Leading up to today& #39;s Clubhouse, @Delphi_Digital is excited to share our proposal for @PowerTradeHQ& #39;s token economics: https://www.delphidigital.io/reports/proposed-powertrade-token-economics/

We">https://www.delphidigital.io/reports/p... see Powertrade& #39;s tokenized insurance fund as the next step in exchange token econ

Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

We">https://www.delphidigital.io/reports/p... see Powertrade& #39;s tokenized insurance fund as the next step in exchange token econ

Thread

1/12 @PowerTradeHQ will initially operate as a CEX focusing on leveraged products including options and perps

Rather than do a burn/discount token a la $BNB / $FTT, Powertrade takes this a step further by tokenizing its insurance fund and putting it in the hands of $PTF holders

Rather than do a burn/discount token a la $BNB / $FTT, Powertrade takes this a step further by tokenizing its insurance fund and putting it in the hands of $PTF holders

2/12 The high-level architecture consists of three main pieces:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">DAO

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">DAO

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Insurance Fund

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Insurance Fund

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Exchange

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Exchange

The DAO governs the insurance fund which underwrites the exchange, deciding on capital allocation, risk framework and assessing incoming claims

The DAO governs the insurance fund which underwrites the exchange, deciding on capital allocation, risk framework and assessing incoming claims

3/12 We believe protocols in which governors make risk decisions that affect 3rd parties (i.e. users) should ensure governors bear the consequences of their decisions, both positive and negative

@AaveAave& #39;s safety module is a great example of this principle in action

@AaveAave& #39;s safety module is a great example of this principle in action

4/12 We& #39;ve taken this skin-in-the-game approach for $PTF

The DAO will be governed by PTF holders who stake into it, receiving xPTF which grants them governance and cashflow rights

xPTF also acts as the senior tranche, backstopping claims which cannot be fully covered by the IF

The DAO will be governed by PTF holders who stake into it, receiving xPTF which grants them governance and cashflow rights

xPTF also acts as the senior tranche, backstopping claims which cannot be fully covered by the IF

5/12 The IF is the junior tranche, which will be built up over time via fee revenue from the exchange

In the meanwhile, we will run an "insurance mining campaign", incentivizing USDC holders to stake into the IF in exchange for PTF rewards (h/t @DDX_Official for the idea)

In the meanwhile, we will run an "insurance mining campaign", incentivizing USDC holders to stake into the IF in exchange for PTF rewards (h/t @DDX_Official for the idea)

