#XRPHolders  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🆚" title="Quadratisches VS" aria-label="Emoji: Quadratisches VS"> @SEC_News Thread:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🆚" title="Quadratisches VS" aria-label="Emoji: Quadratisches VS"> @SEC_News Thread:

@HesterPeirce was interviewed by @ThinkingCrypto1 and said that she was trying to get people at the @SEC_News to stop thinking about the token as a security but instead on how the token was being packaged and sold. https://youtu.be/_qihfMbIk_g ">https://youtu.be/_qihfMbIk...

@HesterPeirce was interviewed by @ThinkingCrypto1 and said that she was trying to get people at the @SEC_News to stop thinking about the token as a security but instead on how the token was being packaged and sold. https://youtu.be/_qihfMbIk_g ">https://youtu.be/_qihfMbIk...

I tweeted out, in disbelief, saying “that’s only been the law for 75 years.”

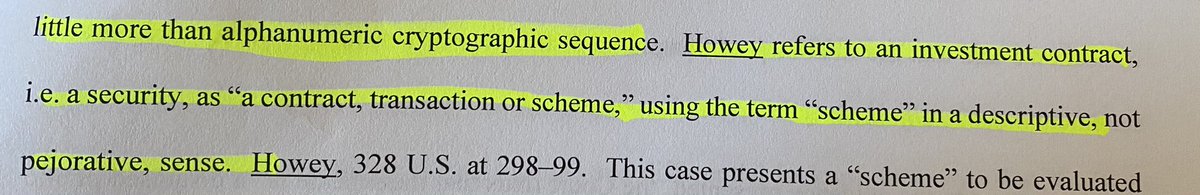

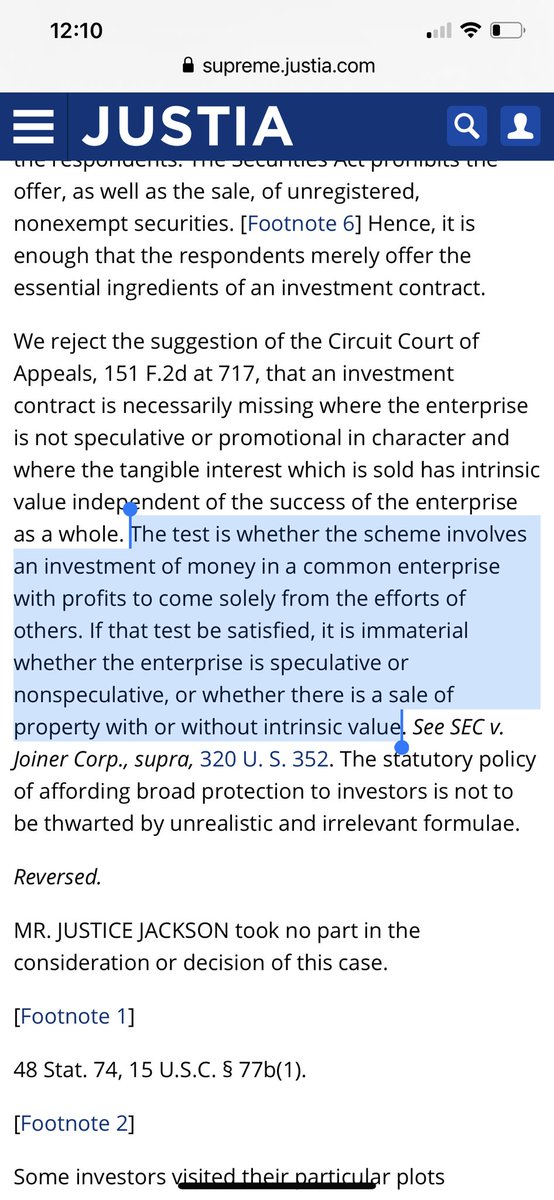

The Supreme Court in #Howey didn’t conclude that the oranges https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍊" title="Mandarine" aria-label="Emoji: Mandarine"> were Securities, but it was the “scheme” and the totality of circumstances surrounding the transactions between the parties that was held

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍊" title="Mandarine" aria-label="Emoji: Mandarine"> were Securities, but it was the “scheme” and the totality of circumstances surrounding the transactions between the parties that was held

The Supreme Court in #Howey didn’t conclude that the oranges

to be an investment contract. But it’s not just the #Howey case that has made it crystal clear that the token itself IS NOT a security.

