1/ DeFi insurer $NXM @NexusMutual seems to offer some interesting potential, given how over-capitalized it is, so here& #39;s my first twitter dive into DeFi. Be kind.

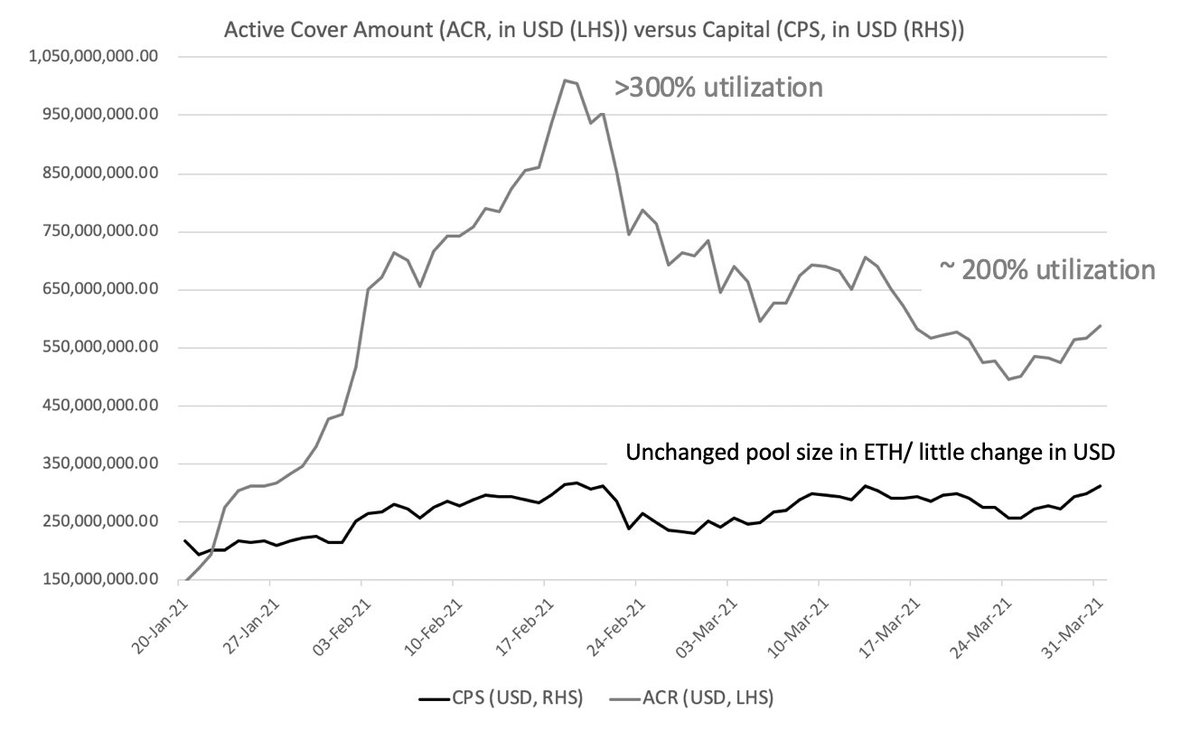

2/ $NXM has been at its floor MCR of 162,450 ETH since late last year. At the same time it has gone from 2x cover in action to over 3x cover in action and back again without requiring a capital pool top-up (data from http://nexustracker.io"> http://nexustracker.io ).

3/ At 200% utilization $NXM is currently earning $18mm annualized in premiums. At sustained 300% utilization, premiums could be 50% higher, or $27mm, without impacting the size of the pool. The cover ceiling at current capital levels could be even higher (400%?).

4/ If we used wNXM’s price, for P/book and P/E we get 1.21 and 23, respectively. (I have assumed very low off chain costs.) In any event, these are numbers approaching traditional insurance value metrics. P/sales puts it alongside MakerDAO, a seasoned cash-generator.

5/ You hear a lot of talk about the float. But $NXM can’t invest in any protocol it covers, or correlated with potential claims. So DeFi is out. Founder Hugh Karp did mention in one call that Eth2 staking could be a possibility. After the lock-in expires?

6/ If $NXM can grow cover or, and this is interesting, decrease the min ETH req, the protocol price would come back into play and the wNXM token would track NXM again in a fully arbitrageable market. Until then, the NXM price simply a price ceiling and wNXM is the true market.

7/ To push the $NXM capital requirement above the minimum, the KYC sticking point needs to be better managed and behavioral nudges are needed to allow the buying of cover as a default option, via a protocol or token wrap option or offered through a wallet.

Read on Twitter

Read on Twitter