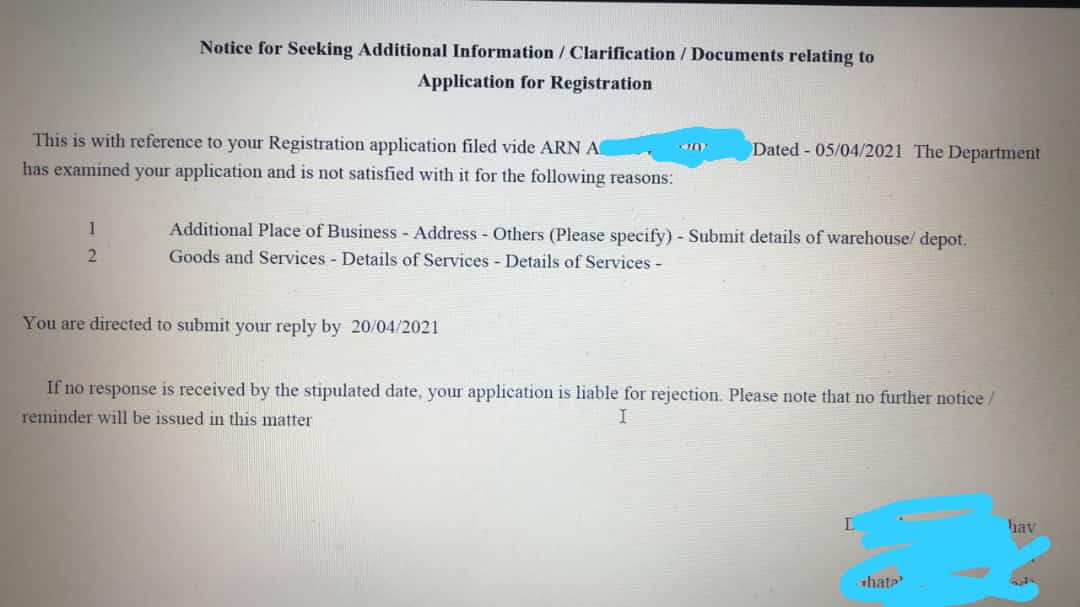

In one case, department has issued SCN in case of new GST registration.

@cbic_india plz refer the grounds of SCN.

Humbly request you to issue a circular / SOP for documents to be asked and queries to be raised

@cbic_india plz refer the grounds of SCN.

Humbly request you to issue a circular / SOP for documents to be asked and queries to be raised

