Okay, I& #39;m gonna compile some criticisms I and others have had of @UnlearnEcon& #39;s treatment of Diamond, and also talk about the ways in which I think his response to some of those criticisms fails.

Firstly, the video:

https://youtu.be/4epQSbu2gYQ

and">https://youtu.be/4epQSbu2g... the Diamond paper:

https://pubs.aeaweb.org/doi/pdfplus/10.1257/aer.20181289">https://pubs.aeaweb.org/doi/pdfpl...

https://youtu.be/4epQSbu2gYQ

and">https://youtu.be/4epQSbu2g... the Diamond paper:

https://pubs.aeaweb.org/doi/pdfplus/10.1257/aer.20181289">https://pubs.aeaweb.org/doi/pdfpl...

Firstly, in the video while this image is on the screen he claims that "The paper claims that the policy led to a 15% reduction in rental units, although if you unpack this it& #39;s actually 8% being converted into owner occupied buildings, with a further 7% being converted...

into rental units which were exempt from rent control, which isn& #39;t a 15% reduction in rental units...."

But that& #39;s *not* what the paper claims. The refutation is on the screen while he& #39;s talking!

But that& #39;s *not* what the paper claims. The refutation is on the screen while he& #39;s talking!

It& #39;s also in the abstract! The paper *doesn& #39;t* claim a 15% reduction in the total rental stock, it claims that those who had properties under rent control reduced their housing stock in that category by 15%, by either taking it off the rental market entirely to demolish and...

convert into owner-occupied housing or developing the property to exempt it from the rent control category.

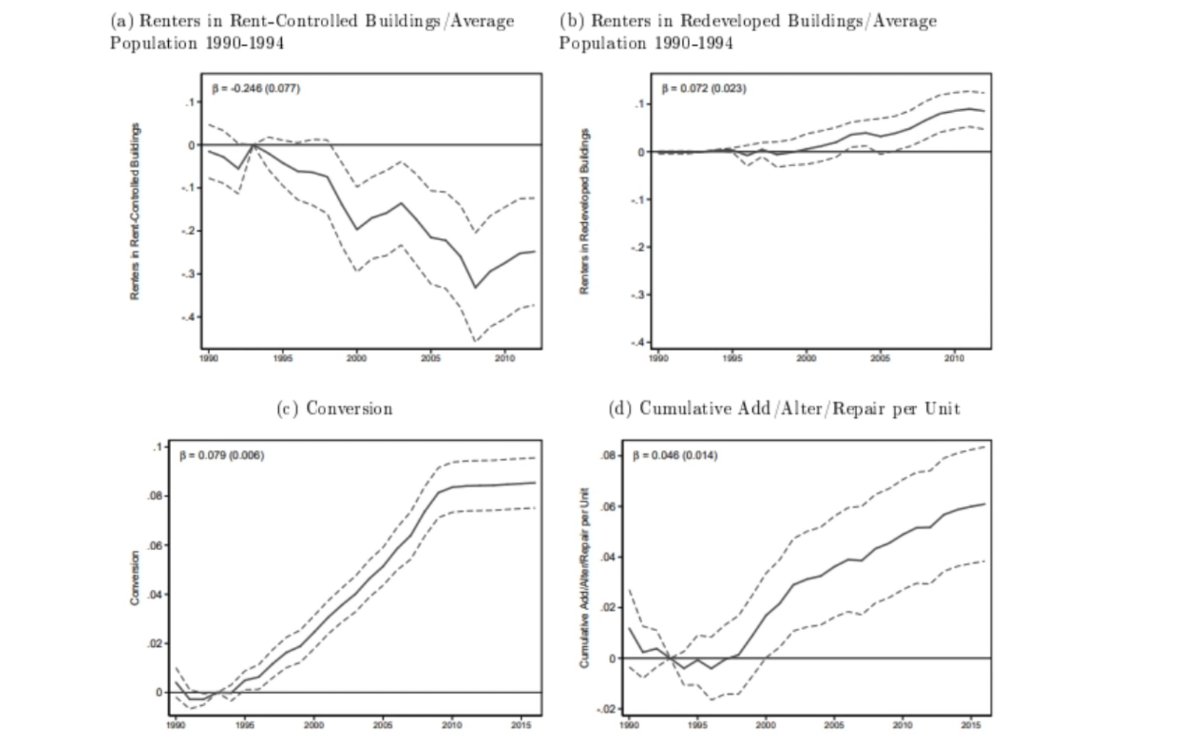

Others have had different criticisms, namely when he has these plots on the screen. He& #39;s responded to these (and I& #39;ll respond to his response), but I& #39;ll lay them out here:

Of the top left plot, he says that we can see "rent has fallen", but look at the title of the plot, it& #39;s talking about the proportion of *renters* who live in rent controlled buildings. He& #39;s admitted this one was a mistake.

Of the other plots, he says that this rising proportion of renters in redeveloped buildings, rising conversions to owner-occupied dociles, and rising alterations/repairs per unit suggests that "rent control does increase quality, in contrast with [what economists think]"

Others have pointed out that these is misleading at best, because what the paper is *actually* saying is that under of specifics of the SF law they& #39;re looking at, landlords converted or developed their buildings to *exempt them from rent control*.

The "econ 101" picture is that landlords under rent control will have a reduced incentive to repair/upgrade their units because they won& #39;t be able to reap any additional profits later for those repairs. The assumption when saying that is that they can& #39;t escape rent control.

But sometimes cities craft policies such that developing can remove the property from the rent controlled category. This is not the scenario in which the "econ 101" (read: perfect competition model) is talking about when it says that rent control will reduce quality.

The perfect competition model says that this quality reduction will occur *among rent controlled units.* It is entirely consistent with the idea that if landlords can take their units out of rent control, they will (if the associated costs aren& #39;t too high).

Others have also critiqued his treatment of the paper& #39;s discussion about inequality, saying that his analysis of it is surface level, and when you read what he quotes it& #39;s evident that the paper is talking about how the poor residents will be priced out in the long term.

And that in a rent-controlled environment, eventually it will be *only* the rich residents who can afford to live in the area, as the lower-income residents get priced out by rises in non-housing related costs and landlord pressure.

He& #39;s responded to some of these criticisms, specifically the ones about that set of four plots. He admits a verbal slip up on the rent v. renters (top left) plot, but his responses to the others are inadequate, in my opinion. https://twitter.com/UnlearnEcon/status/1380821714200891396">https://twitter.com/UnlearnEc...

The second paragraph I& #39;ve already addressed, which is that the caveat that& #39;s allowing this is the way the SF law is crafted. Ceteris paribus, the perfect competition model tells you rent control does decrease the quality *of the rent controlled units*.

In the last two paragraphs of his response he seems to simply point out that there is some subset of people who benefit from the rent control policy by not being priced out, but "econ 101" agrees with him here! No one would dispute this.

The perfect competition model doesn& #39;t say there won& #39;t be some people who benefit, it says that on the whole a rent controlled market will Pareto inefficient, meaning that some people have been made better off by making others (even more) worse off.

Sometimes making that tradeoff can be worth it! Sometimes its worth it to take hits in efficiency to produce a more equitable outcome, but the point is that the literature suggests the hits you have to take to do this with rent control are really high.

Read on Twitter

Read on Twitter