Here’s the story of how I (almost) lost everything building and selling my last company Islands to WeWork

I’ve never told this story publicly. Sharing it on Twitter because sharing is caring

Here we go…...

I’ve never told this story publicly. Sharing it on Twitter because sharing is caring

Here we go…...

In June 2016, I was having tea in SF and realized “group chat is the new social network”

My thinking: everything would be verticalized

You’d have group chats around finance, around gaming, around work etc.

People want fluid, spontaneous communities/groups, not newsfeeds

My thinking: everything would be verticalized

You’d have group chats around finance, around gaming, around work etc.

People want fluid, spontaneous communities/groups, not newsfeeds

I had previously sold a company. I created a short slide pitch deck

I raised $2m from some of the world’s best investors on an idea. From first pitch to money in the bank in 45 days

We had no product. No prototype. No users. Just a crazy idea

I raised $2m from some of the world’s best investors on an idea. From first pitch to money in the bank in 45 days

We had no product. No prototype. No users. Just a crazy idea

SF is sometimes magical like that. It was a privilege

We were off to the races

We were off to the races

We built the product. We decided to focus on colleges

The idea: open up Islands on your campus, see group chats around you, form communities and create relationships

It was like Slack for communities. Focused on college

The idea: open up Islands on your campus, see group chats around you, form communities and create relationships

It was like Slack for communities. Focused on college

We beta launched at 1 school: University of Western Ontario (Canadian school)

Why?

- If you screw up in Canada, no one pays attention

- If you screw up at NYU, everyone pays attention

Tip: places like New Zealand, Canada, Australia are great places to launch your app

Why?

- If you screw up in Canada, no one pays attention

- If you screw up at NYU, everyone pays attention

Tip: places like New Zealand, Canada, Australia are great places to launch your app

We started scaling colleges

Hundreds of thousands of messages were flowing through the Islands systems

But retention sucked. Most people weren’t sticking around

Note: if people aren’t sticking around, you’re dead in the water

Hundreds of thousands of messages were flowing through the Islands systems

But retention sucked. Most people weren’t sticking around

Note: if people aren’t sticking around, you’re dead in the water

Mashable said we were taking over college campuses!

Axios said we were the next Facebook!

Marc Andreessen told me he loved our progress. He was a role model of mine. Validation!

Realistically: we had blown through $1.5m and we were scrambling to get to product/market fit

Axios said we were the next Facebook!

Marc Andreessen told me he loved our progress. He was a role model of mine. Validation!

Realistically: we had blown through $1.5m and we were scrambling to get to product/market fit

Most of the colleges we were live at were in the South of the US

Alabama. Mississippi. Georgia.

I had to get out of SF. The only way to zig-zag to product/market fit is to understand your community

I was 28. I went “back to college” and spent 9 months of my life in Alabama

Alabama. Mississippi. Georgia.

I had to get out of SF. The only way to zig-zag to product/market fit is to understand your community

I was 28. I went “back to college” and spent 9 months of my life in Alabama

I think it was Inc Magazine that called me “when 21 Jump Street meets Silicon Valley”

Damn. I had to do it. Sometimes you have to do crazy things to make your startup succeed.

Cost of doing startup business

Goodbye California.

Damn. I had to do it. Sometimes you have to do crazy things to make your startup succeed.

Cost of doing startup business

Goodbye California.

We iterated on the product. Adding features. Removing features. Adding. Removing.

We obsessed over onboarding, viral loops, copy. That stuff matters

These details make or break products

We obsessed over onboarding, viral loops, copy. That stuff matters

These details make or break products

FINALLY! We did it

We got retention in a place that it was higher than products like Twitter

Community-based product design works. I’ll die on that cross

Islands started to work! Now it’s time to go raise VC to scale this baby

We got retention in a place that it was higher than products like Twitter

Community-based product design works. I’ll die on that cross

Islands started to work! Now it’s time to go raise VC to scale this baby

Picture this.