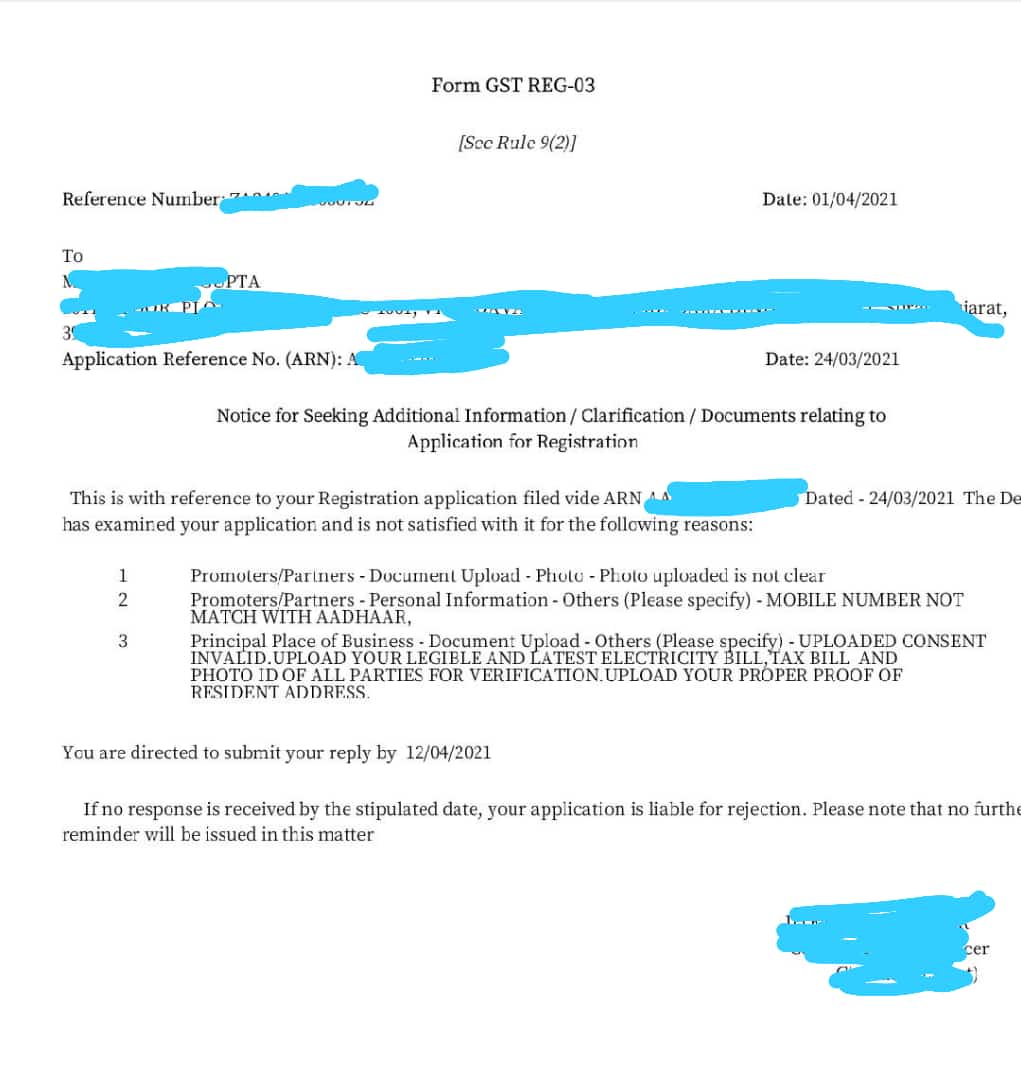

Queries

1. Size limit for photo is 100 KB. What assessee can do max?

2. Where it is written that mobile no. in aadhaar & GST reg application should be same?

PS - I& #39;m sharing this for general awareness of @cbic_india, so that necessary SOP can be issued at the earliest

1. Size limit for photo is 100 KB. What assessee can do max?

2. Where it is written that mobile no. in aadhaar & GST reg application should be same?

PS - I& #39;m sharing this for general awareness of @cbic_india, so that necessary SOP can be issued at the earliest

Humble request to all stakeholders to add to this thread, if anyone of you have been served with such queries which you think is not in line with the provisions of the law.

It will help @cbic_india to take necessary steps in this regard.

It will help @cbic_india to take necessary steps in this regard.

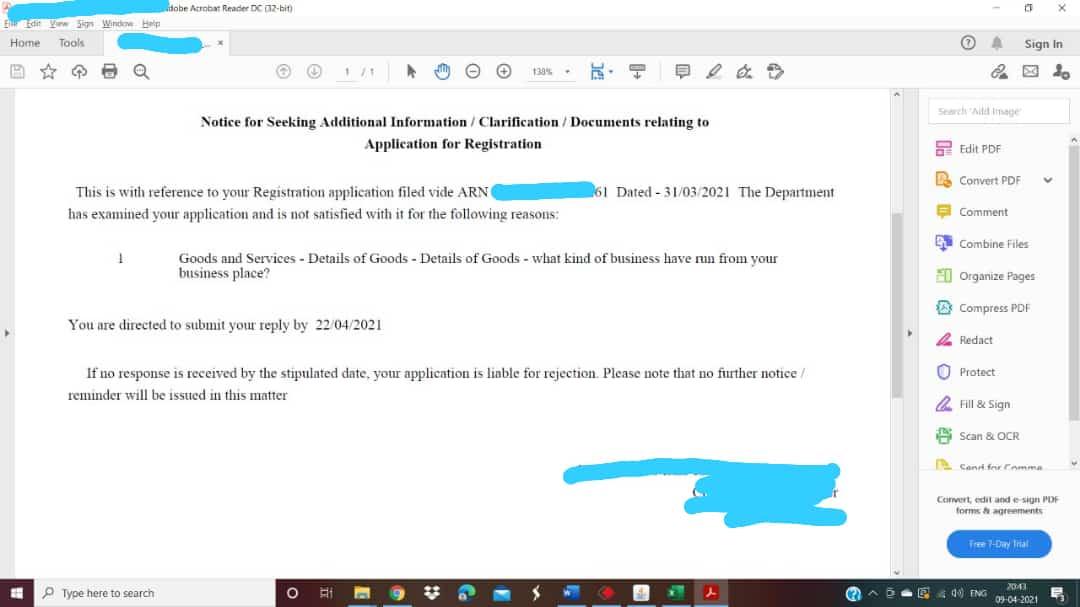

Dear @cbic_india, here is another one.

New business applied for GSTIN. The officer is raising query in the "goods /service tab" that "what kind of business have run from your business place?"

HSN is clearly mentioned. Is this query legible?

Where is #EaseOfDoingBusiness

New business applied for GSTIN. The officer is raising query in the "goods /service tab" that "what kind of business have run from your business place?"

HSN is clearly mentioned. Is this query legible?

Where is #EaseOfDoingBusiness

Read on Twitter

Read on Twitter