Have a look at our Q1 report: https://bit.ly/3fT8Zlo ">https://bit.ly/3fT8Zlo&q...

The dynamic of increased demand and reduced supply of properties is creating competition and pushing prices up https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">.

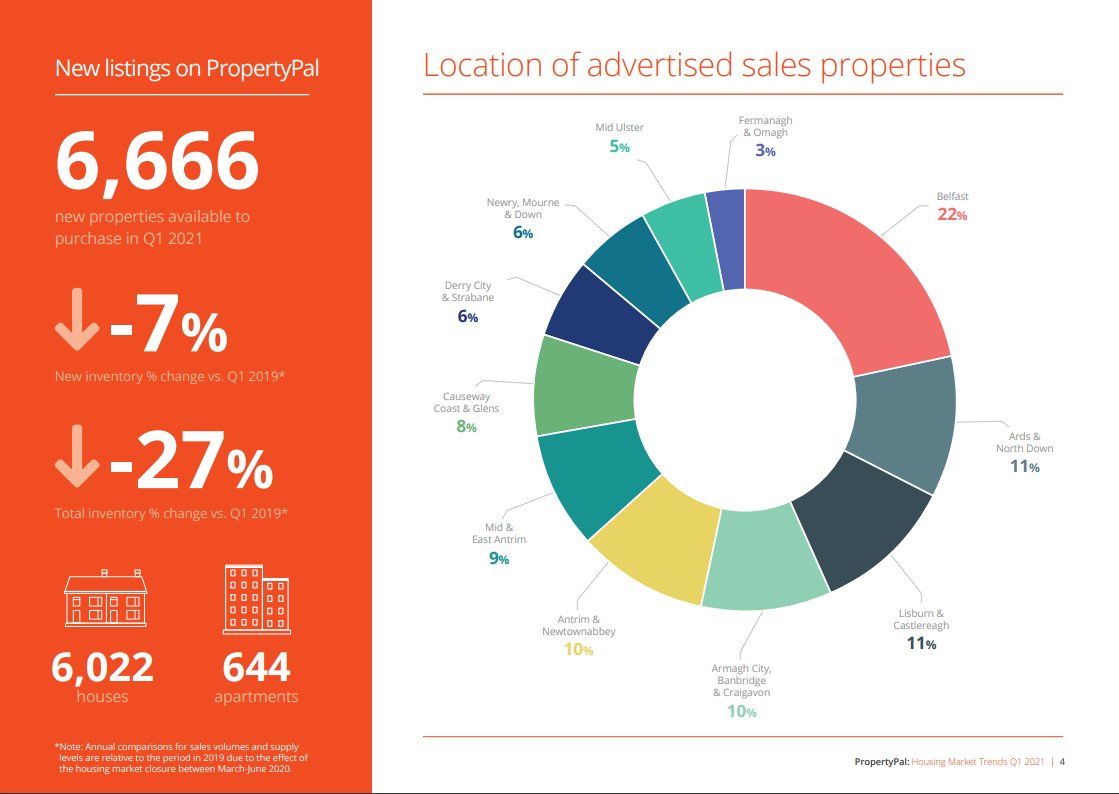

In total there were almost 6,670 properties added to the market during Q1, approx 7% fewer than the same & #39;normal& #39; period in Q1 2019. Total stock is down 27%

In total there were almost 6,670 properties added to the market during Q1, approx 7% fewer than the same & #39;normal& #39; period in Q1 2019. Total stock is down 27%