#BTC https://abs.twimg.com/hashflags... draggable="false" alt="">, #ETH, #XRP, #Gold, #Soybeans, #copper, #coffee and any other product or commodity can be marketed, packaged, sold and distributed

https://abs.twimg.com/hashflags... draggable="false" alt="">, #ETH, #XRP, #Gold, #Soybeans, #copper, #coffee and any other product or commodity can be marketed, packaged, sold and distributed

#BTC

as part of an investment contract. The @SEC_Enforcement lawyers have relied on and referenced the recent #Telegram case as an example for the SDNY Court to follow. I AGREE!

@CryptoLawUS has uploaded for your review the two Opinions and Orders entered by Judge Castel in the

@CryptoLawUS has uploaded for your review the two Opinions and Orders entered by Judge Castel in the

#Telegram case. I encourage you to read them. After reading Telegram 1 & 2, you will get even more pissed off at what the SEC refuses to acknowledge.

Remember, in #Telegram, the SEC sought a preliminary injunction (and won) preventing #Telegram from using the funds raised

Remember, in #Telegram, the SEC sought a preliminary injunction (and won) preventing #Telegram from using the funds raised

by selling #Grams to build the TON Blockchain. #Telegram was very much like @VitalikButerin’s initial fundraising scheme.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> #Telegram was a pure ICO scheme. As the Court found, the #Grams were sold to VCs and high net worth individuals or hedge funds.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> #Telegram was a pure ICO scheme. As the Court found, the #Grams were sold to VCs and high net worth individuals or hedge funds.

Comparing #Grams to #XRP https://twitter.com/digitalassetbuy/status/1374329387403862019">https://twitter.com/digitalas...

Comparing #Grams to #XRP https://twitter.com/digitalassetbuy/status/1374329387403862019">https://twitter.com/digitalas...

would be like comparing  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍊" title="Mandarine" aria-label="Emoji: Mandarine">s to

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍊" title="Mandarine" aria-label="Emoji: Mandarine">s to  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚽️" title="Fußball" aria-label="Emoji: Fußball"> and

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚽️" title="Fußball" aria-label="Emoji: Fußball"> and  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏈" title="American Football" aria-label="Emoji: American Football">. Let’s review excerpts from the #Telegram case which the SEC loves to compare against @Ripple.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏈" title="American Football" aria-label="Emoji: American Football">. Let’s review excerpts from the #Telegram case which the SEC loves to compare against @Ripple.

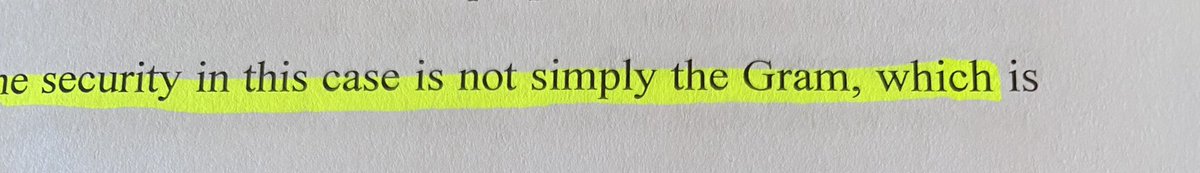

“the security in this case is not simply the #Gram, which is little more than alphanumeric cryptographic sequence.”

That seems pretty clear

“the security in this case is not simply the #Gram, which is little more than alphanumeric cryptographic sequence.”

That seems pretty clear

Maybe the SEC disagrees and that decision isn’t clear enough to help @HesterPeirce convince her fellow commissioners and prosecutors that the Token itself - IS NOT the security.