It’s 2018. It a social media winter

No one wanted to fund social apps. People are into AI, IoT and VR

The narrative was: Facebook was just going to copy you. Just give up

Ouch.

It’s 2018. It a social media winter

No one wanted to fund social apps. People are into AI, IoT and VR

The narrative was: Facebook was just going to copy you. Just give up

Ouch.

Buuuut we had a product that was WORKING

Our metrics were 2x what some top Series A firms told me they needed to see in order to lead the round in 2016

Retention was high. Growth was good. The average user invited 2+ people

I had to raise this Series A...

Our metrics were 2x what some top Series A firms told me they needed to see in order to lead the round in 2016

Retention was high. Growth was good. The average user invited 2+ people

I had to raise this Series A...

Despite the social winter. VCs listened to me

I pitched EVERYONE. Partners meetings at almost every major fund. I pitched about 100 VCs

I pitched EVERYONE. Partners meetings at almost every major fund. I pitched about 100 VCs

Yet, no checks came in. I couldn’t get the money I needed

I wanted to “go big or go home”

That’s why you start a social app. That’s why you move to Silicon Valley

It was time to go home...

I wanted to “go big or go home”

That’s why you start a social app. That’s why you move to Silicon Valley

It was time to go home...

So, we decided we should sell the company

In Dec 2018, we found a massive internet company that wanted to buy us

We met their leadership team. They loved us and were excited about the partnership

In Dec 2018, we found a massive internet company that wanted to buy us

We met their leadership team. They loved us and were excited about the partnership

WE DID IT!

We’re going to make internet history! Woo hoo!

Champagne glasses cheersing https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍾" title="Flasche mit knallendem Korken" aria-label="Emoji: Flasche mit knallendem Korken">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍾" title="Flasche mit knallendem Korken" aria-label="Emoji: Flasche mit knallendem Korken"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥂" title="Anstoßende Gläser" aria-label="Emoji: Anstoßende Gläser">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥂" title="Anstoßende Gläser" aria-label="Emoji: Anstoßende Gläser">

I’m picturing the news headlines now…

Can you blame me?

Until I get this call that would change my life a few weeks later...

We’re going to make internet history! Woo hoo!

Champagne glasses cheersing

I’m picturing the news headlines now…

Can you blame me?

Until I get this call that would change my life a few weeks later...

I get a call on Christmas eve. It was one of their execs

The deal is off. They decided they’d just build their community feature internally

DAMN! We were banking on this

Our bank account was almost zero.

The deal is off. They decided they’d just build their community feature internally

DAMN! We were banking on this

Our bank account was almost zero.

I had to regroup. Greg this is going to work out. We’ll find someone else

I had to personally fund the business until we figure this out

Merry Christmas to me https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Lächelndes Gesicht mit offenem Mund und Angstschweiß" aria-label="Emoji: Lächelndes Gesicht mit offenem Mund und Angstschweiß">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Lächelndes Gesicht mit offenem Mund und Angstschweiß" aria-label="Emoji: Lächelndes Gesicht mit offenem Mund und Angstschweiß">

I had to personally fund the business until we figure this out

Merry Christmas to me

Head up, I find my way in the door of any company (tech or not) interested in community

We started to get offers

Meanwhile, my bank account continued to dwindle...

We started to get offers

Meanwhile, my bank account continued to dwindle...

