1. Hello everyone again! This time the thread goes to http://ape.tax"> http://ape.tax and @poolpitako ! He is the developer behind the vaults!

There were too many questions about it, so i want to make a thread about it! Let& #39;s start!

$ftm

There were too many questions about it, so i want to make a thread about it! Let& #39;s start!

$ftm

2. Vaults in #DeFi grants too much advantage to depositors. Because tx fees are distributed among people(even if they are 0.00001$ in ftm) , and those contracts automates the system so you don& #39;t have to claim&restake every time.

You just deposit and wait.

Vault magic. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦍" title="Gorilla" aria-label="Emoji: Gorilla">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦍" title="Gorilla" aria-label="Emoji: Gorilla">

You just deposit and wait.

Vault magic.

3. As we have our first big farm on #opera, the first strategic vault deployed on http://ape.tax"> http://ape.tax by @poolpitako !

At first, it was basically stake $ICE for you on http://popsicle.finance"> http://popsicle.finance , then restakes it. And it was too aggressive because of zero-cost fees on $ftm!

At first, it was basically stake $ICE for you on http://popsicle.finance"> http://popsicle.finance , then restakes it. And it was too aggressive because of zero-cost fees on $ftm!

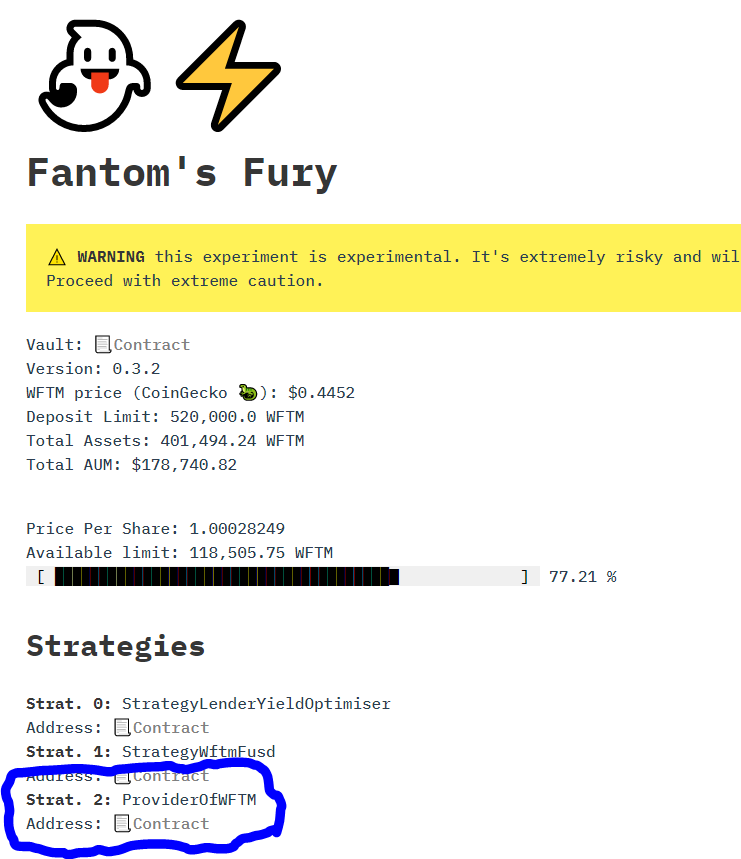

4. We had wFTM vault too, but there was no good strategy for wFTM beyond minting fUSD for yield. The vault was basically waiting for fLend to lend wFTM there.

But the octopus found a genius way!

But the octopus found a genius way!

