RICHCORE LIFESCIENCES PVT LTD - A brief coverage

(became LAURUS BIO PVT LTD after acquisition)

Please read the complete thread

1.ABOUT

Richcore Lifesciences Pvt Ltd is founded on 1Jan 2001 by Subramani Ramchandrappa

It is a Bengaluru based innovation-led biotech company...

1/n https://twitter.com/LaurusLabs/status/1331563711140491265">https://twitter.com/LaurusLab...

(became LAURUS BIO PVT LTD after acquisition)

Please read the complete thread

1.ABOUT

Richcore Lifesciences Pvt Ltd is founded on 1Jan 2001 by Subramani Ramchandrappa

It is a Bengaluru based innovation-led biotech company...

1/n https://twitter.com/LaurusLabs/status/1331563711140491265">https://twitter.com/LaurusLab...

....developing novel enzymatic solutions for Industrial Biotechnology and Animal Origin Free recombinant proteins and enzymes for Biopharma.

Its solutions are used in the global food,water,energy,and biopharma industries.

Richcore has large scale fermentation capabilities...

2/n

Its solutions are used in the global food,water,energy,and biopharma industries.

Richcore has large scale fermentation capabilities...

2/n

...and manufactures animal origin free (AOF) recombinant products.

Richcore makes animal origin-free ingredients for cell culture.

Their unique proposition is what they make animal origin-free. That’s their unique selling point.

3/n

Richcore makes animal origin-free ingredients for cell culture.

Their unique proposition is what they make animal origin-free. That’s their unique selling point.

3/n

Basically Richcore has three verticals for revenue, Biotech Ingredients, Enzymes & CDMO.

These products help vaccine, insulin, stem-cell based regenerative medicine and other biopharma companies eliminate dependency on animal and human blood derived products and in turn....

4/n

These products help vaccine, insulin, stem-cell based regenerative medicine and other biopharma companies eliminate dependency on animal and human blood derived products and in turn....

4/n

...produce safer medicines.

Richcore is currently in its growth phase and its second manufacturing plant near Bengaluru is expected to be completed by 31 March 2021.

Richcore has raised early and growth stage funding from Eight Roads Ventures,VenturEast Proactive Fund...

5/n

Richcore is currently in its growth phase and its second manufacturing plant near Bengaluru is expected to be completed by 31 March 2021.

Richcore has raised early and growth stage funding from Eight Roads Ventures,VenturEast Proactive Fund...

5/n

and VenturEast Life Fund III.

In FY2020 Richcore has 70,000 Ltrs of fermentation capacity which will be expanded to 1,80,000 in March 2021 and again an expansion to 2,50,000 Ltrs of capacity in around April 2021.

Company is working on doubling its capacity in coming years.

6/n

In FY2020 Richcore has 70,000 Ltrs of fermentation capacity which will be expanded to 1,80,000 in March 2021 and again an expansion to 2,50,000 Ltrs of capacity in around April 2021.

Company is working on doubling its capacity in coming years.

6/n

Richore also helps global customers in CDMO.

It is a major player in the biotech CDMO space.

7/n

It is a major player in the biotech CDMO space.

7/n

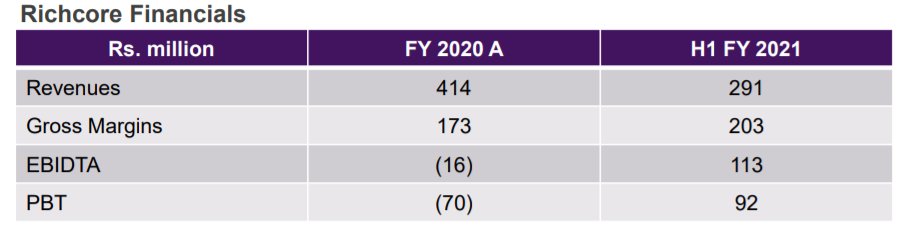

2. FINANCIALS

Richcore clocked Rs 30 crore revenue in its first six months of this FY.

Revenue is expected to grow by 40-50% in FY2021 to around 60Cr.

PAT is expected in FY2021 to around 13-15 cr. It has current debt of around 9 Cr which may increase to 12-15 Cr.

8/n

Richcore clocked Rs 30 crore revenue in its first six months of this FY.

Revenue is expected to grow by 40-50% in FY2021 to around 60Cr.

PAT is expected in FY2021 to around 13-15 cr. It has current debt of around 9 Cr which may increase to 12-15 Cr.

8/n

3. LAURUS LABS ACQUISTION

Laurus Labs, on Nov. 26 2020, closed a Rs 246-crore deal to acquire a majority stake in Richcore Lifesciences, Richcore is valued at 340Cr.

10/n

Laurus Labs, on Nov. 26 2020, closed a Rs 246-crore deal to acquire a majority stake in Richcore Lifesciences, Richcore is valued at 340Cr.

10/n

This acquisition is marking its entry into the biotech space and adding to its existing three divisions - active pharmaceutical ingredients, formulations and synthesis.

The startup’s promoters and management will continue to run the business...

11/n

The startup’s promoters and management will continue to run the business...

11/n

...while Laurus Labs—having acquired just over 72.5% stake—will allow the company to scale its manufacturing.

Richcore will get a good boost in revenue from FY21 onward by the help of LAURUS LABS.

12/n

Richcore will get a good boost in revenue from FY21 onward by the help of LAURUS LABS.

12/n

Since, Richcore make ingredients, they make enzymes and they know how to make recombinant proteins.

Laurus will help Richcore in becoming a fully integrated biotech company.

By help of this acquisition, Laurus labs is aiming to become a leader in Biocatalysis.

13/n

Laurus will help Richcore in becoming a fully integrated biotech company.

By help of this acquisition, Laurus labs is aiming to become a leader in Biocatalysis.

13/n

Large geographical footprint and customer base of LAURUS will help RICHCORE boost its revenue in Future.

***End of Thread***

Thanks for reading till the last. If you are getting helped by these threads, then please share the thread with other investors. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Daumen hoch" aria-label="Emoji: Daumen hoch">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Daumen hoch" aria-label="Emoji: Daumen hoch"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="😇" title="Lächelndes Gesicht mit Heiligenschein" aria-label="Emoji: Lächelndes Gesicht mit Heiligenschein">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😇" title="Lächelndes Gesicht mit Heiligenschein" aria-label="Emoji: Lächelndes Gesicht mit Heiligenschein">

14/n

***End of Thread***

Thanks for reading till the last. If you are getting helped by these threads, then please share the thread with other investors.

14/n

Read on Twitter

Read on Twitter