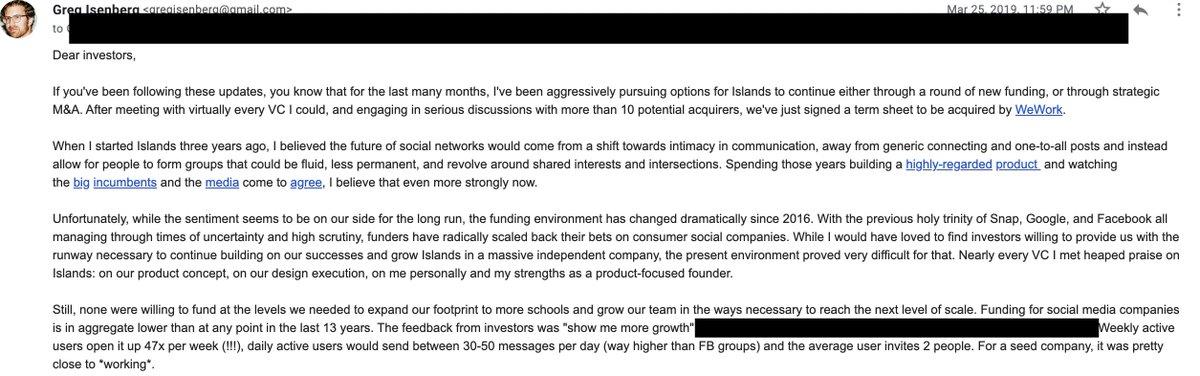

A few months later. We finally sell the company

It’s WeWork. We’re excited about the partnership. I’m excited about the new chapter

Here& #39;s my final investor update. Please read

It’s WeWork. We’re excited about the partnership. I’m excited about the new chapter

Here& #39;s my final investor update. Please read

I learned a lot from this rollercoaster

Key takeaways coming up:

Key takeaways coming up:

1. If you’re a VC-backed business, and you’re space isn’t hot anymore, funding becomes 100x harder

Trends come and go. So be sure to do everything in your power to NOT be dependent on venture capital

Avoid dependency

Trends come and go. So be sure to do everything in your power to NOT be dependent on venture capital

Avoid dependency

2. The M&A process sucks

It’s a difficult process. Takes a toll on you

Key: optimize for multiple offers, not for price

It’s a difficult process. Takes a toll on you

Key: optimize for multiple offers, not for price

3. Startups rewire your brain

I’ll never be the same after this experience

Startups are as much as a business endeavor as a personal endeavor

It was an incredible experience

I’ll never be the same after this experience

Startups are as much as a business endeavor as a personal endeavor

It was an incredible experience

4. The secret to win the game against billion dollar competition: invent and play another game

The product features that made us stand out versus competition were the unique features

A good exercise: what’s the roadmap for the anti-Spotify, the anti-Instagram, the anti-Amazon

The product features that made us stand out versus competition were the unique features

A good exercise: what’s the roadmap for the anti-Spotify, the anti-Instagram, the anti-Amazon

5. Mental health is wealth

I had so much support from good friends, family and had my own rituals like going to the Russian bath house to take steams/saunas to clear my mind

Do whatever you can to make sure you’re mentally well during these times

I had so much support from good friends, family and had my own rituals like going to the Russian bath house to take steams/saunas to clear my mind

Do whatever you can to make sure you’re mentally well during these times

6. Be thankful for your team

My team kept a smile on my face during the good and the bad

Thank you to every member of the Islands team and special shoutout to my CTO @edeng. He gave me a roof above my head when things were rough

(well, it was an attic, but thats another story)

My team kept a smile on my face during the good and the bad

Thank you to every member of the Islands team and special shoutout to my CTO @edeng. He gave me a roof above my head when things were rough

(well, it was an attic, but thats another story)

The end.

Follow me on Twitter @gregisenberg for more threads like this

If you liked this thread, I’d love a follow

Follow me on Twitter @gregisenberg for more threads like this

If you liked this thread, I’d love a follow

For more detailed insights on startups and community based companies, you should probably sign up to my newsletter here http://latecheckout.substack.com"> http://latecheckout.substack.com

And most importantly... if you want to invest in the future of community based companies, invest alongside me with my new Rolling Fund (must be accredited)

https://angel.co/v/back/late-checkout-fund

Be">https://angel.co/v/back/la... on the right side of history ;)

https://angel.co/v/back/late-checkout-fund

Be">https://angel.co/v/back/la... on the right side of history ;)

Read on Twitter

Read on Twitter