lose small and win big.

but the other 10% should be designed to *benefit* you from the craziness.

Remember, there& #39;s a winner and a loser on every trade.

Taleb wants you to lose small and win big.

I hope you found this thread fun and helpful!

If so, jump to the top, smash that retweet button, and share with the world https://abs.twimg.com/emoji/v2/... draggable="false" alt="☺️" title="Lächelndes Gesicht" aria-label="Emoji: Lächelndes Gesicht"> https://twitter.com/james_d_baird/status/1381059204711116800?s=20">https://twitter.com/james_d_b...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="☺️" title="Lächelndes Gesicht" aria-label="Emoji: Lächelndes Gesicht"> https://twitter.com/james_d_baird/status/1381059204711116800?s=20">https://twitter.com/james_d_b...

If so, jump to the top, smash that retweet button, and share with the world

For those aghast at my Bitcoin suggestion, I understand.

If you want less volatility, size your position differently.

But you need a hedge against USD currency risk—and bonds don’t provide that. https://twitter.com/raydalio/status/1371887244643082247">https://twitter.com/raydalio/...

If you want less volatility, size your position differently.

But you need a hedge against USD currency risk—and bonds don’t provide that. https://twitter.com/raydalio/status/1371887244643082247">https://twitter.com/raydalio/...

Read on Twitter

Read on Twitter