1/ In a recent series of papers, I argue that many important behaviors are shaped by neglect of selection bias in social observation.

HT to @Ben_Golub for a fascinating thread about effects of neglect of selection bias. https://twitter.com/ben_golub/status/1380150221917851648?s=20">https://twitter.com/ben_golub...

HT to @Ben_Golub for a fascinating thread about effects of neglect of selection bias. https://twitter.com/ben_golub/status/1380150221917851648?s=20">https://twitter.com/ben_golub...

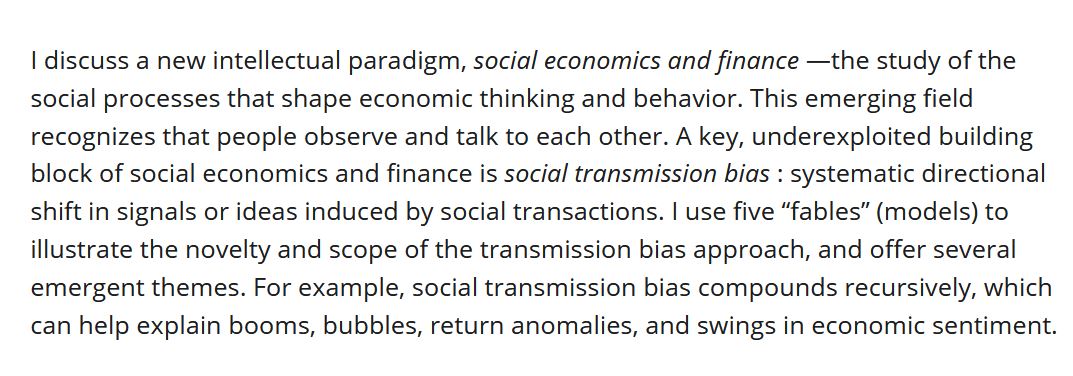

2/ In a “call to arms” paper, I argue that neglect of selection bias in social observation is one of the key sources of bias in the transmission of ideas and behaviors. https://twitter.com/4misceldah/status/1238626741641342977?s=20">https://twitter.com/4miscelda...

3/ And that in turn, bias in the social transmission of ideas and behaviors is a key intellectual building block for social economics.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3550880">https://papers.ssrn.com/sol3/pape...

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3550880">https://papers.ssrn.com/sol3/pape...

4/ As we dig further into neglect of selection bias in social observation, and observer neglect of selection bias, we find myriad examples of such effects, in the small and in the large.

#transmissionbias #socialeconomics #socialfinance

#transmissionbias #socialeconomics #socialfinance

5/ My models suggest that neglect of selection bias in social observation can explain excessive speculative trading, under-saving, real investment boom-bust dynamics, the sudden spread of political and religious movements, stock market bubbles, & return anomalies.

Specifically:

Specifically:

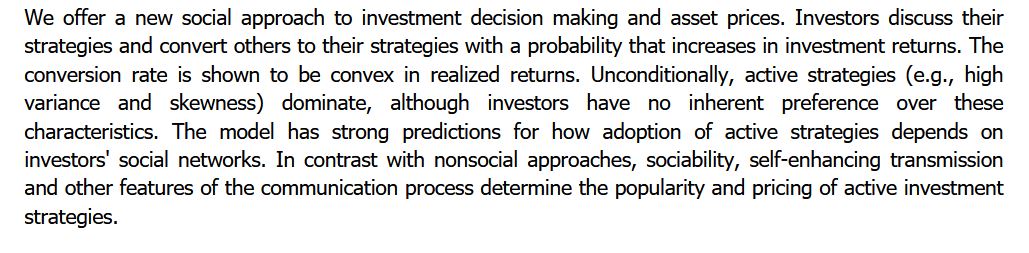

6/ Suppose that people talk about their investment successes more than failures. Then naïve listeners who hear about high returns of others will overestimate the value of high-variance and high skewness trading strategies.

https://ssrn.com/abstract=2663860">https://ssrn.com/abstract=...

https://ssrn.com/abstract=2663860">https://ssrn.com/abstract=...

7/ This explains some key empirical patterns in investor trading & asset pricing.

https://twitter.com/4misceldah/status/1277024921181253633?s=20">https://twitter.com/4miscelda... https://twitter.com/4misceldah/status/1246557106234245120?s=20">https://twitter.com/4miscelda...

https://twitter.com/4misceldah/status/1277024921181253633?s=20">https://twitter.com/4miscelda... https://twitter.com/4misceldah/status/1246557106234245120?s=20">https://twitter.com/4miscelda...

8/ Suppose that consumption activities (eating out, going on a trip, parking a boat in your driveway) are observed or posted on social media more than non-consumption.

https://twitter.com/lukestein/status/1055880100409835520?s=20">https://twitter.com/lukestein...

#saving #consumption #socialmedia

https://twitter.com/lukestein/status/1055880100409835520?s=20">https://twitter.com/lukestein...

#saving #consumption #socialmedia

9/ Then people will tend to have high estimates of others’ consumption, and infer from this that it’s safe to save little.

https://ssrn.com/abstract=2798638

https://ssrn.com/abstract=... href="https://twtext.com//hashtag/socialeconomics"> #socialeconomics #socialfinance

https://ssrn.com/abstract=2798638

10/ This can explain why people undersave, and has new policy implications for how to address this problem.

https://twitter.com/4misceldah/status/1247988523082211328?s=20">https://twitter.com/4miscelda...

#transmissionbias #socialeconomics #socialfinance

https://twitter.com/4misceldah/status/1247988523082211328?s=20">https://twitter.com/4miscelda...

