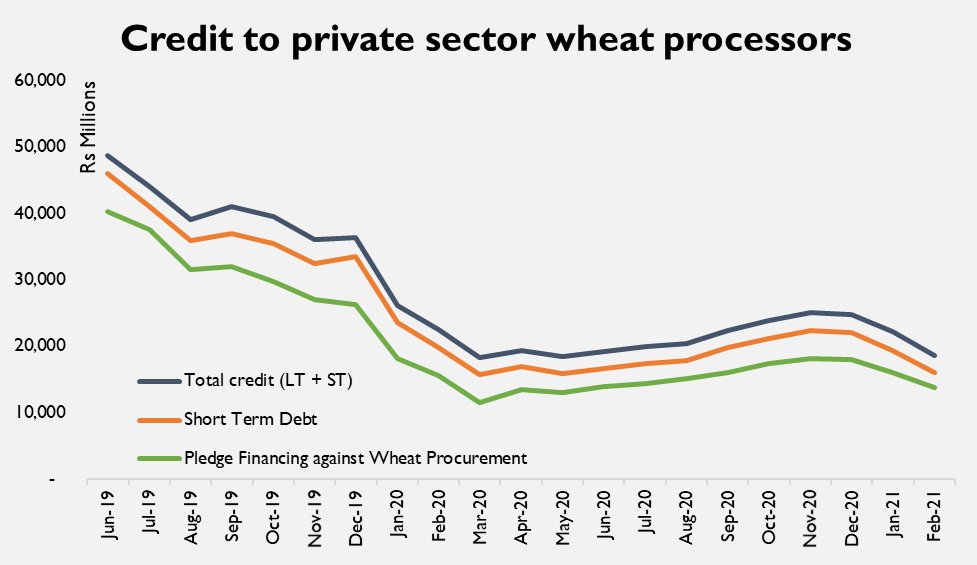

Although we are quick to point out administrative failures in wheat management, this is an indictment of central bank& #39;s role, which by policy crowds out private sector participation in wheat buying by diallowing bank-lending to pvt. mills during Apr to Jun

https://www.brecorder.com/news/40082044/the-murky-origins-of-commodity-operations-debt">https://www.brecorder.com/news/4008...

This is done to "facilitate govt. procurement targets" but infact ensures that govt. is the only buyer during peak harvest. From July onwards, banks are tacitly encouraged to lend to those wheat mills which utilize credit to purchase from provincial Food Depts. But thats not all

