Yo. Let& #39;s talk about @LiquityProtocol, which launched Monday.

Get an interest-free loan up to 90% LTV by depositing $ETH and getting their stablecoin $LUSD.

Uhm, okay. Sounds insane. 10x leverage w/ no interest? pLuS sTAbLeCOin? Wen ape??

Get in. This one& #39;s complicated.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦧" title="Orang-Utan" aria-label="Emoji: Orang-Utan">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦧" title="Orang-Utan" aria-label="Emoji: Orang-Utan"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Get an interest-free loan up to 90% LTV by depositing $ETH and getting their stablecoin $LUSD.

Uhm, okay. Sounds insane. 10x leverage w/ no interest? pLuS sTAbLeCOin? Wen ape??

Get in. This one& #39;s complicated.

Tl;dr unlike @MakerDAO which relies on 3rd parties (Liquidators, Keepers) to maintain system solvency, @LiquityProtocol socializes $ETH tail risk to Stability Pool providers, passing the benefit to borrowers.

It& #39;s pennies in front of steamrollers, but the pennies sure are shiny.

It& #39;s pennies in front of steamrollers, but the pennies sure are shiny.

Let& #39;s jump straight to the shiniest headline: "interest-free."

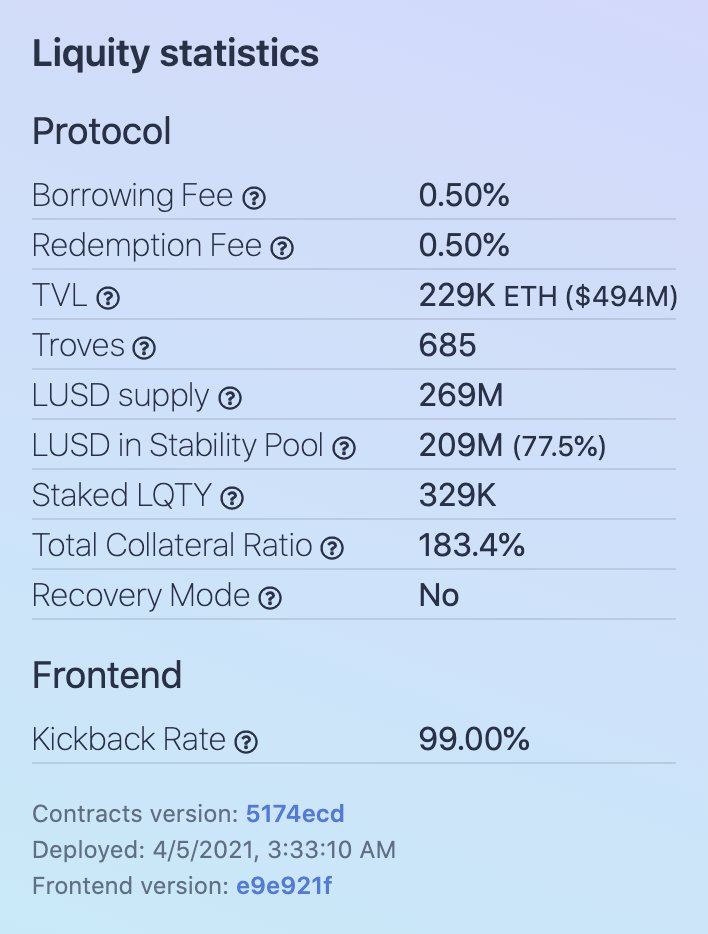

Here& #39;s the fine print: borrowers a fixed 0.5% loan origination fee to open a Liquity Trove (a loan, or collateralized debt position in @MakerDAO parlance).

Here& #39;s the fine print: borrowers a fixed 0.5% loan origination fee to open a Liquity Trove (a loan, or collateralized debt position in @MakerDAO parlance).

It& #39;s zero interest but not zero cost, and the origination fee imputes a rate:

Chad has to open a new Trove every month to cover his Lambo payments. APR: 12%.

Chadette opens a Trove and closes it after five years when $ETH is the global reserve currency. Her APR is 0.1%.

Chad has to open a new Trove every month to cover his Lambo payments. APR: 12%.

