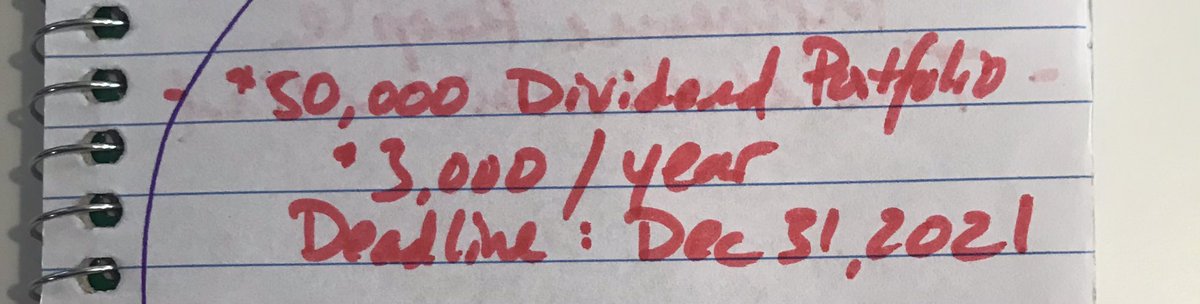

1/6) Beginning of the year, I wrote in my journal that one of my financial goals is to build a $50,000 #dividend portfolio that produced $3,000 in dividend annually, 6% yield. I love @tastytrade active investing but I wanted some “passive” income sitting on my butt doing nothing.

2/6) So here’s the strategy – sell naked puts (combo of atm, itm, 30 delta) on low priced ULs on its down days. If I get assigned, I sell calls and collect dividends while holding the stocks. I REFUSE TO BUY STOCKS OUTRIGHT. #NakedPut #CoveredCall

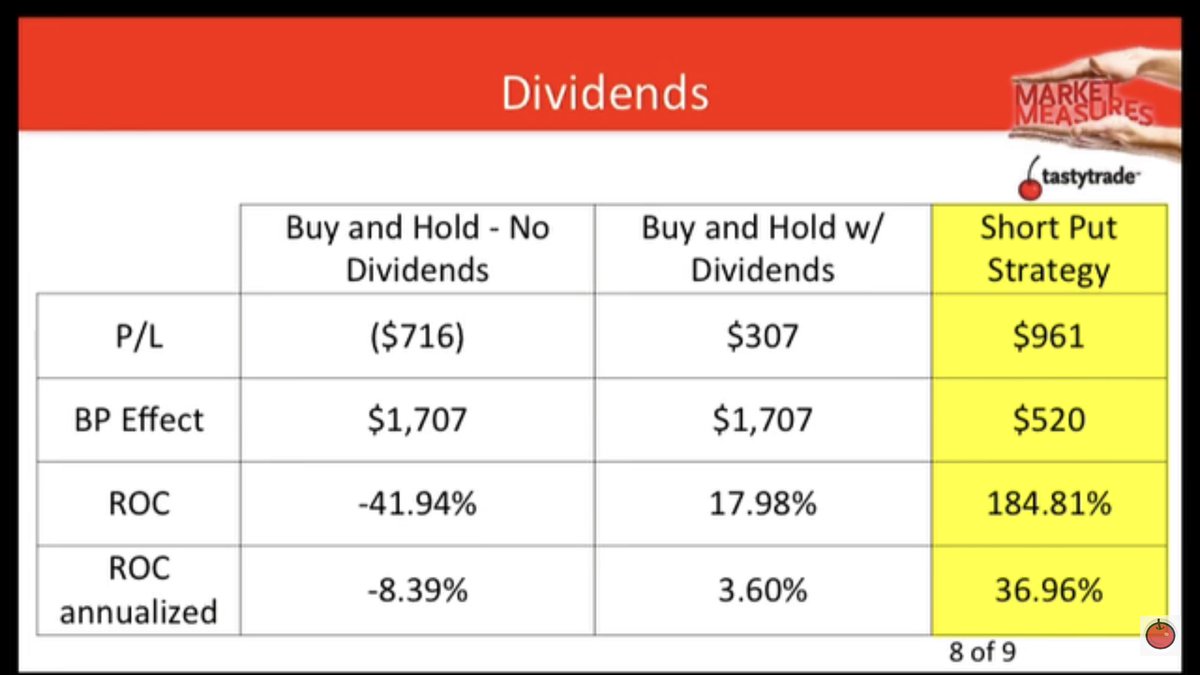

3/6) @tastytrade did an awesome study where it showed the short put strategy DESTROYED the Buy & Hold Strategy. https://youtu.be/qe5sjKn7IaU ">https://youtu.be/qe5sjKn7I...