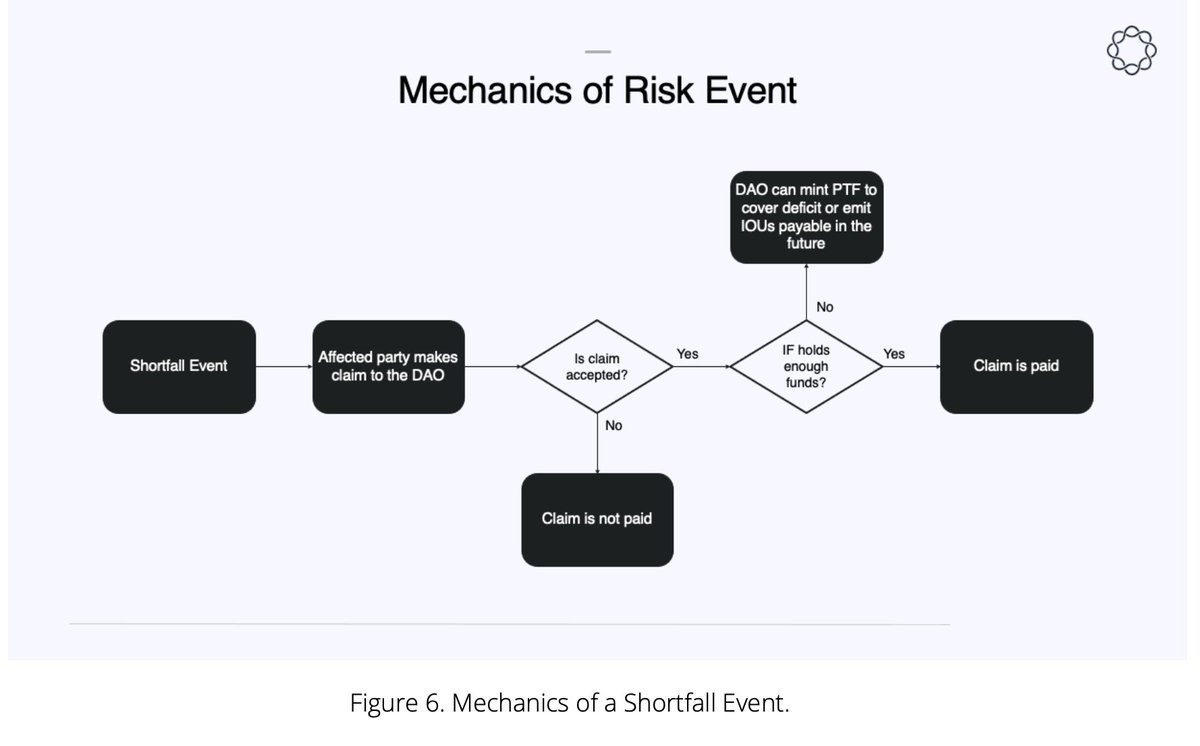

6/12 If a shortfall event occurs, the 3-tranche architecture kicks in:

1st tranche: IF Fees Pool

2nd tranche: IF Staking Pool

3rd tranche: xPTF staking pool (up to 30% auctioned off to cover deficit)

If this isn& #39;t enough, the DAO can choose to mint PTF or issue debt tokens

1st tranche: IF Fees Pool

2nd tranche: IF Staking Pool

3rd tranche: xPTF staking pool (up to 30% auctioned off to cover deficit)

If this isn& #39;t enough, the DAO can choose to mint PTF or issue debt tokens

7/12 25% of fees will flow to the DAO, split as follows:

Before IF is sufficiently capitalized: 80% IF, 20% xPTF

After IF is sufficiently capitalized: 100% xPTF

The necessary capital ratio for the IF will be determined based on a risk framework to be approved by governors

Before IF is sufficiently capitalized: 80% IF, 20% xPTF

After IF is sufficiently capitalized: 100% xPTF

The necessary capital ratio for the IF will be determined based on a risk framework to be approved by governors

8/12 The risk framework is a key piece of the system and should be considered carefully and monitored/updated regularly by governance

@Delphi_Digital has proposed an initial risk assessment methodology, but exploring it is outside the scope of this piece

@Delphi_Digital has proposed an initial risk assessment methodology, but exploring it is outside the scope of this piece

9/12 The DAO could be incentivized to approve an overly optimistic risk framework in order to generate more profits for stakers. However, this would be as shortsighted as $NXM holders refusing to pay out claims

In the long-run, it will cause lack of trust in the exchange

In the long-run, it will cause lack of trust in the exchange

10/12 Nevertheless, to further align incentives between DAO stakers and exchange users, we propose a tiered benefits system for stakers, pictured below

11/12 This means xPTF holders are incentivized to use the exchange to receive fee rebates and maximize utility of their token holdings

OTOH, large exchange users are incentivized to become xPTF holders in order to reduce fee cost and maximize trading profits

OTOH, large exchange users are incentivized to become xPTF holders in order to reduce fee cost and maximize trading profits