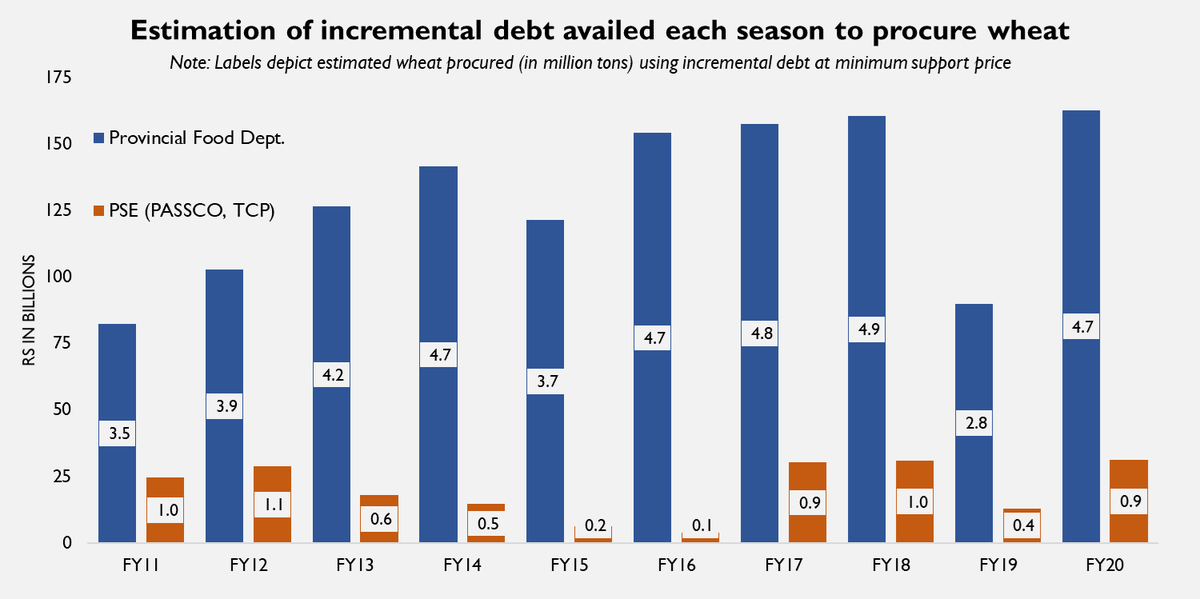

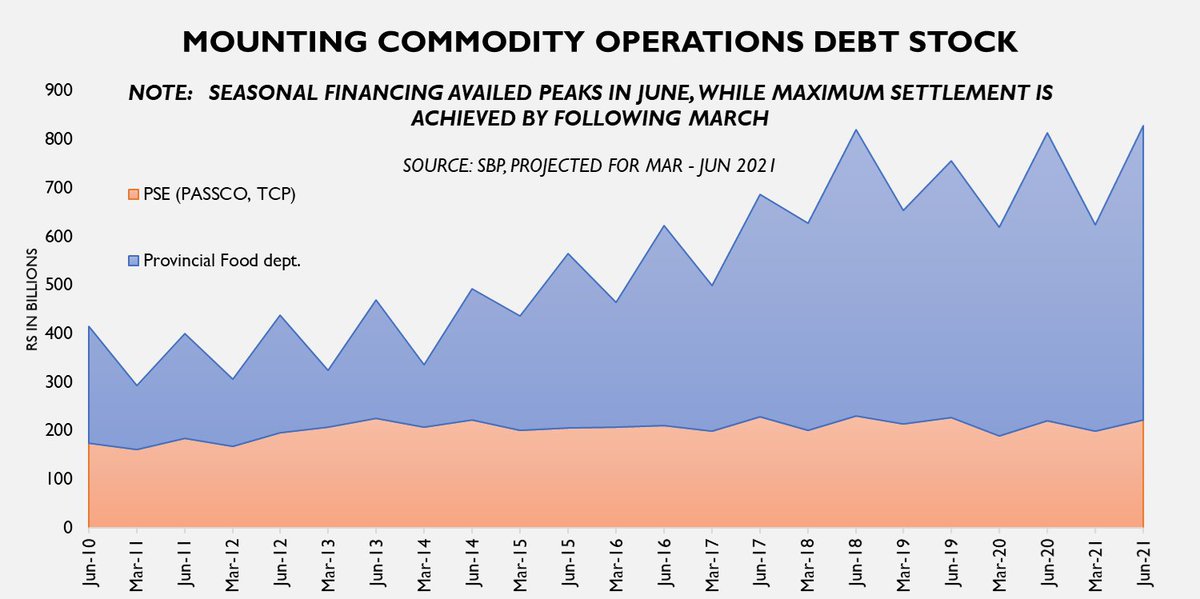

at federal level, procurement is done by PASSCO, a PSE 25% owned by GoP, & rest 75% by 6 commercial banks. PASSCO owes commodity debt of Rs200bn+ which has turned hardcore for past 10yrs, despite its & #39;self-liquidating& #39; nature. Instead Passco now largely borrows to service markup

What the article doesn& #39;t say is that in case of Passco, commercial banks effectively lend to themselves, while earning K+spread on top. Meanwhile, SBP doesn& #39;t even want private sector buying directly from growers. & Discrimination doesn& #39;t end there.

PASSCO & Food dept. commodity debt is secured against GoP& #39;s letter of guarantee and/or hypothecation, while private sector is required to pledge it& #39;s wheat. Nevermind that the leakages & disappearances of wheat stock takes place from Food dept godowns, and not private sector& #39;s.

What& #39;s stopping SBP from changing the rules and allowing private sector to compete with Food Depts by extending credit lines during Apr-Jun? Look closely, & it becomes clear that the regulator & banks are scratching each other& #39;s backs. How? (Cont.)

On one hand, commercial banks are happy lending to sovereign, whereas lending to private sector is seen as high risk because most wheat mills are SMEs while banks prefer name lending. Meanwhile, lending Rs800bn to Food depts/passco helps meet targets of agri-commodity lending.

One commercial bank& #39;s initial investment in Passco of Rs 5.5Mn has grown to 2.75billion in 46yrs. That& #39;s CAGR of 14%. This for a PSE which is embroiled in a circular debt of its own, as per SBP& #39;s Financial Stability Review (2019). Go figure!

In 2020, Peak commercial bank lending to private sector processors for wheat procurement was no more than Rs18Bn. This is a mere 10% of incremental debt of ~Rs 190bn borrowed by Food depts. & PASSCO.

Read on Twitter

Read on Twitter