Chadette opens a Trove and closes it after five years when $ETH is the global reserve currency. Her APR is 0.1%.

Okay, what about that juicy 10x leverage (90% loan-to-value)?

Well you have to post and maintain 110% minimum collateral so it& #39;s actually 100/110 = 90.91%.

And you have to set aside a 200 $LUSD Liquidation Reserve to cover gas in case of liquidation.

Well you have to post and maintain 110% minimum collateral so it& #39;s actually 100/110 = 90.91%.

And you have to set aside a 200 $LUSD Liquidation Reserve to cover gas in case of liquidation.

Say you post $2,200 of collateral for a $2,000 loan, $200 of it goes to the Liquidation Reserve and you& #39;re charged 0.5% of origination on the remaining debt.

Functional LTV would therefore be $1,791/$2,200 = 81.4% or 5.38x. That& #39;s boomer shit.

So big loanz = moar leverage.

Functional LTV would therefore be $1,791/$2,200 = 81.4% or 5.38x. That& #39;s boomer shit.

So big loanz = moar leverage.

You can see all the fine print when you open your loan

on one of many 3rd party front-ends. Did I mention the protocol has no front-end??

It not only makes Liquity more censorship resistant but conveniently lets them outsource the risk and burden of KYC/AML.

on one of many 3rd party front-ends. Did I mention the protocol has no front-end??

It not only makes Liquity more censorship resistant but conveniently lets them outsource the risk and burden of KYC/AML.

Risky Troves are liquidated once their collateralization ratio falls below 110%.

$LUSD is burned from the Stability Pool to offset the Trove& #39;s liability (debt outstanding), and $ETH collateral from the liquidated Trove is distributed to pool participants pro-rata.

$LUSD is burned from the Stability Pool to offset the Trove& #39;s liability (debt outstanding), and $ETH collateral from the liquidated Trove is distributed to pool participants pro-rata.

The Stabilit Pool is always willing to buy collateral, which facilitates instant liquidations. Two big implications:

a) The Stability Pool has high certainty of getting >$1 of $ETH for every $1 of $LUSD from liquidations

a) The Stability Pool has high certainty of getting >$1 of $ETH for every $1 of $LUSD from liquidations

b) Minimum collateralization can be low (110%), as collateral is guaranteed to be sold to the Stability Pool.

Up to 90 troves can be liquidated in a single block, further reducing the risk of undercollateralized Troves.

Up to 90 troves can be liquidated in a single block, further reducing the risk of undercollateralized Troves.

