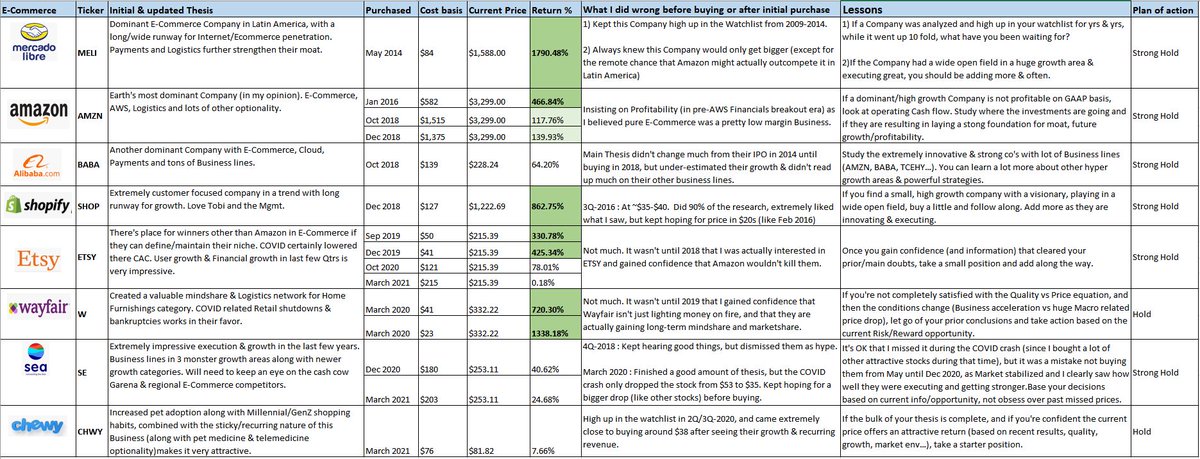

I guess there& #39;s a reason for why I https://abs.twimg.com/emoji/v2/... draggable="false" alt="❤️" title="Rotes Herz" aria-label="Emoji: Rotes Herz">E-commerce so much. These lessons are as important as the returns.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❤️" title="Rotes Herz" aria-label="Emoji: Rotes Herz">E-commerce so much. These lessons are as important as the returns.

Sharing with few Fintwit friends. @saxena_puru @FromValue @dhaval_kotecha @richard_chu97 @adventuresinfi @BahamaBen9 @TMFJMo @7Innovator @borrowed_ideas @investing_city

Sharing with few Fintwit friends. @saxena_puru @FromValue @dhaval_kotecha @richard_chu97 @adventuresinfi @BahamaBen9 @TMFJMo @7Innovator @borrowed_ideas @investing_city

Thank god I didn& #39;t wait for consistent GAAP profitability before investing in them (like I do for most other sectors).  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">

Positions : $MELI $AMZN $BABA $SHOP $ETSY $W $SE $CHWY

Watchlist : $JD $PDD $FTCH $MWK

Haven& #39;t analyzed much : $JMIA $OZON

Positions : $MELI $AMZN $BABA $SHOP $ETSY $W $SE $CHWY

Watchlist : $JD $PDD $FTCH $MWK

Haven& #39;t analyzed much : $JMIA $OZON

E-Commerce is one of those sectors where you have to understand the Business model and lot of non-GAAP (but Business driving) metrics & KPIs.

I& #39;m not an expert by any means, but these are some of the things I broadly think about.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Fettes Häkchen" aria-label="Emoji: Fettes Häkchen">Is the Company a Marketplace (1st party, 3rd party, both?) or a Platform, a combination?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Fettes Häkchen" aria-label="Emoji: Fettes Häkchen">Is the Company a Marketplace (1st party, 3rd party, both?) or a Platform, a combination?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Fettes Häkchen" aria-label="Emoji: Fettes Häkchen">Does it handle inventory?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Fettes Häkchen" aria-label="Emoji: Fettes Häkchen">Does it handle inventory?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Fettes Häkchen" aria-label="Emoji: Fettes Häkchen">Does it handle payments in house?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Fettes Häkchen" aria-label="Emoji: Fettes Häkchen">Does it handle payments in house?

-Operating Cash Flow?

-Shareholder dilution?

-Debt increase?

Are any of those actions making them vulnerable to unfavorable Market conditions?

