Why can the Euro not attain he internatonal role that the EU economy should give it as a store of value and vehicle for transactions? Why does this matter? What can we do about it? I have just been working on this from the @Europarl_EN. Some answers in a THREAD 1/18

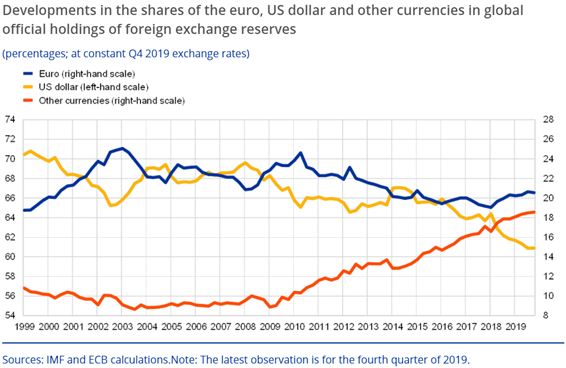

While € is the second most important international currency, it lags well behind the $. Over 60% of international reserves are held in $ and only a scarce 20% in €. The trend is not encouraging either: the € was more widely used as a reserve in 2002 than today (2/18)

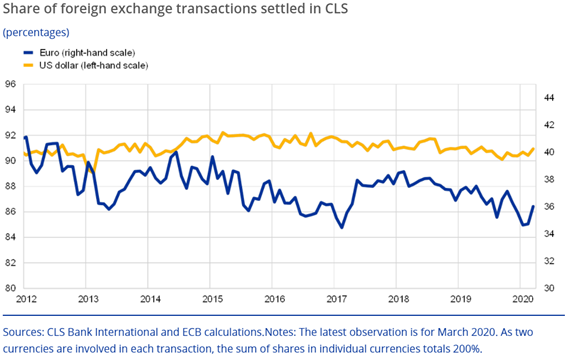

The share of the € in global foreign exchange trading is also smaller by a wide margin. In this case, the $ is the leading currency, being involved in 90% of all transactions (3/18)

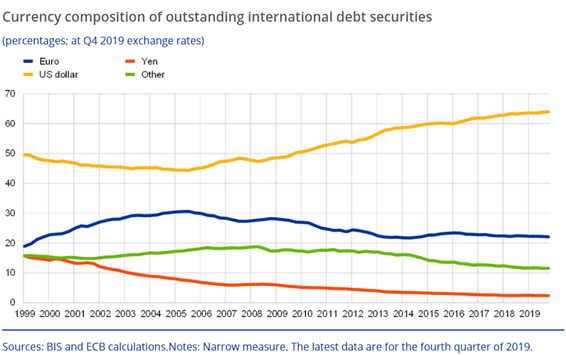

The share of the € in the stock of international debt securities has also been declining since 2005. Surprisingly, the $ has increased its share in debt securities by almost 20% since the financial crisis.The use of € in international debt markets stands now at only 22% (4/18)

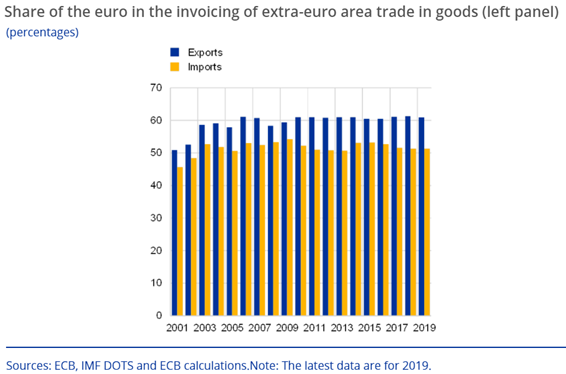

Even more surprisingly, only 61% of our exports outside the EU and 51% of imports outside the EU are invoiced in €. Even in our day-to-day commercial operations, Europe still heavily depends on $ (5/18)

Now, why does it matter? Why is it important to strengthen the role of €? For two reasons. First, it would reduce our exposure to extraterritoriality effects. Second, the effectiveness of monetary policy would be enhanced. Let’s go over both reasons.(6/18)

Since the world heavily depends on the $, most int’l transactions are subject to American jurisdiction, even if the transaction does not involve the US. For instance, most banks rely on correspondent banks in NYC to buy $ to conduct international operations (7/18)

