Earlier today I had an exchange with @StephanieKelton. She referred me to a paper. I read the paper and it makes my point and contradicts her claim.

There is a broader lesson here about whether MMT is an alternative positive theory or normative frame. Thread.

There is a broader lesson here about whether MMT is an alternative positive theory or normative frame. Thread.

As a positive prediction, I would say that higher interest rates reduce output and lower output reduces inflation. You can debate the magnitudes but I would use those signs.

That is separate from the normative question of whether one should raise rates, target inflation, etc.

That is separate from the normative question of whether one should raise rates, target inflation, etc.

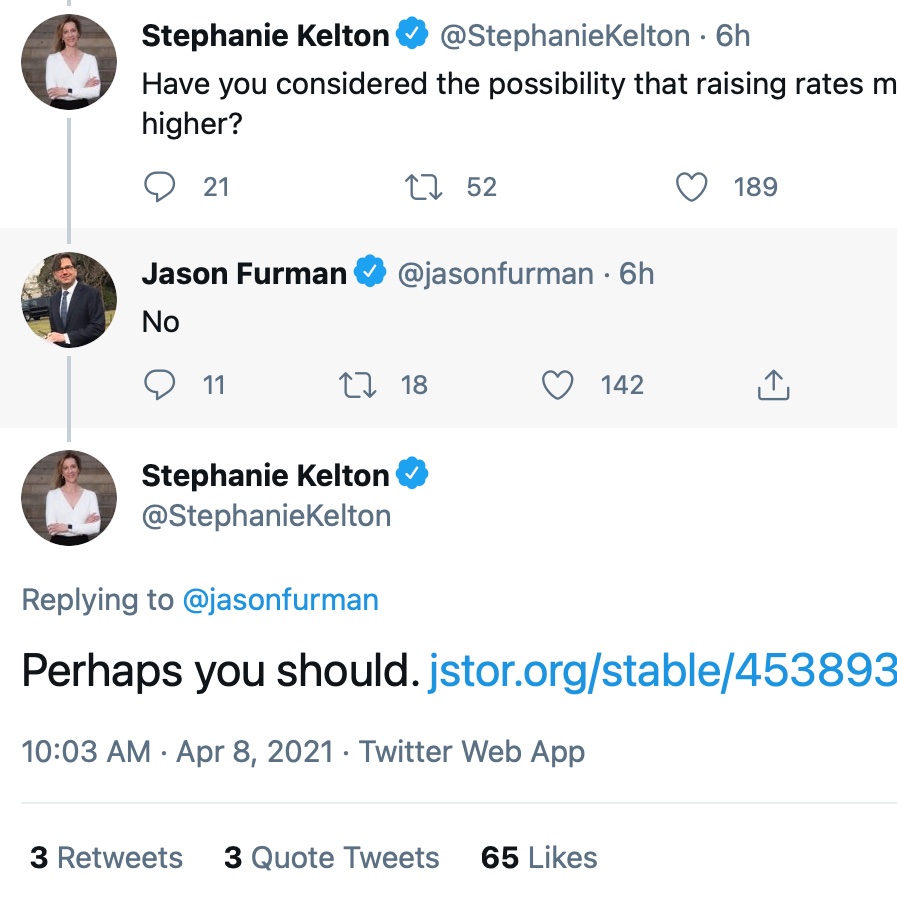

@StephanieKelton appeared to have the opposite positive prediction: "Have you considered the possibility that raising rates might move inflation higher?"

I said "No" and she cited a paper with a theoretical model and empirical estimates that *contradict* her positive statement.

I said "No" and she cited a paper with a theoretical model and empirical estimates that *contradict* her positive statement.

Specifically, the model in the paper is relatively standard and it assumes that high/rising interest rates reduce output (equation 1, the rising term is the non-standard part) & lower output lowers inflation (equation 3).

The authors also show empirical vector autoregression (VAR) that are consistent with this model (although unfortunately they do not show the full set of results).

So much for the positive part.

Now let& #39;s get to policy. The modeling exercise does indeed find that assuming a certain model, certain parameters, and certain form of Fed policy, that inflation targeting will *create* excessive output volatility.

Now let& #39;s get to policy. The modeling exercise does indeed find that assuming a certain model, certain parameters, and certain form of Fed policy, that inflation targeting will *create* excessive output volatility.

This is not an especially novel finding. It is a staple of research from Milton Friedman in the 1950s to a huge number of Fed papers to assume model different Fed reaction functions and assess their impact on inflation and output volatility.

This paper, in particular, only models a very particular form of inflation targeting that has little/no support anywhere, specifically the Fed sets the interest rate level based on solely on inflation (see equation 2).

The Fed& #39;s reaction function is better described as an inertial Taylor rule that both tries to avoid large changes in interest rates and also places weight on output gaps or unemployment.

I suspect the actual Fed policy would do better in this model than the strawman.

I suspect the actual Fed policy would do better in this model than the strawman.

To summarize:

--The model has a relatively conventional *positive* prediction.

--It simulates & finds wanting a form of monetary policy no one supports.

--Our actual monetary policy would likely do well under the model.

--If not, some other anti-inflationary rule would.

--The model has a relatively conventional *positive* prediction.

--It simulates & finds wanting a form of monetary policy no one supports.

--Our actual monetary policy would likely do well under the model.

--If not, some other anti-inflationary rule would.

As an addendum since this is where it all began: if we ever get to a world of 5% inflation and 2% unemployment I am going to be calling on the Fed to raise rates to lower inflation. I am not going to advocate middle class tax increases or spending cuts to control inflation.

Here is a jstor link to the published paper: https://www.jstor.org/stable/4538939

That">https://www.jstor.org/stable/45... appears to be gated, this is an earlier working paper version, don& #39;t know exactly how they differ:

http://www.levyinstitute.org/pubs/wp384.pdf ">https://www.levyinstitute.org/pubs/wp38...

That">https://www.jstor.org/stable/45... appears to be gated, this is an earlier working paper version, don& #39;t know exactly how they differ:

http://www.levyinstitute.org/pubs/wp384.pdf ">https://www.levyinstitute.org/pubs/wp38...

Read on Twitter

Read on Twitter