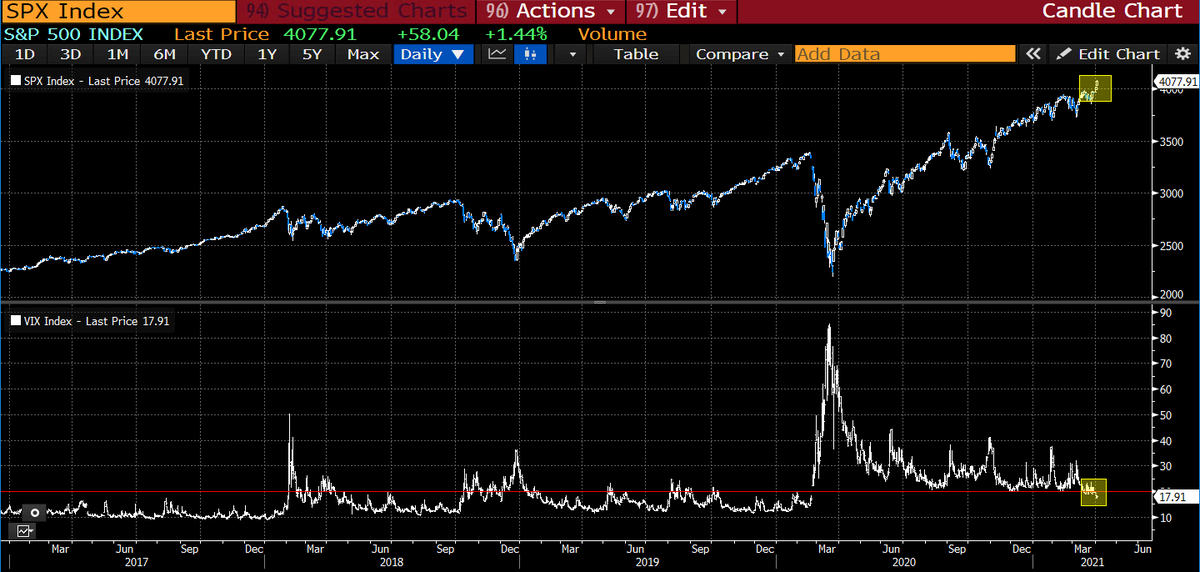

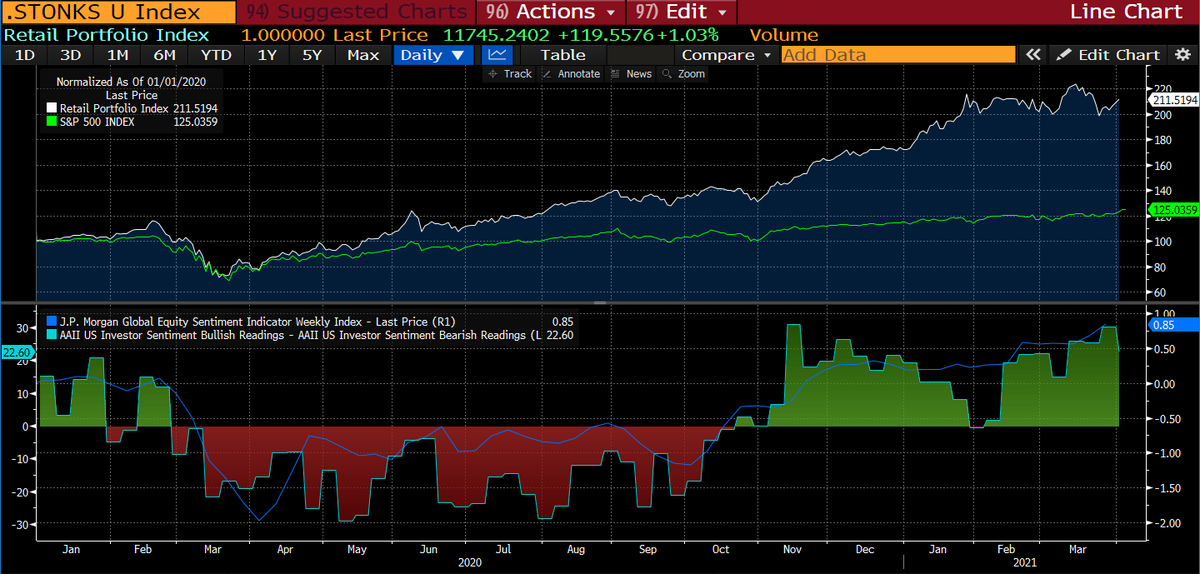

1/x) As $SPX powers through 4K to new ATHs and $VIX cracks below 20, all is well and nature is healing. Yet the irrational ebullience masks over the unresolved and proliferating fragilities lurking underneath the surface that pose a systemic threat to the market structure.

