Thread on taxes paid by US multinationals, for perspective on magnitudes https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

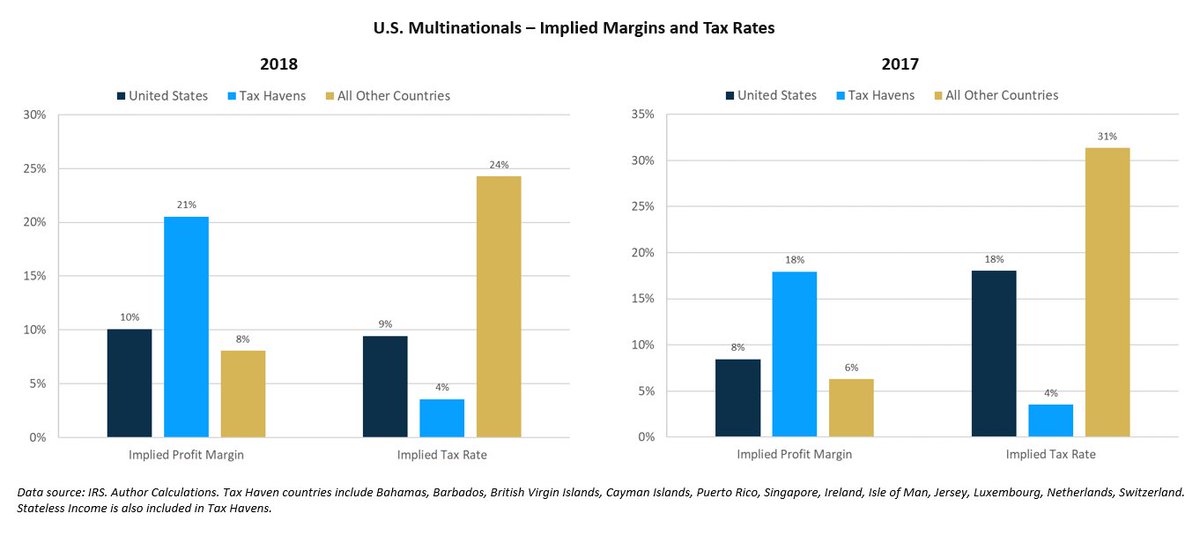

Even post-TCJA (Tax Cut & Jobs Act of 2017), we didn& #39;t see a shift in profits away from tax havens.

28% of 2018 profits were generated in tax havens, similar to 2017.

(IRS yet to release 2019 data)

1/

Even post-TCJA (Tax Cut & Jobs Act of 2017), we didn& #39;t see a shift in profits away from tax havens.

28% of 2018 profits were generated in tax havens, similar to 2017.

(IRS yet to release 2019 data)

1/

65% of foreign profits were generated in tax havens, incl. Caribbean, Ireland, Singapore, Netherlands, Switzerland, Puerto Rico (favored by pharma).

And it hardly changed between 2017 & 2018.

Note this is up from ~25% in mid-1990s. via @M_C_Klein.

https://www.ft.com/content/47d783ce-bc20-3046-83c6-d39e031c4b46

2/">https://www.ft.com/content/4...

And it hardly changed between 2017 & 2018.

Note this is up from ~25% in mid-1990s. via @M_C_Klein.

https://www.ft.com/content/47d783ce-bc20-3046-83c6-d39e031c4b46

2/">https://www.ft.com/content/4...

Some numbers -

2017

US Profits ~ $1.2 tr

Taxes paid ~ $213 bil

Implied rate ~ 18%

So even prior to TCJA, firms were paying nowhere close to top US rate of 35%.

And implied rate collapsed post-TCJA.

2018

US profits ~ $1.5 tr

Taxes paid ~ $141 bil

Implied rate ~ 9%

3/

2017

US Profits ~ $1.2 tr

Taxes paid ~ $213 bil

Implied rate ~ 18%

So even prior to TCJA, firms were paying nowhere close to top US rate of 35%.

And implied rate collapsed post-TCJA.

2018

US profits ~ $1.5 tr

Taxes paid ~ $141 bil

Implied rate ~ 9%

3/

Outside US -

2017

Tax Havens

Profits ~ $554 bil

Taxes ~ $20 bil (4% implied rate)

All Other

Profits ~ $288 bil

Taxes ~ $90 bil (31%)

2018

Tax Havens

Profits ~ $725 bil

Taxes ~ $26 bil (4%)

All Other

Profits ~ $391 bil

Taxes ~ $95 bil (24%)

4/

2017

Tax Havens

Profits ~ $554 bil

Taxes ~ $20 bil (4% implied rate)

All Other

Profits ~ $288 bil

Taxes ~ $90 bil (31%)

2018

Tax Havens

Profits ~ $725 bil

Taxes ~ $26 bil (4%)

All Other

Profits ~ $391 bil

Taxes ~ $95 bil (24%)

4/

Firms continued to use tax havens post-TCJA, with an effective tax rate of ~ 4%.

Offshore tax haven profits were ~ 3.5% of GDP in 2018, vs 2.8% in 2017.

It could be that these areas are ultra-productive (with large profit margins), or ...

its simply tax-shifting.

5/

Offshore tax haven profits were ~ 3.5% of GDP in 2018, vs 2.8% in 2017.

It could be that these areas are ultra-productive (with large profit margins), or ...

its simply tax-shifting.

5/

TCJA taxes offshore profits at 10.5% (global minimum tax rate on intangibles, or GILTI).

Which can be lowered if a firm has significant tangible assets (e.g. factories) abroad.