If unclear, they should read Judge Castel’s Second Opinion and Order in the #Telegram case. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

If unclear, they should read Judge Castel’s Second Opinion and Order in the #Telegram case.

J. Castel (from the same SDNY as J. Torres) made it more clear:

“that the security was neither the Gram Purchase Agreement NOR the #Gram, but the entire scheme that comprised the Gram Purchase Agreements and the accompanying understandings and undertakings made by Telegram ...”

“that the security was neither the Gram Purchase Agreement NOR the #Gram, but the entire scheme that comprised the Gram Purchase Agreements and the accompanying understandings and undertakings made by Telegram ...”

Yep, that’s right. In #Telegram, there was an actual Purchase Agreement that the investors signed - a CONTRACT (equal to half of the phrase: “investment contract”).

J. Castel said that the actual agreement, itself, wasn’t a security let alone the mere alphanumeric code ( #Gram).

J. Castel said that the actual agreement, itself, wasn’t a security let alone the mere alphanumeric code ( #Gram).

But the SEC refuses to acknowledge what the law is. I’ve made it clear from day one that I’m not a Securities law expert, but I can read.

The SEC keeps making a big deal about speculative investing. I encourage them to re-read Howey.

The very next sentence following the test.

The SEC keeps making a big deal about speculative investing. I encourage them to re-read Howey.

The very next sentence following the test.

Considering that the SEC was specifically warned by Grundfest that the exchanges would delist or suspend #XRP, the SEC could have made it clear to the exchanges that it wasn’t claiming #XRP the token was a security per se. They refused. https://www.theblockcrypto.com/linked/89164/former-sec-commissioner-says-ripple-lawsuit-will-cause-multi-billion-dollar-losses-to-innocent-third-parties">https://www.theblockcrypto.com/linked/89...

When we filed our Writ of Mandamus, they could’ve come out and made it clear. They refused. Instead, they blamed the exchanges.