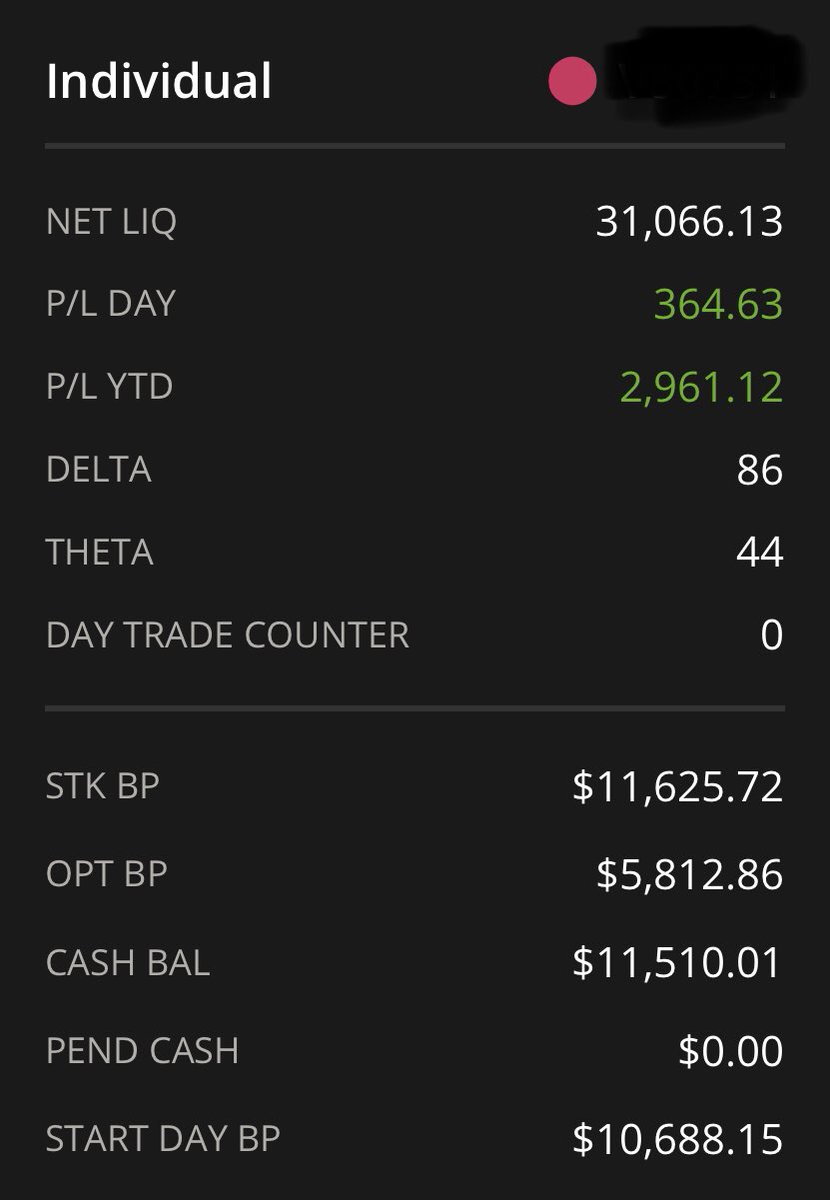

4/6) Here is my result from 2021 Q1:

P/L = $2,961.12

Dividend Payout = $265.46 from the stocks that were assigned

YTD Return = 11.5%

#trading #OptionsTrading

P/L = $2,961.12

Dividend Payout = $265.46 from the stocks that were assigned

YTD Return = 11.5%

#trading #OptionsTrading

5/6) I accidently sold a jade lizard in $CHWY in this #dividend portfolio instead of my PM account and it’s currently a $650 loss that I’m managing. So if I exclude $CHWY, my YTD return would’ve been 13.8%.

6/6) For comparison, S&P 500 YTD return is 9.44%. Even though I was looking for “passive” dividend income, my #tasytrade kicked in and this ended up being more active. But that’s fine because it’s still beating the S&P500! Let’s go #Tastynation!  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍒" title="Kirschen" aria-label="Emoji: Kirschen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍒" title="Kirschen" aria-label="Emoji: Kirschen"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍒" title="Kirschen" aria-label="Emoji: Kirschen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍒" title="Kirschen" aria-label="Emoji: Kirschen"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍒" title="Kirschen" aria-label="Emoji: Kirschen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍒" title="Kirschen" aria-label="Emoji: Kirschen">

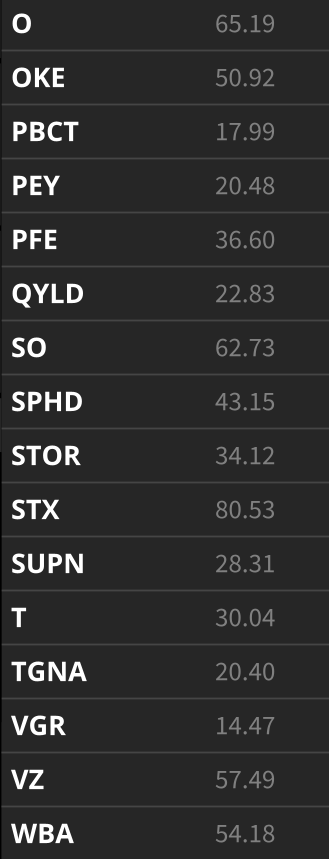

This my constantly revolving #dividend stock list. Let me know if there are any other stocks I should be looking to add to this list!

Read on Twitter

Read on Twitter