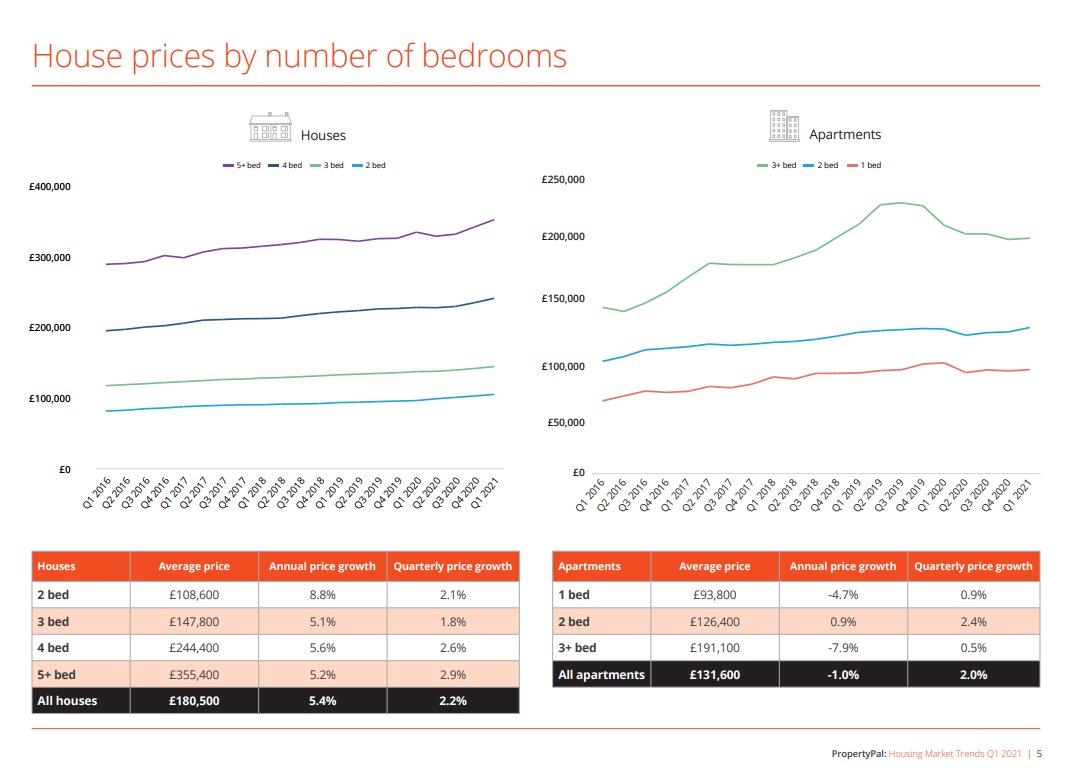

Prices have been growing at stronger rates for houses compared to apartments.

Overall house prices are up 5.4% over last 12 months whilst apartments have fallen by 1.0%. 2 bed apartments have shown modest price growth.

Overall house prices are up 5.4% over last 12 months whilst apartments have fallen by 1.0%. 2 bed apartments have shown modest price growth.

Nine out of the eleven council areas have shown rising prices in the last year. The strongest growth has been experienced in Armagh, Banbridge, Craigavon (7.3%), Ards & North Down (7.3%) and Belfast (7.2%).