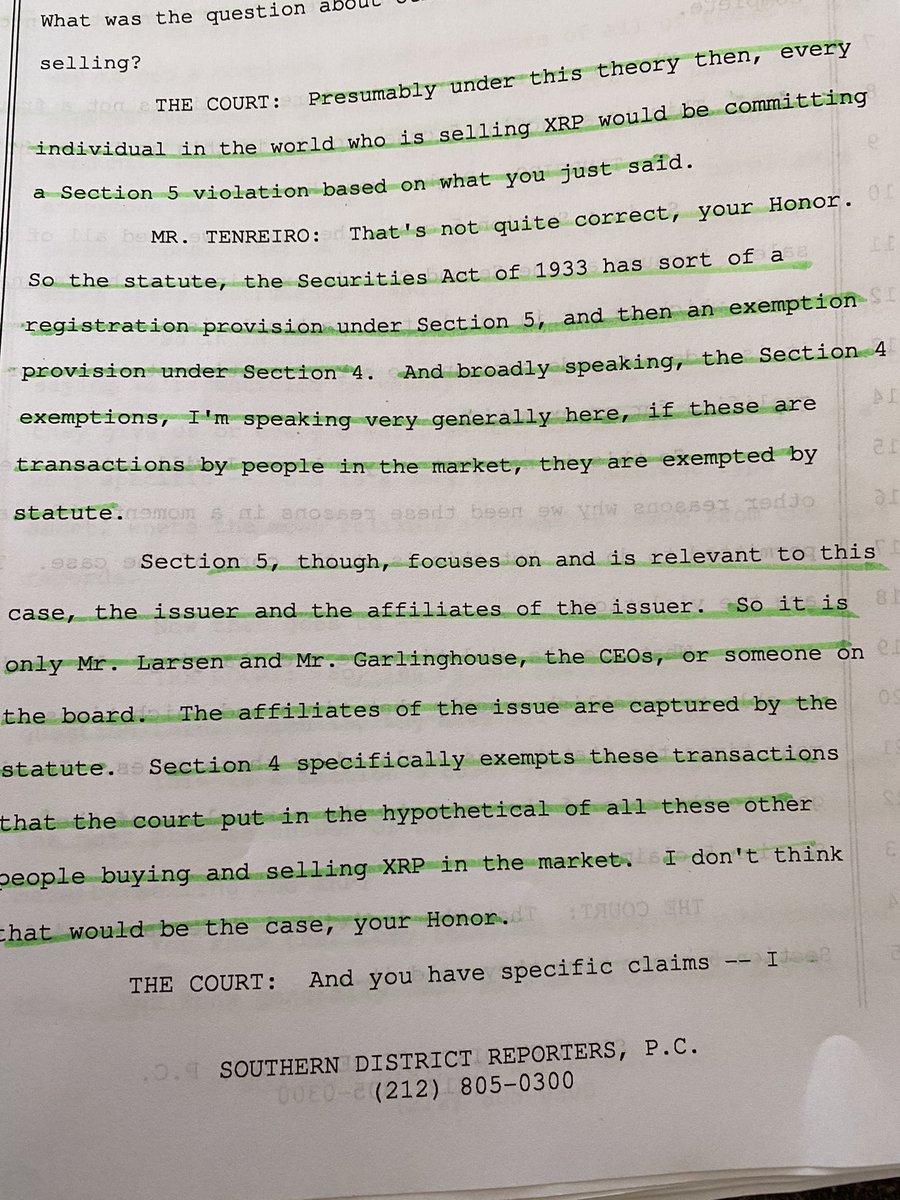

When Judge Netburn told the SEC lawyer that according to his argument every person in the world selling #XRP was in violation of Section 5 ( https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">) of the

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">) of the

When Judge Netburn told the SEC lawyer that according to his argument every person in the world selling #XRP was in violation of Section 5 (

Securities Act, they could’ve made it clear. They didn’t. Instead, they claimed Section 4 exclusions would “likely” apply. But Section 4 ONLY applies IF ITS A SECURITY!

When we filed our Pre-motion letter regarding intervention, the SEC, in its reply letter, could’ve made it

When we filed our Pre-motion letter regarding intervention, the SEC, in its reply letter, could’ve made it

clear that it isn’t claiming that our #XRP is a security. They refused. Instead, they claimed sovereign immunity against us; called us speculative investors, which they claimed proves Ripple sold securities (still trying to figure out what that nonsensical sentence means);

misled the Court by claiming that I said if we get #XRP re-listed the price will double and then we can sell for a profit (I’ve already proven that’s a lie); and, again, blamed the exchanges.

The law is clear. In 1946 it was made clear in #Howey. In 2020 (this time last year)

The law is clear. In 1946 it was made clear in #Howey. In 2020 (this time last year)

it was made clear in #Telegram.

The SEC cannot in good faith claim that the Token #XRP is inherently an investment contract, and thus, a security.

They can try and claim that when #Ripple sold or distributed #XRP, at specific times, it constituted an investment contract.

The SEC cannot in good faith claim that the Token #XRP is inherently an investment contract, and thus, a security.

They can try and claim that when #Ripple sold or distributed #XRP, at specific times, it constituted an investment contract.

But at least acknowledge the law and quit focusing only on winning the case at all costs. Maybe, just maybe, the SEC could also start focusing on protecting investors and users of #XRP.

Until that happens, the SEC will continue to be on trial. https://www.forbes.com/sites/roslynlayton/2021/04/08/in-the-ripple-case-the-sec-is-now-on-trial--and-knows-it">https://www.forbes.com/sites/ros...

Until that happens, the SEC will continue to be on trial. https://www.forbes.com/sites/roslynlayton/2021/04/08/in-the-ripple-case-the-sec-is-now-on-trial--and-knows-it">https://www.forbes.com/sites/ros...