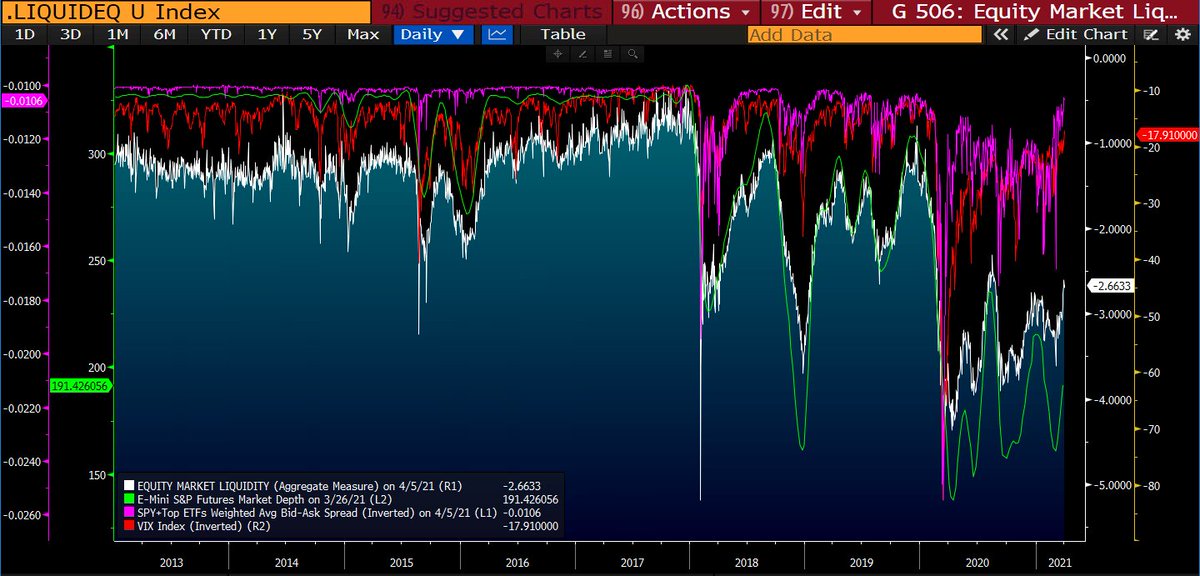

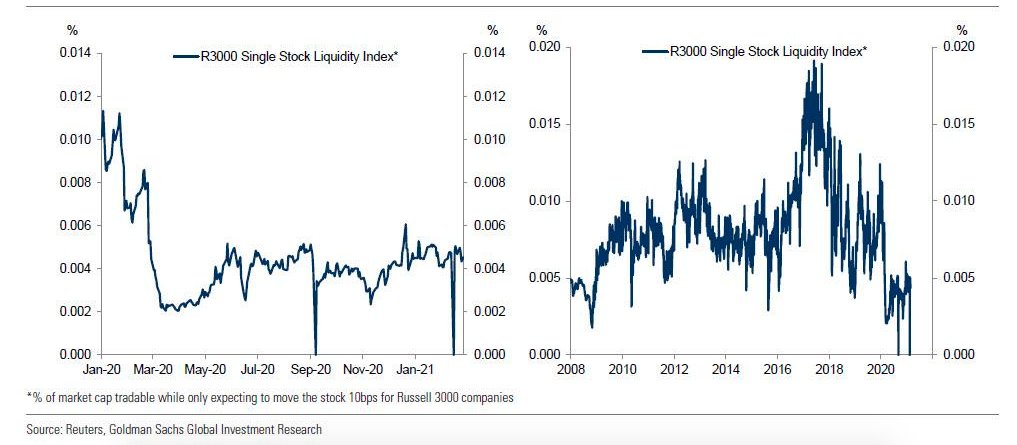

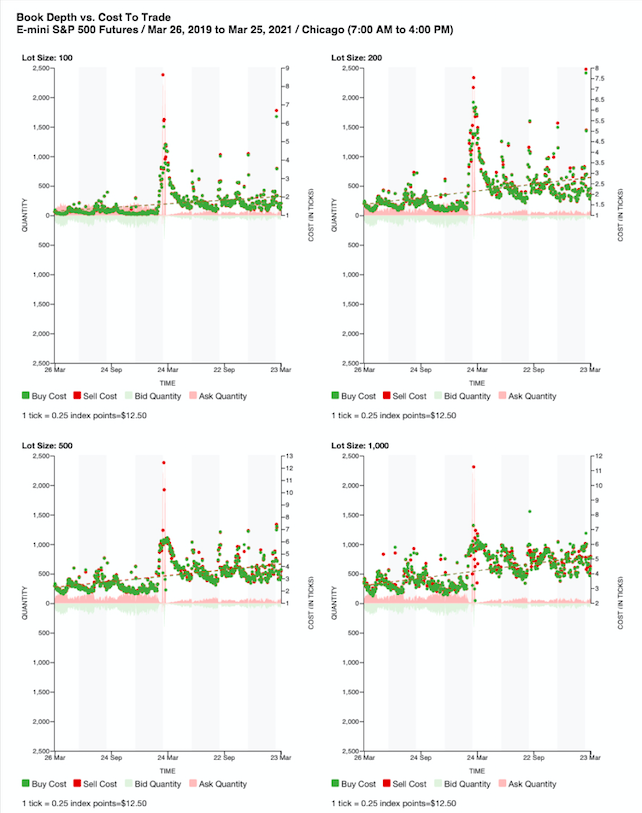

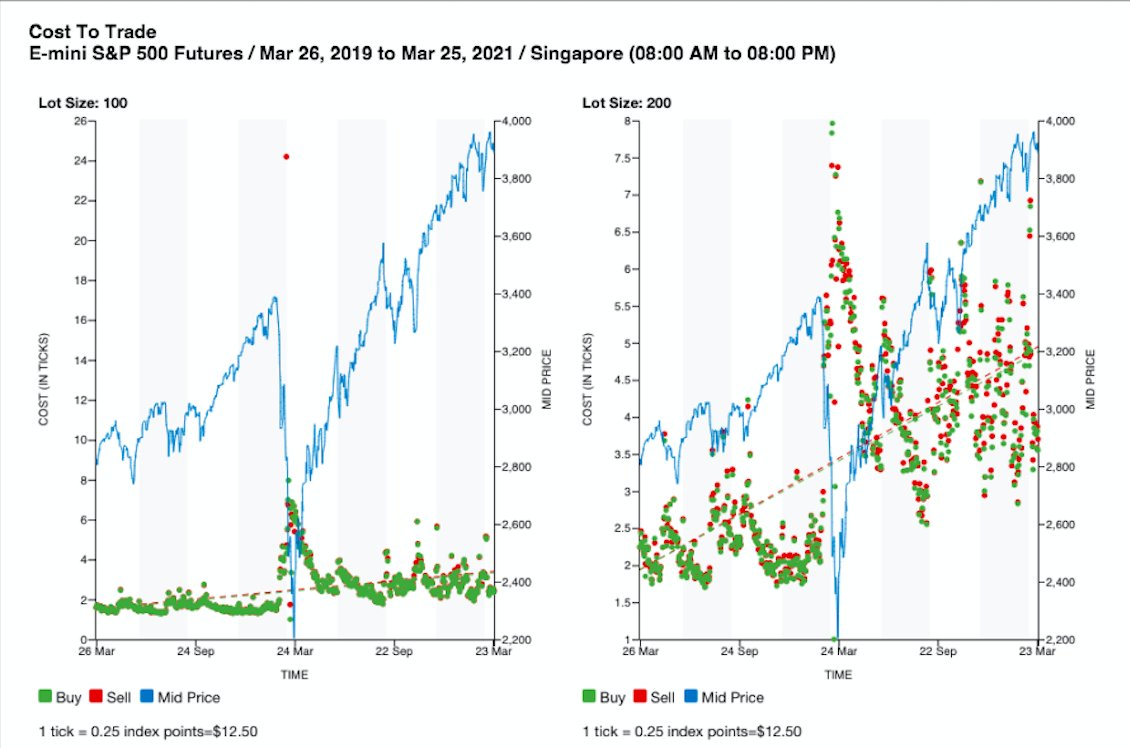