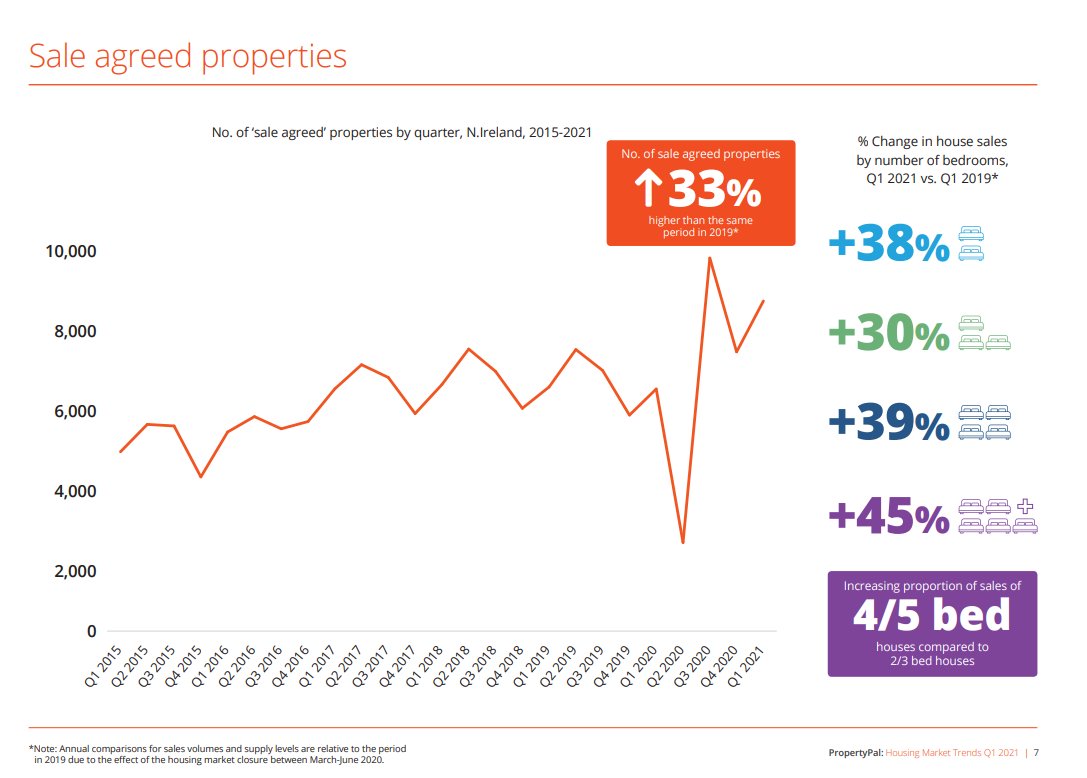

Sales volumes increased by 33% in the opening quarter of the year with almost 8,600 agreed sales. Wealthier demographics continue to play an important role as 4 and 5 bedroom properties increased by 40%.

Watch what people do, not what they say.. Belfast still remains the no. 1 area to buy (by a significant margin).  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏡" title="Haus mit Garten" aria-label="Emoji: Haus mit Garten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏡" title="Haus mit Garten" aria-label="Emoji: Haus mit Garten">

Buying profiles remain similar to previous years, rather it appears the characteristics and composition of individual properties is driving new demand patterns

Buying profiles remain similar to previous years, rather it appears the characteristics and composition of individual properties is driving new demand patterns

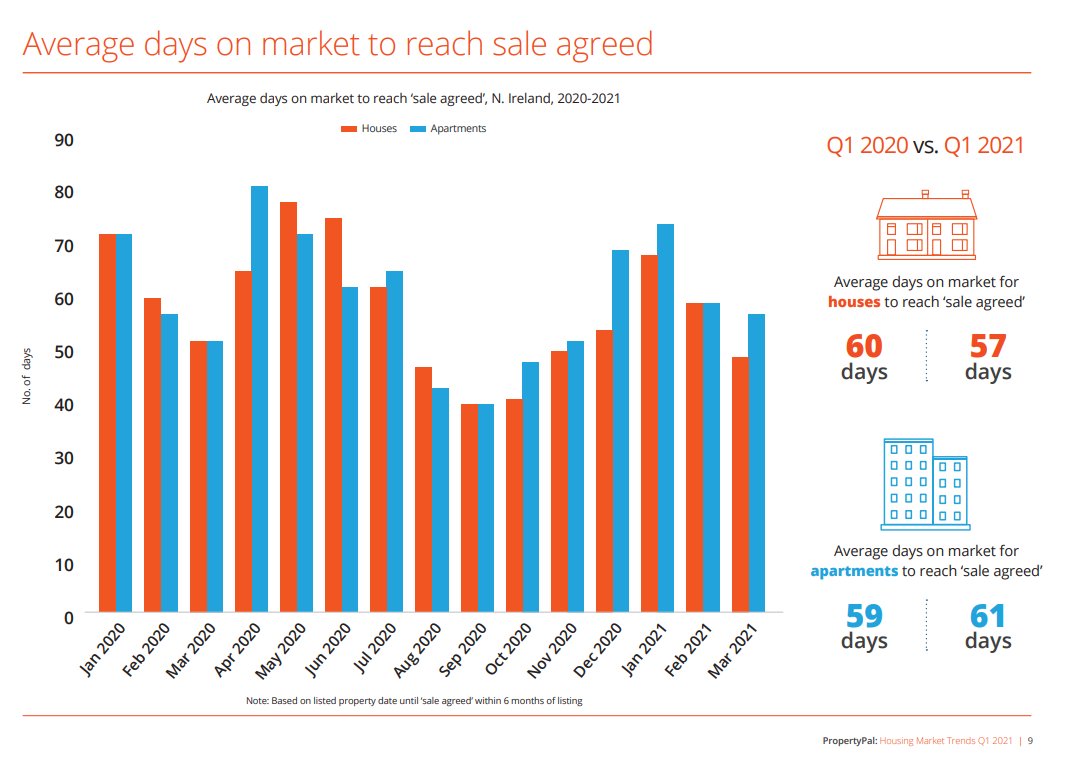

On average, houses are being agreed for sale in 57 days compared to 60 days this time last year, a further signal of buyer demand.

