1/ (of 15)

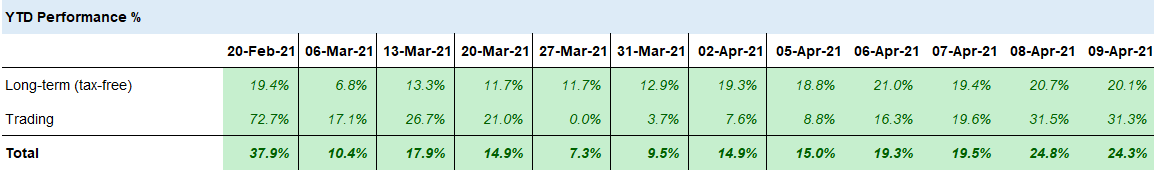

PERFORMANCE UPDATE – 9th Apr 2021

YTD: 24.3%....of which Long-term +20.1% & Trading +31.3%

Note:

A/ These are static results; not time-wgtd (TWR). Waiting on data from my trading platform to calculate TWR. Aiming to show perf in a more intuitive manner in the future.

PERFORMANCE UPDATE – 9th Apr 2021

YTD: 24.3%....of which Long-term +20.1% & Trading +31.3%

Note:

A/ These are static results; not time-wgtd (TWR). Waiting on data from my trading platform to calculate TWR. Aiming to show perf in a more intuitive manner in the future.

2/

B/The results are net of FX costs. As a UK based investor, my perf is in GBP while my investments are in USD, EUR & GBP (some DKK).

C/Noticed an error for last week’s performance which was corrected…

B/The results are net of FX costs. As a UK based investor, my perf is in GBP while my investments are in USD, EUR & GBP (some DKK).

C/Noticed an error for last week’s performance which was corrected…

3/

..My portfolios are spread across 4 different accounts/platforms – this is why I calculate perf on excel – although updated automatically by Bloomberg using Bid-prices.

Is there a system that gives granularity on performance? Tried ShareSight, but anything better out there?

..My portfolios are spread across 4 different accounts/platforms – this is why I calculate perf on excel – although updated automatically by Bloomberg using Bid-prices.

Is there a system that gives granularity on performance? Tried ShareSight, but anything better out there?

4/

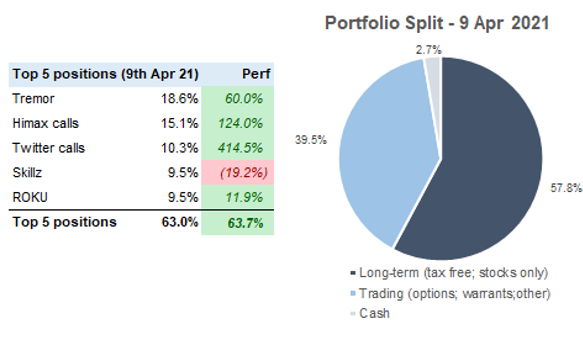

Top 5 positions = 63% allocation. Currently sitting at +63.7% profit (against cost).

The biggest contributors to this week’s PnL were $HIMX & $TWTR calls, $ROKU and $PINS.

Top 5 positions = 63% allocation. Currently sitting at +63.7% profit (against cost).

The biggest contributors to this week’s PnL were $HIMX & $TWTR calls, $ROKU and $PINS.

5/

$HIMX – impressive prelims & I’m certain results will impress even more. There’s a lot more to give here & see FV at $20-$25 area & possibly closer to $30 once FY21 out-perf is taken into account.

$TWTR, $ROKU, $PINS – just back on the uptrend after the market-led decline.

$HIMX – impressive prelims & I’m certain results will impress even more. There’s a lot more to give here & see FV at $20-$25 area & possibly closer to $30 once FY21 out-perf is taken into account.

$TWTR, $ROKU, $PINS – just back on the uptrend after the market-led decline.