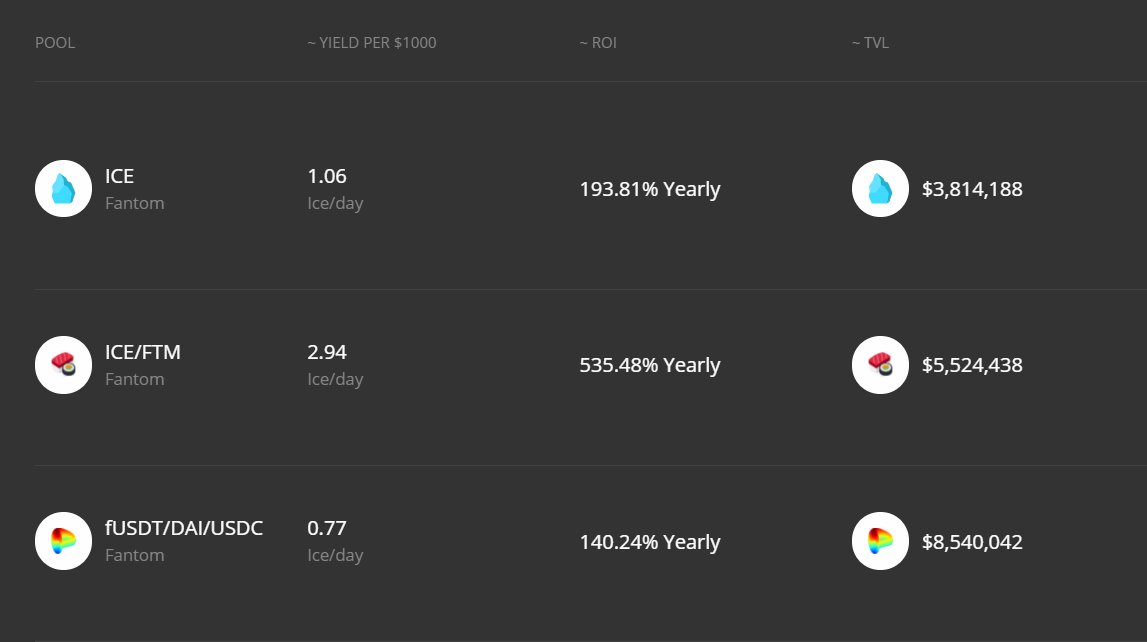

5. The best yield farm on http://popsicle.finance"> http://popsicle.finance is ICE/FTM liquidity pool right now.

And we have $ICE on one vault.

And we have $FTM on the other vault.

Hmmmm.

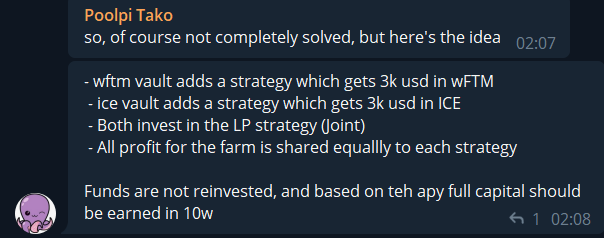

Yes you guessed it right. He linked the both vaults in the last strategy!

And we have $ICE on one vault.

And we have $FTM on the other vault.

Hmmmm.

Yes you guessed it right. He linked the both vaults in the last strategy!

6. $3k worth of tokens from both pools went to the liquidity pools to farm some $ICE!

It& #39;s a bit risky because of impermanent loss, but if nothing extremely bad happens, full capital will be earned in just 10 weeks!

It& #39;s a bit risky because of impermanent loss, but if nothing extremely bad happens, full capital will be earned in just 10 weeks!

7. This is a great way for seeing the potential of the vaults, and how can they be linked.

And i assume because the fees are so cheap, developers can try out strategies without concerning about the money.

Fantom opera mainnet is basically test in prod environment for devs!

And i assume because the fees are so cheap, developers can try out strategies without concerning about the money.

Fantom opera mainnet is basically test in prod environment for devs!

8.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦍" title="Gorilla" aria-label="Emoji: Gorilla">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦍" title="Gorilla" aria-label="Emoji: Gorilla"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤝" title="Handschlag" aria-label="Emoji: Handschlag">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤝" title="Handschlag" aria-label="Emoji: Handschlag"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps">

Apes. Together. Strong.

Don& #39;t forget that these experimental experiments are extremely risky, and don& #39;t play with the money you don& #39;t want to lose, and happy aping!

Apes. Together. Strong.

Don& #39;t forget that these experimental experiments are extremely risky, and don& #39;t play with the money you don& #39;t want to lose, and happy aping!

Read on Twitter

Read on Twitter

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤝" title="Handschlag" aria-label="Emoji: Handschlag">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps">Apes. Together. Strong.Don& #39;t forget that these experimental experiments are extremely risky, and don& #39;t play with the money you don& #39;t want to lose, and happy aping!" title="8. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦍" title="Gorilla" aria-label="Emoji: Gorilla">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤝" title="Handschlag" aria-label="Emoji: Handschlag">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps">Apes. Together. Strong.Don& #39;t forget that these experimental experiments are extremely risky, and don& #39;t play with the money you don& #39;t want to lose, and happy aping!" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤝" title="Handschlag" aria-label="Emoji: Handschlag">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps">Apes. Together. Strong.Don& #39;t forget that these experimental experiments are extremely risky, and don& #39;t play with the money you don& #39;t want to lose, and happy aping!" title="8. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦍" title="Gorilla" aria-label="Emoji: Gorilla">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤝" title="Handschlag" aria-label="Emoji: Handschlag">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps">Apes. Together. Strong.Don& #39;t forget that these experimental experiments are extremely risky, and don& #39;t play with the money you don& #39;t want to lose, and happy aping!" class="img-responsive" style="max-width:100%;"/>