In contrast, apartments are taking an extra couple of days, up to 61 days from 59.

In contrast, apartments are taking an extra couple of days, up to 61 days from 59.

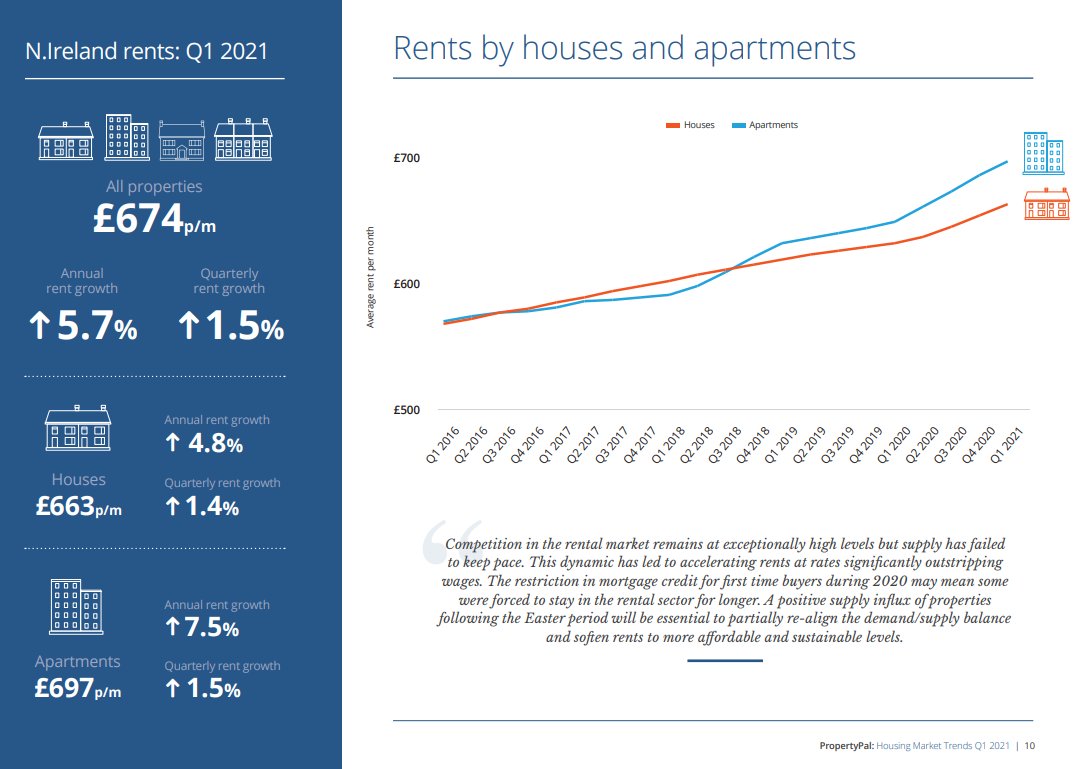

The rental market has been exceptionally buoyant. The supply/demand imbalance has created significant pressure on rents which are now growing at over 5.7% and outstripping wages. New supply following Easter period will be important to re-align the imbalance.