Read on Twitter

Read on Twitter s to https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚽️" title="Fußball" aria-label="Emoji: Fußball"> and https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏈" title="American Football" aria-label="Emoji: American Football">. Let’s review excerpts from the #Telegram case which the SEC loves to compare against @Ripple. “the security in this case is not simply the #Gram, which is little more than alphanumeric cryptographic sequence.”That seems pretty clear" title="would be like comparing https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍊" title="Mandarine" aria-label="Emoji: Mandarine">s to https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚽️" title="Fußball" aria-label="Emoji: Fußball"> and https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏈" title="American Football" aria-label="Emoji: American Football">. Let’s review excerpts from the #Telegram case which the SEC loves to compare against @Ripple. “the security in this case is not simply the #Gram, which is little more than alphanumeric cryptographic sequence.”That seems pretty clear">

s to https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚽️" title="Fußball" aria-label="Emoji: Fußball"> and https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏈" title="American Football" aria-label="Emoji: American Football">. Let’s review excerpts from the #Telegram case which the SEC loves to compare against @Ripple. “the security in this case is not simply the #Gram, which is little more than alphanumeric cryptographic sequence.”That seems pretty clear" title="would be like comparing https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍊" title="Mandarine" aria-label="Emoji: Mandarine">s to https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚽️" title="Fußball" aria-label="Emoji: Fußball"> and https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏈" title="American Football" aria-label="Emoji: American Football">. Let’s review excerpts from the #Telegram case which the SEC loves to compare against @Ripple. “the security in this case is not simply the #Gram, which is little more than alphanumeric cryptographic sequence.”That seems pretty clear">

s to https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚽️" title="Fußball" aria-label="Emoji: Fußball"> and https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏈" title="American Football" aria-label="Emoji: American Football">. Let’s review excerpts from the #Telegram case which the SEC loves to compare against @Ripple. “the security in this case is not simply the #Gram, which is little more than alphanumeric cryptographic sequence.”That seems pretty clear" title="would be like comparing https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍊" title="Mandarine" aria-label="Emoji: Mandarine">s to https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚽️" title="Fußball" aria-label="Emoji: Fußball"> and https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏈" title="American Football" aria-label="Emoji: American Football">. Let’s review excerpts from the #Telegram case which the SEC loves to compare against @Ripple. “the security in this case is not simply the #Gram, which is little more than alphanumeric cryptographic sequence.”That seems pretty clear">

s to https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚽️" title="Fußball" aria-label="Emoji: Fußball"> and https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏈" title="American Football" aria-label="Emoji: American Football">. Let’s review excerpts from the #Telegram case which the SEC loves to compare against @Ripple. “the security in this case is not simply the #Gram, which is little more than alphanumeric cryptographic sequence.”That seems pretty clear" title="would be like comparing https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍊" title="Mandarine" aria-label="Emoji: Mandarine">s to https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚽️" title="Fußball" aria-label="Emoji: Fußball"> and https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏈" title="American Football" aria-label="Emoji: American Football">. Let’s review excerpts from the #Telegram case which the SEC loves to compare against @Ripple. “the security in this case is not simply the #Gram, which is little more than alphanumeric cryptographic sequence.”That seems pretty clear">

" title="Maybe the SEC disagrees and that decision isn’t clear enough to help @HesterPeirce convince her fellow commissioners and prosecutors that the Token itself - IS NOT the security. If unclear, they should read Judge Castel’s Second Opinion and Order in the #Telegram case.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="Maybe the SEC disagrees and that decision isn’t clear enough to help @HesterPeirce convince her fellow commissioners and prosecutors that the Token itself - IS NOT the security. If unclear, they should read Judge Castel’s Second Opinion and Order in the #Telegram case.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

) of the" title="When we filed our Writ of Mandamus, they could’ve come out and made it clear. They refused. Instead, they blamed the exchanges. When Judge Netburn told the SEC lawyer that according to his argument every person in the world selling #XRP was in violation of Section 5 (https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">) of the" class="img-responsive" style="max-width:100%;"/>

) of the" title="When we filed our Writ of Mandamus, they could’ve come out and made it clear. They refused. Instead, they blamed the exchanges. When Judge Netburn told the SEC lawyer that according to his argument every person in the world selling #XRP was in violation of Section 5 (https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">) of the" class="img-responsive" style="max-width:100%;"/>