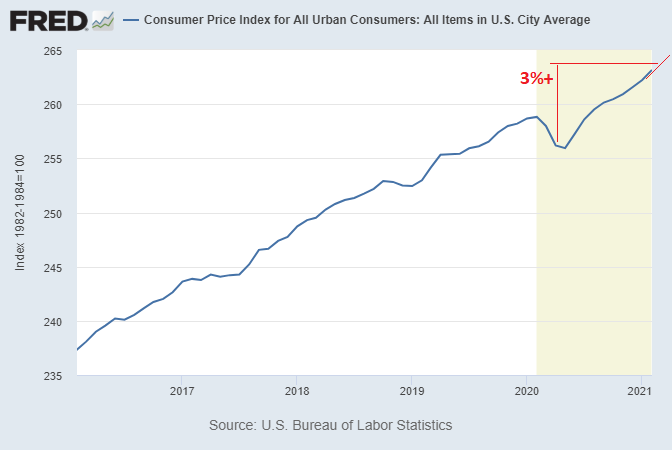

In April and May, there will be various easy comps from low base effects that will make some year-over-year numbers look quite high.

Official CPI for example is likely to hit over 3% year over year:

Official CPI for example is likely to hit over 3% year over year:

The producer price index for March is already over 4% year-over-year, and could very well hit over 7% in April or May thanks to low base effects and fiscal-driven reflation:

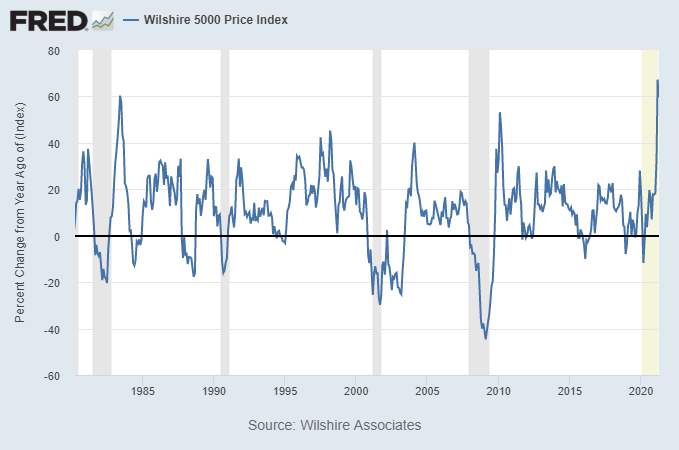

These unusual base effects already occurred for March 2020 vs March 2021 for asset prices, since asset prices bottomed before economic indicators.

For example, the Wilshire 5000 had its best year-over-year increase ever:

For example, the Wilshire 5000 had its best year-over-year increase ever:

This holds true for all sorts of Q2 2020 vs Q2 2021 economic indicators, including GDP, corporate earnings, consumer spending, etc.

The easy comp base effects will result in some modern record year-over-year figures.

The easy comp base effects will result in some modern record year-over-year figures.

There was a good article about these base effects in the WSJ yesterday by @jasonzweigwsj

It’ll be important in this period to look at month-over-month or multi-year changes for various economic indicators, not just YoY. https://www.wsj.com/articles/dont-be-fooled-by-the-stock-markets-newest-magic-trick-that-changed-one-year-returns-11617976919?mod=hp_lead_pos10">https://www.wsj.com/articles/...

It’ll be important in this period to look at month-over-month or multi-year changes for various economic indicators, not just YoY. https://www.wsj.com/articles/dont-be-fooled-by-the-stock-markets-newest-magic-trick-that-changed-one-year-returns-11617976919?mod=hp_lead_pos10">https://www.wsj.com/articles/...

Deflationists will argue that these inflationary effects are transient.

Inflationists will hype up the importance of these late-spring YoY headline numbers.

The truth will likely be somewhere between, and it won’t be until later this summer that data will be more instructive.

Inflationists will hype up the importance of these late-spring YoY headline numbers.

The truth will likely be somewhere between, and it won’t be until later this summer that data will be more instructive.

Due to growth in M2 and a change in political will for fiscal spending, I do think inflationary impacts could be relatively persistent after these easy base effect comps.

However, it& #39;s important to separate the base effect comps from the potentially more persistent outcomes.

However, it& #39;s important to separate the base effect comps from the potentially more persistent outcomes.

Read on Twitter

Read on Twitter