Pandemic Saturday...time for S-1 club!

This week& #39;s entrant: @PriviaHealth

The prospectus draws some parallels to Oak & Agilon, but I read it more as a look under the hood of a traditional fee-for-service business, with a bit of (apparently successful) VBC layered on top. 1/n

This week& #39;s entrant: @PriviaHealth

The prospectus draws some parallels to Oak & Agilon, but I read it more as a look under the hood of a traditional fee-for-service business, with a bit of (apparently successful) VBC layered on top. 1/n

Privia dates to 2007, but the real push started in 2014, with a $400M investment round led by a Goldman Sachs vehicle (Brighton Health) and Pamplona Capital. They& #39;ve since expanded to 6 states and rolled up >2,500 "providers."*

*Defined in S-1 to incl MDs, DOs, NPs & PAs.

*Defined in S-1 to incl MDs, DOs, NPs & PAs.

Structurally, Privia owns some medical groups outright, where that is allowed under state law, and operates as a management services organization (MSO) in others, collecting admin fees and (it seems) operating some ACO vehicles in which those affiliated groups participate.

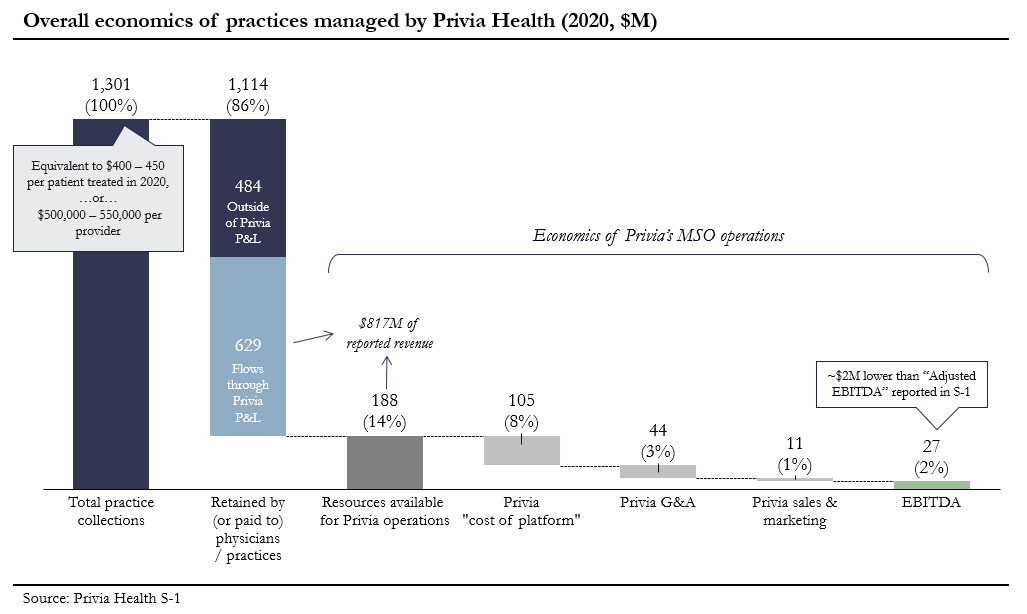

That introduces some fuzziness in the P&L, but the core picture, across all owned & affiliated groups, seems to be:

- 2,550 providers

- Roughly 3 million total patients

- $1.3 billion in aggregate practice collections/revenue

- $27 million of EBITDA for Privia

- 2,550 providers

- Roughly 3 million total patients

- $1.3 billion in aggregate practice collections/revenue

- $27 million of EBITDA for Privia

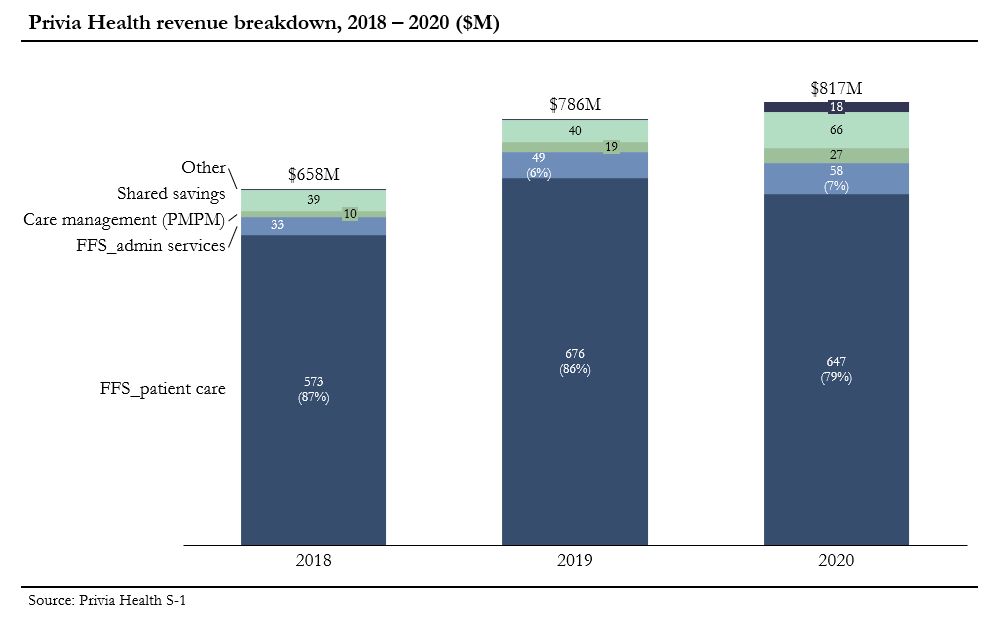

The business is 85 – 90% fee-for-service, with a bit of recurring PMPM revenue ($27M in 2020) and shared savings.

Most of the latter appears to come from Privia’s participation in the Medicare Shared Savings and CPC+ programs, plus some bonuses from commercial ACO programs.

Most of the latter appears to come from Privia’s participation in the Medicare Shared Savings and CPC+ programs, plus some bonuses from commercial ACO programs.

In general, this strikes me as likely a pretty typical picture for large-ish primary care groups, outside of the more focused value-based / total cost of care models operated by Oak, ChenMed or Cano Health.

The latter also means a tighter patient focus on patients 65+.

The latter also means a tighter patient focus on patients 65+.

Privia’s revenue mix shakes out to $500 – 550K per provider, of which $200 – 250K prob ends up as provider compensation.

As an aside, this doesn& #39;t exactly suggest that traditional medical groups are “struggling”

An SMB where 40-50% of revenue is left for principals/owners? https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Daumen hoch" aria-label="Emoji: Daumen hoch">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Daumen hoch" aria-label="Emoji: Daumen hoch"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Daumen hoch" aria-label="Emoji: Daumen hoch">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Daumen hoch" aria-label="Emoji: Daumen hoch">

As an aside, this doesn& #39;t exactly suggest that traditional medical groups are “struggling”

An SMB where 40-50% of revenue is left for principals/owners?

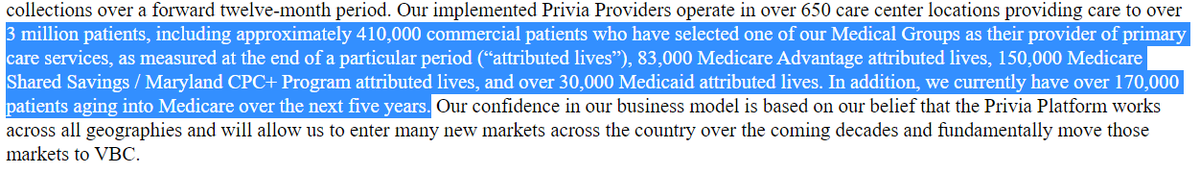

The patient panel deserves a deeper dive. In short, Privia says their providers treated ~3M total patients in 2020, with ~682K “attributed lives” (subset of the 3M).

Those attributed lives are ~61% commercial (presumably commercial HMO plans), ~35% Medicare and 4% Medicaid.

Those attributed lives are ~61% commercial (presumably commercial HMO plans), ~35% Medicare and 4% Medicaid.

In turn, the ~230K Medicare-eligible attributed lives are about 2/3 traditional Medicare enrollees & 1/3 Medicare Advantage.

Not too far off national averages, though the overall picture means that Privia has much less exposure to potential upside via MA or other TCOC models.

Not too far off national averages, though the overall picture means that Privia has much less exposure to potential upside via MA or other TCOC models.

Triangulating a bit, I& #39;d guess that Privia’s practices generate $300 – 400 annually per patient in FFS revenue (about half of One Medical’s revenue/mbr).

Then, Privia adds $100 – 150/patient for the quarter-ish of those patients who are attributed to a P4P contract of some sort.

Then, Privia adds $100 – 150/patient for the quarter-ish of those patients who are attributed to a P4P contract of some sort.

