JPMorgan just released a report titled:

"Why is the Bitcoin futures curve so steep?"

The big banks are eyeing Bitcoin& #39;s contango https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

Here are some of the highlights:

Thread/

"Why is the Bitcoin futures curve so steep?"

The big banks are eyeing Bitcoin& #39;s contango

Here are some of the highlights:

Thread/

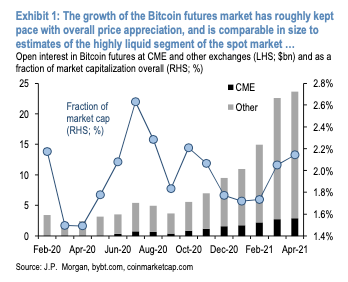

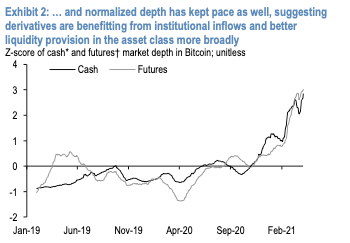

1. "As has often been the case in the past, the growth and gradual maturation of cryptocurrency markets has naturally generated interest in derivatives and other sources of leverage. Though futures trade against a range of pairs, Bitcoin unsurprisingly dominates..."

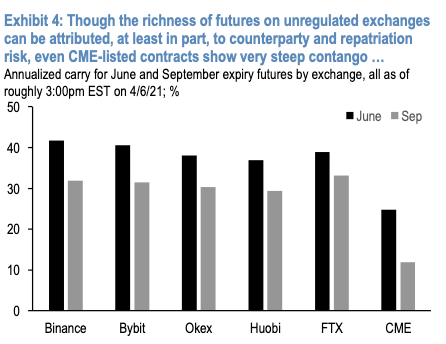

2. "As of this writing, the June CME Bitcoin contract offers ~25% annualized slide relative to spot. The richness of futures is even more acute if we broaden our view to include unrelated exchanges, where carry can be as high as 40+% "

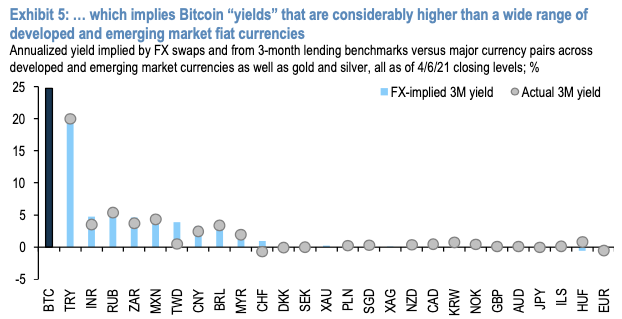

3. "Bitcoin & #39;yields& #39; implied by futures are substantially higher than all major currencies across developed and emerging markets, and the situation is even more pronounced on offshore exchanges.

4. To put this into context, very few fiat currencies, including both developed and emerging markets, offer easily monetizeable local yields (e.g., from FX swaps) in excess of 5%.

5. There is of course the special case of TRY, but with local consumer price inflation around 10% or higher, as compared to the explicitly deflationary monetary policy and cross-border transferability of Bitcoin, this hardly seems a plausible substitute."

6. "Why has such attractive pricing not simply been arbitraged away?"

- Counterparty & repatriation risk in offshore markets

- Complications with obtaining spot BTC exposure in the legacy system

- GBTC being a main source of BTC exposure on the street (premium/discount problems)

- Counterparty & repatriation risk in offshore markets

- Complications with obtaining spot BTC exposure in the legacy system

- GBTC being a main source of BTC exposure on the street (premium/discount problems)

7. "This makes launching a Bitcoin ETF in the U.S. the key to normalizing the pricing of Bitcoin futures, in our view. As has been widely discussed, it could reduce many barriers to entry, bringing new potential demand into the asset class.

8. A risk factor worth considering, however, is that it would also make basis trading much more efficient and attractive at current pricing, particularly if those ETFs can be purchased on margin. We would expect that to bring more basis demand into futures markets, especially

9. the CME but also potentially other onshore exchanges. To the extent that contango normalizes for those contracts, we would expect some pass-through to pricing on unrelated exchanges as well, since presumably there is some arbitrage activity between the two.

10. Normalizing these implied funding spreads with more two-way flow is likely a prerequisite for broadening the base of participants in BTC derivatives more generally, since it takes quite a bullish outlook to be willing to pay 30-40% annually to source levered long exposure."

11. Expect JPMorgan and other legacy institutions to enter this trade in a big way, at first for the yield, and stay when they come to realize what Bitcoin truly is.

The game theory is just starting to heat up. The financial & economic incentives are too strong to ignore.

Fin./

The game theory is just starting to heat up. The financial & economic incentives are too strong to ignore.

Fin./

Read on Twitter

Read on Twitter