Everyone talks about Asset Allocation. But no one tells you how to choose one.

Here is a thread on how to do it https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Here is a thread on how to do it

Reduce No of Decisions: Don& #39;t overcomplicate by debating 60% vs 62% vs 65%

Simplify into 5 levels

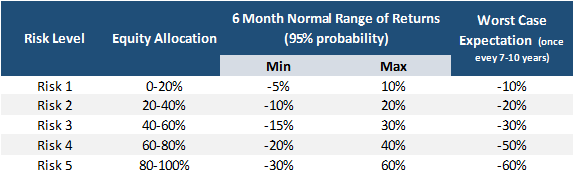

Risk Level 1: 10% Equity: 90% Debt

Risk Level 2: 30% Equity: 70% Debt

Risk Level 3: 50% Equity: 50% Debt

Risk Level 4: 70% Equity: 30% Debt

Risk Level 5: 90% Equity: 10% Debt

Simplify into 5 levels

Risk Level 1: 10% Equity: 90% Debt

Risk Level 2: 30% Equity: 70% Debt

Risk Level 3: 50% Equity: 50% Debt

Risk Level 4: 70% Equity: 30% Debt

Risk Level 5: 90% Equity: 10% Debt

70% Equity: 30% Debt - in the long term, if rebalanced back to original allocation every year (for +/- 5% deviation), provides a return close to 100% Equity.

So, go beyond 70% equity allocation only if - time frame >15 years + you have successfully handled 1-2 bear markets

So, go beyond 70% equity allocation only if - time frame >15 years + you have successfully handled 1-2 bear markets

Now onto our simple framework

TTT Framework

1. Time Frame

2. Tolerance to Declines

3. Tradeoff

TTT Framework

1. Time Frame

2. Tolerance to Declines

3. Tradeoff

2. Tolerance to Declines

English Translation: What extent of temporary portfolio declines will you be ok with?

There are 2 types of temporary declines:

1. Normal: 95% odds

2. Unusual: Can& #39;t be qualified - will happen but no idea when - worst case outcomes

English Translation: What extent of temporary portfolio declines will you be ok with?

There are 2 types of temporary declines:

1. Normal: 95% odds

2. Unusual: Can& #39;t be qualified - will happen but no idea when - worst case outcomes

Normal Temporary Declines:

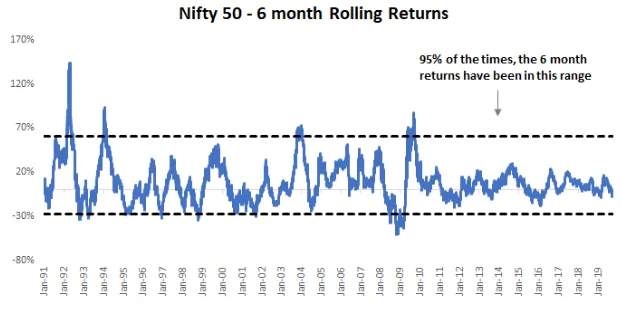

95% of the times the 6-month range of return outcomes for Indian Equities were between -27% to 61%.

95% of the times the 6-month range of return outcomes for Indian Equities were between -27% to 61%.

Similar takeaways from Sensex intra-year declines for the last 40+ years

10-20% temporary declines in equities are as common as your birthday!

10-20% temporary declines in equities are as common as your birthday!

Unusual Temporary Declines:

But sh*t happens!

30-60% falls while not frequent do happen roughly once every 7-10 years

But sh*t happens!

30-60% falls while not frequent do happen roughly once every 7-10 years

Convert % into values based on your portfolio size.

Eg for 1 cr portfolio.

Choose your poison based on the asset allocation you can live with...

Eg for 1 cr portfolio.

Choose your poison based on the asset allocation you can live with...

3. Tradeoff between risk and returns

Add in the return expectations (a rough sensible guess)

Assuming equity returns at 12% and debt returns at 6%...

Add in the return expectations (a rough sensible guess)

Assuming equity returns at 12% and debt returns at 6%...

Appreciate the tradeoff.

If you have chosen Risk 3, the drop from Risk 4 to Risk 3 will cost us around Rs 28 lakhs in the future.

But that’s fine. This is the cost for reducing our anxiety and sleeping well.

If you have chosen Risk 3, the drop from Risk 4 to Risk 3 will cost us around Rs 28 lakhs in the future.

But that’s fine. This is the cost for reducing our anxiety and sleeping well.

While moving back to Risk 4 might seem tempting, the key is that you need to really introspect if you will be able to stay through the journey to enjoy the outcome.

Based on all the above, pick your asset allocation knowing both the likely short term pain and long term gain.

Based on all the above, pick your asset allocation knowing both the likely short term pain and long term gain.

Summing it up:

TTT Framework

1. Time Frame

* Higher the time frame higher the equity allocation

* Not more than 70% Equity Allocation

TTT Framework

1. Time Frame

* Higher the time frame higher the equity allocation

* Not more than 70% Equity Allocation

2. Tolerance for Declines

* Expected Normal Declines

* Expected Worst Case Declines

* Check in actual values and not percentages

* Adjust chosen asset allocation based on past behavior

* Expected Normal Declines

* Expected Worst Case Declines

* Check in actual values and not percentages

* Adjust chosen asset allocation based on past behavior

3. Tradeoff between risk and returns

* Understand the long term trade off in returns

Own your choice and rebalance every year for +/-5% deviation.

If you like to read about this in detail check here

Happy Investing :) https://eightytwentyinvestor.com/2020/11/08/the-eighty-twenty-investor-approach-to-decide-your-asset-allocation-mix/">https://eightytwentyinvestor.com/2020/11/0...

* Understand the long term trade off in returns

Own your choice and rebalance every year for +/-5% deviation.

If you like to read about this in detail check here

Happy Investing :) https://eightytwentyinvestor.com/2020/11/08/the-eighty-twenty-investor-approach-to-decide-your-asset-allocation-mix/">https://eightytwentyinvestor.com/2020/11/0...

Read on Twitter

Read on Twitter