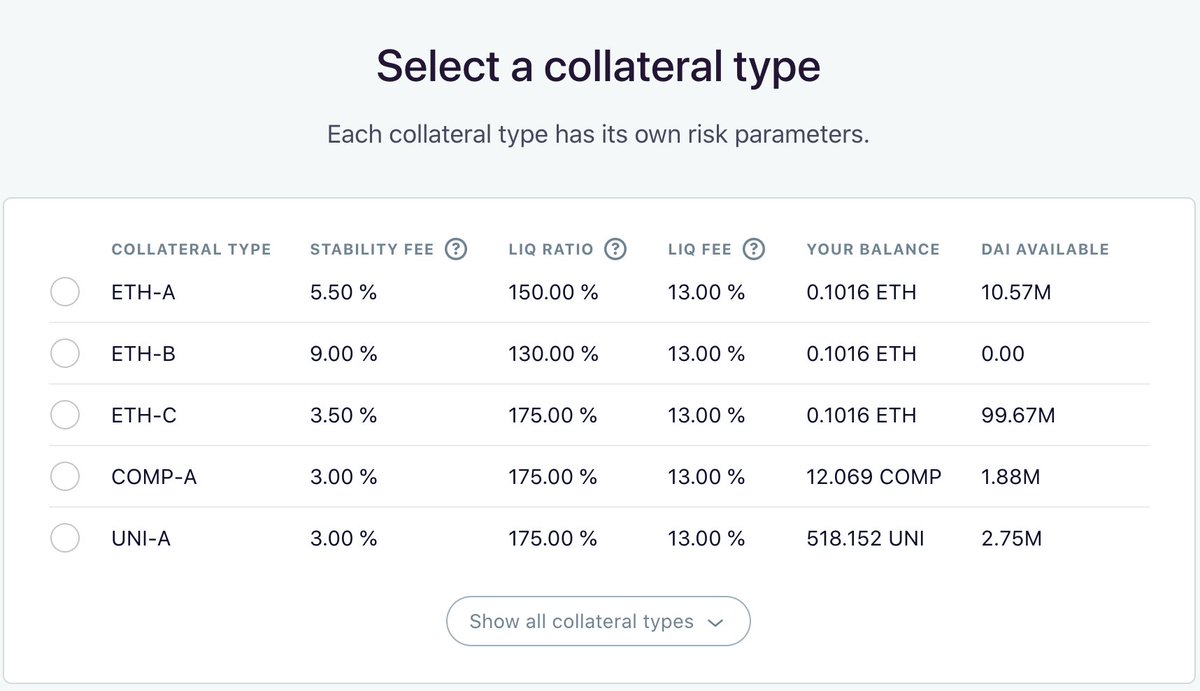

Compare this to @MakerDAO and @AaveAave who run liquidation auctions, selling collateral to Liquidators at steep discounts.

Because there& #39;s no guaranteed buyer, collateral requirements are often 150%+ to incentivized Liquidators with fat discounts.

Because there& #39;s no guaranteed buyer, collateral requirements are often 150%+ to incentivized Liquidators with fat discounts.

Rather than individual Liquidators weighing the risk of buying falling-knife collateral at a discount, the Stability Pool collectively agrees to absorb price risk.

Sound like something? Something something pooling risk?

Yeah. Insurance.

Sound like something? Something something pooling risk?

Yeah. Insurance.

Liquidations of the riskiest Troves improves the overall collateralization ratio, making the system more robust.

And in a scenario where total system collateral falls below 150%, the protocol activates Recovery Mode, liquidating all troves <150%.

Don& #39;t get caught here!

And in a scenario where total system collateral falls below 150%, the protocol activates Recovery Mode, liquidating all troves <150%.

Don& #39;t get caught here!

The Recovery Mode threat is a strong incentive for borrowers to maintain collateral >150%.

<150% Troves are double-risky.

They are not only at risk of liquidation in Recovery Mode, the very act of opening a <150% Trove makes Recovery Mode more likely.

<150% Troves are double-risky.

They are not only at risk of liquidation in Recovery Mode, the very act of opening a <150% Trove makes Recovery Mode more likely.

So wtf should I borrow??

@LiquityProtocol offers a startlingly good deal if you want an up-only bet on $ETH.

Maintaining 150%+ collateral & keeping an eye on system health means you& #39;re only exposed in a -27% $ETH drawdown (150% --> 110%) + if $ETH rises, you de-lever.

@LiquityProtocol offers a startlingly good deal if you want an up-only bet on $ETH.

Maintaining 150%+ collateral & keeping an eye on system health means you& #39;re only exposed in a -27% $ETH drawdown (150% --> 110%) + if $ETH rises, you de-lever.

But while liquidation *cascades* are unlikely, borrowers can quickly get caught unaware if $ETH plummets, system collateralization falls <150%, Recovery Mode activates, and mass liquidations occur.

Go fuck around on the dev site frontend:

https://devui.liquity.org/#/ ">https://devui.liquity.org/...

Go fuck around on the dev site frontend:

https://devui.liquity.org/#/ ">https://devui.liquity.org/...

Next time we& #39;ll talk about the monetary system, how $LUSD maintains peg, the risks of depositing $LUSD in a Stability Pool to earn $LQTY, whether to buy $LQTY outright, and why $LQTY has fundamental value.

As always I stand on the shoulders of giants. Thanks to

@DerrickN_

@0xGav

@PhABCD

@gauntletnetwork

for helpful content & the @LiquityProtocol team& #39;s own documentation.

@DerrickN_

@0xGav

@PhABCD

@gauntletnetwork

for helpful content & the @LiquityProtocol team& #39;s own documentation.

Read on Twitter

Read on Twitter