#transmissionbias #socialeconomics #socialfinance

11/ Suppose that we remember successful undertakings, such as Google, more than the hundreds of contemporaneous startups that fail. Then as entrepreneurs or other firms decide in sequence whether to make an investment, they will tend to be overoptimistic and adopt too often.

12/ This can lead to booms of overadoption. This is sometimes followed by eventual collapse, but if censorship of low outcomes is extreme, incorrect booms can also last forever @jplotkin

https://twitter.com/nberpubs/status/1300523754150195200?s=20">https://twitter.com/nberpubs/...

https://ssrn.com/abstract=3675136

https://ssrn.com/abstract=... href="https://twtext.com//hashtag/transmissionbias"> #transmissionbias #SocialEcon #socialfinance

https://twitter.com/nberpubs/status/1300523754150195200?s=20">https://twitter.com/nberpubs/...

https://ssrn.com/abstract=3675136

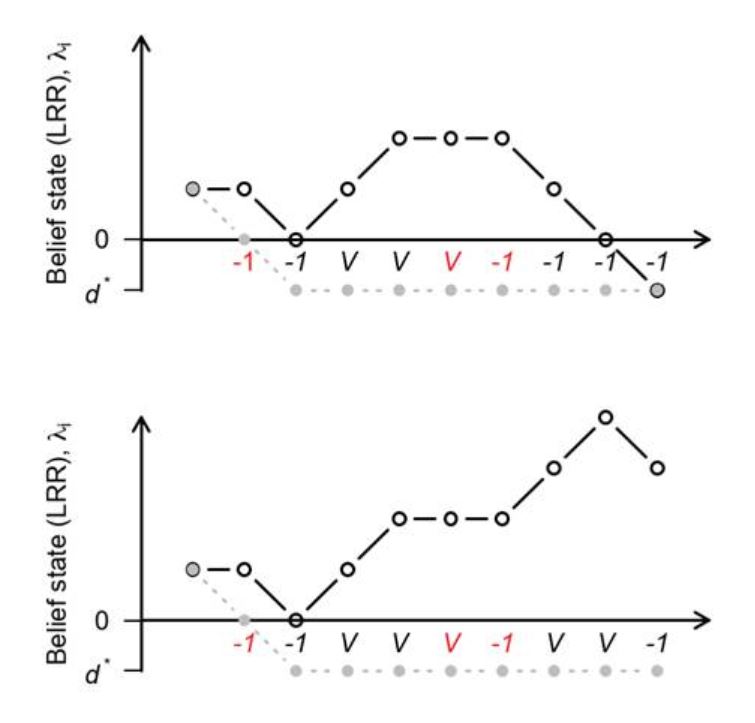

13/ Suppose that people randomly meet over time and share information signals with each about the value of joining a political movement or of buying a stock. Suppose that those with more favorable signals are slightly more likely to share their signals.

https://ssrn.com/abstract=3550880">https://ssrn.com/abstract=...

https://ssrn.com/abstract=3550880">https://ssrn.com/abstract=...

14/ Then over time overoptimism compounds recursively, causing booms, crashes, and predictable stock returns.

https://ssrn.com/abstract=3550880

https://ssrn.com/abstract=... href=" https://twitter.com/4misceldah/status/1238626741641342977?s=20">https://twitter.com/4miscelda...

#investing #stocks #transmissionbias #socialeconomics #socialfinance

https://ssrn.com/abstract=3550880

#investing #stocks #transmissionbias #socialeconomics #socialfinance

15/ Technical note: the abovementioned paper models this issue in a slightly different way. But it can be viewed as capturing metaphorically the “selection bias” intuition above.

16/ I hope these examples persuade you that selection bias in social observation, and the neglect of this bias, provide a rich direction for understanding beliefs and behavior.

Again, see @Ben_Golub thread (& @CFCamerer) for further insightful examples.

Again, see @Ben_Golub thread (& @CFCamerer) for further insightful examples.

Read on Twitter

Read on Twitter

#socialeconomics #socialfinance" title="9/ Then people will tend to have high estimates of others’ consumption, and infer from this that it’s safe to save little. https://ssrn.com/abstract=... href="https://twtext.com//hashtag/socialeconomics"> #socialeconomics #socialfinance" class="img-responsive" style="max-width:100%;"/>

#socialeconomics #socialfinance" title="9/ Then people will tend to have high estimates of others’ consumption, and infer from this that it’s safe to save little. https://ssrn.com/abstract=... href="https://twtext.com//hashtag/socialeconomics"> #socialeconomics #socialfinance" class="img-responsive" style="max-width:100%;"/>

https://twitter.com/4miscelda... #investing #stocks #transmissionbias #socialeconomics #socialfinance" title="14/ Then over time overoptimism compounds recursively, causing booms, crashes, and predictable stock returns. https://ssrn.com/abstract=... href=" https://twitter.com/4misceldah/status/1238626741641342977?s=20">https://twitter.com/4miscelda... #investing #stocks #transmissionbias #socialeconomics #socialfinance" class="img-responsive" style="max-width:100%;"/>

https://twitter.com/4miscelda... #investing #stocks #transmissionbias #socialeconomics #socialfinance" title="14/ Then over time overoptimism compounds recursively, causing booms, crashes, and predictable stock returns. https://ssrn.com/abstract=... href=" https://twitter.com/4misceldah/status/1238626741641342977?s=20">https://twitter.com/4miscelda... #investing #stocks #transmissionbias #socialeconomics #socialfinance" class="img-responsive" style="max-width:100%;"/>