1) All for anyone starting a fund. Did not mean to discourage.

Evidently it wasn& #39;t very hard for @DanielSLoeb1 https://abs.twimg.com/emoji/v2/... draggable="false" alt="😀" title="Grinsendes Gesicht" aria-label="Emoji: Grinsendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😀" title="Grinsendes Gesicht" aria-label="Emoji: Grinsendes Gesicht">

The beginning is difficult for most. Lots of rejection.

No matter how hard you work, need some luck given high sensitivity to initial conditions (year 1 #& #39;s).

Evidently it wasn& #39;t very hard for @DanielSLoeb1

The beginning is difficult for most. Lots of rejection.

No matter how hard you work, need some luck given high sensitivity to initial conditions (year 1 #& #39;s).

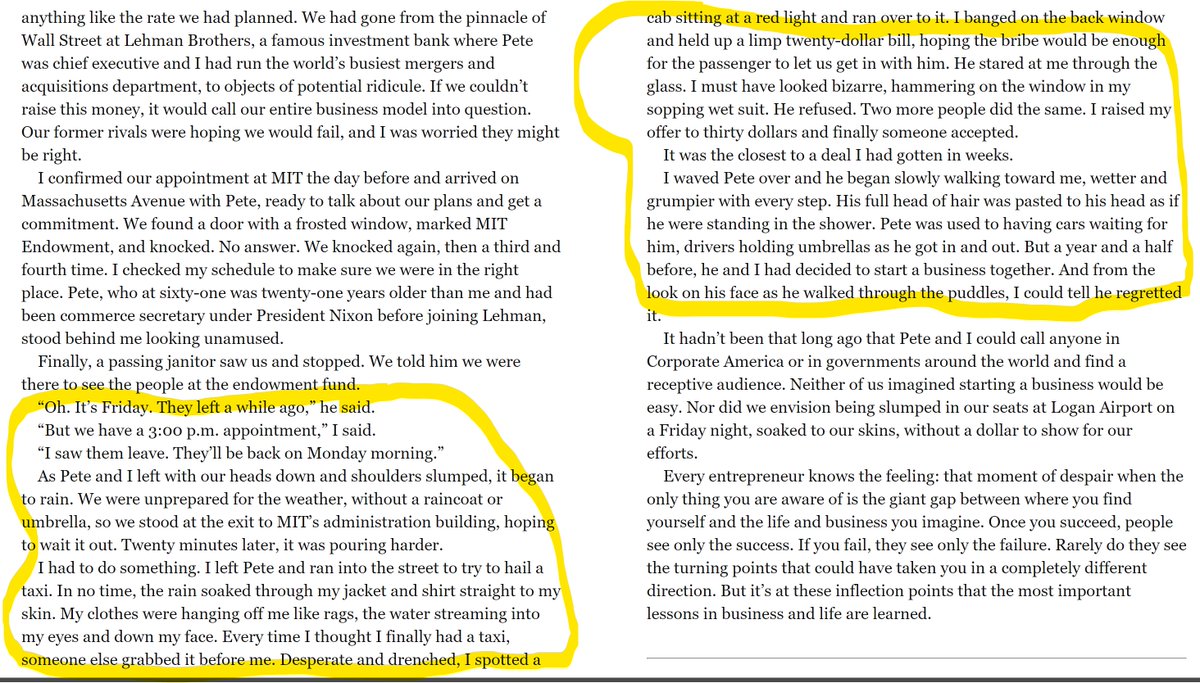

2) Schwarzman& #39;s description in his book of being blown off by a prestigious university endowment in Boston during Blackstone& #39;s launch captures the feeling of rejection well.

It will happen many times. Be mentally prepared.

Everyone "knows" this but it is still surprising.

It will happen many times. Be mentally prepared.

Everyone "knows" this but it is still surprising.

3) Choose your path wisely:

Low cost, sole proprietor "practice" vs. going for a larger launch with the commensurate team size and expenses which requires reasonable personal capital and/or an anchor/seed LP.

First path lowers the sensitivity to initial conditions.

Low cost, sole proprietor "practice" vs. going for a larger launch with the commensurate team size and expenses which requires reasonable personal capital and/or an anchor/seed LP.

First path lowers the sensitivity to initial conditions.

4) @NeckarValue @NoonSixCap @GrahamDuncanNYC @pmje73 have written the best practical stuff on the topic IMO.

And I am happy to help *anyone* if I can.

Especially anyone who is an active, positive contributor to FinTwit.

And I am happy to help *anyone* if I can.

Especially anyone who is an active, positive contributor to FinTwit.

Read on Twitter

Read on Twitter