6/

I’m still running c30% down on my pre-deal SPAC warrants ($CCAC, $CRHC and spare change in $GOAC), with only $HZON being positive @ +13.2%.

No doubt good quality SPACs will come back, but my exposure to pre-deal SPACs remain limited at 6.2% of portfolio (ex $HZON).

I’m still running c30% down on my pre-deal SPAC warrants ($CCAC, $CRHC and spare change in $GOAC), with only $HZON being positive @ +13.2%.

No doubt good quality SPACs will come back, but my exposure to pre-deal SPACs remain limited at 6.2% of portfolio (ex $HZON).

7/

Although I repositioned the portfolio just last week to take a bit more risk in underappreciated / misunderstood opportunities, I must admit I have been thinking of the best time to de-risk.

Although I repositioned the portfolio just last week to take a bit more risk in underappreciated / misunderstood opportunities, I must admit I have been thinking of the best time to de-risk.

8/

This year is going to be a choppy ride and investors have to be prepared to ride out the volatility as it presents time and time again.

In the near term, this will continue to be driven by worries surrounding inflation & rate rises.

This year is going to be a choppy ride and investors have to be prepared to ride out the volatility as it presents time and time again.

In the near term, this will continue to be driven by worries surrounding inflation & rate rises.

9/

We saw this just a month ago & IMHO this will resurface when data clearly shows rising inflation.

I maintain that the inflation rise will be short-lived & ‘transitory’ as the economies adjust to reopenings – but unfort US will be the one of the 1st DM economies to show this.

We saw this just a month ago & IMHO this will resurface when data clearly shows rising inflation.

I maintain that the inflation rise will be short-lived & ‘transitory’ as the economies adjust to reopenings – but unfort US will be the one of the 1st DM economies to show this.

10/

There are many ways to ride this out. Some may wish to ignore as they invest for the longer-term.

No doubt – for individual investors, this is certainly the right approach.

There are many ways to ride this out. Some may wish to ignore as they invest for the longer-term.

No doubt – for individual investors, this is certainly the right approach.

11/

However, “alpha” generation for professional investors, on which we are judged, does not just involve picking the right stocks but also on timing.

It involves being able to see through the market and profit from movements, while picking the right stocks.

However, “alpha” generation for professional investors, on which we are judged, does not just involve picking the right stocks but also on timing.

It involves being able to see through the market and profit from movements, while picking the right stocks.

12/

Some read into this a bit too much and try to day-trade. To be clear, I do not day-trade.

Any repositioning I do is based solely on my read of macro impact on market sentiment/technicals - I will just be waiting for a better entry point.

Some read into this a bit too much and try to day-trade. To be clear, I do not day-trade.

Any repositioning I do is based solely on my read of macro impact on market sentiment/technicals - I will just be waiting for a better entry point.

13/

I’m not quite there yet but hope to give my followers a weekly update on where I stand.

For now, I’m considering a partial portfolio liquidation between end-Apr to mid-May.

I’m not quite there yet but hope to give my followers a weekly update on where I stand.

For now, I’m considering a partial portfolio liquidation between end-Apr to mid-May.

14/

I will not sell everything – and will maintain my deep conviction names unless ofc they rally significantly by then ($TRMR, $SKLZ, $HIMX Jan’22 calls).

Everything else is potentially on the chopping board..but need to think carefully on which to maintain and which to cut.

I will not sell everything – and will maintain my deep conviction names unless ofc they rally significantly by then ($TRMR, $SKLZ, $HIMX Jan’22 calls).

Everything else is potentially on the chopping board..but need to think carefully on which to maintain and which to cut.

15/

The decision to cut does not necessarily mean low conviction, but rather potential for better entry point.

Will keep my followers updated on this.

That’s it – have a good weekend folks.

The decision to cut does not necessarily mean low conviction, but rather potential for better entry point.

Will keep my followers updated on this.

That’s it – have a good weekend folks.

Read on Twitter

Read on Twitter