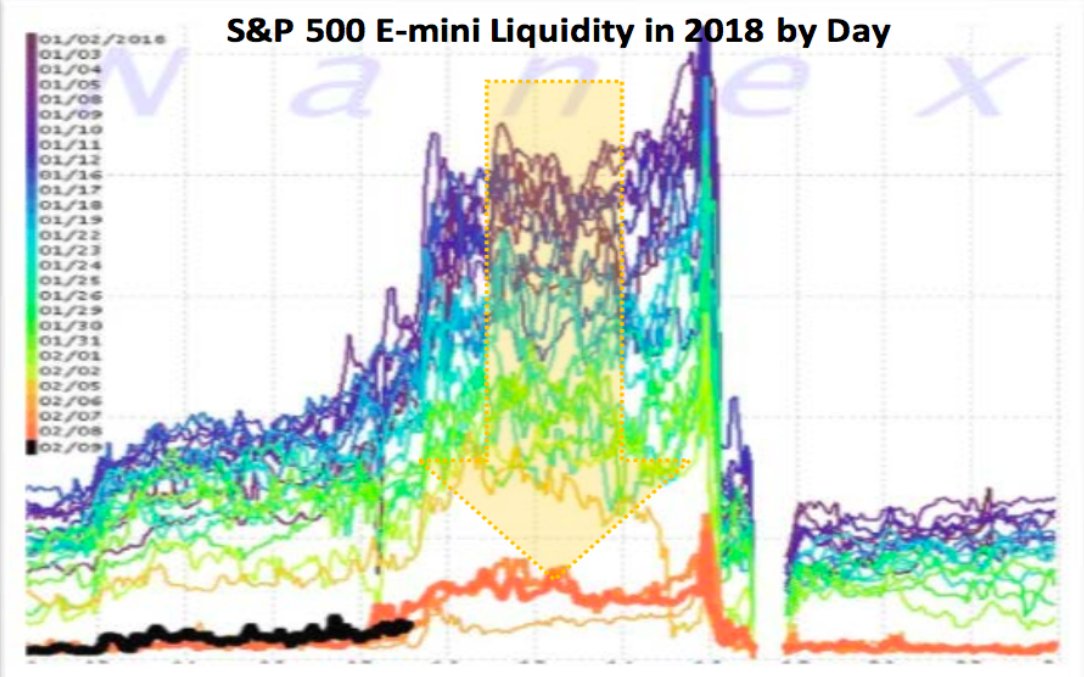

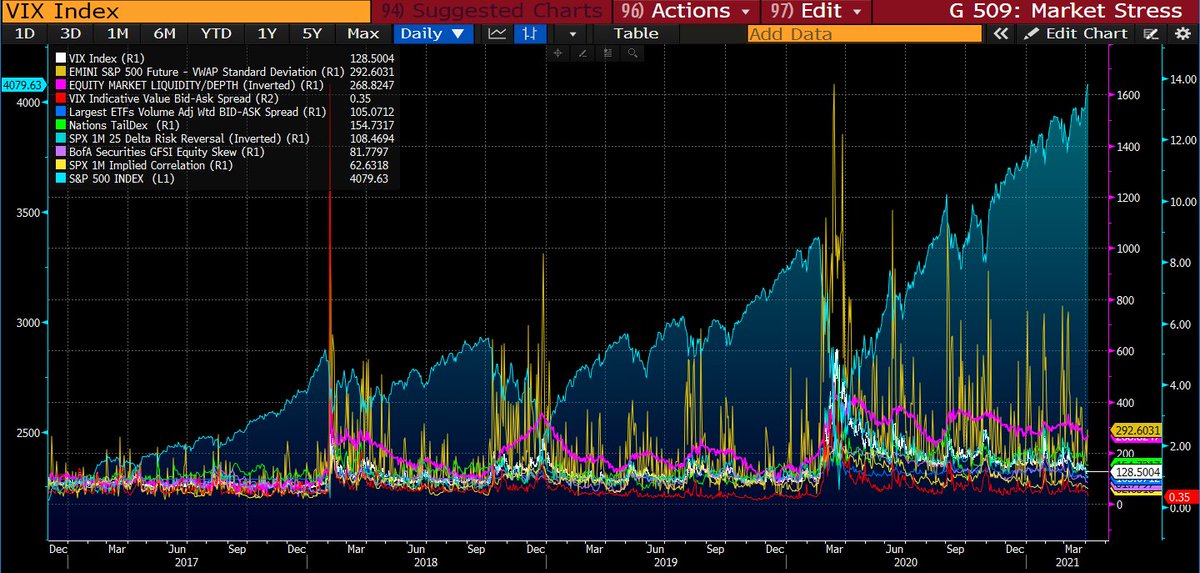

2/x) I& #39;ve already discussed deteriorating equity market liquidity extensively, but in our overleveraged market the significance and implications of this sinister vulnerability can& #39;t be understated. Liquidity –– most importantly market depth, has been vanishing since Volmageddon.