As part of its sanctions’ program, the US could unilaterally prevent States from receiving payments even if they don’t conduct operations in the US. This endangers Europe’s strategic autonomy and is well documented in this article @TheEconomist : https://www.economist.com/briefing/2020/01/18/americas-aggressive-use-of-sanctions-endangers-the-dollars-reign">https://www.economist.com/briefing/... (8/18)

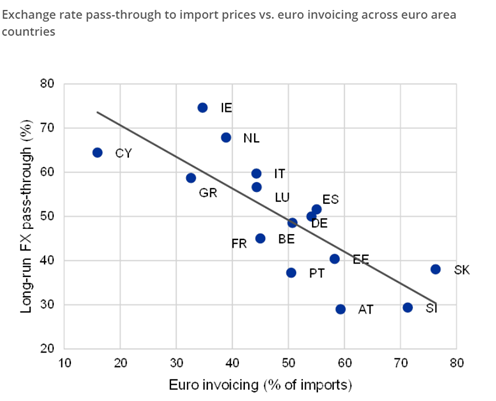

A stronger € is also important for our monetary policy. First, the more the € is used for trade, the less the pass-through to import prices after fluctuations in the exchange rate. This contributes to the ECB objective of price stability. (9/18)

Second, a more widely used € better enables Europe to exercise its monetary autonomy. In periods of crisis, investors prefer the safety of $ assets and hence compresses their term premia compared to € assets and affects financing conditions in the euro area (10/18)

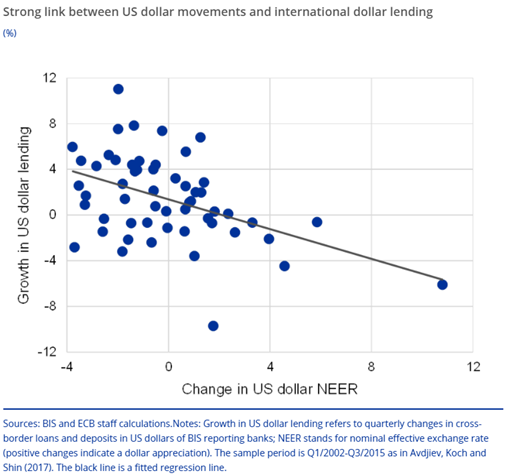

Moreover, a monetary tightening in the US increases global demand for US assets and thus directly reduces Europe’s aggregate demand. This imposes restrictions in our rate policy https://www.ecb.europa.eu//pub/pdf/scpwps/ecb.wp2407~586c50e03f.en.pdf">https://www.ecb.europa.eu//pub/pdf/... (11/18)

Third, a strengthened € would enable larger spillbacks. For instance, a domestic interest rate cut would ease financial conditions globally and feed demand across the world, benefiting open economies, such as the European one (12/18)

What do we need to strengthen the €? Kindleberger identified some rules of monetary hegemony: (i) commit to open markets, (ii) provide counter-cyclical lending, (iii) ensure macroeconomic coordination and (iv) be a lender of last resort. All in all, make € a public good (13/18)

NextGenEU is a historic opportunity. For the 1st time, Europe has agreed on a coordinated approach to face a crisis, providing counter-cyclical spending while increasing global liquidity. Unlike 2008, the € now has an economic growth agenda w/ global spillovers (14/18)

More economic integration is however needed. Fragmentation still contributes to interest differentials, redenomination risks and doom loops. That is why @RenewEurope fights for a deepening of the Capital Markets, Economic and Monetary and Banking Unions (15/18)

Our report recognizes the necessity to set up a European safe portfolio, the empowerment of the Single Resolution Board and creating a European Deposit Insurance. I have published some proposals in this regard. You can check them here: https://luisgaricano.eu/proposals/two-proposals-to-resurrect-the-banking-union-the-safe-portfolio-approach-and-srb/">https://luisgaricano.eu/proposals... (16/18)

In these troubled times, we have potential to take steps towards strengthening our monetary leadership. We are reliable partners committed to free trade, contributing to global fiscal stimulus and liquidity needs while increasing our internal coordination and coherence (17/18)

Europe should not waste this opportunity to make € a global public good. This is the message we hope to conveyed for the European Parliament to the Council. You can find our full report here: https://www.europarl.europa.eu/doceo/document/A-9-2021-0043_EN.pdf">https://www.europarl.europa.eu/doceo/doc... (18/18)

Read on Twitter

Read on Twitter