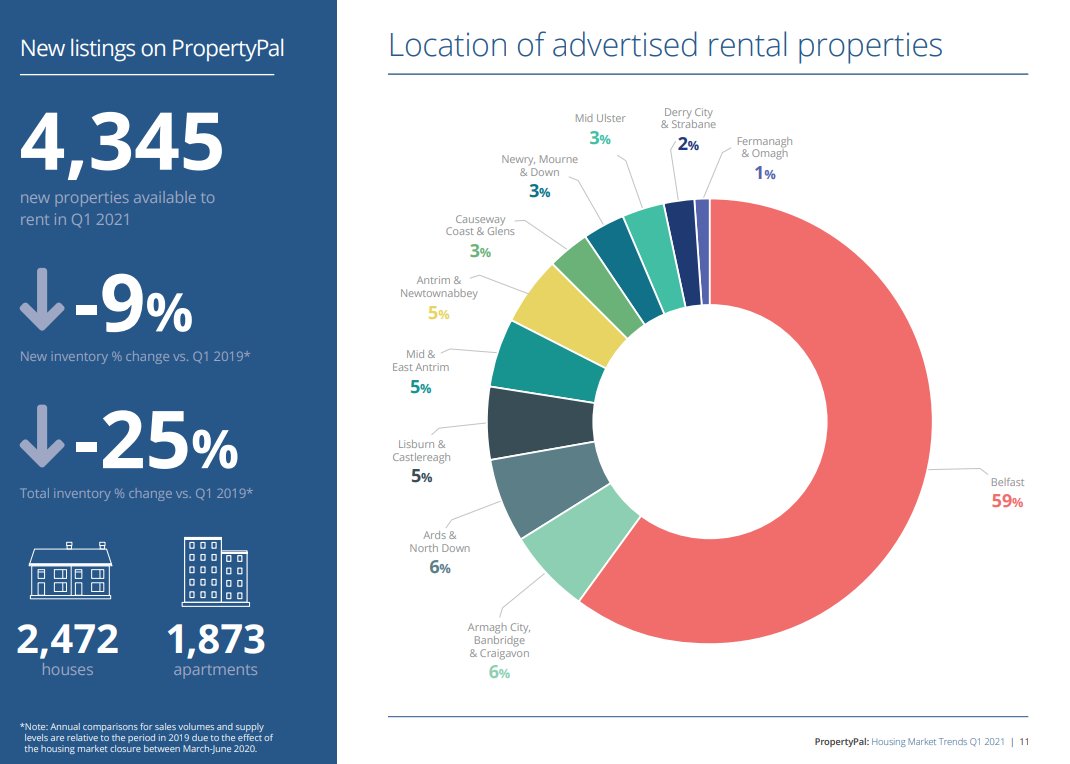

There were approximately 4,350 new rental properties, down 9% on 2019 levels during Q1. Total rental stock is down almost 25%, highlighting the general shortage of properties. Meanwhile, demand levels for rental properties have almost doubled in recent months.

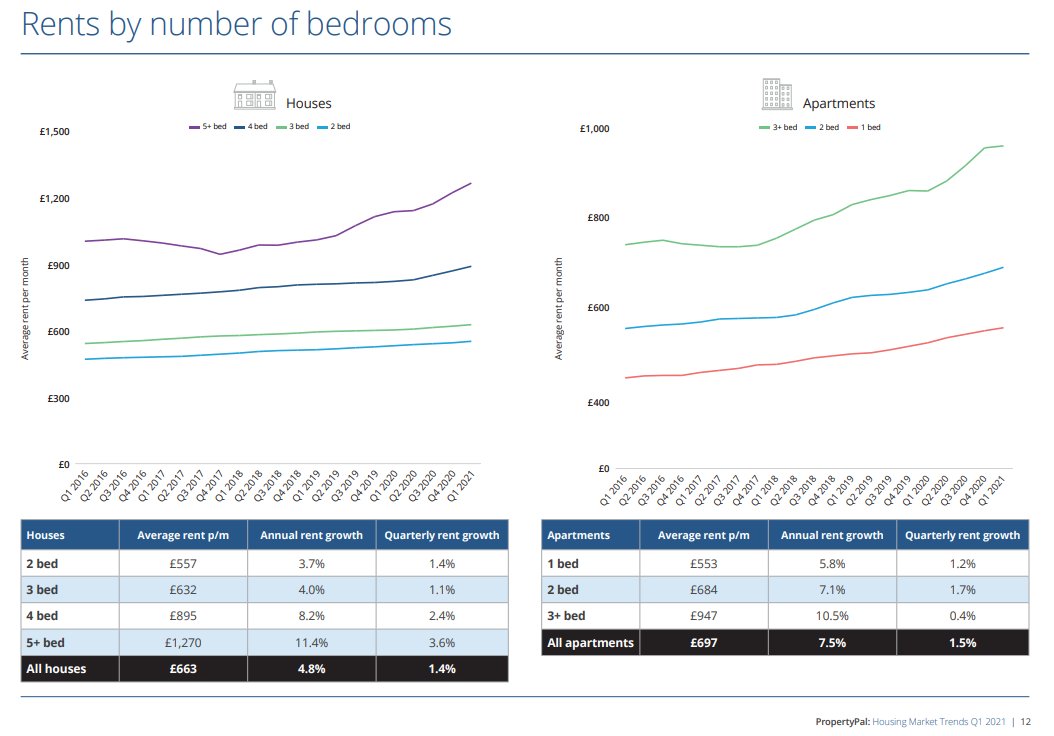

Average rent is now £663 per month. The strongest growth has been in larger properties with more bedrooms and space. 4 bed houses increased 8.2% in last 12 months and 5+ beds by over 11%.