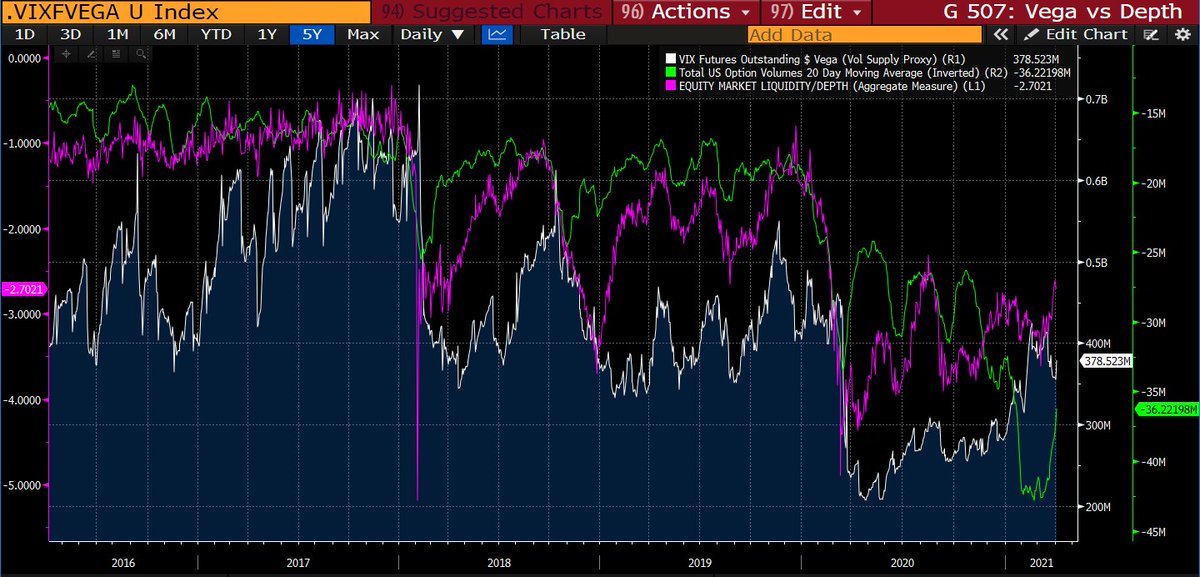

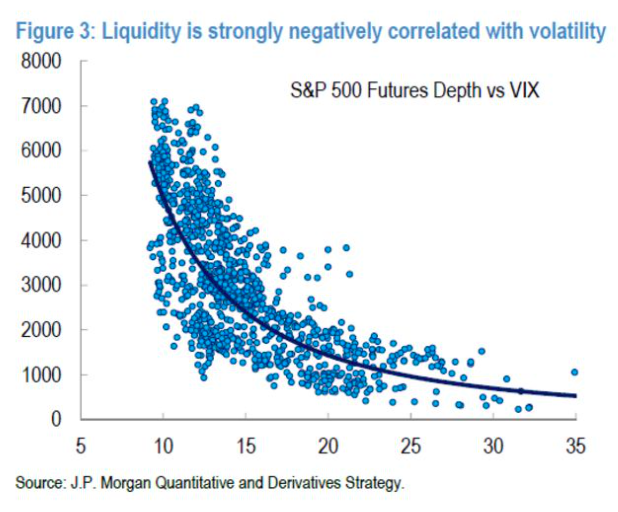

3/x) Volatility & liquidity are reflexively intertwined as I& #39;ve previously noted. Moreover, this also ties in with gamma exposure. You can clearly see here how a decline in vol supply following Volmageddon moves in sync with option volumes & market depth

https://twitter.com/FadingRallies/status/1365030209276284930?s=20">https://twitter.com/FadingRal...

https://twitter.com/FadingRallies/status/1365030209276284930?s=20">https://twitter.com/FadingRal...

