Been looking at my historical chats and emails to understand how I thought about #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">.

https://abs.twimg.com/hashflags... draggable="false" alt="">.

I think it’s a great way to adjust mental models for the future.

I think it’s a great way to adjust mental models for the future.

1/ In a 2011 chat, someone said they’re buying $5k worth of bitcoins (when it was $30 per bitcoin).

I told them I think it’s a bubble :)

I told them I think it’s a bubble :)

2/ As per the emails, I and friends were pretty excited about it in 2013.

Understood the technology properly.

We were even cooking up ideas to make bitcoin transactions simple, like a PayPal for bitcoins.

But at $600 per bitcoin, I decided it was overhyped.

Understood the technology properly.

We were even cooking up ideas to make bitcoin transactions simple, like a PayPal for bitcoins.

But at $600 per bitcoin, I decided it was overhyped.

3/ Multiple times opportunity arose and I passed up because I believed that even though the technology was really beautiful, the value was hard to pin down and hence at all prices, it seems over-valued.

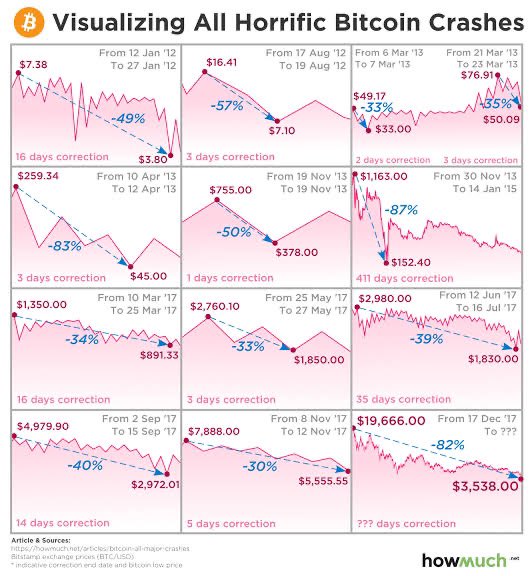

4/ I think the massive (90% or more) crashes in price eventually hardened the skepticism and I stopped paying attention.

5/ My conclusion is that it’s easy to know something is breakthrough but what’s harder is:

- to know how big it’s going to

- whether that potential is already priced in today in the valuation

I knew bitcoin was big but not whether at $30/bitcoin, it justified itself.

- to know how big it’s going to

- whether that potential is already priced in today in the valuation

I knew bitcoin was big but not whether at $30/bitcoin, it justified itself.

6/ My engineer’s point of view was sharp but investor’s point of view was blunt.

(Another evidence of it is that at parent’s insistence, I had bought real estate, something I now know to be a stupid investment decision)

(Another evidence of it is that at parent’s insistence, I had bought real estate, something I now know to be a stupid investment decision)

7/ What’s my current view?

I’m agnostic to whether bitcoin overvalued or undervalued because I haven’t done enough analysis.

My main concern for it is in its contribution to carbon emissions, something that’s counter acted by it’s benefit to people in oppressed nations.

I’m agnostic to whether bitcoin overvalued or undervalued because I haven’t done enough analysis.

My main concern for it is in its contribution to carbon emissions, something that’s counter acted by it’s benefit to people in oppressed nations.

8/ As for the investor’s hat, I think I’m getting better at being able to recognise big breakthroughs early on.

It’s an intellectual challenge too: understanding the curve of technology and how society changes with it.

It’s an intellectual challenge too: understanding the curve of technology and how society changes with it.

9/ I expect this drive to assess potential early will help avoid the cognitive bias that over-values the past that has happened (in which a tech is a toy) but under-values the future that’s yet to happen (in which tech is the incumbent).

10/ I recommend everyone to regularly recalibrate their mental models by reflecting on their past.

Ask yourself:

- What did you predict that turn put to be not true?

- How should you adjust to be less wrong in future?

Ask yourself:

- What did you predict that turn put to be not true?

- How should you adjust to be less wrong in future?

11/ Although remember: in retrospect, everyone is a billionaire :)

Read on Twitter

Read on Twitter