Why everyone in tech needs passive income like dividends

[Thread]

[Thread]

Quick background.

I& #39;m a software entrepreneur.

I& #39;ve worked as a software engineer that has helped startups exit to companies like Ring/Amazon, Docusign, and various private equity companies.

I& #39;ve launched and sold my own startup.

I& #39;m in leadership at a high growth startup.

I& #39;m a software entrepreneur.

I& #39;ve worked as a software engineer that has helped startups exit to companies like Ring/Amazon, Docusign, and various private equity companies.

I& #39;ve launched and sold my own startup.

I& #39;m in leadership at a high growth startup.

Generally I kinda know what it takes to build great products that are "Exit-Worthy".

Ok so let& #39;s put that boring stuff aside.

Much like investing, joining a startup is about finding good leadership.

Good leaders have taken a bunch of risk to get a business started.

Ok so let& #39;s put that boring stuff aside.

Much like investing, joining a startup is about finding good leadership.

Good leaders have taken a bunch of risk to get a business started.

This may be their own capital, sweat equity, reputation, cushy 6 figure job, etc.

They have researched their market, identified what gaps there are, and invested into building a product to fill those gaps.

Growing revenue is a side effect of excellent leadership

They have researched their market, identified what gaps there are, and invested into building a product to fill those gaps.

Growing revenue is a side effect of excellent leadership

So as a tech person when you interview for a job, if you are not asking questions about the product, revenue growth, market opportunity, etc. you are doing yourself a huge disservice.

Why did I cover this stuff?

Because the most important part of going to a startup in my opinion is the potential value of the equity.

Believe me when I say this.

Telling the people that work for you the amount of money they get from an exit event is an amazing feeling.

Because the most important part of going to a startup in my opinion is the potential value of the equity.

Believe me when I say this.

Telling the people that work for you the amount of money they get from an exit event is an amazing feeling.

Ok so we& #39;ve established that equity is important.

How do you get it?

First in the interview process.

A typical naive person will go into the process and think that salary is the most important part of the negotiation.

It is important, but only for anchoring an amount.

How do you get it?

First in the interview process.

A typical naive person will go into the process and think that salary is the most important part of the negotiation.

It is important, but only for anchoring an amount.

If you get an offer...

...always counteroffer

Get to a point where they either say no or say this a best and final offer.

Even then it may not be best and final.

But the goal here is to maximize the offered salary.

Get to the verbal final offer.

...always counteroffer

Get to a point where they either say no or say this a best and final offer.

Even then it may not be best and final.

But the goal here is to maximize the offered salary.

Get to the verbal final offer.

Here& #39;s where things get interesting for those with a nice side income.

For every $X dollars down in salary you are willing to go you are typically given the ability to negotiate equity up by $Y.

Good leaders want people to have skin in the game...

For every $X dollars down in salary you are willing to go you are typically given the ability to negotiate equity up by $Y.

Good leaders want people to have skin in the game...

...So they want you to have equity.

Here& #39;s what a typical negotiation example might look like...

$150k salary, $10k equity

$125k salary, $35k equity

$100k salary, $60k equity

Here& #39;s what a typical negotiation example might look like...

$150k salary, $10k equity

$125k salary, $35k equity

$100k salary, $60k equity

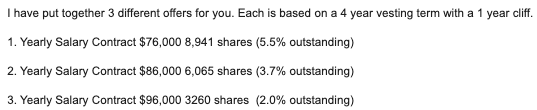

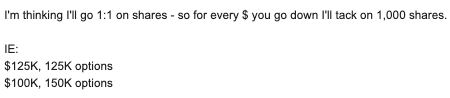

Just so you don& #39;t think I& #39;m bullshitting you...

...Here& #39;s some screenshots of example offers I& #39;ve received in the past.

It follows the sliding scale mentioned above exactly.

...Here& #39;s some screenshots of example offers I& #39;ve received in the past.

It follows the sliding scale mentioned above exactly.

Now startup equity isn& #39;t always the most reliable or stable which is why it is hard to part with your cash to buy equity as an investor.

So this is where dividend or other types of passive income come into the picture.

So this is where dividend or other types of passive income come into the picture.

The ROI on dividend income for me IS NOT the yearly income they produce.

It is the the amount of equity that can potentially 100-1000x by buying down a salary.

It is the the amount of equity that can potentially 100-1000x by buying down a salary.

This is why I laugh out loud when people say dividends aren& #39;t worth it.

They are 100% worth it if you use them the right way.

My 250k dividend portfolio has generated 15k in income in the last year

AND allowed me the opportunity to build 4x that in startup equity.

They are 100% worth it if you use them the right way.

My 250k dividend portfolio has generated 15k in income in the last year

AND allowed me the opportunity to build 4x that in startup equity.

Seems like a pretty good ROI to me.

...

Please give the top tweet a RT if you liked the thread.

If you& #39;d like to learn more about dividends and passive income check out my blog and books.

Links are in bio

...

Please give the top tweet a RT if you liked the thread.

If you& #39;d like to learn more about dividends and passive income check out my blog and books.

Links are in bio

Read on Twitter

Read on Twitter