4/x) Hence, the complete shift in market structure with diminished liquidity altered how the delta1 flows from hedging gamma impacted price action. Vanishing depth enabled hedging flows to dictate a low-liquidity melt-up environment. This creates the facade of a bullish market

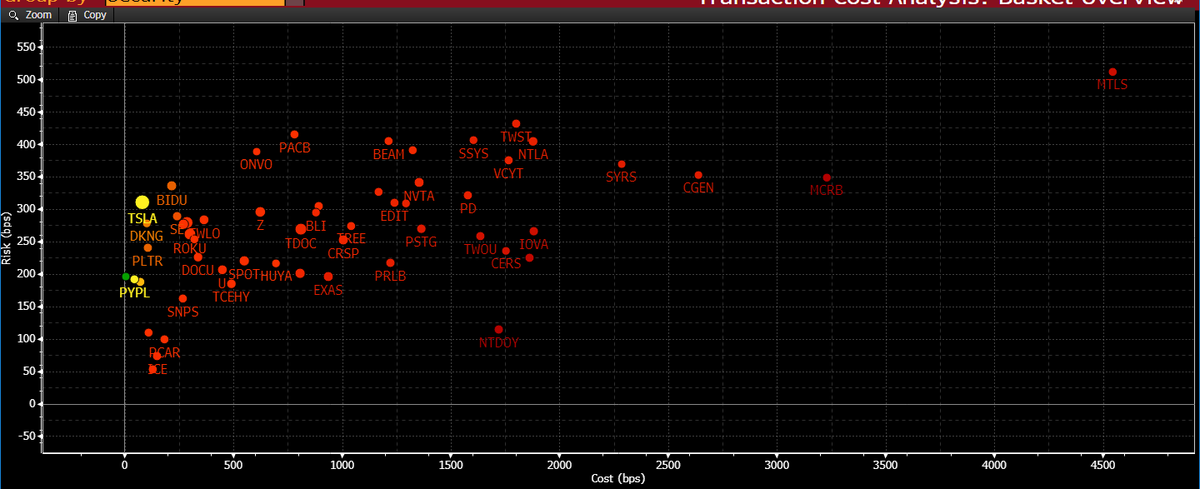

5/x) But in reality, the order book increasingly exhibits a type of convexity, where market depth completely vanishes relative to level in a nonlinear fashion beyond the top of the book. Thus when a side of the book is hammered, prices are impacted asymmetrically by size.

