1/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> I don& #39;t think the insane efficiency of @Uniswap v3 has sunk in yet. Just how efficient is it?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> I don& #39;t think the insane efficiency of @Uniswap v3 has sunk in yet. Just how efficient is it?

The equation for calculating the efficiency of a concentrated v3 position relative to providing to the entire v2 curve:

1/(1 - (a/b)^(1/4))

where a and b are your price bounds

The equation for calculating the efficiency of a concentrated v3 position relative to providing to the entire v2 curve:

1/(1 - (a/b)^(1/4))

where a and b are your price bounds

2/

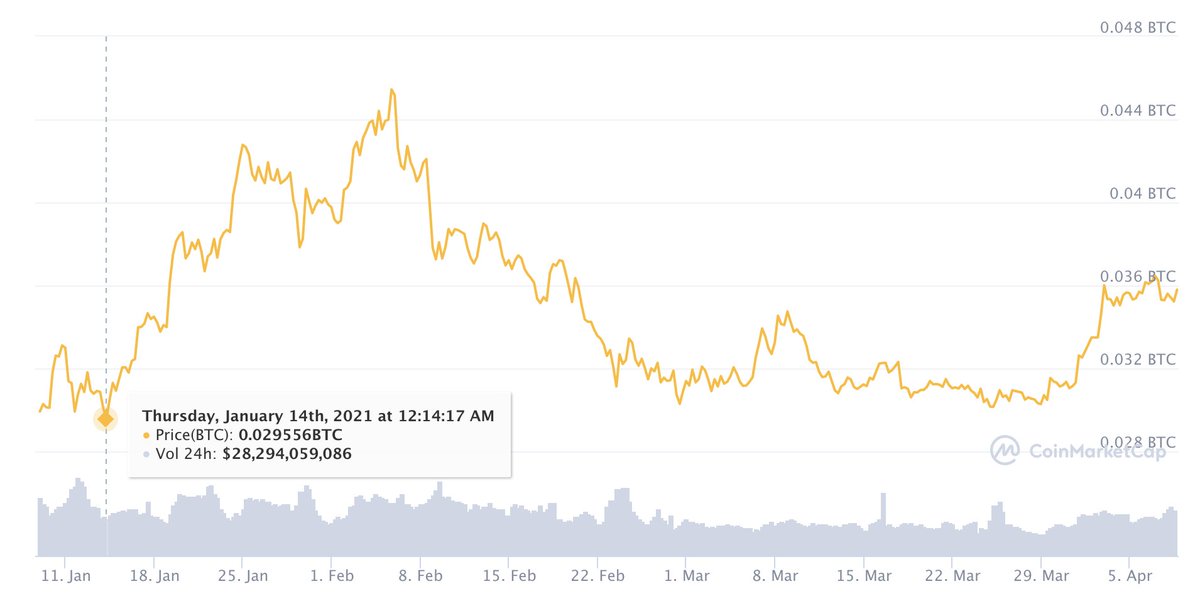

Over the past 3 months (Jan8-present) the price of ETH/BTC has ranged from 0.0295 to 0.0454

Plugging into the formula, we find it is 9.8x more efficient than v2

So what does this actually mean?

Over the past 3 months (Jan8-present) the price of ETH/BTC has ranged from 0.0295 to 0.0454

Plugging into the formula, we find it is 9.8x more efficient than v2

So what does this actually mean?

3/

Today, the Uniswap v2 WBTC/ETH pair has $318m in it.

If WBTC/ETH LPs instead provided to the range of 0.0295 and 0.0454 on v3 they could create the same amount of liquidity, and take on the same amount of impermanent loss with just

318/9.8 = $32m

Today, the Uniswap v2 WBTC/ETH pair has $318m in it.

If WBTC/ETH LPs instead provided to the range of 0.0295 and 0.0454 on v3 they could create the same amount of liquidity, and take on the same amount of impermanent loss with just

318/9.8 = $32m

4/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf"> The pools would have behaved identically, except that v3 LPs would be taking on 10% of the inventory risk and required only 10% of the upfront capital

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf"> The pools would have behaved identically, except that v3 LPs would be taking on 10% of the inventory risk and required only 10% of the upfront capital

You can create identical liquidity with far less capital. You can also create more with the same amount of capital.

You can create identical liquidity with far less capital. You can also create more with the same amount of capital.

5/

If the $318m of v2 liquidity was deposited to a v3 position between 0.0295 and 0.0454 it would create the equivalent of:

318*9.8=$3.1b

in Uniswap v2 liquidity, with the same amount of upfront capital / inventory risk and 9.8 increased impermanent loss

If the $318m of v2 liquidity was deposited to a v3 position between 0.0295 and 0.0454 it would create the equivalent of:

318*9.8=$3.1b

in Uniswap v2 liquidity, with the same amount of upfront capital / inventory risk and 9.8 increased impermanent loss

6/

Efficiency is just a means to an end - the result of concentrated liquidity is offering far better execution rates and giving LPs more desirable positions

How much better will they be once v3 is live? These things can be hard to predict.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete"> But i have a good feeling

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete"> But i have a good feeling

Efficiency is just a means to an end - the result of concentrated liquidity is offering far better execution rates and giving LPs more desirable positions

How much better will they be once v3 is live? These things can be hard to predict.

Read on Twitter

Read on Twitter