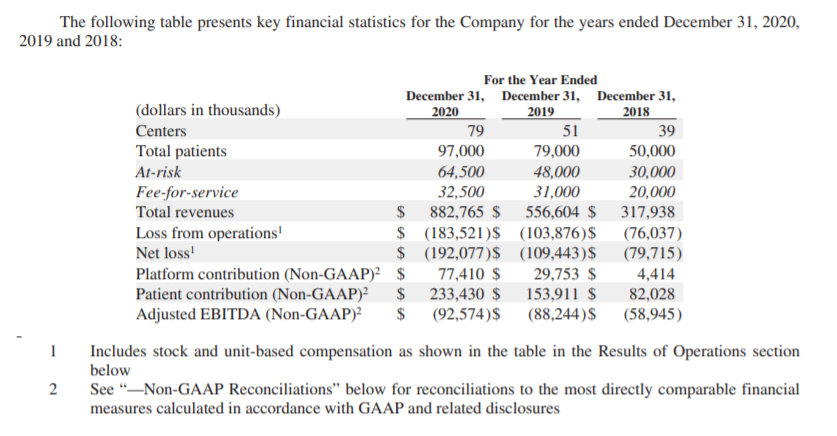

The growth picture is mixed. Attributed lives & practice collections both grew by ~22% in 2019, but lives then dipped by 3% in 2020. This contraction is not well explained in the S-1, apart from a mention that “attrib lives in…commercial value-based programs decreased by 13.7%”

For context, in any case, Oak and Agilon ( https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">) both saw revenue grow by >50% in 2020, while patients under management grew 22% and 45%, respectively.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">) both saw revenue grow by >50% in 2020, while patients under management grew 22% and 45%, respectively.

Privia& #39;s GAAP revenue was up just 4%, while the attributed patient panel shrank a bit.

Privia& #39;s GAAP revenue was up just 4%, while the attributed patient panel shrank a bit.

Pandemic disruptions may have dented revenue a bit (Privia’s FFS revenue from patient care was down by 4% YoY), but it may also just track the apparent loss of a block of commercial patients (or a commercial contract) at some point last year. Unclear.

Beyond that, I’d quibble with inflated TAM estimates (# of primary care physicians, a supposed *$1.9 trillion* mkt for “physician enablement,” etc), and the attempt to redefine EBITDA margins by first constructing a non-GAAP EBITDA measure and then dividing by gross profits. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Gesicht mit rollenden Augen" aria-label="Emoji: Gesicht mit rollenden Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Gesicht mit rollenden Augen" aria-label="Emoji: Gesicht mit rollenden Augen">

That said, I do think "clinician enablement" is a reasonable way to think about this market, even if Privia is over-egging the pudding.

Most of these tech-enabled care delivery orgs launched in 2013/14; the IPO/SPAC filings shed light on different distribution & revenue models.

Most of these tech-enabled care delivery orgs launched in 2013/14; the IPO/SPAC filings shed light on different distribution & revenue models.

Finally, an interesting bit here for virtual care-istas.

Privia traces the virtual curve starting at 0.3% of pre-COVID visits, then jumping to 45% of visits in April 2020, before settling at 15-20% by end of year, where they expect it to stay.

Necessity...invention etc. /n

Privia traces the virtual curve starting at 0.3% of pre-COVID visits, then jumping to 45% of visits in April 2020, before settling at 15-20% by end of year, where they expect it to stay.

Necessity...invention etc. /n

Read on Twitter

Read on Twitter

) both saw revenue grow by >50% in 2020, while patients under management grew 22% and 45%, respectively.Privia& #39;s GAAP revenue was up just 4%, while the attributed patient panel shrank a bit." title="For context, in any case, Oak and Agilon (https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">) both saw revenue grow by >50% in 2020, while patients under management grew 22% and 45%, respectively.Privia& #39;s GAAP revenue was up just 4%, while the attributed patient panel shrank a bit.">

) both saw revenue grow by >50% in 2020, while patients under management grew 22% and 45%, respectively.Privia& #39;s GAAP revenue was up just 4%, while the attributed patient panel shrank a bit." title="For context, in any case, Oak and Agilon (https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">) both saw revenue grow by >50% in 2020, while patients under management grew 22% and 45%, respectively.Privia& #39;s GAAP revenue was up just 4%, while the attributed patient panel shrank a bit.">

) both saw revenue grow by >50% in 2020, while patients under management grew 22% and 45%, respectively.Privia& #39;s GAAP revenue was up just 4%, while the attributed patient panel shrank a bit." title="For context, in any case, Oak and Agilon (https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">) both saw revenue grow by >50% in 2020, while patients under management grew 22% and 45%, respectively.Privia& #39;s GAAP revenue was up just 4%, while the attributed patient panel shrank a bit.">

) both saw revenue grow by >50% in 2020, while patients under management grew 22% and 45%, respectively.Privia& #39;s GAAP revenue was up just 4%, while the attributed patient panel shrank a bit." title="For context, in any case, Oak and Agilon (https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">) both saw revenue grow by >50% in 2020, while patients under management grew 22% and 45%, respectively.Privia& #39;s GAAP revenue was up just 4%, while the attributed patient panel shrank a bit.">