6/x) As mentioned, when offers are lifted it leads to that low liquidity melt-up. However, the true fragility is on the downside. The convexity of the orderbook creates a situation that beyond certain sizes, there is absolutely no bid without moving prices significantly.

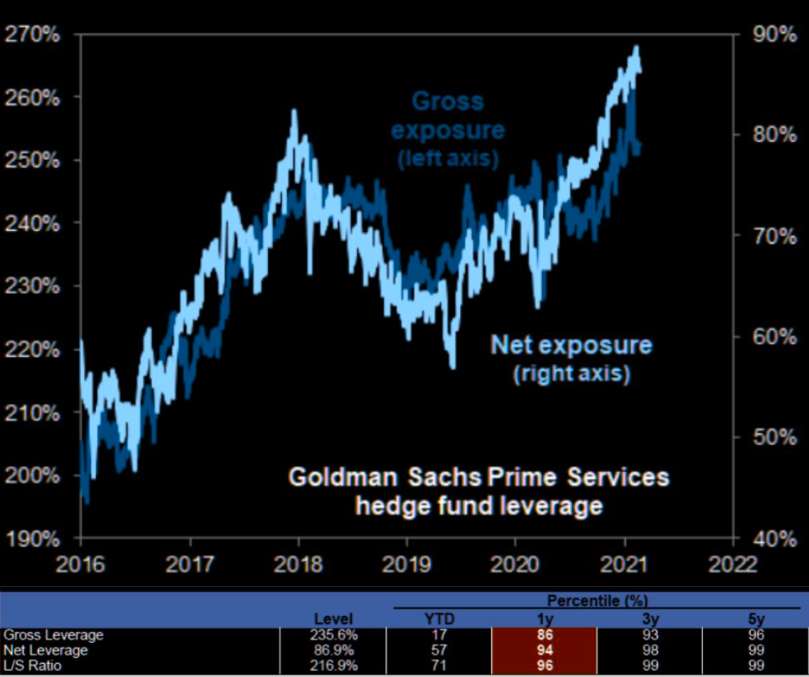

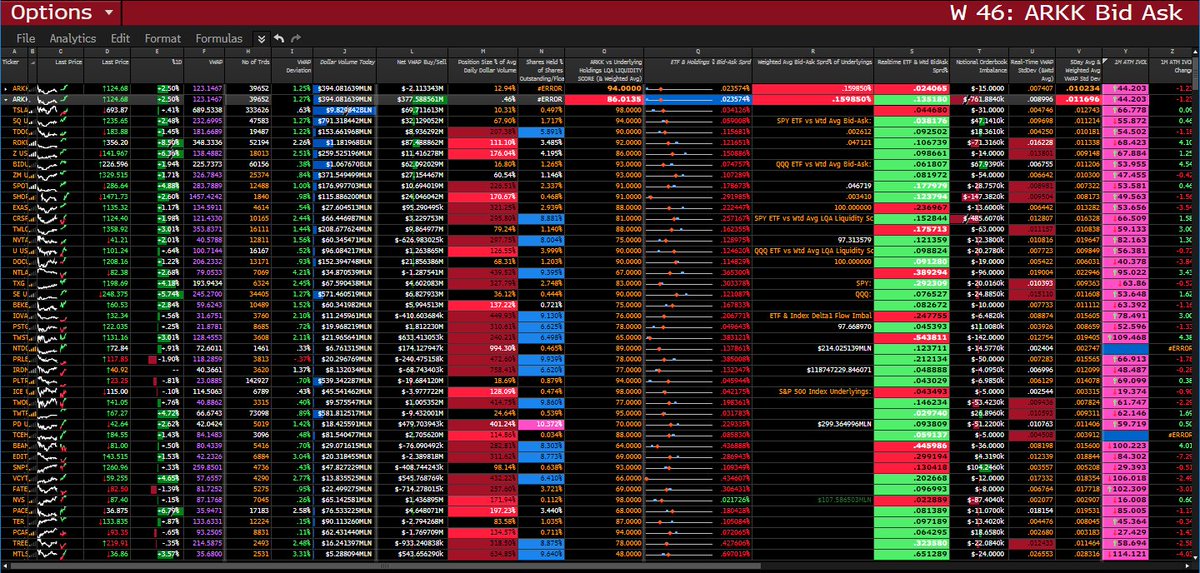

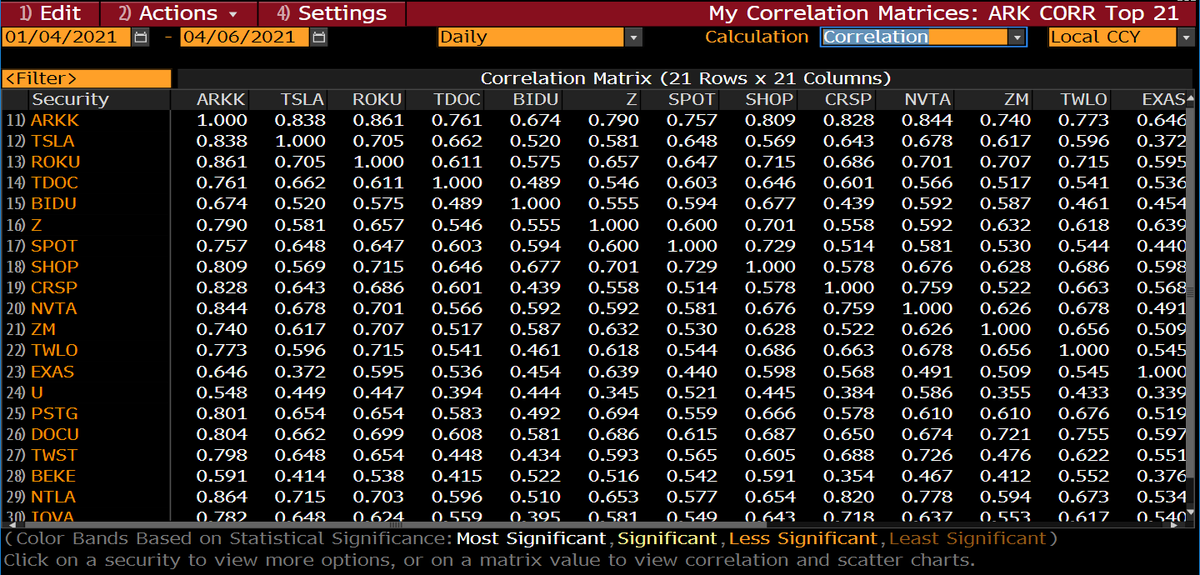

7/x) The issue extends beyond an instance of size wanting to get out –– that ultimately won& #39;t be too difficult. The vulnerability here is that this is systemic. Positioning broadly is at extremes with excessive leverage that is incredibly concentrated in highly correlated assets.

8/x) And no, this isn& #39;t solely about $ARKK. The ARK complex is undoubtedly reflexively fragile due to liquidity, correlation, concentration vulnerabilities... Yet it is merely a microcosm of the underlying chronic disorders in the broader market.

9/x) Forced selling is the only thing that causes markets to crash. Given the extent of leverage that& #39;s concentrated in highly correlated assets, forced liquidations can cascade into a reflexive avalanche of liquidation feedback loops into a market that has no depth – no bids.

10/x) We all observed Archegos wipeout due to overextended concentrated leverage. The significance here is in what implies for positioning across the street; this won& #39;t be an isolated situation. Even a fraction of this level of deleveraging across the street would be devastating.

Read on Twitter

Read on Twitter