As @Brad_Setser noted, this incentivized moving production offshore.

https://www.cfr.org/blog/why-us-tax-reforms-international-provisions-need-be-reformed

6/">https://www.cfr.org/blog/why-...

Which can be lowered if a firm has significant tangible assets (e.g. factories) abroad.

As @Brad_Setser noted, this incentivized moving production offshore.

https://www.cfr.org/blog/why-us-tax-reforms-international-provisions-need-be-reformed

6/">https://www.cfr.org/blog/why-...

Case in point: Pharma

The pharmaceutical trade deficit is up ~$50 bil since TCJA passed (through Feb & #39;21).

Imports are up almost $55 bil.

These imports are mostly coming from Ireland/Switzerland, as the game got easier after TCJA.

https://twitter.com/Brad_Setser/status/1225474139844235273?s=20">https://twitter.com/Brad_Sets...

7/

The pharmaceutical trade deficit is up ~$50 bil since TCJA passed (through Feb & #39;21).

Imports are up almost $55 bil.

These imports are mostly coming from Ireland/Switzerland, as the game got easier after TCJA.

https://twitter.com/Brad_Setser/status/1225474139844235273?s=20">https://twitter.com/Brad_Sets...

7/

Not sure how easy it is to have a common global minimum corporate tax, as @SecYellen and G20 want.

But the proposal to apply a minimum tax on a country-by-country basis (instead of current GILTI) probably more realistic, as Congress can just do it.

https://www.wsj.com/articles/a-better-corporate-tax-for-america-11617813355

8/">https://www.wsj.com/articles/...

But the proposal to apply a minimum tax on a country-by-country basis (instead of current GILTI) probably more realistic, as Congress can just do it.

https://www.wsj.com/articles/a-better-corporate-tax-for-america-11617813355

8/">https://www.wsj.com/articles/...

Eg. Say a firm earns $100 bil in Bermuda (w/ 0% tax rate).

They could move a factory to Germany that generates $100 bil profits, on which they pay $21 mil taxes (21% rate).

So global average rate is 10.5%, meeting current GILTI requirement.

https://www.theatlantic.com/business/archive/2017/12/tax-jobs-overseas/547916/

9/">https://www.theatlantic.com/business/...

They could move a factory to Germany that generates $100 bil profits, on which they pay $21 mil taxes (21% rate).

So global average rate is 10.5%, meeting current GILTI requirement.

https://www.theatlantic.com/business/archive/2017/12/tax-jobs-overseas/547916/

9/">https://www.theatlantic.com/business/...

But, if the minimum is applied on a country-by-country basis, the firm would have to pay $10.5 million on $100 mil profits generated in Bermuda.

No more averaging of GILTI taxes.

Minimum rate could even be raised to 15-21% (GILTI already set to go up to 13.125% in 2026).

10/

No more averaging of GILTI taxes.

Minimum rate could even be raised to 15-21% (GILTI already set to go up to 13.125% in 2026).

10/

Rough back of envelope calc -

Assume $1 billion in tax haven profits now, and increasing 5% a year.

A new 15% minimum rate would raise ~ $1.5tr over 10 years (capturing the difference between current 4% effective rate & the new rate).

Insofar as raising revenue matters.

11/

Assume $1 billion in tax haven profits now, and increasing 5% a year.

A new 15% minimum rate would raise ~ $1.5tr over 10 years (capturing the difference between current 4% effective rate & the new rate).

Insofar as raising revenue matters.

11/

But as @nosunkcosts points out, this is actual populism.

The group of losers here is small and concentrated, i.e. companies that shift profits to the tax havens like the Caribbean Islands, Ireland, Netherlands, Switzerland, Singapore, etc.

12/

The group of losers here is small and concentrated, i.e. companies that shift profits to the tax havens like the Caribbean Islands, Ireland, Netherlands, Switzerland, Singapore, etc.

12/

With respect to raising the corporate tax rate to 28%, I& #39;m with @NewRiverInvest in that it would simply result in a lot more games being played, w/ accounting firms gaining.

Keep as is, or increase to 25%. This is looking pretty likely already.

https://twitter.com/NewRiverInvest/status/1374571467405361154?s=20

end/">https://twitter.com/NewRiverI...

Keep as is, or increase to 25%. This is looking pretty likely already.

https://twitter.com/NewRiverInvest/status/1374571467405361154?s=20

end/">https://twitter.com/NewRiverI...

Read on Twitter

Read on Twitter Even post-TCJA (Tax Cut & Jobs Act of 2017), we didn& #39;t see a shift in profits away from tax havens.28% of 2018 profits were generated in tax havens, similar to 2017.(IRS yet to release 2019 data)1/" title="Thread on taxes paid by US multinationals, for perspective on magnitudeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> Even post-TCJA (Tax Cut & Jobs Act of 2017), we didn& #39;t see a shift in profits away from tax havens.28% of 2018 profits were generated in tax havens, similar to 2017.(IRS yet to release 2019 data)1/" class="img-responsive" style="max-width:100%;"/>

Even post-TCJA (Tax Cut & Jobs Act of 2017), we didn& #39;t see a shift in profits away from tax havens.28% of 2018 profits were generated in tax havens, similar to 2017.(IRS yet to release 2019 data)1/" title="Thread on taxes paid by US multinationals, for perspective on magnitudeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> Even post-TCJA (Tax Cut & Jobs Act of 2017), we didn& #39;t see a shift in profits away from tax havens.28% of 2018 profits were generated in tax havens, similar to 2017.(IRS yet to release 2019 data)1/" class="img-responsive" style="max-width:100%;"/>