2 and 3 beds (which make up a greater proportion of rental stock) are closer to 4.0%

2 and 3 beds (which make up a greater proportion of rental stock) are closer to 4.0%

Seasonal patterns, improving economic performance, stamp duty extensions, mortgage guarantee schemes, covid re-assessments etc, all suggest the short term outlook remains strong. The market particularly needs a stronger flow of properties, this may pick up in coming weeks

Longer term outlook still remains highly uncertain in line with the economic environment. Market activity may soften later in the year as household and business supports are unwound.

(please get in touch with any ideas for analysis you& #39;d like us to look at to help understand the current housing market patterns)

ENDS.

ENDS.

Read on Twitter

Read on Twitter NI HOUSING MARKET TRENDS- Q1 2021 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">House price growth accelerated to 4.7% year on year and 1.9% on the previous 3 months periodhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🏡" title="Haus mit Garten" aria-label="Emoji: Haus mit Garten">There were 8,600 agreed sales during Q1 2021, 33% more than the same period in 2019Have a look at our Q1 report: https://bit.ly/3fT8Zlo&q..." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">NI HOUSING MARKET TRENDS- Q1 2021 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">House price growth accelerated to 4.7% year on year and 1.9% on the previous 3 months periodhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🏡" title="Haus mit Garten" aria-label="Emoji: Haus mit Garten">There were 8,600 agreed sales during Q1 2021, 33% more than the same period in 2019Have a look at our Q1 report: https://bit.ly/3fT8Zlo&q..." class="img-responsive" style="max-width:100%;"/>

NI HOUSING MARKET TRENDS- Q1 2021 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">House price growth accelerated to 4.7% year on year and 1.9% on the previous 3 months periodhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🏡" title="Haus mit Garten" aria-label="Emoji: Haus mit Garten">There were 8,600 agreed sales during Q1 2021, 33% more than the same period in 2019Have a look at our Q1 report: https://bit.ly/3fT8Zlo&q..." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">NI HOUSING MARKET TRENDS- Q1 2021 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">House price growth accelerated to 4.7% year on year and 1.9% on the previous 3 months periodhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🏡" title="Haus mit Garten" aria-label="Emoji: Haus mit Garten">There were 8,600 agreed sales during Q1 2021, 33% more than the same period in 2019Have a look at our Q1 report: https://bit.ly/3fT8Zlo&q..." class="img-responsive" style="max-width:100%;"/>

.In total there were almost 6,670 properties added to the market during Q1, approx 7% fewer than the same & #39;normal& #39; period in Q1 2019. Total stock is down 27%" title="The dynamic of increased demand and reduced supply of properties is creating competition and pushing prices uphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">.In total there were almost 6,670 properties added to the market during Q1, approx 7% fewer than the same & #39;normal& #39; period in Q1 2019. Total stock is down 27%" class="img-responsive" style="max-width:100%;"/>

.In total there were almost 6,670 properties added to the market during Q1, approx 7% fewer than the same & #39;normal& #39; period in Q1 2019. Total stock is down 27%" title="The dynamic of increased demand and reduced supply of properties is creating competition and pushing prices uphttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">.In total there were almost 6,670 properties added to the market during Q1, approx 7% fewer than the same & #39;normal& #39; period in Q1 2019. Total stock is down 27%" class="img-responsive" style="max-width:100%;"/>

Buying profiles remain similar to previous years, rather it appears the characteristics and composition of individual properties is driving new demand patterns" title="Watch what people do, not what they say.. Belfast still remains the no. 1 area to buy (by a significant margin). https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏡" title="Haus mit Garten" aria-label="Emoji: Haus mit Garten">Buying profiles remain similar to previous years, rather it appears the characteristics and composition of individual properties is driving new demand patterns" class="img-responsive" style="max-width:100%;"/>

Buying profiles remain similar to previous years, rather it appears the characteristics and composition of individual properties is driving new demand patterns" title="Watch what people do, not what they say.. Belfast still remains the no. 1 area to buy (by a significant margin). https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏡" title="Haus mit Garten" aria-label="Emoji: Haus mit Garten">Buying profiles remain similar to previous years, rather it appears the characteristics and composition of individual properties is driving new demand patterns" class="img-responsive" style="max-width:100%;"/>