Some KPIs to look at for E-Commerce Co& #39;s before diving into Financial stmnts.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Fettes Häkchen" aria-label="Emoji: Fettes Häkchen">Num of Users & growth trajectory

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Fettes Häkchen" aria-label="Emoji: Fettes Häkchen">Num of Users & growth trajectory

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Fettes Häkchen" aria-label="Emoji: Fettes Häkchen">How is it acquiring those Customers? (Direct Marketing, partnerships, social/viral....)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Fettes Häkchen" aria-label="Emoji: Fettes Häkchen">How is it acquiring those Customers? (Direct Marketing, partnerships, social/viral....)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Fettes Häkchen" aria-label="Emoji: Fettes Häkchen">Num of Subscription or repeat Users?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Fettes Häkchen" aria-label="Emoji: Fettes Häkchen">Num of Subscription or repeat Users?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Fettes Häkchen" aria-label="Emoji: Fettes Häkchen">Retention & Cohort trends

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Fettes Häkchen" aria-label="Emoji: Fettes Häkchen">Retention & Cohort trends

What else would you add?

Coming back to the overall lessons learnt from these E-commerce positions..

Investing is not a set of isolated actions & results. What you learned in a position can be applied elsewhere while making your overall process & returns better.

Three quick examples below.

Investing is not a set of isolated actions & results. What you learned in a position can be applied elsewhere while making your overall process & returns better.

Three quick examples below.

1) $AMZN taught me the power of investing in long-term moat enhancing things can be much more important than aiming for short term business profitability.

The opportunity to invest and capability to execute should be there. The Company needs to produce the results to gain your trust of course.

I used the same playbook when analyzing, investing in and monitoring $SHOP $W

I used the same playbook when analyzing, investing in and monitoring $SHOP $W

2) When I sold $NFLX too early for a modest 80% gain in 2017, while missing on a subsequent 500% gain, all the while not having a good reason to sell or having a better opportunity to invest...

it taught me to hold on to your winners while they have a wide open field in which they are executing beautifully despite short term over/under valuation.

I used that lesson to stay in $MELI for a 1800% gain while not getting tempted by 200%, 500% or even a 1000% gain to sell.

I used that lesson to stay in $MELI for a 1800% gain while not getting tempted by 200%, 500% or even a 1000% gain to sell.

3) My earlier failures in few consumer/fashion related stocks taught me that an objective analysis of current facts should always win over whatever your prior beliefs/position/thesis were.

On the flip side, if new information proves that...

On the flip side, if new information proves that...

...a Company is much stronger/better than you previously thought (while still offering an attractive return potential), you should buy it.

This led me to take a position in #ETSY back in 2019 when it was already clear that $AMZN can& #39;t just bury it.

This led me to take a position in #ETSY back in 2019 when it was already clear that $AMZN can& #39;t just bury it.

OK I guess that& #39;s enough for today. Hope you all found some of this useful.

All the best with your E-commerce positions. This trend still has long ways to go.... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Daumen hoch" aria-label="Emoji: Daumen hoch">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Daumen hoch" aria-label="Emoji: Daumen hoch">

/END

All the best with your E-commerce positions. This trend still has long ways to go....

/END

Read on Twitter

Read on Twitter E-commerce so much. These lessons are as important as the returns.Sharing with few Fintwit friends. @saxena_puru @FromValue @dhaval_kotecha @richard_chu97 @adventuresinfi @BahamaBen9 @TMFJMo @7Innovator @borrowed_ideas @investing_city" title="I guess there& #39;s a reason for why Ihttps://abs.twimg.com/emoji/v2/... draggable="false" alt="❤️" title="Rotes Herz" aria-label="Emoji: Rotes Herz">E-commerce so much. These lessons are as important as the returns.Sharing with few Fintwit friends. @saxena_puru @FromValue @dhaval_kotecha @richard_chu97 @adventuresinfi @BahamaBen9 @TMFJMo @7Innovator @borrowed_ideas @investing_city" class="img-responsive" style="max-width:100%;"/>

E-commerce so much. These lessons are as important as the returns.Sharing with few Fintwit friends. @saxena_puru @FromValue @dhaval_kotecha @richard_chu97 @adventuresinfi @BahamaBen9 @TMFJMo @7Innovator @borrowed_ideas @investing_city" title="I guess there& #39;s a reason for why Ihttps://abs.twimg.com/emoji/v2/... draggable="false" alt="❤️" title="Rotes Herz" aria-label="Emoji: Rotes Herz">E-commerce so much. These lessons are as important as the returns.Sharing with few Fintwit friends. @saxena_puru @FromValue @dhaval_kotecha @richard_chu97 @adventuresinfi @BahamaBen9 @TMFJMo @7Innovator @borrowed_ideas @investing_city" class="img-responsive" style="max-width:100%;"/>