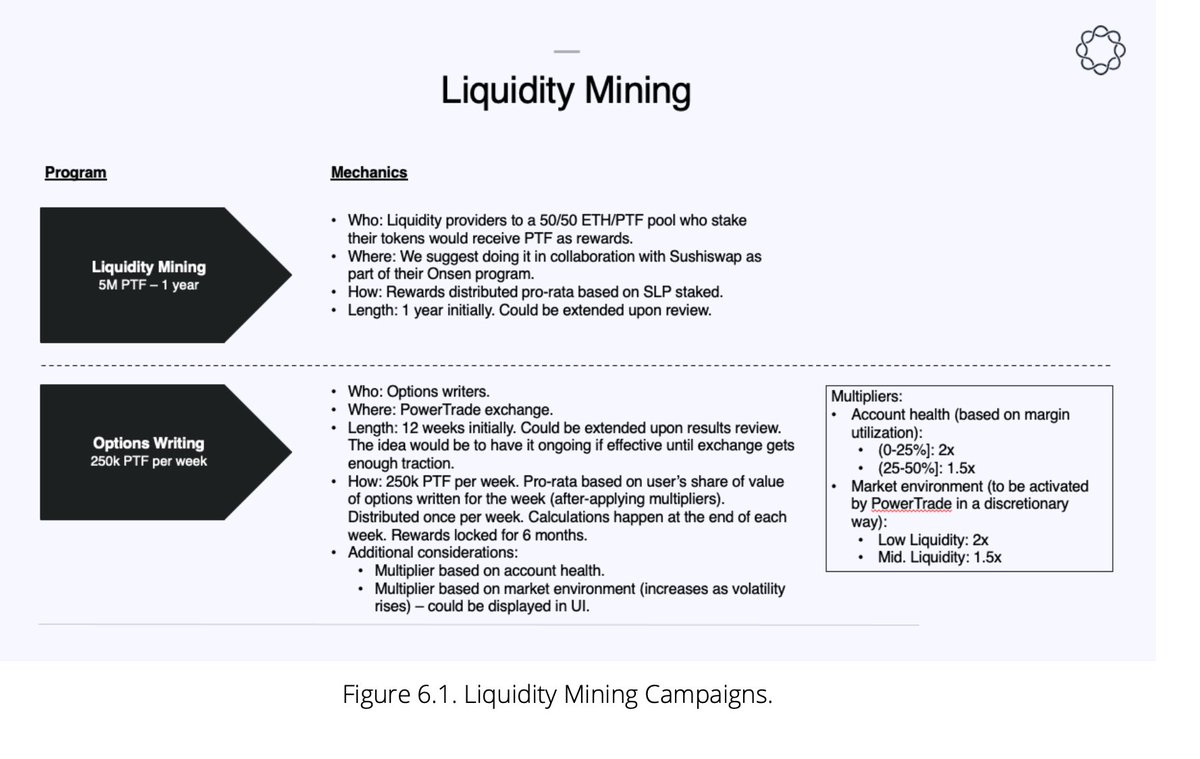

12/12 Liquidity mining

In addition to standard pool 2 incentives, we also designed two separate incentive campaigns aimed at building up targeted liquidity for perps and options while avoiding wash trading

In addition to standard pool 2 incentives, we also designed two separate incentive campaigns aimed at building up targeted liquidity for perps and options while avoiding wash trading

Will be discussing all of this and more on our Clubhouse chat in 1 hour with @StaniKulechov , @_TomHoward and @YanLiberman

Join us here: https://joinclubhouse.com/event/xLJE50EV

We">https://joinclubhouse.com/event/xLJ... look forward to getting the community& #39;s feedback on our proposal! https://twitter.com/PowerTradeHQ/status/1379845657440051202">https://twitter.com/PowerTrad...

Join us here: https://joinclubhouse.com/event/xLJE50EV

We">https://joinclubhouse.com/event/xLJ... look forward to getting the community& #39;s feedback on our proposal! https://twitter.com/PowerTradeHQ/status/1379845657440051202">https://twitter.com/PowerTrad...

Read on Twitter

Read on Twitter DAOhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Insurance Fundhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Exchange The DAO governs the insurance fund which underwrites the exchange, deciding on capital allocation, risk framework and assessing incoming claims" title="2/12 The high-level architecture consists of three main pieces:https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">DAOhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Insurance Fundhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Exchange The DAO governs the insurance fund which underwrites the exchange, deciding on capital allocation, risk framework and assessing incoming claims" class="img-responsive" style="max-width:100%;"/>

DAOhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Insurance Fundhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Exchange The DAO governs the insurance fund which underwrites the exchange, deciding on capital allocation, risk framework and assessing incoming claims" title="2/12 The high-level architecture consists of three main pieces:https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">DAOhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Insurance Fundhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔹" title="Kleine blaue Raute" aria-label="Emoji: Kleine blaue Raute">Exchange The DAO governs the insurance fund which underwrites the exchange, deciding on capital allocation, risk framework and assessing incoming claims" class="img-responsive" style="max-width:100%;"/>