1/ In addition to the speculation surrounding ARK’s concentrated positions, there also has been much discussion on Twitter of her recent trend toward buying her own funds. You’ll be happy to know the SEC has this covered under Section 12 of the Investment Company Act.

2/ Before getting into Sec 12, many funds routinely purchase shares of other registered investment companies. And for clarity’s sake, a registered investment company is an open-end mutual fund, a closed-end, or an ETF.

3/ Ol’ Cath states in her SAI that she is allowed to buy other RIC’s as a matter of policy as you can see here. This language is in many other fund family SAI’s (mine included). This is also the activity that is TIGHTLY governed by Section 12.

4/ Section 12(d)(1)(A) of the Act places the following limits on any RIC

(1) buying more than 3% of another RIC (the “3% Limit”);

(2) investing more than 5% of its assets in a single RIC (the “5% Limit”);

(3) investing more than 10% of its assets in RIC& #39;s (the “10% Limit”)

(1) buying more than 3% of another RIC (the “3% Limit”);

(2) investing more than 5% of its assets in a single RIC (the “5% Limit”);

(3) investing more than 10% of its assets in RIC& #39;s (the “10% Limit”)

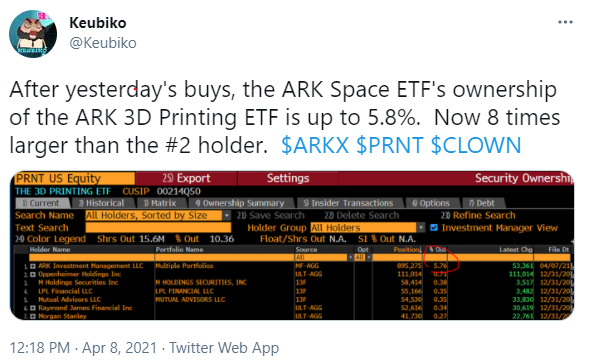

5/ In short, a RIC can’t own 3% of the outstanding shares of another, it can’t allocate more than 5% of IT’S assets to one RIC, and it can’t have more than 10% of its portfolio in RIC’s unless. . . the other RIC is affiliated – i.e., run by the same management company.

6/ Section 12(d)(1)(G) of the 1940 Act permits mutual funds and unit investment trusts (“UITs”) to acquire unlimited shares in other mutual funds or UITs in the same fund complex. There are two aspects of this rule worth exploring here: fee layering and redemptions.

7/ Generally speaking, if you invest in your own funds, you should (not mandatory) back out the portion of fees earned from your stake in the purchased fund. Your Fund A buys 1.0mm in your Fund B, your fee calc in Fund A needs to back out the AUM in Fund B.

8/ This calculation is done by the Trust admin, in Cathie’s case, BONY. There is also a qualitative element: to justify the purchase, 12(d)(1) requires the acquiring fund’s adviser to determine that it is in the best interest of the acquiring fund to invest in the acquired fund.

9/ So, a good faith effort needs to be made to determine the exposure gained is more efficient and better for shareholders by using the acquired fund INSTEAD of the individual stocks that make it up.

10/Usually this works when a fund buys a long/short fund for hedging purchases, or an EM fund because you can’t settle locally or don’t want to buy ADR’s or something. That’s an easy justification.

11/ I can’t for the life of me figure out the justification for ARKK buying PRNT or ARKX or whateverthefrig she does, instead of just the underlying stocks. It’s certainly more expensive for shareholders but better for ARK’s AUM management. Ultimately it is a board decision.

12/ The more interesting angle is with respect to. . . redemptions. To address concerns that an acquiring fund could threaten large-scale redemptions as a means of exercising undue influence over an acquired fund. . .

13/ 12(d)(1) prohibits a fund that acquires more than 3% of an acquired fund’s outstanding shares from redeeming more than 3% of an acquired fund’s total outstanding shares in any 30-day period.

14/ Here’s where it gets really fun: an affiliated fund is ALSO restricted in its ability to redeem affiliated funds. Prior to 2019, affiliated fund of funds could freely redeem significant amounts of affiliated underlying funds.

15/ This also means the acquiring fund would need to treat its now redemption-restricted investment as illiquid. Remember yesterday’s discussion on liquidity?

16/ There are a whole host of other issues in play here far too complicated for this thread. Suffice it to say in my prior life I had a front row seat for 12(d)(1) issues and learned some expensive and painful lessons in the process (another thread someday).

17/ So many people that cover Investment Companies know so little about the plumbing. Beware of idiot Bloomberg writers who should know better but don& #39;t. It amazes me how clueless people are that are supposed to be knowledgeable about the space they cover.

What she’s doing is allowed. With limits. I can’t find a purchase rationale for the affiliated funds, but then I don’t pray with Billy Hwang either. She probably isn’t double-dipping but either way, this is on the board to permit and monitor.

Read on Twitter

Read on Twitter